Uniswap Reports Phishing Scam, As UNI Records 10% Profit In 24 Hours

12 Juillet 2022 - 8:25PM

NEWSBTC

Uniswap (UNI) has been moving against the general sentiment in the

market. As Bitcoin, Ethereum, and larger cryptocurrencies give out

their last week’s gains, UNI’s price remains impervious and

maintains bullish momentum. Related Reading | TA: Ethereum

Breakdown Looks like the Real Deal, $1K Is The Key At the time of

writing, Uniswap (UNI) trades at $5.7% and records a 10% profit in

the past 7 days and a 32% profit over the last month. In smaller

timeframes, UNI’s price has begun to weaken as it displays a 3%

loss in the past day. Yesterday, liquidity providers on the

platform suffered millions of dollars in losses as a result of a

phishing scam. Via its official Twitter handle, Uniswap Labs

confirmed the attack and called it a “problem far too common in

crypto today”. The company addressed the situation as there were

ongoing rumors about a potential exploit to the Uniswap v3

platform. In that sense, they confirmed the phishing attack but

claimed no exploit took place. As they explained, liquidity

providers on the platform received “malicious tokens” via airdrops

which pointed them to a “malicious interface”. Users fell for this

phishing attack because they were promised a chance to swap the

airdropped tokens for UNI. The company explained: This generated a

setApprovalForAll transaction, which, if approved by the user in

their wallet, gave the attacker the ability to redeem all of the

user’s Uniswap v3 LP tokens for their full underlying value. The

company explained that users must consider potential phishing

attacks from all those domain names not associated with unswap.org.

In response to probable future measures to be adopted to mitigate

these attacks, the creator of Uniswap Hayden Adams said: In

addition to education, I think there is a ton that can be done at

the UI layer (wallets and other interfaces) to protect users.

Example: by default, hide any unknown token with a URL in the name.

Why Uniswap Is Moving Against The Trend Despite the attacks, the

sentiment in the crypto market, and the UNI tokens entering the

market, UNI’s price was able to maintain its weekly and monthly

gains. The persistent bullish price action could be driven by a

series of partnerships and acquisitions. Uniswap Labs announced the

purchase of non-fungible token (NFT) marketplace aggregator Genie.

This will enable the platform to offer trading services for these

digital assets. In addition, developers will be able to leverage a

new API to build applications on Uniswap and offer ERC-20, NFTs,

and cryptocurrency trading. Thus, making the protocol a

“comprehensive platform for users and builders in Web3. Related

Reading | Back Into Crab Mode, Bitcoin Bullish Potential

Capped For The Coming Months? The acquisition included a future

USDC airdrop to all users that traded in the platform before April

15, 2022, and GENIE NFT holders. This has potentially boosted UNI’s

trading volume and demand which provided the token with more

resilience against the persistent bearish price action across the

crypto market.

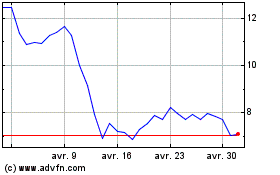

Uniswap (COIN:UNIUSD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Uniswap (COIN:UNIUSD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024