The Agfa-Gevaert Group in Q1 2023 - regulated information

Regulated information – May

9,

2023 -

7:45 a.m.

CET The

Agfa-Gevaert Group in Q1

2023:

- HealthCare IT:

- Increase in order intake of 25%, 4.8% revenue increase

- Profitability impacted by cost inflation and unfavorable mix

effects

- Digital Print &

Chemicals:

- Growth driven by Digital Printing and Zirfon membranes

- Successful price increase actions and cost reductions allowed

to restore profitability

- Radiology Solutions:

- Medical film: volume recovery in China but continuing margin

pressure and geopolitical impact

- Direct Radiography: continuing the positive trend in sales and

profitability

- Adjusted EBITDA amounted to

13 million Euro

- Net loss of 66

million Euro, impacted by the loss of

discontinued operations as a result of the Offset Solutions

sale

Mortsel (Belgium), May

9,

2023

– Agfa-Gevaert today

commented on its results in

the first quarter of

2023.

Reporting post Offset SolutionsThe recent sale

of the Offset Solutions division (now rebranded to ECO3) influences

the way the Agfa-Gevaert Group reports its results. The Q1 numbers

from sales to EBITDA present the Agfa-Gevaert Group with Offset

Solutions excluded (Asset held for Sale), but with a new division

called ‘Contractor Operations & Services former Offset’ or

‘CONOPS’. CONOPS represents the supply of film and chemicals as

well as a set of support services delivered by Agfa to Offset

Solutions. As of Q2, this will represent the agreements with the

external party ECO3. The turnover represents the supply agreements,

with corresponding COGS charges. The income related to the support

services will be accounted for as Other Income, while the costs

related to those support services are represented in the different

SG&A lines.Q1 ‘23 reflects the financials as if the agreements

are already in place. The comparative period Q1 ‘22 has been

re-presented accordingly. As per IFRS 5, stranded costs related to

Offset Solutions have been treated differently in 2023 vs 2022. In

Q1’22 stranded costs are reported under CONOPS. In Q1 ’23 these are

absorbed by the 3 business divisions.

|

in million Euro |

Q1 2023 |

Q1 2022re-presented |

% change (excl. FX

effects) |

|

REVENUE |

|

|

|

|

HealthCare IT |

57 |

55 |

4.8% (3.6%) |

|

Radiology Solutions |

102 |

101 |

1.6% (0.9%) |

|

Digital Print & Chemicals |

97 |

79 |

22.0% (21.5%) |

|

Contractor Operations and Services – former Offset |

14 |

18 |

-20.9% |

|

GROUP |

270 |

252 |

7.2%

(7.3%) |

|

ADJUSTED EBITDA (*) |

|

|

|

|

HealthCare IT |

2.7 |

4.4 |

-38.2% |

|

Radiology Solutions |

6.3 |

7.0 |

-9.8% |

|

Digital Print & Chemicals |

6.6 |

4.1 |

61.8% |

|

Contractor Operations and Services – former Offset |

1.3 |

(3.4) |

|

|

Unallocated |

(4.0) |

(4.7) |

|

|

GROUP |

13 |

7 |

77.9% |

(*) before

restructuring and non-recurring items

“Early April, we took an important step in our transformation

journey with the divestment of our Offset Solutions division. This

transaction will allow us to focus on our growing market segments,

which is crucial for our future success. Businesswise, we are very

satisfied with the Q1 performance of the growth engines in our

Digital Print & Chemicals division. The huge potential of our

Zirfon membranes for green hydrogen production is starting to

materialize, as this business’ Q1 revenue already exceeded that of

the full year 2022. However, as it is still in an industrial

ramp-up and development phase, the Zirfon business is not yet

contributing to the results. In the Radiology Solutions division,

we saw further top line and profitability improvements for Direct

Radiography. HealthCare IT saw a 25% increase in order intake.

However, this division’s profit growth is influenced by a delay in

order book implementation, as the increased portion of managed

services implies revenue recognition over a longer period of time,”

said Pascal Juéry, President and CEO of the Agfa-Gevaert Group.

Agfa-Gevaert Group

|

in million Euro |

Q1 2023 |

Q1 2022re-presented |

% change(excl. FX

effects) |

|

Revenue |

270 |

252 |

7.2% (7.3%) |

|

Gross profit (*) |

87 |

78 |

11.6% |

|

% of revenue |

32.1% |

30.8% |

|

|

Adjusted EBITDA (*) |

13 |

7 |

77.9% |

|

% of revenue |

4.8% |

2.9% |

|

|

Adjusted EBIT (*) |

2 |

(5) |

|

|

% of revenue |

0.8% |

-1.8% |

|

|

Net result |

(66) |

(7) |

|

|

Profit from continuing operations |

(20) |

(12) |

|

|

Profit from discontinued operations |

(47) |

5 |

|

(*) before

restructuring and non-recurring items

First quarter

- Excluding currency effects, the Agfa-Gevaert Group posted a

revenue increase of 7.3%. The growth was mainly driven by the

Digital Print & Chemicals division, which benefited not only

from the Inca Digital Printers acquisition, but also from price

increases, strong demand for inks and for ZIRFON membranes for

green hydrogen production. HealthCare IT and Radiology Solutions

also posted revenue growth.

- Not taking into account the divested activities, the Group’s

gross profit margin improved from 30.8% of revenue in Q1 2022 to

32.1%, mainly due to price increases and cost reduction

actions.

- Adjusted EBITDA improved to 13 million Euro (4.8% of

revenue).

- Restructuring and non-recurring items resulted in a charge of

10 million Euro, versus 8 million Euro in Q1 2022.

- The net finance costs amounted to 6 million Euro.

- Income tax expenses increased to 5 million Euro versus 2

million Euro in Q1 2022.

- The Agfa-Gevaert Group posted a net loss of 66 million Euro,

impacted by the loss of discontinued operations as a result of the

Offset Solutions sale (amounting to 47 million Euro).

Financial position and cash

flow

- Net financial debt (including IFRS 16) evolved from a net cash

position of 72 million Euro at the end of 2022 to a net cash

position of 24 million Euro.

- Trade working capital (CONOPS excluded) evolved from 32% of

turnover at the end of 2022 to 33% in Q1. In absolute numbers,

trade working capital evolved from 342 million Euro at the end of

2022 to 367 million Euro.

- The Group generated a free cash flow of minus 39 million

Euro.

OutlookOverall, the

Agfa-Gevaert Group expects a recovery in profitability in the full

year 2023 versus 2022.

2023 outlook per division:

- HealthCare IT: Whilst order intake growth continues to be very

strong, the uncertainty around the timing of the order book

execution and continued cost inflation could result in a weaker

first half of the year, followed by a stronger second half.

Therefore full year EBITDA growth versus last year could be

delayed.

- Radiology Solutions: Stability is expected, with continuous

margin pressure for medical film. The progress in Direct

Radiography that was recorded in the second half of 2022 is

expected to continue.

- Digital Print & Chemicals: The division expects to restore

profitability, based on pricing, cost improvement actions and

positive contributions from the Inca acquisition and the Zirfon

membranes. The revenue generated by Zirfon will continue to grow

very strongly.

HealthCare IT

|

in million Euro |

Q1

2023 |

Q1

2022re-presented |

% change(excl. FX

effects) |

|

Revenue |

57 |

55 |

4.8% (3.6%) |

|

Adjusted EBITDA (*) |

2.7 |

4.4 |

-38.2% |

|

% of revenue |

4.7% |

8.0% |

|

|

Adjusted EBIT (*) |

0.9 |

2.5 |

-62.4% |

|

% of revenue |

1.7% |

4.6% |

|

(*) before restructuring and non-recurring items

First quarter

- HealthCare IT’s order book remains at a healthy level. The

division recorded a 25% growth in the 12 months rolling order

intake versus the year before, with high value business (own

software) increasing with 35%. Although the market is currently

characterized by decision-making delays for large IT projects, the

division signed a 7-year agreement with a U.S. integrated health

network in Minnesota, Wisconsin and North Dakota with over 2.000

physicians and 1.1 million imaging studies, replacing a legacy PACS

with Agfa’s Enterprise Imaging platform.

- In new contracts, the portion of managed services is often

substantial, which typically implies that revenue recognition is

spread over a longer period of time.

- Continuing the momentum that started to build in the second

half of 2022, the HealthCare IT division’s top line increased by

3.6% (excluding currency effects) versus Q1 2022.

- Impacted by continuous cost inflation (e.g. for hardware and

personnel costs) and unfavorable product/mix effects, the

division’s gross profit margin decreased from 44.9% of revenue in

Q1 2022 to 41.7%. The adjusted EBITDA margin decreased from 8.0% to

4.7%.

- In recent months, Agfa HealthCare’s innovation efforts and

customer services were recognized by various research companies and

industry experts:

- Agfa HealthCare has been recognized as Best in KLAS for its

Enterprise Imaging for Radiology solution in the PACS Middle

East/Africa category. This achievement is a sign of Agfa

HealthCare’s focus on delivering high value and support to its

customers in the region.

- Frost & Sullivan awarded Agfa HealthCare with the “Best

Practices Customer Value Leadership Award” for 2023. This award

recognizes companies for their customer-first approach, innovative

leadership, providing clinical confidence with patient-centric

contextual intelligence, and enabling smooth collaboration between

departments and geographical locations.

- Black Book Market Research awarded Agfa HealthCare the Highest

Client Satisfaction Award. Black Book Market Research provides

healthcare IT users and other stakeholders in the healthcare sector

with client experiences, competitive analysis and purchasing

trends.

- The positive development of the order intake shows that the

division’s strategy to target customer segments and geographies for

which its Enterprise Imaging solution is best fit and to prioritize

higher value revenue streams is working and delivering. This

strategy will ultimately allow the division to reach the targeted

growth of EBITDA: starting from a mid-single-digit percentage in

2019 to percentages in the high-teens over the next years.

Radiology Solutions

|

in million Euro |

Q1 2023 |

Q1

2022re-presented |

% change(excl. FX

effects) |

|

Revenue |

102 |

101 |

1.6% (0.9%) |

|

Adjusted EBITDA (*) |

6.5 |

7.0 |

-7.4% |

|

% of revenue |

6.3% |

6.9% |

|

|

Adjusted EBIT (*) |

2.2 |

1.0 |

121.7% |

|

% of revenue |

2.1% |

1.0% |

|

(*) before

restructuring and non-recurring items

First quarter

- The medical film business continues to be influenced by the

current geopolitical situation. In China, medical film volumes

recovered from COVID-related issues to normal levels, but the

gradual implementation of new centralized procurement practices

continues to cause margin pressure. In other regions, Agfa

continues to implement its pricing policy.

- Agfa continues to manage the market driven top line decline of

the Computed Radiography business, maintaining healthy profit

margins.

- The Direct Radiography business posted modest revenue growth,

thus continuing the positive trend of the previous quarters. Order

intake was softer in Q1, due to the geopolitical situation and the

financial challenges that many customers and governments are

facing.

- At the ECR 2023 event in Vienna, Agfa and Lunit demonstrated

the integration of the Lunit INSIGHT CXR software in Agfa’s MUSICA

workstation. Thanks to this collaboration, radiographers can

automatically be notified in case of life-threatening pathologies

detected in chest X-rays.

- The first effects of Agfa’s actions to increase the business’

agility and to better adapt it to the current market conditions

(right-sizing of the organization, relocations, cost control

actions, price increases, net working capital actions) became

visible in Q1. Mainly driven by a strong improvement for DR, the

division’s gross profit margin increased from 30.3% of revenue in

Q1 2022 to 32.2%. Increased silver prices and inflationary pressure

had a negative impact on the division’s profitability.

Digital Print & Chemicals

|

in million Euro |

Q1 2023 |

Q1 2022re-presented |

% change(excl. FX

effects) |

|

Revenue |

97 |

79 |

22.0% (21.5%) |

|

Adjusted EBITDA (*) |

6.6 |

4.1 |

61.8% |

|

% of revenue |

6.8% |

5.1% |

|

|

Adjusted EBIT (*) |

3.1 |

1.5 |

112.0% |

|

% of revenue |

3.2% |

1.8% |

|

(*) before

restructuring and non-recurring items

First quarter

- In the field of digital print, the top line of the sign &

display business continued its strong profitable growth, based on

the good performance of the ink product ranges for sign &

display applications, as well as the Inca Digital Printers

acquisition, as the first quarter saw the revenue recognition of

the first three Agfa-branded Onset wide-format systems using Agfa

inks. In the field of industrial inkjet, the décor printing

business continued to feel the effects of the weak investment

climate. On the other hand, volumes for OEM inks started to pick up

following a slowdown towards the end of 2022.

- Q1 sales figures for the Zirfon membranes for advanced alkaline

electrolysis grew strongly, already exceeding the revenue that was

recorded in the full year 2022. As it is still in an industrial

ramp-up and development phase, this business is not yet

contributing to the results of the division. Over 100 active

customers are now using Zirfon membranes, thus confirming Zirfon’s

status as the most efficient technology for hydrogen production via

alkaline electrolysis. Several large customers are now starting to

build commercial electrolyzers, which allows Agfa to generate

recurring Zirfon sales. March 7, 2023, the Board of Directors

validated an investment for a new industrial unit for Zirfon

membranes at Agfa’s Mortsel site in Belgium. This will allow the

Group to be ready for the expected further increase in customer

demand. As this investment is fully in line with the EU’s ambitions

to build a strong European hydrogen economy, Agfa submitted a

funding proposal to the EU Innovation Fund.

- The weakness in the electronics industry continued to impact

volumes of the Orgacon conductive materials and the products for

the production of printed circuit boards.

- Successful price increase actions, cost reductions and a

positive contribution of the acquired Inca business allowed the

division to restore its gross profit margin from 18.7% of revenue

in Q4 2022 to 31.1%. In Q1 2022, the gross profit margin was at

30.4% of revenue.

- In recent months the organization of the division was also

adapted and 2 new business leaders were added to the division’s

management team. The organizational structure is now ready to

facilitate future growth.

Contractor

Operations and

Services – former Offset

|

in million Euro |

Q1 2023 |

Q1 2022re-presented |

% change(excl. FX

effects) |

|

Revenue |

14 |

18 |

-20.9% |

|

Adjusted EBITDA (*) |

1.3 |

(3.4) |

|

|

% of revenue |

9.4% |

-19.5% |

|

|

Adjusted EBIT (*) |

0.0 |

(4.7) |

|

|

% of revenue |

0.3% |

-26.9% |

|

(*) before

restructuring and non-recurring items

- Early April, the Agfa-Gevaert Group completed the sale of its

Offset Solutions division to Aurelius Group. The new division

contains results related to supply and manufacturing agreements

that the Agfa-Gevaert Group signed with its former division, now

rebranded as ECO3.

- Q1 ‘23 reflects the financials as if the agreements are already

in place. The comparative period Q1 ‘22 has been re-presented

accordingly. As per IFRS 5 rules, stranded costs related to Offset

Solutions have been treated differently in 2023 vs 2022. In Q1’22

stranded costs are reported under CONOPS. In Q1 ’23 these are

absorbed by the 3 business

divisions.

End of messageManagement Certification of Financial

Statements and Quarterly ReportThis statement is made in

order to comply with new European transparency regulation enforced

by the Belgian Royal Decree of November 14, 2007 and in effect as

of 2008."The Board of Directors and the Executive Committee of

Agfa-Gevaert NV, represented by Mr. Frank Aranzana, Chairman of the

Board of Directors, Mr. Pascal Juéry, President and CEO, and Mr.

Dirk De Man, CFO, jointly certify that, to the best of their

knowledge, the consolidated financial statements included in the

report and based on the relevant accounting standards, fairly

present in all material respects the financial condition and

results of Agfa-Gevaert NV, including its consolidated

subsidiaries. Based on our knowledge, the report includes all

information that is required to be included in such document and

does not omit to state all necessary material

facts.”Statement of riskThis statement is made in

order to comply with new European transparency regulation enforced

by the Belgian Royal Decree of November 14, 2007 and in effect as

of 2008."As with any company, Agfa is continually confronted with –

but not exclusively – a number of market and competition risks or

more specific risks related to the cost of raw materials, product

liability, environmental matters, proprietary technology or

litigation." Key risk management data is provided in the annual

report available on www.agfa.com.

Contact:Viviane DictusDirector

Corporate CommunicationSeptestraat 272640 Mortsel - BelgiumT +32

(0) 3 444 71 24E viviane.dictus@agfa.com

The full press release and financial information is also

available on the company's website:

www.agfa.com.Consolidated

Statement of Profit or Loss

(in million Euro)

Unaudited, consolidated figures following IFRS

accounting policies.

|

|

Q1 2023 |

Q1 2022re-presented |

|

Revenue |

270 |

252 |

|

Cost of sales |

(184) |

(175) |

|

Gross profit |

87 |

77 |

|

Selling expenses |

(44) |

(43) |

|

Administrative expenses |

(36) |

(38) |

|

R&D expenses |

(21) |

(19) |

|

Net impairment loss on trade and other receivables, including

contract assets |

1 |

1 |

|

Other & sundry operating income |

13 |

18 |

|

Other & sundry operating expenses |

(9) |

(8) |

|

Results from operating activities |

(8) |

(12) |

|

Interest income (expense) - net |

- |

- |

|

Interest income |

2 |

- |

|

Interest expense |

(2) |

(1) |

|

Other finance income (expense) - net |

(7) |

3 |

|

Other finance income |

1 |

7 |

|

Other finance expense |

(8) |

(5) |

|

Net finance costs |

(6) |

2 |

|

Share of profit of associates, net of tax |

- |

- |

|

Profit (loss) before income taxes |

(14) |

(10) |

|

Income tax expenses |

(5) |

(2) |

|

Profit (loss) from continued

operations |

(20) |

(12) |

|

Profit (loss) from discontinued operations, net of

tax |

(47) |

5 |

|

Profit (loss) for the period |

(66) |

(7) |

|

Profit (loss) attributable to: |

|

|

|

Owners of the Company |

(68) |

(4) |

|

Non-controlling interests |

1 |

(3) |

|

|

|

|

|

Results from operating activities |

(8) |

(12) |

|

Restructuring and non-recurring items |

(10) |

(8) |

|

Adjusted EBIT |

2 |

(5) |

|

|

|

|

|

Earnings per Share Group – continued operations (Euro) |

(0.13) |

(0.08) |

|

Earnings per Share Group – discontinued operations (Euro) |

(0.31) |

0.05 |

|

Earnings per Share Group – total (Euro) |

(0.44) |

(0.02) |

(1) Compliant with IFRS 5.33, the Company has disclosed in its

Consolidated Statements of Profit or Loss and Comprehensive Income,

a single amount comprising the total of the post-tax profit of

discontinued operations and the post-tax loss on the disposal of

the net assets constituting the discontinued operation. The Group

has sold on April 3, 2023 its Offset Solutions business.

Consolidated Statements of Comprehensive Income for

the quarter ending

March

2022

/ March

2023 (in million

Euro) Unaudited, consolidated figures

following IFRS accounting policies.

|

|

Q1 2023 |

Q1

2022

re-presented |

|

Profit / (loss) for the period |

(66) |

(7) |

|

Profit / (loss) for the period from continuing

operations |

(20) |

(12) |

|

Profit / (loss) for the period from discontinuing

operations |

(47) |

5 |

|

Other Comprehensive Income, net of tax |

|

|

|

Items that are or may be reclassified subsequently to

profit or loss: |

|

|

|

Exchange differences: |

(8) |

9 |

|

Exchange differences on translation of foreign operations |

(8) |

9 |

|

Cash flow hedges: |

2 |

- |

|

Effective portion of changes in fair value of cash flow hedges |

1 |

(1) |

|

Changes in the fair value of cash flow hedges reclassified to

profit or loss |

2 |

1 |

|

Adjustments for amounts transferred to initial carrying amount of

hedged items |

- |

- |

|

Income taxes |

- |

- |

|

Items that will not be reclassified subsequently to profit

or loss: |

- |

1 |

|

Equity investments at fair value through OCI – change in fair

value |

- |

1 |

|

Remeasurements of the net defined benefit liability |

- |

- |

|

Income tax on remeasurements of the net defined benefit

liability |

- |

- |

|

Total Other Comprehensive

Income for the period, net of tax |

(6) |

10 |

|

Total other comprehensive income for the period from

continuing operations |

(6) |

4 |

|

Total other comprehensive income for the period from

discontinuing operations |

- |

6 |

|

|

|

|

|

Total Comprehensive

Income for the period,

net of tax attributable to |

(73) |

3 |

|

Owners of the Company |

(74) |

5 |

|

Non-controlling interests |

1 |

(2) |

|

Total comprehensive income for the period from continuing

operations attributable to: |

(26) |

(8) |

|

Owners of the Company (continuing operations) |

(26) |

(8) |

|

Non-controlling interests (continuing operations) |

- |

- |

|

Total comprehensive income for the period from

discontinuing operations attributable to: |

(47) |

11 |

|

Owners of the Company (discontinuing operations) |

(48) |

13 |

|

Non-controlling interests (discontinuing operations) |

1 |

(2) |

(1) Compliant with IFRS 5.33, the Company has disclosed in its

Consolidated Statements of Profit or Loss and Comprehensive Income,

a single amount comprising the total of the post-tax profit of

discontinued operations and the post-tax loss on the disposal of

the net assets constituting the discontinued operation. The Group

has sold on April 3, 2023 its Offset Solutions business.

Consolidated Statement of Financial

Position (in million Euro)

Unaudited, Consolidated figures following IFRS

accounting policies.

| |

31/03/2023 |

31/12/2022re-presented |

|

Non-current assets |

565 |

602 |

| Goodwill |

215 |

218 |

| Intangible

assets |

28 |

29 |

| Property, plant

and equipment |

109 |

107 |

| Right-of-use

assets |

42 |

45 |

| Investments in

associates |

1 |

1 |

| Other financial

assets |

4 |

5 |

| Assets related to

post-employment benefits |

18 |

18 |

| Trade

receivables |

4 |

9 |

| Receivables under

finance leases |

68 |

72 |

| Other assets |

- |

8 |

| Deferred tax

assets |

76 |

91 |

| Current

assets |

1,119 |

1,153 |

| Inventories |

355 |

487 |

| Trade

receivables |

155 |

291 |

| Contract

assets |

93 |

94 |

| Current income

tax assets |

44 |

56 |

| Other tax

receivables |

22 |

28 |

| Other financial

assets |

- |

1 |

| Receivables under

finance lease |

24 |

31 |

| Other

receivables |

4 |

6 |

| Other current

assets |

12 |

17 |

| Derivative

financial instruments |

3 |

3 |

| Cash and cash

equivalents |

111 |

138 |

| Non-current

assets held for sale |

296 |

2 |

|

TOTAL ASSETS |

1,684 |

1,756 |

|

|

31/03/2023 |

31/12/2022re-presented |

| Total

equity |

480 |

561 |

| Equity

attributable to owners of the company |

446 |

520 |

| Share

capital |

187 |

187 |

| Share

premium |

210 |

210 |

| Retained

earnings |

974 |

1,042 |

| Other

reserves |

(1) |

(3) |

| Translation

reserve |

(16) |

(9) |

| Post-employment

benefits: remeasurements of the net defined benefit liability |

(908) |

(908) |

|

Non-controlling interests |

34 |

41 |

|

Non-current liabilities |

538 |

610 |

| Liabilities for

post-employment and long-term termination benefit plans |

483 |

536 |

| Other employee

benefits |

6 |

9 |

| Loans and

borrowings |

29 |

41 |

| Provisions |

11 |

14 |

| Deferred tax

liabilities |

6 |

9 |

| Contract

liabilities |

- |

- |

| Other non-current

liabilities |

1 |

- |

| Current

liabilities |

667 |

585 |

| Loans and

borrowings |

57 |

25 |

| Provisions |

28 |

36 |

| Trade

payables |

126 |

249 |

| Contract

liabilities |

106 |

109 |

| Current income

tax liabilities |

16 |

29 |

| Other tax

liabilities |

14 |

32 |

| Other

payables |

7 |

6 |

| Employee

benefits |

85 |

95 |

| Other current

liabilities |

3 |

- |

| Derivative

financial instruments |

1 |

2 |

| Liabilities

directly associated with the assets held for sale |

224 |

- |

| TOTAL

EQUITY AND LIABILITIES |

1,684 |

1,756 |

Consolidated Statement of Cash Flows (in million

Euro) Unaudited, consolidated figures following IFRS

accounting policies.

|

|

Q1 2023 |

Q1 2022 |

|

Profit (loss) for the period |

(66) |

(7) |

|

Income taxes |

8 |

3 |

|

Share of (profit)/loss of associates, net of tax |

- |

- |

|

Net finance costs |

7 |

(2) |

|

Operating result |

(52) |

(6) |

|

|

|

|

|

Depreciation & amortization (excluding D&A on right-of-use

assets) |

6 |

8 |

|

Depreciation & amortization on right-of-use assets |

5 |

7 |

|

Impairment losses on goodwill, intangibles and PP&E |

- |

- |

|

Impairment losses on right-of-use assets |

2 |

- |

|

|

|

|

|

Exchange results and changes in fair value of derivates |

- |

4 |

|

Recycling of hedge reserve |

2 |

1 |

|

Government grants and subsidies |

(2) |

(1) |

|

Result on the planned disposal of discontinued operations |

47 |

- |

|

Expenses for defined benefit plans & long-term termination

benefits |

5 |

7 |

|

Accrued expenses for personnel commitments |

20 |

20 |

|

Write-downs/reversal of write-downs on inventories |

5 |

4 |

|

Impairments/reversal of impairments on receivables |

(1) |

(1) |

|

Additions/reversals of provisions |

2 |

1 |

|

|

|

|

|

Operating cash flow before changes in working

capital |

41 |

44 |

|

|

|

|

|

Change in inventories |

(32) |

(59) |

|

Change in trade receivables |

- |

(9) |

|

Change in contract assets |

- |

(3) |

|

Change in trade working capital assets |

(32) |

(71) |

|

Change in trade payables |

(28) |

3 |

|

Change in contract liabilities |

14 |

10 |

|

Changes in trade working capital liabilities |

(15) |

13 |

|

Changes in trade working capital |

(46) |

(58) |

|

|

Q1 2023 |

Q1 2022 |

|

Cash out for employee benefits |

(30) |

(24) |

|

Cash out for provisions |

(5) |

(4) |

|

Changes in lease portfolio |

10 |

4 |

|

Changes in other working capital |

(13) |

(8) |

|

Cash settled operating derivatives |

- |

(1) |

|

|

|

|

|

Cash used in operating activities |

(44) |

(46) |

|

|

|

|

|

Income taxes paid |

(1) |

(2) |

|

Net cash from / (used in) operating

activities |

(46) |

(48) |

|

of which related to discontinued operations |

(13) |

(3) |

|

|

|

|

|

Capital expenditure |

(7) |

(7) |

|

Proceeds from sale of intangible assets |

- |

1 |

|

Acquisition of subsidiaries, net of cash acquired |

3 |

- |

|

Interests received |

3 |

1 |

|

Dividends received |

- |

- |

|

|

|

|

|

Net cash from / (used in) investing

activities |

(1) |

(5) |

|

of which related to discontinued operations |

(1) |

(1) |

|

|

|

|

|

Interests paid |

(2) |

(1) |

|

Dividends paid to non-controlling interests |

(9) |

- |

|

Purchase of treasury shares |

- |

(8) |

|

Proceeds from borrowings |

41 |

- |

|

Repayment of borrowings |

- |

(1) |

|

Payment of finance leases |

(7) |

(7) |

|

Proceeds / (payment) of derivatives |

(3) |

(2) |

|

Other financing income / (costs) received/paid |

- |

7 |

|

|

|

|

|

Net cash from / (used in) financing

activities |

19 |

(13) |

|

of which related to discontinued operations |

(2) |

(2) |

|

|

|

|

|

Net increase / (decrease) in cash & cash

equivalents |

(27) |

(66) |

|

|

|

|

|

Cash & cash equivalents at the start of the

period |

138 |

398 |

|

Net increase / (decrease) in cash & cash equivalents |

(27) |

(66) |

|

Effect of exchange rate fluctuations on cash held |

(3) |

(2) |

|

Cash & cash equivalents at the end of the

period |

108 |

330 |

Consolidated Statement of changes in Equity (in million

Euro) Unaudited, consolidated figures following IFRS

accounting policies.

|

in million Euro |

Share capital |

Share premium |

Retained earnings |

Reserve for own shares |

Revaluation reserve |

Hedging reserve |

Remeasurement of the net defined benefit

liability |

Translation reserve |

Total |

NON-CONTROLLING INTERESTS |

TOTAL EQUITY |

|

Balance at January 1, 2022 |

187 |

210 |

1,284 |

- |

2 |

(2) |

(1,033) |

(15) |

632 |

54 |

685 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income for the period |

|

|

|

|

|

|

|

|

|

|

|

|

Profit (loss) for the period |

- |

- |

(4) |

- |

- |

- |

- |

- |

(4) |

(3) |

(7) |

|

Other comprehensive income, net of tax |

- |

- |

- |

- |

1 |

- |

- |

8 |

9 |

1 |

10 |

|

Total comprehensive income for the period |

- |

- |

(4) |

- |

1 |

- |

- |

8 |

5 |

(2) |

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transactions with owners, recorded directly in

equity |

|

|

|

|

|

|

|

|

|

|

|

|

Dividends |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

Purchase of own shares |

- |

- |

- |

(8) |

- |

- |

- |

- |

(8) |

- |

(8) |

|

Cancellation of own shares |

- |

- |

(8) |

8 |

- |

- |

- |

- |

- |

- |

- |

|

Total transactions with owners, recorded directly in

equity |

- |

- |

(8) |

- |

- |

- |

- |

- |

(8) |

- |

(8) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at March

31,

2022 |

187 |

210 |

1,272 |

- |

2 |

(2) |

(1,034) |

(7) |

629 |

51 |

680 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at January 1, 2023 |

187 |

210 |

1,042 |

- |

(1) |

(2) |

(908) |

(9) |

520 |

41 |

561 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income for the period |

|

|

|

|

|

|

|

|

|

|

|

|

Profit (loss) for the period |

- |

- |

(68) |

- |

- |

- |

- |

- |

(68) |

1 |

(66) |

|

Other comprehensive income, net of tax |

- |

- |

- |

- |

- |

2 |

- |

(8) |

(6) |

- |

(6) |

|

Total comprehensive income for the period |

- |

- |

(68) |

- |

- |

2 |

- |

(8) |

(74) |

1 |

(72) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transactions with owners, recorded directly in

equity |

|

|

|

|

|

|

|

|

|

|

|

|

Dividends |

- |

- |

- |

- |

- |

- |

- |

- |

- |

(9) |

(9) |

|

Purchase of own shares |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

Cancellation of own shares |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

Total transactions with owners, recorded directly in

equity |

- |

- |

- |

- |

- |

- |

- |

- |

- |

(9) |

(9) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at March

31, 2023 |

187 |

210 |

974 |

- |

(1) |

- |

(908) |

(16) |

446 |

34 |

480 |

- Press release in pdf

- Financial statements in pdf

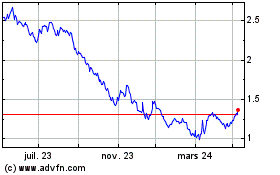

AGFA Gevaert NV (EU:AGFB)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

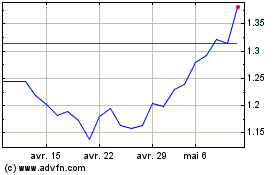

AGFA Gevaert NV (EU:AGFB)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024