Solana Recovery Momentum Set The Stage For $194 Resistance Breakout

24 Décembre 2024 - 3:30PM

NEWSBTC

Recent trading activities reveal that Solana (SOL) is showing signs

of renewed strength as its price stages a notable recovery. After

enduring a period of bearish dominance, SOL has found support at

$164, sparking optimism among market participants. Currently, the

cryptocurrency is approaching the critical $194 resistance level, a

pivotal barrier that could determine the next phase of its

trajectory. This recovery highlights the resilience of Solana’s

bulls, who appear ready to reclaim control and push the price

higher. However, the journey to surpass $194 is far from

straightforward. Historical data reveals this level as a

significant hurdle, where sellers have often mounted strong

defenses. A successful breakout above $194 could signal a

resurgence of bullish momentum, potentially propelling SOL toward

new highs and reinforcing confidence in its long-term prospects.

Solana Resilience Amidst Waning Market Condition The $164 level has

proven to be a critical support zone for Solana, acting as a safety

net against further declines. Historically, this level has

facilitated strong buying pressure, signaling that bulls are

vigorously defending this zone. Its ability to hold firm during

recent market turbulence underscores its importance in SOL’s

recovery narrative. Related Reading: Solana Price Continues

Downward Slide — Is A Rebound Possible At $180? Additionally, the

$137 level has emerged as another significant area of interest.

Though the price has not revisited this mark in recent trading

sessions, its historical role as a bounce-back point for SOL cannot

be overlooked. The convergence of multiple support zones has

created a robust foundation, enabling the asset to stabilize and

regain momentum. Bullish Indicators Supporting Recovery Several

technical indicators are aligning to suggest a potential

continuation of upward momentum: Composite Trend Oscillator: Both

the signal line and the SMA of this indicator are gradually

climbing out of oversold territory, reflecting an increase in

buying pressure and a shift toward positive sentiment. 100-Day

Simple Moving Average (SMA): The price is approaching this key

moving average, signaling a possible shift in the medium-term

momentum. A successful breach above this level could solidify the

recovery trend. Volume Profile: Trading volumes near the $185

support level have shown a significant uptick, indicating renewed

interest among buyers and the possibility of sustained upward

strength. In conclusion, SOL’s recovery from key support levels is

a testament to the asset’s resilience in the face of adversity. If

the bulls capitalize on this momentum and push the price beyond the

$194 resistance, it could signal the start of a broader bullish

rally, as the price will move to challenge the $209 resistance.

Related Reading: Solana Holds Weekly Support At $180 – Analyst

Expects $330 Mid-Term Conversely, If bearish action strengthens,

Solana might face increased selling pressure, possibly pulling its

price to the $164 support zone. A clear break below this critical

threshold may pave the way for further declines, with the next

significant support level situated at $137. Featured image from

iStock, chart from Tradingview.com

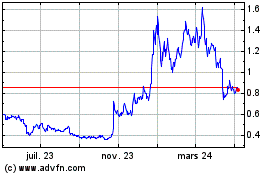

Mina (COIN:MINAUSD)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Mina (COIN:MINAUSD)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024