49,700 Dormant Bitcoin Just Moved—What’s Next For BTC’s Price?

06 Février 2025 - 6:30AM

NEWSBTC

Bitcoin recent price movements have been nothing short of a

rollercoaster ride. Earlier this week, BTC traded below $90,000 and

quickly bounced back to above $100,000. As of today, the asset now

hovers above $98,000. Amid this price performance, CryptoQuant

contributor XBTManager has provided insights into an important

on-chain metric, highlighting a notable shift in the 6-12 month

spent output age bands. This activity sheds light on possible

market dynamics and future price developments. Related Reading: Why

Bitcoin’s Price Crash Could Be a Buying Opportunity for Big Players

Analyzing Bitcoin’s Spent Output Age Bands The 6-12 month spent

output age band reveals instances where long-held Bitcoin is moved,

offering a glimpse into shifting market behavior. According to

XBTManager, a significant amount—49,700 BTC—has recently been spent

in this category today. Such substantial movement can often precede

market volatility, as it may signal larger holders or dormant

wallets re-entering active circulation. This sudden activity raises

questions about how the market might react. Historically, large

movements in older Bitcoin holdings can create temporary selling

pressure. If these coins are sold, it can lead to short-term

further price drops, potentially causing retail investors to panic.

However, this downward trend can also set the stage for a rebound,

with prices recovering as buyers absorb the new supply. The analyst

wrote: A large portion of these Bitcoins is expected to be sold in

the coming days, potentially creating selling pressure in the

market. This could cause retail investors to panic and sell at

lower prices. Subsequently, prices might be pushed back up,

enabling these Bitcoins to be sold to retail investors at higher

prices. Therefore, such movements can be seen as signs of market

manipulation. Investors should remain cautious about potential

market fluctuations in the coming days. Bitcoin Market Performance

Meanwhile, Bitcoin continues to face selling pressure, with the

asset unable to sustain a notable rebound or reclaim key levels. So

far, Bitcoin has seen quite a plunge dropping roughly 10% from its

all-time high above $109,000 registered in January. Related

Reading: Bitcoin Traders Fearful For First Time Since October:

Buying Signal? In the past week, the asset has also declined 3.5%

bringing its price to trade at $98,485, at the time of writing down

by 0.5% in the past day. This price decline in BTC has affected the

broader crypto market significantly with over $3 billion liquidated

in the crypto market in just the past few days. Interestingly,

despite this negative price performance from BTC, the asset’s daily

trading volume has however seen an opposite trend recording an

increase from below $40 billion this time last week to sitting

above $58 billion as of today. Featured image created with DALL-E,

Chart from TradingView

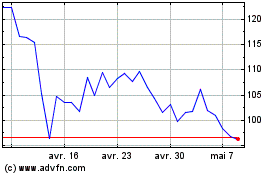

Quant (COIN:QNTUSD)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Quant (COIN:QNTUSD)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025