TIDMAAU

RNS Number : 9713S

Ariana Resources PLC

15 March 2023

15 March 2023

AIM: AAU

2023 PRODUCTION GUIDANCE

Ariana Resources plc ("Ariana" or "the Company"), the AIM-listed

mineral exploration and development company with gold mining

interests in Europe, is pleased to announce the production guidance

for 2023 for its interests in the Kiziltepe Mine ("Kiziltepe" or

"the Project"). Kiziltepe is 23.5% owned by Ariana through its

shareholding in Zenit Madencilik San. ve Tic. A.S.

Highlights:

-- Gold production guidance for 2023 from Kiziltepe is expected

to be c. 18,000 ounces of gold*, more than twice the production

levels estimated in the feasibility plan for this approximate stage

of mine life.

-- Average monthly production is expected at approximately

29,000 tonnes of ore, with a stockpile of approximately 120,000

tonnes currently maintained on site.

-- Ore throughput to the mill during 2023 is expected to be c. 350,000 tonnes.

-- Average grade of gold to be mined during the year is expected

to be c. 1.7 g/t Au and gold recovery is expected to exceed

90%.

-- Open-pit mining will continue largely at the Arzu North, Derya and Banu pits during 2023.

-- Extensive near-mine exploration remains underway.

Dr. Kerim Sener, Managing Director, commented:

"Production from the Kiziltepe Mine in 2022 reached all-time

highs in terms of gold ounces produced (28,421 ounces gold) and in

revenue (US$58 million), marking the most successful period of

mining ever and the sixth year of guidance-beating output. This

followed on from the timely financing and the introduction of the

processing plant expansion which was completed in 2021. This has

enabled a marked increase in throughput, to about 440,000 tonnes

per annum in 2022.

It is notable that Kiziltepe has now produced 50% more gold over

its life than projected in our Feasibility Study and has done so

within only three-quarters of the time. This is an extraordinary

success and all credit is due to our operational team at Zenit and

our exploration team's efforts, who have doubled our resources

since the commencement of mining in 2017. With the expected

incremental growth of our resources following further drilling, we

plan on maintaining production until the mid-2020s. Furthermore,

recent exploration successes have highlighted the potential to make

further discoveries in the area, such as beneath Kiziltepe Hill at

Kepez Main, albeit they represent deeper targets.

Kiziltepe will be operated in 2023 at a somewhat reduced rate,

processing typically lower-grade ore and at a slightly reduced mill

throughput, according to the current mine plan. We are also

enabling the exploration team to fully assess the targets

identified in recent geophysics and to determine the drilling

required to test these new opportunities adequately.

While Kiziltepe represents our oldest project, we are encouraged

that even 18 years since we purchased it from Newmont, it still

yields significant exploration upside. We have successfully

demonstrated the progression of a project from the greenfields

stage with just under 4,000m of drilling when purchased in 2005, to

one with over 55,000m of drilling, delineating a Global Resource of

380,000 ounces of gold and over 6 million ounces of silver, of

which perhaps half may be mined economically at this time."

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK Domestic Law by virtue of the European Union (Withdrawal) Act

2018 ("UK MAR").

* Silver production guidance is not provided, as silver is

treated as a by-product credit. All figures are stated gross to the

Project unless otherwise stated.

Summary of Project

The Kiziltepe gold-silver mine was expected to deliver up to

20,000 oz gold per annum over eight years of initial mine life from

2017 to 2024. Expansion of the Global Reserves to 175,000 ounces of

gold enables the mine life to be extended further. The operating

company, Zenit Madencilik San. ve Tic. A.S., is a partnership

between Ariana (23.5%), Proccea (23.5%) and Ozaltin (53%), with

management control being with Proccea. The commercial production

was initiated at Kiziltepe during July 2017 and has continued

without interruption, with production consistently being delivered

above plan. Kiziltepe has now produced approximately 50% more gold

than expected from its total life of mine plan and has done so in

three-quarters of the projected time.

The latest Resource and Reserve estimate for Kiziltepe was based

on recent drilling and geological interpretation in February 2022.

Detailed technical and economic assessments are underway on several

satellite vein systems not currently in the mining plan, in

anticipation of these being developed in future years. The

Kiziltepe operation is currently targeting a minimum ten-year mine

life, which will require the addition of a further 25,000 oz gold

in Reserves outside of the five main pits (Arzu South, Arzu North,

Banu, Derya and Kepez) that are currently scheduled to be mined.

The joint venture is confident that this can be achieved assuming

the conversion of existing Resources to Reserves and parts of the

Exploration Target being converted as well.

Contacts:

Ariana Resources plc Tel: +44 (0) 20 7407 3616

Michael de Villiers, Chairman

Kerim Sener, Managing Director

Beaumont Cornish Limited Tel: +44 (0) 20 7628 3396

Roland Cornish / Felicity Geidt

Panmure Gordon (UK) Limited Tel: +44 (0) 20 7886 2500

John Prior / Hugh Rich / Atholl

Tweedie

Yellow Jersey PR Limited Tel: +44 (0) 7983 521 488

Dom Barretto / Shivantha Thambirajah arianaresources@yellowjerseypr.com

/

Bessie Elliot

Editors' Note:

The information in this announcement that relates to exploration

results is based on information compiled by Dr. Kerim Sener BSc

(Hons), MSc, PhD, Managing Director of Ariana Resources plc. Dr.

Sener is a Fellow of The Geological Society of London and a Member

of The Institute of Materials, Minerals and Mining and has

sufficient experience relevant to the styles of mineralisation and

type of deposit under consideration and to the activity that has

been undertaken to qualify as a Competent Person as defined by the

2012 edition of the Australasian Code for the Reporting of

Exploration Results, Mineral Resources and Ore Reserves (JORC Code)

and under the AIM Rules - Note for Mining and Oil & Gas

Companies. Dr. Sener consents to the inclusion in the report of the

matters based on his information in the form and context in which

it appears.

About Ariana Resources:

Ariana is an AIM-listed mineral exploration and development

company with an exceptional track-record of creating value for its

shareholders through its interests in active mining projects and

investments in exploration companies. Its current interests include

gold production in Turkey and copper-gold exploration and

development projects in Cyprus and Kosovo.

The Company holds 23.5% interest in Zenit Madencilik San. ve

Tic. A.S. a joint venture with Ozaltin Holding A.S. and Proccea

Construction Co. in Turkey which contains a depleted total of c.

2.1 million ounces of gold and other metals (as at February 2022).

The joint venture comprises the Kiziltepe Mine and the Tavsan and

Salinbas projects.

The Kiziltepe Gold-Silver Mine is located in western Turkey and

contains a depleted JORC Measured, Indicated and Inferred Resource

of 222,000 ounces gold and 3.8 million ounces silver (as at

February 2022). The mine has been in pro table production since

2017 and is expected to produce at a rate of c.20,000 ounces of

gold per annum to at least the mid-2020s. A Net Smelter Return

("NSR") royalty of 2.5% on production is being paid to

Franco-Nevada Corporation.

The Tavsan Gold Mine is located in western Turkey and contains a

JORC Measured, Indicated and Inferred Resource of 307,000 ounces

gold and 1.1 million million ounces silver (as at November 2022).

Following the approval of its Environmental Impact Assessment and

associated permitting, Tavsan is being developed as the second gold

mining operation in Turkey. Construction progress is temporarily

suspended pending the outcome of a local court decision pertaining

to the EIA. A NSR royalty of up to 2% on future production is

payable to Sandstorm Gold.

The Salinbas Gold Project is located in north-eastern Turkey and

contains a JORC Measured, Indicated and Inferred Resource of 1.5

million ounces of gold (as at July 2020). It is located within the

multi-million ounce Artvin Gold eld, which contains the "Hot Gold

Corridor" comprising several signi cant gold- copper projects

including the 4 million ounce Hot Maden project, which lies 16km to

the south of Salinbas. A NSR royalty of up to 2% on future

production is payable to Eldorado Gold Corporation.

Ariana owns 100% of Australia-registered Asgard Metals Fund

("Asgard"), as part of the Company's proprietary Project Catalyst

Strategy. The Fund is focused on investments in high-value

potential, discovery-stage mineral exploration companies located

across the Eastern Hemisphere and within easy reach of Ariana's

operational hubs in Australia, Turkey and the UK.

Ariana owns 75% of UK-registered Western Tethyan Resources Ltd

("WTR"), which operates across south-eastern Europe and is based in

Pristina, Republic of Kosovo. The company is targeting its

exploration on major copper-gold deposits across the

porphyry-epithermal transition. WTR is being funded through a

ve-year Alliance Agreement with Newmont Corporation (

www.newmont.com ).

Ariana owns 50% (increasing to 58%) of UK-registered Venus

Minerals Ltd ("Venus") which is focused on the exploration and

development of copper-gold assets in Cyprus which contain a

combined JORC Indicated and Inferred Resource of 17Mt @ 0.45% to

1.10% copper (excluding additional gold, silver and zinc.

Panmure Gordon (UK) Limited is broker to the Company and

Beaumont Cornish Limited is the Company's Nominated Adviser and

Broker.

For further information on Ariana you are invited to visit the

Company's website at www.arianaresources.com .

Glossary of Technical Terms:

"Au" chemical symbol for gold;

"g/t" grams per tonne;

"JORC" the Joint Ore Reserves Committee;

"oz" Troy ounces;

Ends.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFLFVDVDISLIV

(END) Dow Jones Newswires

March 15, 2023 03:00 ET (07:00 GMT)

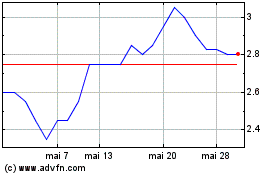

Ariana (AQSE:AAU.GB)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Ariana (AQSE:AAU.GB)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025