Holding FTT And BNB? It Might Be Time For You To Get Out

07 Novembre 2022 - 6:00PM

NEWSBTC

Cryptocurrencies such as BNB and FTT have been seeing some downside

in the last 24 hours. This follows an eventful weekend that has

culminated in what has been a clear intention of crypto exchange

Binance to begin dumping its FTT holdings. As a result, there is

expected to be a reaction from both FTT and BNB when the exchange

completes the dumping of its billion-dollar holdings in FTT.

Binance Pulls Out Of FTT Social media was lit afire when Binance

CEO Changpeng Zhao (CZ) said that the crypto exchange had decided

to liquidate its FTT position. Now, Binance had been an incubator

for the FTX exchange and when the exchange exited, it had received

$2.1 billion in stablecoins and FTT tokens, which Binance has held

until now. Related Reading: What Happens To Dogecoin If Twitter

Fails To Implement Crypto Plans? However, according to CZ, the

crypto exchange has decided that it is going to sell off its FTT

holdings following recent “revelations”. Binance had already begun

its sell-offs with almost $600 million worth of FTT tokens that

were moved to the exchange to be sold. CZ explained that they

were actually looking at ways to sell the tokens while minimizing

the impact on the market. The CEO said that the exchange usually

just holds tokens that they get, but it had decided to go this way

with FTT following what can only be speculated to be glaring red

flags about the token or the FTX exchange. It is no surprise that

Binance is choosing to play it safe this time around. The Terra

collapse had actually cost the exchange billions of dollars because

it held through the worst of it. The exchange’s $2.2 billion worth

of LUNA tokens was only worth a couple of hundred dollars once the

network collapsed. FTX Token struggles at $22 | Source: FTTUSD on

TradingView.com Retaliation Against BNB? As CZ mentioned in his

tweet, the crypto exchange actually holds tokens so it doesn’t seem

like they were taking action against competitors. With the selling

of its FTT tokens, there is no doubt that this is how it will come

off, especially after the offer for FTX to buy the tokens from

Binance at a value of $22 per token was reportedly turned down.

Related Reading: Why Ethereum Would Have Been A Better Investment

For MicroStrategy Given this, it is expected that FTX would likely

retaliate towards the exchange by selling off any BNB tokens that

it holds. A development such as this could see both digital assets

suffer massive declines in price, which is already being witnessed

at this point. At the time of this writing, FTT and BNB are both

down 1.85% and 5.01% respectively in the last 24 hours. As the

saying goes, “When elephants fight, it is the grass that suffers”,

retail investors will likely bear the brunt of the war between

these two giants. For many, this has signaled an exit point while

watching the battle unfold from afar. If it turns into a full-blown

war of both exchanges trying to undermine the other, then it will

likely be the trigger that pushes the crypto market below its

current cycle lows. Featured image from Bitcoinist, chart from

TradingView.com Follow Best Owie on Twitter for market insights,

updates, and the occasional funny tweet…

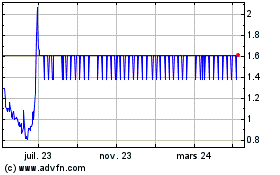

FTX Token (COIN:FTTUSD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

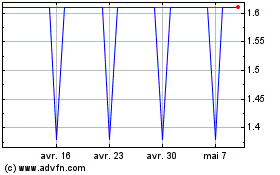

FTX Token (COIN:FTTUSD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024