ADA Faces Retest Of $0.8119 As Technical Indicators Turn Bearish

23 Décembre 2024 - 11:00AM

NEWSBTC

Cardano (ADA) is facing increasing bearish momentum, with its price

nearing a critical support level at $0.8119. This potential retest

signals a pivotal moment for the cryptocurrency as market

conditions turn unfavorable. Recent price action with

negative signals from key technical indicators has intensified

concerns about further downside risks. The Relative Strength Index

(RSI) and other metrics suggest growing selling pressure, making

ADA’s ability to hold above this key level a matter of

significance. A breach below $0.8119 could pave the way for more

losses, potentially pulling ADA into uncharted bearish territory.

However, defending this support level might provide the foundation

for a stabilization or recovery. As the market sentiment shifts,

can Cardano regain its footing or succumb to deeper declines? This

critical juncture highlights the importance of monitoring technical

and market-driven factors in the token’s ongoing journey. Technical

Indicators Signal Further Downside For ADA Historically, the

$0.8119 level has served as a crucial threshold for price action,

acting as both a support and resistance point in previous market

cycles. Its proximity now highlights the mounting challenges

Cardano faces as bearish momentum continues to dominate the market.

Related Reading: Cardano Price Eyes Recovery Toward $2 As

Million-Dollar Whale Transactions Explode On The Network The

negative sentiment around the token is largely fueled by weakening

technical indicators and a waning market mood. ADA remains below

key moving averages, such as the 100-day Simple Moving Average

(SMA), which underscores a prolonged downtrend. This alignment of

the price below pivotal technical levels signals a lack of upward

strength and an increased likelihood of more downside pressure.

Adding to the bearish narrative is the Relative Strength Index

(RSI), which has been trending lower, signaling intensified selling

pressure. Currently hovering near oversold levels, the RSI reflects

waning buyer interest and heightened dominance by sellers. Should

the trend continue, it could pave the way for the altcoin to break

below the $0.8119 mark, possibly triggering a new wave of selling.

Potential Scenarios: Break Below $0.8119 Or Rebound? If ADA fails

to hold above $0.8119, it may signal a continuation of downbeat

momentum, potentially triggering a deeper decline. In this case,

sellers might push the price toward lower support zones such as

$0.6822 or even $0.5229 areas that have previously acted as

stabilizing levels during market downturns. A break below $0.8119

would likely confirm seller dominance, further eroding market

confidence and leading to heightened volatility. Related Reading:

Cardano Could Be Heading For A 20% Correction – Technical Data

Signals Bearish Price Structure On the other hand, a successful

defense of the $0.8119 level could lay the groundwork for a

rebound. Buyers may seize the opportunity to regain control,

leveraging the support level as a springboard for recovery. This

could result in ADA attempting to revisit resistance levels near

$1.2630 or higher, reversing the bearish trend and reigniting

optimism in the market. Featured image from Unsplash, chart from

Tradingview.com

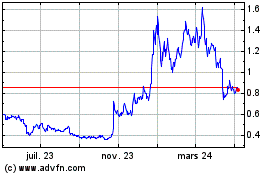

Mina (COIN:MINAUSD)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Mina (COIN:MINAUSD)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024