Bitcoin Turns Bearish As Whales Sell-Off On Gemini

12 Août 2021 - 10:00PM

NEWSBTC

On-chain data may suggest huge Bitcoin inflows to crypto exchange

Gemini might be the reason behind the recent dip. Huge Bitcoin

Inflows To Crypto Exchange Gemini As pointed out by a CryptoQuant

post, these BTC inflows to Gemini might be the reason for the

current downwards trend in the crypto’s price. The Bitcoin inflow

is an indicator that shows the amount of BTC transferred into

exchange wallets. The opposite metric is called the outflow. The

difference between the inflows and outflows gives the exchange

netflow. When this indicator’s value is positive, it means inflows

are outweighing outflows. While on the otherhand, if the netflow is

negative, it implies more Bitcoin is moving out of exchanges than

in. Now, here is a chart for the BTC Gemini netflow: Gemini

received huge inflows shortly before the price dip | Source:

CryptoQuant As the graph shows, the BTC price started moving down

as soon as Gemini started noticing negative spikes in the netflow.

The reason behind the dip is that big inflows mean whales are

sending their coins to the exchange for selling purposes/altcoin

purchasing. Related Reading | S2F Creator Beckons Beginning Of

Second Leg Of Bitcoin Bull Run However, as the graph shows, big

inflows aren’t the only necessary condition for the price to go

down. There are two other indicators that influence the price,

namely the BTC spot reserves and the stablecoins issued metric. The

spot reserves is the total amount of Bitcoin in wallets of all

exchanges. If the value of this indicator moves up, it means

exchanges across the board are noticing large inflows. On the

contrary, if the spot reserves move down, it means exchanges are

overall observing higher outflows. Looking at the above chart, spot

reserves moving up seems to cause a drop in the price, as expected.

Related Reading | Could The New “China Model” Be The Reason The

Country Banned Bitcoin Mining? The graph also shows that if Gemini

receives large inflows while the spot reserves go down, the price

isn’t negatively affected. Similarly, large amounts of stablecoins

being issued also seems to cause a similar effect. BTC Price At the

time of writing, Bitcoin’s price is around $44k, up 8% in the last

7 days. Over the past month, the cryptocurrency has amassed 34% in

gains. Below is a chart showing the changes in the coin’s value

over the past three months: BTC's price seems to be crashing down |

Source: BTCUSD on TradingView After peaking not too far from the

$47k price mark, Bitcoin seems to be sharply moving downwards. As

explained above, this could be related to the inflows to Gemini.

Some signs still seem to be bullish for the crypto so it’s hard to

say which direction it will go in next. However, if such inflows

continue, there could be a bear market ahead.

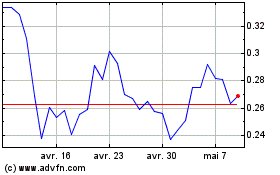

Graph Token (COIN:GRTUSD)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Graph Token (COIN:GRTUSD)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024