Fourth Bitcoin Halving Completed – Here Are The Implications

20 Avril 2024 - 6:00PM

NEWSBTC

The long-awaited fourth Bitcoin halving finally occurred after BTC

posted its 840,000th block. This event is significant as it is

expected to have several implications for the Bitcoin ecosystem and

the crypto market going forward. What To Expect Following The

Bitcoin Halving The Bitcoin halving slashed miners’ rewards from

6.25 BTC to 3.125 BTC for each block mined. This means that Bitcoin

miners are set to earn a reduced income of 450 BTC instead of the

900 BTC they earned before the fourth halving. This development is

expected to have a dire effect on their operations, as NewsBTC

reported that they could lose a whopping $10 billion following the

halving. Related Reading: Shiba Inu Burn Rate Sees 81%

Daily Increase, But Why Is Participation Low? While the effects of

the halving are not so pleasant for BTC miners, the halving is

deemed necessary for the growth of the Bitcoin ecosystem. It makes

Bitcoin (BTC) deflationary by reducing the rate at which more

tokens come into circulation. This could make the flagship crypto

more scarce and ultimately drive up its value, as it has done in

the past three halvings. In anticipation of history repeating

itself, crypto analysts and experts have made several predictions

about how high Bitcoin could rise this time post-halving. So far,

the most bullish price prediction remains by Samson Mow, the CEO of

Jan3 and Bitcoiner, who predicts that the flagship crypto could

rise to $1 million this year. He added that this

unprecedented price surge was possible considering that BTC’s

demand is expected to continue outpacing the supply, with more

institutional investors recently getting on board through the Spot

Bitcoin ETFs. The imbalance between Bitcoin’s supply and demand is

also why crypto analyst MacronautBTC believes Bitcoin could rise to

$237,000. Billionaire Tim Draper also agrees that Bitcoin

could attain such heights based on his prediction that the flagship

crypto will hit $250,000 in 2025. Implications On The Broader

Crypto Market Crypto analyst Michaël van de Poppe recently

predicted a narrative shift post-halving. He expects Bitcoin to

take months to consolidate while altcoins significantly move to the

upside during this period. This is plausible, considering Bitcoin

doesn’t experience that parabolic price surge until about six

months after the halving. Related Reading: Ripple CEO Walks

Back $5 Trillion Crypto Marker Prediction, Unveils New Target

During this period, altcoins like XRP and Cardano (ADA), which have

underperformed up until now, will be closely monitored as investors

wait to see if they will show any sign of bullish momentum in them.

Ethereum (ETH) will also be the focus of many in the crypto

community as they watch how the second-largest crypto token by

market cap will perform while Bitcoin (BTC) consolidates.

Interestingly, Van de Poppe expects the narrative to shift to

Ethereum and projects in the Decentralized Physical Infrastructure

Networks (DePIN) and Real World Assets (RWA) sector. Therefore,

such projects are also worth keeping an eye on. BTC bulls

hold price above $63,000 | Source: BTCUSD on Tradingview.com

Featured image from Cointribune, chart from Tradingview.com

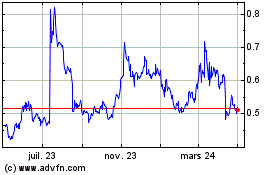

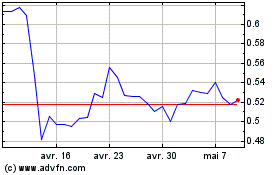

Ripple (COIN:XRPUSD)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Ripple (COIN:XRPUSD)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024