Bitcoin To Hit $180,000 If These Cycle Top Indicators Are Absent, Says VanEck’s Sigel

17 Décembre 2024 - 2:30PM

NEWSBTC

Bitcoin could soar to $180,000 in 2025 if key cycle top indicators

remain muted, according to Matthew Sigel, Head of Digital Assets

Research at VanEck. Speaking with podcast host Natalie Brunell,

Sigel outlined a clear four-year pattern in Bitcoin’s price action

that he believes has persisted through multiple market cycles. Why

$180,000 Per Bitcoin Seems Plausible Sigel explained that Bitcoin

tends to outperform nearly every other asset class for three years

out of each four-year halving cycle, followed by a deep correction

in the fourth year. Referencing a drawdown typically ranging from

60% to 80%, Sigel said this decline often arrives roughly two years

after the BTC halving event. Since Bitcoin’s most recent halving

took place in April 2024, Sigel sees 2024 and 2025 as potentially

strong years. “That down year typically is the second year after

the halving,” Sigel explained. “The Bitcoin halving occurred in

April of this year. So 2024 [will be a] strong year, 2025 should be

a strong year. I think 2026, unless something changes, would be a

down year.” Related Reading: Can Bitcoin Hit $160,000 In 2025?

Matrixport Thinks So Drawing on historical data, he recalled the

smallest trough-to-peak appreciation in Bitcoin’s previous cycles,

which was approximately 2,000%. Even if that figure halves to

1,000%, Sigel pointed out that Bitcoin could rise from a trough of

around $18,000 to as high as $180,000 in the current cycle. “So I

see an upside to $180,000 this cycle, and I think that’s likely to

happen next year,” Sigel added. He also emphasized that Bitcoin’s

volatility means the price could overshoot or undershoot that

number, but that $180,000 represents a plausible target for 2024 if

the pattern holds and no major “red light” indicators appear. Sigel

broke down what he sees as the most important topping signals for

traders to watch. The first involves derivatives funding rates: if

the annualized cost to hold bullish Bitcoin positions on leveraged

markets pushes above 10% for longer than a couple of months, Sigel

considers that a red flag. “Some of those indicators include the

funding rates. When the funding rate for Bitcoin exceeds 10% for

more than a couple months, that tends to be a red light,” Sigel

warned and explained that recent market activity reset elevated

funding rates: “[Last week’s] washout eliminated that as well. So

funding rates [are] not really flashing red.” The second is the

level of unrealized profits on the blockchain, where on-chain

analysis can reveal whether market participants’ cost basis is so

low that significant profit-taking might soon create selling

pressure. “We’re not seeing scary amounts of unrealized profits

[yet],” Sigel noted. Finally, he said anecdotal evidence of

widespread retail leverage or speculation could also flash warning

lights. He explained that if all these risk indicators were to

align at a certain price point—for example, if Bitcoin hit $150,000

and these metrics pointed to a market top—he would be cautious.

However, he said that if the price reached around $180,000 without

those signals appearing, there might still be room for further

appreciation. Related Reading: National Bitcoin Reserve Initiative:

MP Satoshi Hamada Urges Japan To Take Action “If we reach $180K and

none of those lights are flashing, maybe we let it run. If all

those lights are flashing and the price is $150K, I’m not gonna

wait,” Sigel added. Next BTC Cycle Predictions He also explored the

longer-term growth potential for Bitcoin by comparing it to gold’s

market capitalization. Because about half of gold’s supply is used

for industrial and jewelry purposes, he reasoned that the other

half can be compared more directly to Bitcoin’s function as an

investment and store of value. If Bitcoin were to reach a valuation

comparable to that half portion of gold’s market cap, Sigel

believes the price could trend toward roughly $450,000 per coin

over the course of the next cycle. Taking an even more

forward-looking perspective, he described VanEck’s long-term model

in which global central banks might eventually hold Bitcoin as part

of their reserves, even if just at a 2% weighting. Since gold

constitutes about 18% of central bank reserves worldwide, Sigel’s

assumption is that Bitcoin’s share would be far smaller by

comparison. He also factored in the prospect that Bitcoin might one

day serve as a settlement currency for global trade, potentially

among emerging economic alliances such as the BRICS nations

(Brazil, Russia, India, China, and South Africa), which could push

its valuation significantly higher. In VanEck’s calculations, this

scenario might place Bitcoin at $3 million per coin by 2050: “We

also assume that Bitcoin is used as a settlement currency for

global trade, most likely among BRICS countries. We get to three

million dollars a coin by 2050, which would be about a 16% compound

annual growth rate.” At press time, BTC traded at $107,219.

Featured image from YouTube / Natalie Brunell, chart from

TradingView.com

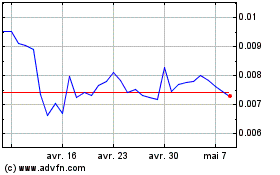

Amp (COIN:AMPUSD)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Amp (COIN:AMPUSD)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024