Bitcoin Price Forecast: What To Expect In The Final 24 Hours Before US Election

04 Novembre 2024 - 5:41PM

NEWSBTC

As the US presidential election approaches, the Bitcoin price has

found a stable support range between $68,000 and $69,000, just shy

of its all-time high earlier this year. While the

cryptocurrency has struggled to surpass this significant milestone,

investor sentiment remains cautiously optimistic, with expectations

for further price increases tempered by anticipated market

volatility in the upcoming hours. Bitcoin Price Expected To Swing

8% Post-Election The options market indicates the Bitcoin price

could see price swings of approximately 8% in either direction

following the election, a notable increase compared to the typical

2% fluctuations seen on regular trading days. Caroline

Mauron, co-founder of Orbit Markets, a crypto derivatives liquidity

provider, noted that “no significant volatility premium is priced

in after Nov. 7,” suggesting the market anticipates a relatively

swift resolution to the election results. Related Reading:

Solana Expected To Reach $500 By Bull Run’s End, Says Crypto

Analyst The election pits Republican nominee and former President

Donald Trump against Democratic Vice President Kamala Harris, with

both candidates eliciting varied responses from the crypto

community. Trump’s favorable stance towards cryptocurrencies

has positioned Bitcoin as part of the so-called “Trump trades,”

especially in light of the regulatory crackdown experienced under

President Joe Biden. As Trump’s odds have fluctuated in

betting markets, the Bitcoin price has mirrored these changes,

briefly nearing record highs before retreating as polls indicate a

tightly contested race. The options market reflects a balanced

sentiment, with an even distribution of bearish and bullish

positions throughout October, indicating that traders are preparing

for upward and downward movements as the election draws near.

Data from the Deribit exchange suggests a potential trading range

of $60,000 to $80,000 for the Bitcoin price in the weeks following

the election, based on peak open interest in options contracts.

Path To $100,000 Remains Viable Crypto analyst Miles Deutscher has

also shared his view on social media, positing that a Trump victory

could lead to an immediate Bitcoin price surge, potentially

establishing a new all-time high this year. Conversely, the

analyst suggests that a win for Harris might result in a price

drop, delaying any new highs until Q1 2025. Regardless of the

election outcome, Deutscher remains confident that Bitcoin will

reach $100,000. Market expert Patric H. adds another layer of

analysis, observing that Bitcoin closed the past week above a daily

downtrend channel, indicating a potential reversal. However,

Patrick notes that the weekly candle shows weakness, prompting

market participants to de-risk before the election. His bullish

thesis hinges on Bitcoin holding above $65,000; a drop below this

level could signal a return to extended price volatility. Related

Reading: Dogecoin (DOGE) Poised for a Move: Will It Start a Fresh

Increase? From a trading perspective, data indicates that perpetual

traders on Binance have withdrawn limit buy orders below $50,000,

suggesting a shift in sentiment. Previously, there was

substantial long interest in the “multi-billion dollar range”

between $42,000 and $50,000, but traders appear to have sidelined

that capital in favor of higher price levels. The next

significant limit buy order is $63,800, with additional smaller

orders scattered down to that level, indicating that Bitcoin may

not fall significantly below this point. On the upside, the next

significant resistance level for the Bitcoin price is $73,000,

where substantial selling interest from Coinbase and Binance is

noted. Patrick anticipates a potential rejection in the $75,000 to

$76,000 range, which could precede a breakout if those levels are

successfully breached. At the time of writing, Bitcoin is trading

at $68,360, up 0.8% over the past 24 hours. Featured image from

DALL-E, chart from TradingView.com

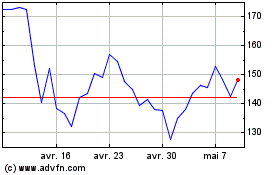

Solana (COIN:SOLUSD)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Solana (COIN:SOLUSD)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025