XRP Consolidation Could End Once It Clears $2.60 – Top Analyst Expects $4 Soon

17 Décembre 2024 - 7:00PM

NEWSBTC

XRP has entered a consolidation phase after reaching a multi-year

high of $2.90 during the first week of December. The

cryptocurrency’s price action has left investors uncertain about

its next move, fueling speculation about whether XRP will surpass

the critical $3 mark or if the cycle top has already been set. This

indecisive environment reflects a broader trend of caution among

market participants, as XRP’s future remains unclear. Related

Reading: Ethereum Whales Load Up: Bullish Sign Or Bear Trap? Ali

Martinez, a prominent crypto analyst, recently shared insights

suggesting that XRP has been trading within a bull flag pattern, a

classic continuation signal in technical analysis. According to

Martinez, the key to unlocking XRP’s next rally is overcoming the

$2.60 resistance level. A breakout above this threshold could set

the stage for XRP to push past $3 and potentially explore even

higher price levels. As the market closely watches XRP’s movements,

the $2.60 level has become a critical battleground for bulls and

bears alike. With momentum building and the broader crypto market

showing strength, XRP’s ability to break free from its

consolidation phase could determine whether it sets new highs or

faces a potential reversal. For now, all eyes remain on its next

major move. Preparing For The Next Rally? XRP has been in a

volatile consolidation phase since December 3, experiencing a 34%

retrace followed by a 36% bounce, though it remains below its local

high of $2.90. This price action reflects a tug-of-war between

bullish momentum and market hesitation as investors speculate on

XRP’s next move. Despite the back-and-forth, XRP’s structure shows

promise for another significant rally. Top analyst and investor Ali

Martinez recently provided insight into XRP’s price, sharing a

technical X analysis highlighting the current bull flag pattern.

According to Martinez, this setup indicates a potential uptrend

continuation once XRP clears the critical $2.60 resistance level.

If this breakout occurs, Martinez predicts XRP could “be off to the

races,” targeting an ambitious $4 price level. The $2.60 resistance

is key to breaking XRP out of its current range, and a successful

move above this level would likely trigger bullish momentum.

Furthermore, reclaiming the $2.90 local high would signal the start

of price discovery, with XRP poised to surpass its next

psychological milestone at $3.31. Related Reading: Bitcoin Breaks

ATH Pushing Back Into Price Discovery – BTC To $130K? As XRP

consolidates, its future hinges on overcoming these resistance

levels. The current bull flag pattern and broader market sentiment

suggest the potential for a breakout, but the timing and strength

of the move remain uncertain. Investors continue to watch closely

for signals of confirmation. XRP Price Action: Levels To Watch XRP

trades at $2.57, edging closer to the critical $2.64 resistance

level. This price point is pivotal for XRP’s near-term trajectory,

as clearing it would open the door to testing the $2.90 local high.

Breaking through these levels in the coming days could spark a

massive rally, potentially driving XRP into uncharted territory

above its all-time high (ATH). The $2.64 mark is a key barrier that

must be surpassed to confirm bullish momentum. If XRP successfully

pushes past this hurdle, it will likely attract fresh buying

interest, accelerating its upward movement. A move beyond $2.90

would further validate the trend’s strength and set the stage for

significant gains. Related Reading: AAVE Dominates DeFi Lending –

Metrics Reveal 45% Market Share However, failure to break above

$2.64 could leave XRP vulnerable to downside pressure. Maintaining

support above $2.33 would be crucial in this scenario to avoid a

deeper correction. Losing this level might signal a shift in

sentiment, potentially leading to a more pronounced retracement.

Featured image from Dall-E, chart from TradingView

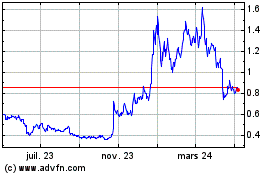

Mina (COIN:MINAUSD)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Mina (COIN:MINAUSD)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024