Bitcoin Open Interest Dropped Significantly – Investors Cautions Amid US Election Week?

05 Novembre 2024 - 1:00AM

NEWSBTC

Bitcoin has faced significant volatility and uncertainty as it

approaches a pivotal week, with tomorrow’s U.S. election expected

to play a key role in determining its price action. BTC is holding

steady above the $68,000 mark, a critical level that has shifted

from resistance to a solid demand zone. Analysts see this level as

essential for maintaining bullish momentum, especially with

high-stakes events on the horizon. Key data from Coinglass reveals

a notable drop in Bitcoin’s open interest, suggesting that many

investors are closing their positions amid the uncertainty

surrounding the election and the Federal Reserve’s upcoming

interest rate decision on Thursday. This decline in open interest

reflects a cautious market stance as traders anticipate the

election outcome and its potential influence on broader financial

markets and Bitcoin’s trajectory. Related Reading: Solana Likely To

Target $200 ‘If It Holds Current Support’ – What To Expect With BTC

managing to hold above this demand zone, the coming days will be

crucial for confirming its direction. A sustained hold could

strengthen BTC’s outlook, setting it up for a potential breakout.

Conversely, increased selling pressure tied to market reactions

could put this level to the test. The week ahead could be a

defining moment for Bitcoin’s price action as macro events unfold.

Bitcoin Investors Preparing For This Week Bitcoin is gearing up for

what could be the most defining week of this market cycle.

Approaching all-time highs, BTC is facing heightened volatility as

two critical events unfold: the U.S. presidential election and the

Federal Reserve’s decision on interest rates. These events are

poised to impact Bitcoin and global financial markets, potentially

shaping global trade policies and economic stability. Recent data

from Coinglass highlights that investors are bracing for a

turbulent week as open interest in Bitcoin dropped significantly,

with many traders opting to close their long and short positions

before the election. This retreat in open interest signals caution,

as the crypto market anticipates significant volatility stemming

from the election results and the Fed’s rate decision. Coinglass

shared an analysis on X, emphasizing that Bitcoin’s price could

experience extreme swings regardless of who wins the election,

likening it to a “wild rollercoaster.” This week is crucial for

Bitcoin and the broader global economy, with analysts suggesting

that the election could set the tone for international economic

policies and trade relations in the years to come. The Fed’s rate

decision, scheduled just days after the election, adds additional

uncertainty, as it could dictate monetary policy direction and

market liquidity. Related Reading: Dogecoin Analyst Reveals Buying

Opportunities At Lower Prices – Details With BTC teetering near

historic highs, investors are closely watching these events to

learn about market direction. Whether Bitcoin breaks to new heights

or experiences a pullback largely depends on the unfolding economic

landscape. For now, Bitcoin remains on edge, with investors poised

for a week that could define its trajectory for the months ahead.

BTC Testing Crucial Liquidity Bitcoin is trading at

$68,800 after falling short of breaking its all-time highs last

week. This week promises heightened unpredictability for BTC’s

price action, driven by major events in the global economy. Key

levels will be essential to watch: if Bitcoin can maintain support

above $68,000, it will likely set the stage for another attempt to

surge past its record high. However, volatility may test this

support, potentially shaking out “weak hands” before any

significant upward momentum. Should BTC dip below $68,000, further

pullbacks could follow, allowing institutional buyers to accumulate

before a renewed push. If Bitcoin successfully breaks above its

$73,794 all-time high, it will enter a price discovery phase, where

the lack of resistance can trigger a rally fueled by FOMO (fear of

missing out) among investors. This upward momentum in a price

discovery zone often leads to rapid price increases as more buyers

enter the market. Related Reading: Analyst Exposes Ethereum

Ascending Support At $2,400 – Best Chance To Accumulate ETH? As

Bitcoin edges to this level, market participants remain watchful,

anticipating a potential breakout that could redefine the broader

market sentiment and establish new highs for the cycle. Featured

image from Dall-E, chart from TradingView

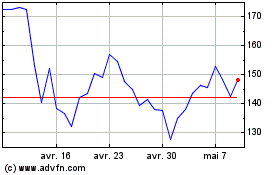

Solana (COIN:SOLUSD)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Solana (COIN:SOLUSD)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025