On-Chain Data Suggests Cardano Is Growing Rapidly

29 Mars 2023 - 6:00PM

NEWSBTC

On-chain data provider Santiment shows Cardano (ADA) is presenting

mild decoupling signs this week. According to the report, the

decoupling highlights ADA’s increasing strength as an independent

asset. ADA’s recent price moves and uptrend depicts resilience for

over a month, even amid downturns in the broader crypto market.

Santiment reported that major Cardano investors with 10,000 or more

ADA tokens embarked on a buying spree. Cardano Bucks

Downtrends With Impressive Price Performances Over the past two

days, ADA has witnessed an 11% price growth, distinguishing itself

from other assets in the crypto market. While other assets traded

in the red, losing previous gains, ADA gained. Related Reading: Six

Million Bitcoins Now Lost Forever? Why This Matters This price

performance may indicate investors are betting on ADA’s long-term

utility and potential. It may also mean that the Cardano ecosystem

is getting mature. Santiment data reveals that addresses holding

over 10,000 ADA have accumulated 1.03 billion coins, a 3.3%

increase from their initial token holdings. Source: Santiment This

accumulation further suggested increased on-chain activity even

amid bearish sentiments in the market. Moreover, ADA’s steady price

increase over the last month indicates bullish sentiment among its

investors. ADA might see more decoupling actions as the Cardano

network expands its ecosystem and remains innovative. This could

further distinguish it as a dominant asset supporting crypto

diversification. ADA Price Pushing Forward As Investors’ Sentiment

increase No matter how hard Cardano fights, it still has strong

rivalry in projects like Ethereum and Solana. However, Cardano is

planning several projects to improve the developer experience

within its ecosystem. Cardano (ADA) is trading at $0.3852, with

over a 4% price increase over the past 24 hours. Despite slight

pullbacks here and there, ADA has gained 12% in two weeks,

retaining some of its past month’s gains while most coins

surrendered theirs. ADA’s current price compared to its January 1

price indicates the token observed notable rallies this year amid

major developments on the Cardano network. According to an update

by a top crypto trader, Cardano broke the all-time high Total Value

Locked (TVL) with 381.05 million ADA locked. So, ADA TVL would

reach $1.181 billion if the token hit $3.10. The trader is

confident that ADA’s TVL could increase ten times its current value

during the next bull market. At press time, ADA’s TVL has reduced

to $140.38 million. But it has recorded an 8.51% increase over the

past 24 hours. Related Reading: Bitcoin In Free Fall As Regulators

Turn Their Attention To Binance Total value locked (TVL) is a

metric used to measure the total amount of assets locked up in

decentralized finance (DeFi) protocols. An increase in TVL often

precedes increased liquidity, popularity, and usability of a crypto

asset. ADA’s increased TVL further confirms its gaining traction

from the investor community. Featured image from Pixabay and chart

from Tradingview.com

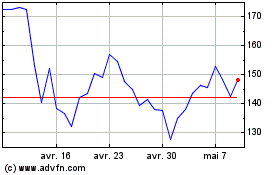

Solana (COIN:SOLUSD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Solana (COIN:SOLUSD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024