Ethereum Open Interest Sets New Record, Analyst Says Fireworks ‘Guaranteed’

29 Novembre 2024 - 12:30PM

NEWSBTC

Data shows the Ethereum Open Interest has recently observed a sharp

jump to a new all-time high (ATH) of around $16.8 billion. Ethereum

Open Interest Has Shot Up Recently In a new post on X, CryptoQuant

community analyst Maartunn has discussed about the latest trend in

the Ethereum Open Interest. The “Open Interest” here is an

indicator that keeps track of the total amount of ETH-related

derivatives positions currently open on all centralized exchanges.

Related Reading: Glassnode’s Bitcoin “Seller Exhaustion” Indicator

Just Flashed A Signal: Bottom In? Below is the chart the analyst

shared that shows this metric’s trend over the past week. The graph

shows that the Ethereum Open Interest has observed a sharp increase

over the past day. This means the investors have just opened many

new positions on the derivatives market. Generally, the total

amount of leverage in the market goes up whenever new positions pop

up, so mass liquidation events can become more probable. A Mass

liquidation event, popularly called a squeeze, can be a violent

event where a large amount of liquidations occur simultaneously,

feeding back into the price move that caused them. This provides

more fuel for the move, which in turn causes even more liquidation.

Ethereum has been rallying recently, so some speculative interest

is normal, but the scale of the latest Open Interest increase may

be concerning. The metric has increased by around 19% within a

24-hour span, reaching a new ATH of around $16.8 billion. As has

often happened in history, this rapid growth in the Ethereum Open

Interest could once again lead into volatility for the asset’s

price. “This is guaranteed for heavy fireworks,” notes Maartunn. In

theory, the volatility resulting from this increase in the

indicator could take the asset in either direction. Still, since

the rise has come alongside a rally in the ETH price, these

positions will likely be long. Related Reading: Bitcoin Sentiment

Cools Down From Extreme Greed: Can Rally Restart Now? And indeed,

as an analyst pointed out in a CryptoQuant Quicktake post, the

Ethereum Funding Rates have been positive recently, implying the

long positions have been outweighing the short ones. Usually, a

squeeze is more likely to affect the side of the market with more

positions. As such, if the overheated derivatives market unwinds in

a volatile storm, Ethereum may come out with a drawdown in the

price. ETH Price At the time of writing, Ethereum is trading at

around $3,500, up almost 7% over the last seven days. Featured

image from Dall-E, CryptoQuant.com, chart from TradingView.com

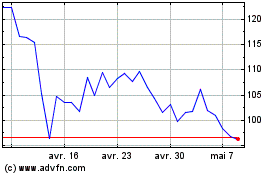

Quant (COIN:QNTUSD)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Quant (COIN:QNTUSD)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024