Bitcoin Dips, But Don’t Panic: ETFs See Three Days Of Bullish Inflow

06 Avril 2024 - 2:30PM

NEWSBTC

The recent approval of Bitcoin exchange-traded funds (ETFs) by the

SEC sent jitters through the financial world. Initial concerns

about fading demand seem unfounded as Bitcoin ETFs continue to

shatter trading volume records. This is further bolstered by three

consecutive sessions of net inflows into these investment vehicles.

Related Reading: Solana Primed For Takeoff? Expert Analysis Points

To Buying Opportunity Bitcoin ETF Inflows Signal Long-Term Investor

Appetite A recent dip in ETF activity sparked fears that the

initial excitement might be short-lived. However, those fears have

been quelled by a resurgence in inflows. According to data from

SoSoValue, yesterday saw a net inflow of $203 million into Bitcoin

spot ETFs, marking the third straight day of positive inflow. This

sustained green streak suggests that investors remain interested in

gaining exposure to the top crypto through ETFs, potentially

anticipating a price surge due to the upcoming Bitcoin halving – a

pre-programmed code update that cuts production in half,

historically leading to price increases. BlackRock’s Bitcoin ETF

Leads The Pack BlackRock, the world’s largest asset manager, has

emerged as a frontrunner in the crypto ETF space. Their iShares

Bitcoin Trust (IBIT) recorded the highest net inflow on a single

day, exceeding $144 million. BTC market cap currently at $1.3

trillion. Chart: TradingView.com This impressive figure has pushed

IBIT’s total net inflow over the past two weeks to over $14

billion. BlackRock’s commitment to Bitcoin ETFs is further

underscored by their recent decision to include prominent Wall

Street institutions like Goldman Sachs, Citigroup, Citadel

Securities, and UBS as Authorized Participants (APs) in their spot

Bitcoin ETF prospectus. These additions position these banking

giants as first-time participants in the ETF market, joining

established players like JPMorgan and Jane Street. The inclusion of

such heavyweights is seen as a significant vote of confidence in

the future of Bitcoin ETFs and a potential catalyst for further

mainstream adoption. Volatility On The Horizon For ETFs While the

recent surge in demand paints a bullish picture for Bitcoin ETFs,

experts warn that volatility may be lurking on the horizon.

CryptoQuant, a cryptocurrency analysis platform, points to signals

in the futures market that suggest potential price swings in the

near future. Related Reading: Trouble Ahead? Binance Coin Futures

Market Under Pressure With Negative Funding Rates A consistently

high premium often signifies strong institutional buying pressure,

particularly in light of the recent inflows witnessed in US Bitcoin

ETFs. This increased institutional activity can contribute to price

fluctuations, creating opportunities for both gains and losses.

Despite the potential for short-term volatility, the overall

outlook for Bitcoin ETFs remains positive. The sustained demand,

coupled with the backing of major financial institutions like

BlackRock, suggests that these investment vehicles are poised to

play a significant role in bridging the gap between traditional

finance and the cryptocurrency world. Featured image from Vegavid

Technology, chart from TradingView

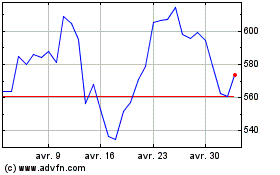

Binance Coin (COIN:BNBUSD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Binance Coin (COIN:BNBUSD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024