This Indicator Hints US Investors Sold Bitcoin Harder Than Others During Crash

15 Novembre 2022 - 8:00PM

NEWSBTC

The Bitcoin Coinbase Premium Index suggests US investors have been

selling more heavily than others during the latest crash in the

crypto. Bitcoin Coinbase Premium Index Has Turned Deep Red Recently

As pointed out by an analyst in a CryptoQuant post, whales on

Coinbase Pro seem to have been behind the latest dump. The

“Coinbase Premium Index” is an indicator that measures the

percentage difference between the Bitcoin price listed on Coinbase

Pro (USD Pair) and the one listed on Binance (USDT pair). Coinbase

Pro is popularly known to be used by investors based in the US

(especially large institutionals), while Binance gets a more global

traffic. Therefore, the price gaps listed on these two crypto

exchanges can hint at which investors are selling or buying more.

When the metric has a positive value, it means the value of BTC on

Coinbase is higher than on Binance right now, suggesting that US

investors have provided more buying pressure recently. Related

Reading: Bitcoin Moves Differently From US Stock Market,

Correlation Weakening? On the other hand, negative values of the

premium suggest American holders are dumping more than global

investors at the moment. Now, here is a chart that shows the trend

in the Bitcoin Coinbase Premium Index over the past year: The value

of the metric seems to have been red in recent days | Source:

CryptoQuant As you can see in the above graph, the Bitcoin Coinbase

Premium Index has plunged into negative values recently along with

the crash. This means that US investors have been dumping more

aggressively than investors from the rest of the world in the past

week. Related Reading: Quant Points Out Striking Resemblance

Between 2017 And 2021 Bitcoin Cycles Also, as is clearly visible in

the chart, a similar trend was also seen back in early May, when

BTC’s price crashed from $40k to $30k. The quant notes that while

Coinbase observed this selling, the Bitcoin Korea Premium Index

showed an interesting behavior. The below chart highlights this

trend. Looks like this metric had a green value recently | Source:

CryptoQuant The Korea Premium Index measures the gap between the

prices listed on South Korean crypto exchanges, and that on other

exchanges. From the graph, it’s apparent that during both the

current crash as well as the one in May, the indicator showed

positive spikes. This implies that while the US investors were

dumping, the Korean investors were focusing on “buying the dip.”

BTC Price At the time of writing, Bitcoin’s price floats around

$16.8k, down 15% in the last week. Over the past month, the crypto

has shed 11% in value. BTC has been stuck in consolidation under

$17k in the last few days | Source: BTCUSD on TradingView Featured

image from Unsplash.com, charts from TradingView.com,

CryptoQuant.com

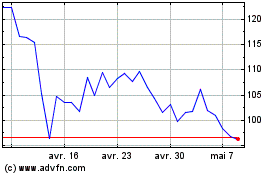

Quant (COIN:QNTUSD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Quant (COIN:QNTUSD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024