Bitcoin Exchange Reserves Hit 5-Year Low—What Does This Signal?

16 Novembre 2024 - 9:30AM

NEWSBTC

The Bitcoin market appears to have taken an intriguing turn as the

asset’s reserves on centralized exchanges have hit the lowest

levels since November 2018. This development, highlighted by a

CryptoQuant analyst known as G a a h, points out a notable change

in BTC’s investor behavior within the crypto space and also

suggests quite an interesting trend for Bitcoin. Related Reading:

Bitcoin Crosses $93,000 – Is There More Room for Gains or Are We

Nearing a Peak? Bitcoin Reserves On Exchanges Reach Five-Year Low

According to the analyst, Bitcoin reserves on exchanges have

diminished significantly throughout 2024, reflecting a shift

towards long-term holding strategies among market participants.

This trend suggests that investors

increasingly transfer their assets to private wallets,

reducing the supply available for immediate sale and contributing

to buying pressure in a market already constrained by supply.

According to G a a h, this behavior indicates a broader sentiment

shift, with market participants displaying increased confidence in

Bitcoin as a store of value amidst “economic uncertainty and rising

inflation.” By moving Bitcoin away from exchanges, investors reduce

the likelihood of sudden sell-offs, which can lead to increased

price stability. However, the reduced supply on exchanges may also

lead to heightened volatility, especially if demand continues to

grow or remains consistent. The CryptoQuant analyst noted: With

that said, this scenario signals a potentially more volatile but

more resilient Bitcoin market, with less selling pressure and a

growing dominance of long-term holders, which could open up space

for new price peaks. BTC’s Upward Momentum Cools Off Following

an all-time high (ATH) of $93,477 on Wednesday, November 13,

BTC has faced quite a noticeable correction, now down by 4%

from this peak. So far, the asset has been unable to continue its

upward momentum and appears to be seeing more sell-offs. When

writing, Bitcoin trades below $90,000 with a current trading price

of $89,779, down by 1.4% in the past day. This price decline

resulted in roughly $49 billion subtracted from its market

capitalization valuation on Wednesday. For context, as of today,

BTC’s market cap sits at $1.775 trillion, a nearly 5% decrease from

the $1.835 trillion valuation two days ago. Bitcoin’s daily trading

volume dropped from over $100 billion earlier this week to below

$85 billion. Related Reading: Binance Dominates As Bitcoin Futures

Volume Hits New Peaks Amid Historic Price Rally Besides the

implications on its market cap and trading volume, BTC’s decline

has significantly impacted a handful of traders. According to data

from Coinglass, in the past 24 hours alone, roughly 170,215 traders

have been liquidated, bringing the total liquidations in the crypto

market to $510.13 million. Out of these total liquidations, Bitcoin

accounts for $132.43 million, with the majority of the liquidations

coming from long positions—those who bet that the upward momentum

would continue. Featured image created with DALL-E, Chart from

TradingView

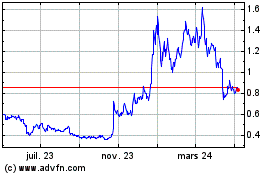

Mina (COIN:MINAUSD)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Mina (COIN:MINAUSD)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024