The Agfa-Gevaert Group in Q2 2024: solid quarter, powered by growth engines - regulated information - inside information

28 Août 2024 - 7:45AM

UK Regulatory

The Agfa-Gevaert Group in Q2 2024: solid quarter, powered by growth

engines - regulated information - inside information

Regulated information – Inside information

August 28, 2024 - 7:45 a.m. CET

The Agfa-Gevaert Group in Q2 2024: solid quarter, powered

by growth engines

- HealthCare IT:

- Highest ever quarterly order intake recorded: 22% increase in

the 12 months rolling order intake versus the year before, mainly

based on cloud-related contracts

- Digital Print & Chemicals:

- Continuous double digit growth for Green Hydrogen

Solutions

- Digital Printing Solutions: top line growth and strong

profitability improvement

- Film activities: continuous pressure from macro-economic

conditions

- Radiology Solutions:

- Continued reorganization of go-to-market processes for medical

film in China

- Program to improve competitiveness of film-related

activities through transformation of supply chain and operations –

expected to reduce cost base by 50 million euro by end of

2027

- Adjusted EBITDA improved strongly to 22 million

euro

- Net profit of 5 million euro

Mortsel (Belgium), August 28, 2024 – 7:45 a.m. CET –

Agfa-Gevaert today commented on its results in the second quarter

of 2024.

“The growth engines of the Digital Print & Chemicals division

recorded healthy top line growth. In HealthCare IT, we recorded the

highest ever order intake volume, based on our cloud offering and

net new customer gains. Furthermore, we saw significant

quarter-on-quarter profitability improvement across all business

areas. As part of our strategy to optimally manage mature markets

for cash, we recently launched a transformation program to improve

the competitiveness of our film-related operations. The program

aims to structurally reduce the cost base of the film business by

50 million euro by the end of 2027,” said Pascal Juéry, President

and CEO of the Agfa-Gevaert Group.

in million euro |

Q2 2024

|

Q2 2023

|

% change (excl. FX effects) |

H1 2024

|

H1 2023

|

% change (excl. FX effects) |

|

REVENUE |

|

|

|

|

|

|

|

HealthCare IT |

58 |

62 |

-6.4% (-6.9%) |

109 |

119 |

-8.7% (-8.6%) |

|

Digital Print & Chemicals |

112 |

104 |

7.7% (8.4%) |

203 |

200 |

1.3% (2.1%) |

|

Radiology Solutions |

98 |

103 |

-4.6% (-4.8%) |

185 |

205 |

-9.9% (-9.2%) |

|

Contractor Operations and Services – former Offset |

18 |

18 |

1.0% (1.0%) |

39 |

32 |

22.0% (22.0%) |

|

GROUP |

286 |

287 |

-0.2% (-0.1%) |

536 |

557 |

-3.8% (-3.2%) |

|

ADJUSTED EBITDA (*) |

|

|

|

|

|

|

|

HealthCare IT |

5.6 |

4.6 |

23.9% |

6.9 |

7.3 |

-4.6% |

|

Digital Print & Chemicals |

11.6 |

2.7 |

334.5% |

12.6 |

9.2 |

36.4% |

|

Radiology Solutions |

7.1 |

9.9 |

-28.6% |

6.3 |

16.3 |

-61.6% |

|

Contractor Operations and Services – former Offset |

1.2 |

0.3 |

276.1% |

5.0 |

1.6 |

206.9% |

|

Unallocated |

(3.1) |

(3.9) |

|

(6.7) |

(7.9) |

|

|

GROUP |

22 |

13 |

67.1% |

24 |

27 |

-9.0% |

(*) before

restructuring expenses and non-recurring results

Definitions of non-IFRS financial measures (APMs): see page

7-8.

Agfa-Gevaert Group

|

in million euro |

Q2 2024

|

Q2 2023

|

% change (excl. FX effects) |

H1 2024

|

H1 2023

|

% change (excl. FX effects) |

|

Revenue |

286 |

287 |

-0.2% (-0.1%) |

536 |

557 |

-3.8% (-3.2%) |

|

Gross profit (*) |

96 |

87 |

10.8% |

171 |

173 |

-1.5% |

|

% of revenue |

33.5% |

30.2% |

|

31.8% |

31.1% |

|

|

Adjusted EBITDA (*) |

22 |

13 |

67.1% |

24 |

27 |

-9.0% |

|

% of revenue |

7.9% |

4.7% |

|

4.5% |

4.8% |

|

|

Adjusted EBIT (*) |

12 |

2 |

517.6% |

3 |

4 |

-23.4% |

|

% of revenue |

4.2% |

0.7% |

|

0.6% |

0.7% |

|

|

Net result |

5 |

(14) |

|

(17) |

(81) |

|

|

Profit from continuing operations |

(1) |

(17) |

|

(17) |

(37) |

|

|

Profit from discontinued operations |

5 |

3 |

|

- |

(43) |

|

(*) before

restructuring expenses and non-recurring results

Second quarter

- Following a seasonally weaker first quarter 2024, the

Agfa-Gevaert Group’s revenue remained stable in the second quarter

(excluding currency effects) based on the resurgence of sales for

the Digital Printing Solutions growth engine. The Green Hydrogen

Solutions business continued its top line growth, while HealthCare

IT sales started to pick up following the weak first quarter. The

traditional film activities continued to be under pressure from the

weakness in the electronics market and the new central procurement

practices and Agfa’s related reorganization for medical film in

China.

- The Group’s gross profit margin improved from 30.2% of revenue

in the second quarter of 2023 to 33.5%.

- Adjusted EBITDA increased to 22 million euro (7.9% of

revenue).

- Restructuring and non-recurring items resulted in a charge of 5

million euro versus 10 million euro in the second quarter of

2023.

- The net finance costs amounted to 8 million euro.

- Income tax expenses decreased to 0 million euro versus 4

million euro in the previous year.

- The Agfa-Gevaert Group posted a net profit of 5 million

euro.

Financial position and cash flow

- Net financial debt (including IFRS 16) evolved from 47 million

euro in Q1 2024 to 99 million euro.

- Working capital (CONOPS included) amounted to 33% in Q2 2024.

In absolute numbers, working capital evolved from 381 million euro

at the end of Q2 2023 to 369 million euro. Working capital was

influenced by the usual seasonal inventory build-up, the freight

issues in the Middle East and the silver price impact in

inventories.

- In the second quarter of 2024, the Group generated a free cash

flow of minus 40 million euro.

Outlook

In 2024, the Agfa-Gevaert Group expects a continuation of the

trends seen in the previous year, with continued growth and further

profitability improvements for the growth engines. The weakness in

Radiology Solutions is expected to continue in the second half of

the year, further impacted by higher silver prices.

2024 outlook per division:

- HealthCare IT: A continued progress in profitability is

expected, although strong investments in cloud technology are

planned. The same pattern as in the previous year is expected. For

the full year, the division expects an increase in the 12 months

rolling order intake in the mid to high teens %.

- Digital Print & Chemicals: The division expects significant

top line and profitability growth, driven by Digital Printing

Solutions and Green Hydrogen Solutions.

- Radiology Solutions: The progress in Direct Radiography is

expected to continue, but is not expected to offset the negative

impact of the film market evolution.

The working capital situation is expected to return back to

normal by the end of 2024.

The outstanding receivable in connection with the sale of the

Offset Solutions division to Aurelius Group is still partly under

discussion. The issue has been submitted to an independent expert,

who will have to establish the final purchase price. The conclusion

is expected at the earliest in September 2024, the final cash

payment is expected in the fourth quarter of 2024.

HealthCare IT

|

in million euro |

Q2 2024

|

Q2 2023

|

% change

(excl. FX effects) |

H1 2024

|

H1 2023

|

% change

(excl. FX effects) |

|

Revenue |

58 |

62 |

-6.4% (-6.9%) |

109 |

119 |

-8.7% (-8.6%) |

|

Adjusted EBITDA (*) |

5.6 |

4.6 |

23.9% |

6.9 |

7.3 |

-4.6% |

|

% of revenue |

9.7% |

7.3% |

|

6.4% |

6.1% |

|

|

Adjusted EBIT (*) |

3.8 |

2.7 |

37.9% |

3.2 |

3.7 |

-13.7% |

|

% of revenue |

6.5% |

4.4% |

|

2.9% |

3.1% |

|

(*) before restructuring expenses and non-recurring results

Second quarter

- The accelerated market momentum in the first half of 2024

contributed to a significant order intake volume (excluding

Support/Software Maintenance Agreements) in the second quarter, in

fact the highest ever recorded. Mainly based on cloud-related

contracts, the division recorded a 22% increase in the 12 months

rolling order intake starting from 126 million euro the year before

to 153 million euro. 41% of total Q2 order intake is cloud-related.

Net new customers represent 35% of total Q2 order intake. In Q2,

58% of total order intake is related project contracts and 42% to

recurring revenue contracts.

- With a market demand rapidly shifting to cloud solutions

(larger deals, longer term of contract, recurring revenue vs

project revenue), the demand for hardware has decreased and the

volume of recurring revenue (vs project revenue) has increased.

With that, the division’s top line decreased by 6.9% versus the

second quarter of 2023 (excluding currency effects). The majority

of the sales decline is related to hardware, which is concurring

with a shift to cloud technology. As an increasing share of total

order intake is related to recurring revenue, the high order intake

will not immediately translate in higher sales in the coming

quarters.

- Thanks to the increased service contribution and favorable

product mix effects, HealthCare IT’s gross profit margin improved

from 43.5% in the second quarter of 2023 to 46.6%. The adjusted

EBITDA margin improved from 7.3% to 9.7%.

- Following the release of Enterprise Imaging Cloud at RSNA last

November, Agfa HealthCare has experienced growing and steady

momentum in the healthcare market, translating into an accelerated

demand for new Cloud-based Enterprise Imaging contracts.

- Early in June, Agfa HealthCare announced the signing of a

significant new deal with Alliance Medical to implement an advanced

cloud-based Enterprise Imaging solution at 120 Alliance Medical

sites across the UK.

- Later that month, Agfa HealthCare Enterprise Imaging Cloud was

selected to serve a 1.4 million patients North American Regional

Health System as its medical imaging solution across the entire

region for its ability to deliver a turn-key platform, thus,

solving infrastructure limitations and providing fast access to

medical images.

- Other major Enterprise Imaging contracts were signed with among

others St. Vincent’s Private Hospital in Dublin, Ireland and

Technoray, a premier radiology center in Jordan.

- Investment towards innovation: expected to amount to 10 million

euro in 2024-2025 – will be capitalized and will come on top of the

current R&D expenditure.

- The KLAS Research Enterprise Imaging Report 2024 states “Agfa

HealthCare Makes Relationship & Delivery Strides”, showcasing

the significant steps as an Enterprise Imaging partner Agfa

HealthCare has delivered over the past year.

Digital Print & Chemicals

|

in million euro |

Q2 2024

|

Q2 2023

|

% change

(excl. FX effects) |

H1 2024

|

H1 2023

|

% change

(excl. FX effects) |

|

Revenue |

112 |

104 |

7.7% (8.4%) |

203 |

200 |

1.3% (2.1%) |

|

Adjusted EBITDA (*) |

11.6 |

2.7 |

334.5% |

12.6 |

9.2 |

36.4% |

|

% of revenue |

10.4% |

2.6% |

|

6.2% |

4.6% |

|

|

Adjusted EBIT (*) |

7.4 |

(1.7) |

|

4.4 |

1.3 |

230.2% |

|

% of revenue |

6.6% |

-1.7% |

|

2.2% |

0.7% |

|

(*) before restructuring expenses and non-recurring results

Second quarter

Digital Printing Solutions

- The Digital Printing Solutions business’ top line grew by 8%

versus the second quarter of 2023.

- Ink top line grew by 24%, driven by higher sales across all

segments as well as the ongoing program to convert former Inca

customers to Agfa’s ink sets.

- First effects of recent product launches and of the global

strategic partnership between Agfa and EFI for digital printing

equipment. Based on these elements, Agfa expects to build further

momentum with its digital printing portfolio in the second half of

the year.

- In the UK, the 1st SpeedSet Orca installation at Delta Display

has progressed well with print production becoming a reality.

- Agfa received two prestigious European Digital Press

Association (EDP) Awards for two of its recently introduced inkjet

innovations:

- Anapurna Ciervo H3200 – Category: Flatbed/Hybrid printer

<150 m²/h

- SpeedSet Orca 1060 – Category: Folding Carton,

Digital/Hybrid

- The Delta Group - one of the largest printers of point of sales

materials and display graphics in the UK - invested in two Tauro

wide-format print engines. Earlier this year, The Delta Group

became the first official customer site for Agfa’s SpeedSet Orca

1060 single-pass inkjet press.

Green Hydrogen Solutions

- ZIRFON sales grew by 62% versus the second quarter of 2023,

driven by the promising green hydrogen market. Establishment of new

industrial-scale ZIRFON production plant in Mortsel, Belgium is on

track. Continued manufacturing efficiency improvement.

- Market developments have been growing slower globally in the

last 12 months due to delaying of Final Investment Decisions at

customers. However, these delayed implementations have been taken

into account in Agfa’s business plan, for which the company has

taken a cautious approach.

- Overall market momentum is improving with increasing interest

in alkaline water electrolysis projects for green hydrogen in North

America, India and the Middle East; as well as important

investments expected to be launched in Europe on the back of new

IPCEI and Hydrogen Bank funded projects.

Division performance

- The Digital Print & Chemicals division’s top line grew by

8.4% (excluding currency effects).

- Continued growth for Green Hydrogen Solutions, with

considerable profitability progress thanks to improved

manufacturing efficiency.

- Digital Printing Solutions’ top line grew by 8%. Ink sales grew

by 24% versus Q2 2023, partly due to the ongoing program to convert

former Inca customers to Agfa’s ink sets. Printing equipment sales

started to pick up following new product releases and the

partnership with EFI.

- The weakness in the electronics industry continued to impact

volumes of the ORGACON conductive materials and the products for

the production of printed circuit boards.

- The division’s gross profit margin improved strongly from 24.1%

of revenue in the second quarter of 2023 to 31.9%, partly due to

improved manufacturing efficiencies.

- The division’s recurring EBITDA margin increased from 2.6% in

the second quarter of 2023 to 10.4%.

Radiology Solutions

|

in million euro |

Q2 2024

|

Q2 2023

|

% change

(excl. FX effects) |

H1 2024

|

H1 2023

|

% change

(excl. FX effects) |

|

Revenue |

98 |

103 |

-4.6% (-4.8%) |

185 |

205 |

-9.9% (-9.2%) |

|

Adjusted EBITDA (*) |

7.1 |

9.9 |

-28.6% |

6.3 |

16.3 |

-61.6% |

|

% of revenue |

7.2% |

9.6% |

|

3.4% |

8.0% |

|

|

Adjusted EBIT (*) |

3.4 |

4.9 |

-31.3% |

(1.4) |

7.1 |

|

|

% of revenue |

3.4% |

4.8% |

|

-0.8% |

3.5% |

|

(*) before restructuring expenses and non-recurring results

Second quarter

- The gradual implementation of new centralized procurement

practices in China continued to impact the medical film business.

Agfa continued to reorganize its go-to-market approach in that

country. Recently, a new President for Radiology Solutions in

Greater China was appointed and a new sales organization was

installed.

- The Direct Radiography business posted a mid-single digit top

line increase, partly driven by the pick-up of the business in

North America. In Europe, consolidation exercises in healthcare

groups are leading to postponed investment plans, while a further

trend toward big tenders is increasing the fluctuations between

quarters.

- At the UKIO 2024 event, Agfa showcased its innovative

DensityScan tool, powered by the Bone Health software of IBEX

Innovations Ltd. DensityScan can turn an ordinary X-ray exam into

an opportunity to identify patients at risk of osteoporosis who

might benefit from a bone density scan.

- The division’s second quarter profitability was negatively

impacted by the volume decrease. This was partly offset by measures

to control costs and to streamline the business. The division’s

gross profit margin decreased slightly from 32.5% of revenue in the

second quarter of 2023 to 32.0%. In Q1 2024, the margin was at

26.3%. The adjusted EBITDA margin decreased from 9.6% of revenue in

Q2 2023 to 7.2% (minus 0.8% in Q1 2024.).

- Benefits from the above mentioned program to structurally

reduce the cost base of Agfa’s film business are expected to show

as from 2025.

Contractor Operations and Services – former

Offset

|

in million euro |

Q2 2024

|

Q2 2023

|

% change

(excl. FX effects) |

H1 2024

|

H1 2023

|

% change

(excl. FX effects) |

|

Revenue |

18 |

18 |

1.0% (1.0%) |

39 |

32 |

22.0% (22.0%) |

|

Adjusted EBITDA (*) |

1.2 |

0.3 |

276.1% |

5.0 |

1.6 |

206.9% |

|

% of revenue |

6.8% |

1.8% |

|

13.0% |

5.2% |

|

|

Adjusted EBIT (*) |

0.6 |

0.1 |

706.0% |

3.9 |

0.1 |

|

|

% of revenue |

3.5% |

0.4% |

|

9.9% |

0.4% |

|

(*) before restructuring expenses and non-recurring results

- Early April 2023, the Agfa-Gevaert Group completed the sale of

its Offset Solutions division to Aurelius Group. The division

contains results related to supply and manufacturing agreements

that the Agfa-Gevaert Group signed with its former division, now

rebranded as ECO3.

End of message

Management Certification of Financial Statements and

Quarterly Report

This statement is made in order to comply with new European

transparency regulation enforced by the Belgian Royal Decree of

November 14, 2007 and in effect as of 2008.

"The Board of Directors and the Executive Committee of Agfa-Gevaert

NV, represented by Mr. Frank Aranzana, Chairman of the Board of

Directors and Mr. Pascal Juéry, President and CEO, jointly certify

that, to the best of their knowledge, the consolidated financial

statements included in the report and based on the relevant

accounting standards, fairly present in all material respects the

financial condition and results of Agfa-Gevaert NV, including its

consolidated subsidiaries. Based on our knowledge, the report

includes all information that is required to be included in such

document and does not omit to state all necessary material

facts.”

Statement of risk

This statement is made in order to comply with European

transparency regulation enforced by the Belgian Royal Decree of

November 14, 2007 and in effect as of 2008.

"As with any company, Agfa is continually confronted with – but not

exclusively – a number of market and competition risks or more

specific risks related to the cost of raw materials, product

liability, environmental matters, proprietary technology or

litigation."

Key risk management data is provided in the annual report available

on www.agfa.com.

Definitions of non-IFRS financial measures

(APMs)

- Adjusted EBIT: The result from continuing

operating activities before restructuring expenses and

non-recurring results.

- Adjusted EBITDA: The result from continuing

operating activities before depreciation, amortization,

restructuring expenses and non-recurring results.

- Gross profit (margin): Gross profit (margin)

before restructuring expenses and non-recurring results.

- Restructuring expenses: Expenses related to

detailed and formal restructuring plans approved by management.

Related expenses comprise expenses recognized when accounting for a

‘Provision for restructuring’ but could also comprise other

expenses that are directly linked to a formal restructuring plan

(e.g. exceptional write-downs on inventories and impairment losses

on receivables when specifically linked to / resulting from a

decision to restructure). Restructuring expenses mainly relate to

employee termination costs.

- Non-recurring results: Income and expenses

related to activities or events which are not indicative as arising

from normal, recurring business operations and are not related to a

restructuring plan. These non-recurring results comprise expenses

related to important transformation programs, material changes in

the measurement estimates of assets or liabilities related to

infrequent events (such as the sale of a building), material gains

or losses related to infrequent events or transactions (e.g.

mergers and acquisitions) as well as substantial litigations which

are not part of the normal recurring business activities. In case

the activities or events are not directly linked to a specific

segment but are related to Agfa as a Group, the costs are not

attributed to the reportable segments.

- Free Cash Flow: The sum of ‘Net cash from /

(used in) operating activities’ and ‘Net cash from / (used in)

investing activities excluding the impact of ‘Acquisitions of

subsidiaries, net of cash acquired’, ‘Interests received’ and the

‘Net cash from / (used in) operating and investing activities that

relates to discontinued operations’.

- Adjusted Free Cash Flow: Free Cash Flow

‘Adjusted’/ excluded for the impact of: the ‘Cash out for pensions

below EBIT’, the ‘Cash out for long-term termination benefits’ and

the cash out for ‘Restructuring and non-recurring items’.

- Cash out for pensions below EBIT: The sum of

Expenses for defined benefit plans & long-term termination

benefits (see ‘Consolidated Statement of Cash Flows’) and the cash

out for defined benefit plans & long-term termination benefits

that are part of the ‘Cash out for employee benefits’ as presented

in the Consolidated Statement of Cash Flows.

- Restructuring expenses and non-recurring

results: Cash in- and outflows resulting from income and

expenses that are either in the current or previous reporting

periods recognized in ‘Non-recurring results’ or ‘Restructuring

expenses’.

- Working Capital: the sum of Inventories plus

trade receivables plus contract assets minus contract liabilities

and minus trade payables.

- Net financial debt incl IFRS 16: the sum of

Liabilities to banks-Current portion plus Lease liabilities-Current

portion plus Bank overdraft plus Revolving Credit

Facility-Non-current portion plus Lease liabilities-Non-current

portion minus Cash and cash equivalents.

- Net financial debt excl IFRS 16: the sum of

Liabilities to banks-Current portion plus Bank overdraft plus

Revolving Credit Facility-Non-current portion minus Cash and cash

equivalents.

- Order intake: The financial value of all new

orders accepted by Agfa HealthCare IT during the period, including

Licenses, Implementation services, Hardware and/or Cloud computing,

but excluding Support/Software Maintenance Agreements.

- Support/Software Maintenance Agreements (SMA):

Service contracts entitling Agfa HealthCare IT Perpetual License

customers to software updates and patches as well as service and

support. Order Intake is not recorded for SMA contracts.

- Net new order intake: Order Intake accepted

from customers who were not using Agfa HealthCare IT software prior

to the order. (aka “New Logo” sales), usually with such an order

the customer replaces a system from a competitor with a system from

Agfa HealthCare IT.

- Cloud order intake: Order Intake accepted for

deployments of Agfa HealthCare IT’s solution on a Cloud Computing

infrastructure instead of the traditional deployment on dedicated

Hardware on the customers premises (“on Premise”).

- Recurring order intake: Order Intake for

services with a recurring transaction model (Revenue recognition

over time as opposed to one-off). Examples include: License

Subscriptions, Managed services, Cloud computing services, SaaS

contracts).

- Project order intake: Order Intake for goods

and services delivered and revenue recognized at a single point in

time. Examples include: Perpetual Licenses, Implementation

services, Hardware.

Contact:

Viviane Dictus

Director Corporate Communication

Septestraat 27

2640 Mortsel - Belgium

T +32 (0) 3 444 71 24

E viviane.dictus@agfa.com

The full press release and financial information is also

available on the company's website: www.agfa.com.

Consolidated Statement of Profit or Loss (in million

euro)

Unaudited, consolidated figures following IFRS

accounting policies.

Continued operations |

Q2 2024

|

Q2 2023

|

H1 2024

|

H1 2023

|

|

Revenue |

286 |

287 |

536 |

557 |

|

Cost of sales |

(190) |

(200) |

(365) |

(384) |

|

Gross profit |

96 |

87 |

171 |

173 |

|

Selling expenses |

(42) |

(42) |

(82) |

(86) |

|

Administrative expenses |

(34) |

(35) |

(67) |

(71) |

|

R&D expenses |

(18) |

(19) |

(36) |

(39) |

|

Net impairment loss on trade and other receivables, including

contract assets |

- |

- |

- |

1 |

|

Other operating income |

10 |

13 |

21 |

26 |

|

Other operating expenses |

(5) |

(11) |

(11) |

(20) |

|

Results from operating activities |

7 |

(8) |

(4) |

(16) |

|

Interest income (expense) - net |

(1) |

- |

(2) |

1 |

|

Interest income |

3 |

3 |

6 |

6 |

|

Interest expense |

(4) |

(3) |

(8) |

(5) |

|

Other finance income (expense) - net |

(6) |

(6) |

(12) |

(13) |

|

Other finance income |

- |

- |

1 |

2 |

|

Other finance expense |

(7) |

(7) |

(13) |

(15) |

|

Net finance costs |

(8) |

(6) |

(13) |

(12) |

|

Share of profit of associates, net of tax |

- |

- |

- |

- |

|

Profit (loss) before income taxes |

- |

(14) |

(17) |

(28) |

|

Income tax expenses |

- |

(4) |

- |

(9) |

|

Profit (loss) from continued operations |

(1) |

(17) |

(17) |

(37) |

|

Profit (loss) from discontinued operations, net of

tax |

5 |

3 |

- |

(43) |

|

Profit (loss) for the period |

5 |

(14) |

(17) |

(81) |

|

Profit (loss) attributable to: |

|

|

|

|

|

Owners of the Company |

5 |

(14) |

(17) |

(82) |

|

Non-controlling interests |

- |

- |

- |

1 |

|

|

|

|

|

|

|

Results from operating activities |

7 |

(8) |

(4) |

(16) |

|

Restructuring expenses and non-recurring results |

(5) |

(10) |

(7) |

(20) |

|

Adjusted EBIT |

12 |

2 |

3 |

4 |

|

|

|

|

|

|

|

Earnings per Share Group – continued operations (euro) |

- |

(0.11) |

(0.11) |

(0.24) |

|

Earnings per Share Group – discontinued operations (euro) |

0.03 |

0.02 |

- |

(0.29) |

|

Earnings per Share Group – total (euro) |

0.03 |

(0.09) |

(0.11) |

(0.53) |

Consolidated Statement of Comprehensive Income for the

quarter ending June 2023 / June 2024 (in million

euro)

Unaudited, consolidated figures following IFRS accounting

policies.

|

|

Q2 2024

|

Q2 2023

|

|

Profit / (loss) for the period |

5 |

(14) |

|

Profit / (loss) for the period from continuing

operations |

- |

(17) |

|

Profit / (loss) for the period from discontinuing

operations |

5 |

3 |

|

Other Comprehensive Income, net of tax |

|

|

|

Items that are or may be reclassified subsequently to

profit or loss: |

|

|

|

Exchange differences: |

(5) |

1 |

|

Exchange differences on translation of foreign operations |

1 |

3 |

|

Release of exchange differences of discontinued operations to

profit or loss |

(6) |

(2) |

|

Cash flow hedges: |

- |

- |

|

Effective portion of changes in fair value of cash flow hedges |

- |

- |

|

Changes in the fair value of cash flow hedges reclassified to

profit or loss |

- |

- |

|

Adjustments for amounts transferred to initial carrying amount of

hedged items |

- |

- |

|

Income taxes |

- |

- |

|

Items that will not be reclassified subsequently to profit

or loss: |

|

|

|

Equity investments at fair value through OCI – change in fair

value |

- |

- |

|

Remeasurements of the net defined benefit liability |

- |

- |

|

Income tax on remeasurements of the net defined benefit

liability |

- |

- |

|

Total Other Comprehensive Income for the period, net of

tax |

(5) |

1 |

|

Total other comprehensive income for the period from

continuing operations |

- |

2 |

|

Total other comprehensive income for the period from

discontinuing operations |

(6) |

(1) |

|

|

|

|

|

Total Comprehensive Income for the period, net of tax

attributable to |

(1) |

(13) |

|

Owners of the Company |

(1) |

(14) |

|

Non-controlling interests |

- |

2 |

|

Total comprehensive income for the period from continuing

operations attributable to: |

- |

(15) |

|

Owners of the Company (continuing operations) |

- |

(15) |

|

Non-controlling interests (continuing operations) |

- |

- |

|

Total comprehensive income for the period from

discontinuing operations attributable to: |

(1) |

2 |

|

Owners of the Company (discontinuing operations) |

(1) |

- |

|

Non-controlling interests (discontinuing operations) |

- |

2 |

Consolidated Statement of Comprehensive Income for the

period ending June 2023 / June 2024 (in million

euro)

Unaudited, consolidated figures following IFRS accounting

policies.

|

|

H1 2024

|

H1 2023

|

|

Profit / (loss) for the period |

(17) |

(81) |

|

Profit / (loss) for the period from continuing

operations |

(17) |

(37) |

|

Profit / (loss) for the period from discontinuing

operations |

- |

(43) |

|

Other Comprehensive Income, net of tax |

|

|

|

Items that are or may be reclassified subsequently to

profit or loss: |

|

|

|

Exchange differences: |

3 |

(6) |

|

Exchange differences on translation of foreign operations |

3 |

(4) |

|

Release of exchange differences of discontinued operations to

profit or loss |

(1) |

(2) |

|

Cash flow hedges: |

(1) |

2 |

|

Effective portion of changes in fair value of cash flow hedges |

(1) |

1 |

|

Changes in the fair value of cash flow hedges reclassified to

profit or loss |

- |

2 |

|

Adjustments for amounts transferred to initial carrying amount of

hedged items |

- |

- |

|

Income taxes |

- |

- |

|

Items that will not be reclassified subsequently to profit

or loss: |

|

|

|

Equity investments at fair value through OCI – change in fair

value |

(1) |

- |

|

Remeasurements of the net defined benefit liability |

- |

- |

|

Income tax on remeasurements of the net defined benefit

liability |

- |

- |

|

Total Other Comprehensive Income for the period, net of

tax |

1 |

(4) |

|

Total other comprehensive income for the period from

continuing operations |

2 |

(3) |

|

Total other comprehensive income for the period from

discontinuing operations |

(1) |

(1) |

|

|

|

|

|

Total Comprehensive Income for the period, net of tax

attributable to |

(15) |

(85) |

|

Owners of the Company |

(15) |

(87) |

|

Non-controlling interests |

- |

2 |

|

Total comprehensive income for the period from continuing

operations attributable to: |

(15) |

(40) |

|

Owners of the Company (continuing operations) |

(15) |

(40) |

|

Non-controlling interests (continuing operations) |

- |

- |

|

Total comprehensive income for the period from

discontinuing operations attributable to: |

(1) |

(45) |

|

Owners of the Company (discontinuing operations) |

(1) |

(46) |

|

Non-controlling interests (discontinuing operations) |

- |

2 |

Consolidated Statement of Financial Position (in million

euro)

Unaudited, consolidated figures following IFRS

accounting policies.

| |

30/06/2024

|

31/12/2023

|

|

Non-current assets |

599 |

576 |

| Goodwill |

217 |

215 |

| Intangible

assets |

25 |

24 |

| Property, plant

and equipment |

121 |

115 |

| Right-of-use

assets |

44 |

39 |

| Investments in

associates |

1 |

1 |

| Other financial

assets |

3 |

4 |

| Assets related to

post-employment benefits |

30 |

29 |

| Trade

receivables |

3 |

2 |

| Receivables under

finance leases |

71 |

69 |

| Other assets |

4 |

4 |

| Deferred tax

assets |

79 |

74 |

| Current

assets |

821 |

792 |

| Inventories |

343 |

289 |

| Trade

receivables |

166 |

175 |

| Contract

assets |

87 |

83 |

| Current income

tax assets |

51 |

51 |

| Other tax

receivables |

25 |

20 |

| Receivables under

finance lease |

22 |

31 |

| Other

receivables |

41 |

48 |

| Other current

assets |

14 |

13 |

| Derivative

financial instruments |

1 |

2 |

| Cash and cash

equivalents |

69 |

77 |

| Non-current

assets held for sale |

2 |

2 |

|

TOTAL ASSETS |

1,420 |

1,368 |

|

|

30/06/2024

|

31/12/2023

|

| Total

equity |

381 |

396 |

| Equity

attributable to owners of the Company |

380 |

395 |

| Share

capital |

187 |

187 |

| Share

premium |

210 |

210 |

| Retained

earnings |

927 |

945 |

| Other

reserves |

(1) |

- |

| Translation

reserve |

(19) |

(22) |

| Post-employment

benefits: remeasurements of the net defined benefit liability |

(925) |

(926) |

|

Non-controlling interests |

2 |

1 |

|

Non-current liabilities |

655 |

584 |

| Liabilities for

post-employment and long-term termination benefit plans |

473 |

486 |

| Other employee

benefits |

6 |

5 |

| Loans and

borrowings |

153 |

69 |

| Provisions |

5 |

7 |

| Deferred tax

liabilities |

9 |

9 |

| Trade

payables |

1 |

3 |

| Other non-current

liabilities |

8 |

4 |

| Current

liabilities |

384 |

388 |

| Loans and

borrowings |

15 |

14 |

| Provisions |

13 |

13 |

| Trade

payables |

130 |

132 |

| Contract

liabilities |

98 |

97 |

| Current income

tax liabilities |

22 |

23 |

| Other tax

liabilities |

19 |

24 |

| Other

payables |

11 |

9 |

| Employee

benefits |

72 |

73 |

| Other current

liabilities |

2 |

1 |

| Derivative

financial instruments |

2 |

- |

| TOTAL

EQUITY AND LIABILITIES |

1,420 |

1,368 |

Consolidated Statement of Cash Flows (in million

euro)

Unaudited, consolidated figures following IFRS accounting

policies.

|

|

Q2 2024

|

Q2 2023

|

H1 2024

|

H1 2023

|

|

Profit (loss) for the period |

5 |

(14) |

(17) |

(81) |

|

Income taxes |

- |

4 |

- |

12 |

|

Share of (profit)/loss of associates, net of tax |

- |

- |

- |

- |

|

Net finance costs |

2 |

6 |

13 |

13 |

|

Operating result |

7 |

(4) |

(4) |

(56) |

|

|

|

|

|

|

|

Depreciation & amortization |

7 |

7 |

13 |

13 |

|

Depreciation & amortization on right-of-use assets |

4 |

5 |

8 |

10 |

|

Impairment losses on intangibles and PP&E |

- |

- |

- |

- |

|

Impairment losses on right-of-use assets |

- |

4 |

- |

7 |

|

|

|

|

|

|

|

Exchange results and changes in fair value of derivates |

- |

- |

- |

- |

|

Recycling of hedge reserve |

- |

- |

- |

2 |

|

Government grants and subsidies |

(1) |

(1) |

(2) |

(2) |

|

Result on the disposal of discontinued operations |

1 |

(3) |

1 |

44 |

|

Expenses for defined benefit plans & long-term termination

benefits |

10 |

11 |

15 |

16 |

|

Accrued expenses for personnel commitments |

9 |

10 |

26 |

30 |

|

Write-downs/reversal of write-downs on inventories |

3 |

3 |

5 |

8 |

|

Impairments/reversal of impairments on receivables |

- |

- |

- |

(1) |

|

Additions/reversals of provisions |

2 |

(1) |

2 |

1 |

|

|

|

|

|

|

|

Operating cash flow before changes in working

capital |

41 |

29 |

63 |

70 |

|

|

|

|

|

|

|

Change in inventories |

(23) |

(2) |

(59) |

(34) |

|

Change in trade receivables |

(9) |

(3) |

9 |

(4) |

|

Change in contract assets |

(2) |

(5) |

(3) |

(5) |

|

Change in working capital assets |

(34) |

(10) |

(53) |

(42) |

|

Change in trade payables |

(4) |

2 |

(4) |

(26) |

|

Change in contract liabilities |

(2) |

(3) |

- |

11 |

|

Changes in working capital liabilities |

(6) |

(1) |

(4) |

(15) |

|

Changes in working capital |

(39) |

(11) |

(57) |

(57) |

|

|

Q2 2024

|

Q2 2023

|

H1 2024

|

H1 2023

|

|

Cash out for employee benefits |

(42) |

(43) |

(63) |

(73) |

|

Cash out for provisions |

(2) |

(7) |

(5) |

(12) |

|

Changes in lease portfolio |

5 |

- |

9 |

10 |

|

Changes in other working capital |

8 |

(8) |

- |

(21) |

|

Cash settled operating derivatives |

- |

- |

1 |

- |

|

|

|

|

|

|

|

Cash from / (used in) operating activities |

(30) |

(39) |

(52) |

(83) |

|

|

|

|

|

|

|

Income taxes paid |

- |

1 |

(3) |

- |

|

Net cash from / (used in) operating

activities |

(31) |

(37) |

(55) |

(83) |

|

of which related to discontinued operations |

- |

- |

- |

(10) |

|

|

|

|

|

|

|

Capital expenditure |

(10) |

(8) |

(21) |

(14) |

|

Proceeds from sale of intangible assets and PP&E |

1 |

1 |

1 |

1 |

|

Acquisition of subsidiaries, net of cash acquired |

- |

- |

- |

3 |

|

Disposal of discontinued operations, net of cash disposed of |

- |

(5) |

- |

(5) |

|

Acquisition of associates |

- |

(1) |

- |

(1) |

|

Interests received |

3 |

3 |

6 |

6 |

|

|

|

|

|

|

|

Net cash from / (used in) investing

activities |

(7) |

(9) |

(14) |

(9) |

|

of which related to discontinued operations |

- |

(5) |

- |

(5) |

|

|

|

|

|

|

|

Interests paid |

(4) |

(3) |

(8) |

(5) |

|

Dividends paid to non-controlling interests |

- |

- |

- |

(9) |

|

Proceeds from borrowings |

66 |

- |

80 |

31 |

|

Repayment of borrowings |

- |

(10) |

- |

(1) |

|

Payment of finance leases |

(5) |

- |

(10) |

(12) |

|

Proceeds / (payment) of derivatives |

- |

(5) |

- |

(4) |

|

Other financing income / (costs) received/paid |

(1) |

(1) |

(2) |

- |

|

|

|

|

|

|

|

Net cash from / (used in) financing

activities |

55 |

(19) |

59 |

- |

|

of which related to discontinued operations |

- |

- |

- |

(11) |

|

|

|

|

|

|

|

Net increase / (decrease) in cash & cash

equivalents |

17 |

(65) |

(10) |

(92) |

|

|

|

|

|

|

|

Cash & cash equivalents at the start of the

period |

50 |

108 |

77 |

138 |

|

Net increase / (decrease) in cash & cash equivalents |

17 |

(65) |

(10) |

(92) |

|

Effect of exchange rate fluctuations on cash held |

- |

1 |

1 |

(2) |

|

Cash & cash equivalents at the end of the

period |

68 |

44 |

68 |

44 |

The Group has elected to present a statement of cash flows that

includes all cash flows, including both continuing and

discontinuing operations.

Consolidated Statement of changes in Equity (in million

euro)

Unaudited, consolidated figures following IFRS accounting

policies.

in million euro |

Share capital |

Share premium |

Retained earnings |

Reserve for own shares |

Revaluation reserve |

Hedging reserve |

Remeasurement of the net defined benefit

liability |

Translation reserve |

TOTAL |

NON-CONTROLLING INTERESTS |

TOTAL EQUITY |

|

Balance at January 1, 2023 |

187 |

210 |

1,042 |

- |

(1) |

(2) |

(908) |

(9) |

520 |

41 |

561 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income for the period |

|

|

|

|

|

|

|

|

|

|

|

|

Profit (loss) for the period |

- |

- |

(82) |

- |

- |

- |

- |

- |

(82) |

1 |

(81) |

|

Other comprehensive income, net of tax |

- |

- |

- |

- |

- |

2 |

- |

(7) |

(5) |

1 |

(4) |

|

Total comprehensive income for the period |

- |

- |

(82) |

- |

- |

2 |

- |

(7) |

(87) |

2 |

(85) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transactions with owners, recorded directly in

equity |

|

|

|

|

|

|

|

|

|

|

|

|

Dividends |

- |

- |

- |

- |

- |

- |

- |

- |

- |

(9) |

(9) |

|

Transfer of amounts recognised in OCI to retained earnings

following loss of control |

- |

- |

11 |

- |

- |

- |

(11) |

- |

- |

- |

- |

|

Derecognition of NCI following loss of control |

- |

- |

- |

- |

- |

- |

- |

- |

- |

(32) |

(32) |

|

Total transactions with owners, recorded directly in

equity |

- |

- |

11 |

- |

- |

- |

(11) |

- |

- |

(41) |

(41) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at June 30, 2023 |

187 |

210 |

971 |

- |

(1) |

- |

(919) |

(16) |

433 |

2 |

434 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at January 1, 2024 |

187 |

210 |

945 |

- |

(1) |

1 |

(926) |

(22) |

395 |

1 |

396 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income for the period |

|

|

|

|

|

|

|

|

|

|

|

|

Profit (loss) for the period |

- |

- |

(17) |

- |

- |

- |

- |

- |

(17) |

- |

(17) |

|

Other comprehensive income, net of tax |

- |

- |

- |

- |

(1) |

(1) |

- |

3 |

1 |

- |

1 |

|

Total comprehensive income for the period |

- |

- |

(17) |

- |

(1) |

(1) |

- |

3 |

(15) |

- |

(15) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transactions with owners, recorded directly in

equity |

|

|

|

|

|

|

|

|

|

|

|

|

Dividends |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

Transfer of amounts recognised in OCI to retained earnings

following loss of control |

- |

- |

(1) |

- |

- |

- |

1 |

- |

- |

- |

- |

|

Total transactions with owners, recorded directly in

equity |

- |

- |

(1) |

- |

- |

- |

1 |

- |

- |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at June 30, 2024 |

187 |

210 |

927 |

- |

(2) |

1 |

(925) |

(19) |

380 |

2 |

381 |

Reconciliation of non-IFRS information (in million

euro)

(Adjusted) Free Cash Flow

|

|

Q2 2024

|

Q2 2023

|

H1 2024

|

H1 2023

|

|

Adjusted EBITDA |

22 |

13 |

24 |

27 |

|

Working capital - net |

(34) |

(12) |

(48) |

(43) |

|

CAPEX |

(10) |

(8) |

(21) |

(14) |

|

Provisions & other |

2 |

(23) |

7 |

(16) |

|

Income taxes |

- |

1 |

(3) |

1 |

|

Adjusted Free Cash Flow |

(20) |

(28) |

(40) |

(45) |

|

Pensions (below EBIT) & long term termination benefits |

(12) |

(7) |

(21) |

(20) |

|

Restructuring and non-recurring items |

(8) |

(10) |

(14) |

(21) |

|

Free Cash Flow |

(40) |

(45) |

(75) |

(86) |

|

|

|

|

|

|

|

Adjustments for: |

|

|

|

|

|

Payment of finance leases |

(5) |

(5) |

(10) |

(10) |

|

Proceeds from borrowings |

66 |

(10) |

80 |

31 |

|

Repayment of borrowings |

- |

- |

- |

(1) |

|

Acquisition of subsidiaries, net of cash acquired |

- |

- |

- |

3 |

|

Interests received |

3 |

3 |

6 |

6 |

|

Interests paid |

(4) |

(3) |

(8) |

(5) |

|

Other financial flows |

(2) |

(1) |

(2) |

(5) |

|

|

58 |

(16) |

66 |

20 |

|

Cash flows from continuing operations |

18 |

(61) |

(10) |

(66) |

|

|

|

|

|

|

|

Net cash from/(used in) operating activities related to

discontinued operations |

- |

- |

- |

(10) |

|

Net cash from/(used in) investing activities related to

discontinued operations |

- |

(5) |

- |

(5) |

|

Net cash from/(used in) financing activities related to

discontinued operations |

- |

- |

- |

(11) |

|

Cash flows from discontinued operations |

- |

(5) |

- |

(26) |

|

|

|

|

|

|

|

Net increase / (decrease) in cash & cash

equivalents |

17 |

(65) |

(10) |

(92) |

Reconciliation of non-IFRS information (in million

euro)

Adjusted EBIT

|

|

Q2 2024

|

Q2 2023

|

H1 2024

|

H1 2023

|

|

Segment Adjusted EBIT |

15 |

6 |

10 |

12 |

|

Adjusted EBIT from operating activities not allocated to a

reportable segment: mainly related to ‘Corporate Services’ |

(3) |

(4) |

(7) |

(8) |

|

|

|

|

|

|

|

Adjusted EBIT |

12 |

2 |

3 |

4 |

|

|

|

|

|

|

|

Restructuring |

(1) |

(1) |

(1) |

(5) |

|

Non-recurring |

(4) |

(9) |

(6) |

(15) |

|

|

|

|

|

|

|

Results from operating activities |

7 |

(8) |

(4) |

(16) |

- Press release in pdf

- Half Year report in pdf

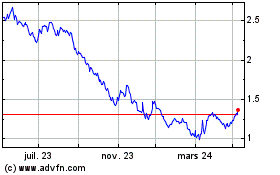

AGFA Gevaert NV (EU:AGFB)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

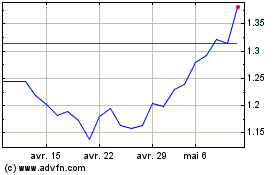

AGFA Gevaert NV (EU:AGFB)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024