Ethereum Withdrawals From Exchanges Top 260,000 ETH – What This Means For Price

26 Avril 2024 - 7:00PM

NEWSBTC

Ethereum withdraws from centralized exchanges have ramped up over

the last week, suggesting a direction for investor sentiment during

this time. Given the sheer volume of ETH withdrawn from these

exchanges, it is prudent to try to understand what this could mean

for the crypto’s price. 260,000 ETH Leaves Exchanges Amid the

uncertainty that has plagued the crypto market, Ethereum investors

are making moves to secure their positions for better price

prospects. Pseudonymous crypto technical analyst Titan of Crypto

took to X (formerly Twitter) to share what Ethereum investors are

doing about their holdings right. Related Reading: Bitcoin Bears

Risk Losing $7.2 Billion If BTC Price Reaches This Level The post

revealed that these investors have been withdrawing large amounts

of ETH from centralized exchanges. In the one week period that was

tracked, the report found that a total of 260,000 ETH were

withdrawn from exchanges, which was worth almost $800 million at

the time. #Altcoins Crypto exchanges witnessed an outflow of over

260,000 #ETH equivalent to more than $781 million within the past 7

days. It’s time for #Ethereum shine. ✨🌕 pic.twitter.com/jT1aocjvbI

— Titan of Crypto (@Washigorira) April 24, 2024 Now, exchange

deposits and withdrawals are important for any cryptocurrency

because it can often tell how investors are looking at that coin

and what they are doing with their holdings. In the case of large

deposits to centralized exchanges, it can be very bearish for the

price because investors often deposit their coins in order to sell

them as exchanges provide deep liquidity. In contrast, withdrawals

from exchanges suggest that investors are not looking to sell their

ETH. Rather, they are accumulating the coins to wait for better

prices before selling. Naturally, this is bullish for the Ethereum

price as a diminished selling pressure gives room for the price to

recover. In this case, the withdrawals are bullish or the Ethereum

price, as investors continue to accumulate. It also signals that

investors are expecting a price breakout, and as the withdrawals

ramp up, demand could surpass supply, leading to a surge in price.

Ethereum Headwinds Still Negative Ethereum, while currently seeing

some positive activity from investors, has still not turned

completely bullish. For one, there has been a significant decline

in its daily trading volume. According to data from Coinmarketcap,

Ethereum’s trading volume is down approximately 20% in the last

day. Related Reading: Renowned Economist Reveals What Will Happen

If Bitcoin Can’t Hold $60,000 This decline in volume suggests a

declining interest from investors to actually trade the coin. As

such, its price may be negatively affected as attention begins to

shift elsewhere, with investors looking for better prospects.

Nevertheless, the cryptocurrency still looks bullish for the long

term. Ethereum continues to closely mirror the price performance of

Bitcoin, which is expected to go on a bull run following the

successful completion of its fourth halving event. For now,

Ethereum continues to struggle to hold above $3,100 with small

gains of 0.18% in the last day. Over the last month, it has

suffered multiple crashes, registering a 12.36% loss in the last 30

days. ETH price struggles to hold $3,100 support | Source: ETHUSD

on Tradingview.com Featured image from Investopedia, chart from

Tradingview.com

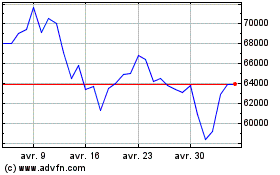

Bitcoin (COIN:BTCUSD)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Bitcoin (COIN:BTCUSD)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024