The Agfa-Gevaert Group in Q2 2023: continued progress for the

growth engines

Regulated information – August

23,

2023 -

7:45 a.m.

CET The

Agfa-Gevaert Group in Q2

2023:

continued progress for the growth engines

- HealthCare IT:

- Increase in order intake of 11%, revenue increase of 8%

- Quarter-on-quarter profitability improvement, but service

margins under pressure due to cost inflation

- Digital Print &

Chemicals:

- Good performance of the ZIRFON and Digital Print growth

engines

- Profitability improvements for ZIRFON and Digital Print offset

by:

- weakness in the electronics industry, especially in China

- manufacturing inefficiencies for industrial film

- Radiology Solutions:

- Medical film: continuing margin pressure in China and

geopolitical impact

- Direct Radiography: continuing positive trend in

profitability

- Profitability impacted by adverse currency

effects

- Adjusted EBITDA at 13 million

Euro

- Net result at

minus 14 million

Euro

Mortsel (Belgium), August

23,

2023

– Agfa-Gevaert today

commented on its results in

the second quarter

of

2023.

“Whereas the macroeconomic and geopolitical conditions remained

tough for several of our traditional activities, we booked

significant revenue growth for our growth engines in HealthCare IT

and Digital Print. In terms of new business creation, we are on

track with the development of the SpeedSet 1060 single-pass

packaging printer. When introduced to the market in 2024, it will

be the fastest printer in its category. Furthermore, as more and

more large green hydrogen projects are being implemented, sales for

our industry-leading ZIRFON membranes are growing exponentially.

Meanwhile, we are making good progress with our project to build a

new industrial unit for ZIRFON membranes at our Mortsel site in

Belgium. I am very pleased that this project has been selected for

a EU Innovation Fund Grant. The new plant will allow us to meet

future customer demand and to be a key player in the clean energy

transition,” said Pascal Juéry, President and CEO of the

Agfa-Gevaert Group.

Reporting post Offset SolutionsThe recent sale

of the Offset Solutions division (now rebranded to ECO3) influences

the way the Agfa-Gevaert Group reports its results. The numbers

from sales to EBITDA present the Agfa-Gevaert Group with Offset

Solutions excluded, but with a new division called ‘Contractor

Operations & Services former Offset’ or ‘CONOPS’. CONOPS

represents the supply of film and chemicals as well as a set of

support services delivered by Agfa to the external party ECO3. The

turnover represents the supply agreements, with corresponding COGS

charges. The income related to the support services will be

accounted for as Other Income, while the costs related to those

support services are represented in the different SG&A lines.

The comparative period Q2 ‘22 has been re-presented accordingly. As

per IFRS 5, stranded costs related to Offset Solutions have been

treated differently in 2023 vs 2022. In Q2 ‘22 stranded costs are

reported under CONOPS. In Q2 ‘23 these are absorbed by the 3

business divisions.

|

in million Euro |

Q2 2023 |

Q2 2022re-presented |

% change (excl. FX

effects) |

H1 2023 |

H1 2022re-presented |

% change (excl. FX

effects) |

|

REVENUE |

|

|

|

|

|

|

|

HealthCare IT |

62 |

57 |

8.2% (10.8%) |

119 |

112 |

6.5% (7.3%) |

|

Radiology Solutions |

103 |

113 |

-9.0% (-5.7%) |

205 |

214 |

-4.0% (-1.9%) |

|

Digital Print & Chemicals |

104 |

98 |

5.8% (7.6%) |

200 |

177 |

13.1% (14.3%) |

|

Contractor Operations and Services – former Offset |

18 |

18 |

-2.4% (-2.3%) |

32 |

36 |

-11.5% (-11.3%) |

|

GROUP |

287 |

287 |

-0.1%

(2.3%) |

557 |

539 |

3.3% (4.7%) |

|

ADJUSTED EBITDA (*) |

|

|

|

|

|

|

|

HealthCare IT |

4.6 |

5.6 |

-18.1% |

7.3 |

9.9 |

-26.8% |

|

Radiology Solutions |

9.9 |

12.2 |

-18.8% |

16.3 |

19.2 |

-14.6% |

|

Digital Print & Chemicals |

2.7 |

4.2 |

-36.7% |

9.2 |

8.3 |

11.2% |

|

Contractor Operations and Services – former Offset |

0.3 |

(0.5) |

|

1.6 |

(3.9) |

|

|

Unallocated |

(3.9) |

(4.4) |

|

(7.9) |

(9.1) |

|

|

GROUP |

13 |

17 |

-21.5% |

27 |

24 |

8.3% |

(*) before

restructuring and non-recurring items

Agfa-Gevaert Group

|

in million Euro |

Q2 2023 |

Q2 2022re-presented |

% change(excl. FX

effects) |

H1 2023 |

H1 2022re-presented |

% change(excl. FX

effects) |

|

Revenue |

287 |

287 |

-0.1% (2.3%) |

557 |

539 |

3.3% (4.7%) |

|

Gross profit (*) |

87 |

89 |

-2.8% |

173 |

167 |

3.9% |

|

% of revenue |

30.2% |

31.1% |

|

31.1% |

30.9% |

|

|

Adjusted EBITDA (*) |

13 |

17 |

-21.5% |

27 |

24 |

8.3% |

|

% of revenue |

4.7% |

6.0% |

|

4.8% |

4.5% |

|

|

Adjusted EBIT (*) |

2 |

5 |

-58.0% |

4 |

0.1 |

|

|

% of revenue |

0.7% |

1.6% |

|

0.7% |

0.0% |

|

|

Net result |

(14) |

(13) |

|

(81) |

(20) |

|

|

Profit from continuing operations |

(17) |

(20) |

|

(37) |

(32) |

|

|

Profit from discontinued operations |

3 |

7 |

|

(43) |

12 |

|

(*) before

restructuring and non-recurring items

Second quarter

- The Agfa-Gevaert Group’s revenue was stable versus the second

quarter of 2022. All growth engines posted revenue growth. The

Digital Print & Chemicals division benefited from price

increases and strong demand for inks and for ZIRFON membranes for

green hydrogen production.

- The Group’s gross profit margin decreased slightly to 30.2%,

mainly due to cost inflation, adverse currency effects,

manufacturing inefficiencies, lower service margins in HealthCare

IT, mix effects and the weakness in the industrial film

markets.

- Adjusted EBITDA decreased from 17 million Euro to 13 million

Euro (4.7% of revenue).

- Restructuring and non-recurring items resulted in a charge of

10 million Euro versus 12 million Euro in Q2 2022.

- The net finance costs amounted to 6 million Euro.

- Income tax expenses increased to 4 million Euro versus 2

million Euro in Q2 2022.

- The Agfa-Gevaert Group posted a net loss of 14 million

Euro.

Financial position and cash

flow

- Net financial debt (including IFRS 16) evolved from a net cash

position of 24 million Euro at the end of Q1 2023 to a net debt

position of 33 million Euro.

- Trade working capital (CONOPS excluded) evolved from 36% of

turnover at the end of Q2 2022 to 32% in Q2 2023. In absolute

numbers, trade working capital evolved from 370 million Euro at the

end of Q2 2022 to 354 million Euro.

- In Q2 2023, the Group generated a free cash flow of minus 45

million Euro.

OutlookOverall, the

Agfa-Gevaert Group expects a recovery in profitability in the full

year 2023 versus 2022.

2023 outlook per division:

- HealthCare IT: Order intake growth continues to be strong. As

the portion of own IP in the sales mix is expected to grow,

profitability is expected to continue to improve gradually

quarter-on-quarter. This will likely result in a strong second half

of the year. Impacted by adverse currency effects, full year EBITDA

is expected to be slightly below that of last year.

- Radiology Solutions: Stability is expected, with continuous

margin pressure for medical film. The progress in Direct

Radiography is expected to continue.

- Digital Print & Chemicals: The division expects to restore

profitability, based on pricing, cost improvement actions and

positive contributions from the Inca acquisition and the ZIRFON

membranes. The revenue generated by ZIRFON will continue to grow

very strongly.

HealthCare IT

|

in million Euro |

Q2

2023 |

Q2

2022re-presented |

% change(excl. FX

effects) |

H1 2023 |

H1

2022re-presented |

% change(excl. FX

effects) |

|

Revenue |

62 |

57 |

8.2% (10.8%) |

119 |

112 |

6.5% (7.3%) |

|

Adjusted EBITDA (*) |

4.6 |

5.6 |

-18.1% |

7.3 |

9.9 |

-26.8% |

|

% of revenue |

7.3% |

9.7% |

|

6.1% |

8.9% |

|

|

Adjusted EBIT (*) |

2.7 |

3.7 |

-26.1% |

3.7 |

6.2 |

-40.7% |

|

% of revenue |

4.4% |

6.4% |

|

3.1% |

5.5% |

|

(*) before restructuring and non-recurring items

Second quarter

- HealthCare IT’s order book remains at a healthy level. The

division recorded a 11% growth in the 12 months rolling order

intake versus the year before.

- In new contracts, the portion of managed services is often

substantial, which typically implies that revenue recognition is

spread over a longer period of time. For the HealthCare IT

division, fluctuations between quarters are normal, as a

significant portion of revenues and margins are realized when

projects reach key milestones.

- Continuing the momentum that started to build in the second

half of 2022, the HealthCare IT division’s top line increased by

10.8% (excluding currency effects) versus Q2 2022.

- Impacted by cost inflation, the fact that own IP sales grew

slightly slower than 3rd party sales, and decreasing service

margins, the gross profit margin decreased from 45.8% in Q2 2022 to

43.5%. The adjusted EBITDA margin decreased from 9.7% to 7.3%. The

division expects quarter-on-quarter improvement, as the product/mix

is expected to improve substantially towards the end of the

year.

- The positive development of the order intake shows that the

division’s strategy to target customer segments and geographies for

which its Enterprise Imaging solution is best fit and to prioritize

higher value revenue streams is working and delivering.

- At the JPR 2023 event (held in April in São Paulo) Agfa

HealthCare announced the official relaunch of its activities in

Brazil.

- Also in Q2, Agfa HealthCare was awarded Frost & Sullivan’s

‘Best Practices Customer Value Leadership Award’ for 2023. This

award recognizes companies which are at the forefront of innovation

– a position achieved by growing in their industries, consolidating

their leadership positions and innovating and creating new

products, solutions and services to meet ever-evolving customer

needs.

Radiology Solutions

|

in million Euro |

Q2

2023 |

Q2

2022re-presented |

% change(excl. FX

effects) |

H1 2023 |

H1

2022re-presented |

% change(excl. FX

effects) |

|

Revenue |

103 |

113 |

-9.0% (-5.7%) |

205 |

214 |

-4.0% (-1.9%) |

|

Adjusted EBITDA (*) |

9.9 |

12.2 |

-18.8% |

16.3 |

19.2 |

-14.6% |

|

% of revenue |

9.6% |

10.7% |

|

8.0% |

8.9% |

|

|

Adjusted EBIT (*) |

4.9 |

6.0 |

-17.7% |

7.1 |

6.9 |

2.2% |

|

% of revenue |

4.8% |

5.3% |

|

3.5% |

3.2% |

|

(*) before restructuring and non-recurring items

Second quarter

- The medical film business continues to be influenced by the

current geopolitical situation. In China, the business was

influenced by the gradual implementation of new centralized

procurement practices. In other regions, Agfa is successfully

implementing its pricing policy.

- Agfa continues to manage the market driven top line decline of

the Computed Radiography business, maintaining healthy profit

margins.

- The Direct Radiography business posted a revenue decrease in Q2

due to the geopolitical situation and the financial challenges that

many customers and governments are facing. In Europe and

North-America, certain customer groups are pivoting investment

plans.

- Agfa’s actions to increase the business’ agility and to better

adapt it to the current market conditions (right-sizing of the

organization, relocations, cost control actions, price increases,

net working capital actions) are now fully implemented.

- The division’s gross profit margin decreased slightly from

32.8% of revenue in Q2 2022 to 32.5%.

Digital Print & Chemicals

|

in million Euro |

Q2

2023 |

Q2

2022re-presented |

% change(excl. FX

effects) |

H1 2023 |

H1

2022re-presented |

% change(excl. FX

effects) |

|

Revenue |

104 |

98 |

5.8% (7.6%) |

200 |

177 |

13.1% (14.3%) |

|

Adjusted EBITDA (*) |

2.7 |

4.2 |

-36.7% |

9.2 |

8.3 |

11.2% |

|

% of revenue |

2.6% |

4.3% |

|

4.6% |

4.7% |

|

|

Adjusted EBIT (*) |

(1.7) |

1.2 |

|

1.3 |

2.7 |

-51.2% |

|

% of revenue |

-1.7% |

1.3% |

|

0.7% |

1.5% |

|

(*) before restructuring and non-recurring items

Second quarter

- In the field of digital print, the top line of the sign &

display business continued to grow, based on the good performance

of the ink product ranges for sign & display applications, as

well as the Inca Digital Printers acquisition. Agfa already sold

several Onset printers using Agfa inks and the development of the

SpeedSet 1060 single-pass packaging printer is proceeding as

planned. The market introduction of this digital press with water

based inks – which will be the fastest printer in its category at

11,000 B1 sized carton boards per hour – will happen as planned in

2024, with a customer unveiling later this year. In Q2, Agfa also

announced the launch of new ink sets for its Onset inkjet printers.

These inks boast an excellent sustainability footprint, high

quality and performance while minimizing ink usage.

- In the field of industrial inkjet, Agfa sold a second

InterioJet water-based inkjet printing press to décor paper

printing company Chiyoda, in spite of the weak investment climate

in that sector.

- In Q2, sales figures for the ZIRFON membranes for advanced

alkaline electrolysis continued to grow strongly. Although

important productivity progress is being made, this business is not

yet contributing to the results of the division. Over 100 active

customers are now using ZIRFON membranes, thus confirming ZIRFON’s

status as the most efficient technology for hydrogen production via

alkaline electrolysis. Several large customers are now starting to

build commercial electrolyzers, which allows Agfa to generate

recurring ZIRFON sales.

- Agfa’s project to build a new industrial unit for ZIRFON

membranes at its Mortsel site in Belgium has been selected for an

EU Innovation Fund Grant. The next important step for all selected

projects is grant agreement preparation. The new plant will allow

the Group to meet the booming customer demand.

- The weakness in the electronics industry continued to impact

volumes of the Orgacon conductive materials and the products for

the production of printed circuit boards.

- Price increase actions are implemented in most segments to

mitigate cost inflation impacts. However, manufacturing

inefficiencies, adverse currency effects and the weakness in the

electronics industry negatively impacted the gross profit margin,

which decreased from 26.2% of revenue in Q2 2022 to 24.1%.

Contractor

Operations and

Services – former Offset

|

in million Euro |

Q2

2023 |

Q2

2022re-presented |

% change(excl. FX

effects) |

H1 2023 |

H1

2022re-presented |

% change(excl. FX

effects) |

|

Revenue |

18 |

18 |

-2.4% (-2.3%) |

32 |

36 |

-11.5% (-11.3%) |

|

Adjusted EBITDA (*) |

0.3 |

(0.5) |

|

1.6 |

(3.9) |

|

|

% of revenue |

1.8% |

-2.5% |

|

5.2% |

-10.9% |

|

|

Adjusted EBIT (*) |

0.1 |

(1.9) |

|

0.1 |

(6.6) |

|

|

% of revenue |

0.4% |

-10.3% |

|

0.4% |

-18.5% |

|

(*) before restructuring and non-recurring items

- Early April, the Agfa-Gevaert Group completed the sale of its

Offset Solutions division to Aurelius Group. The new division

contains results related to supply and manufacturing agreements

that the Agfa-Gevaert Group signed with its former division, now

rebranded as ECO3.

- The comparative period Q2 ‘22 has been re-presented

accordingly. As per IFRS 5 rules, stranded costs related to Offset

Solutions have been treated differently in 2023 vs 2022. In Q2 ‘22

stranded costs are reported under CONOPS. In Q2 ‘23 these are

absorbed by the 3 business divisions.

End of messageManagement Certification of Financial

Statements and Quarterly ReportThis statement is made in

order to comply with new European transparency regulation enforced

by the Belgian Royal Decree of November 14, 2007 and in effect as

of 2008."The Board of Directors and the Executive Committee of

Agfa-Gevaert NV, represented by Mr. Frank Aranzana, Chairman of the

Board of Directors, Mr. Pascal Juéry, President and CEO, and Mr.

Dirk De Man, CFO, jointly certify that, to the best of their

knowledge, the consolidated financial statements included in the

report and based on the relevant accounting standards, fairly

present in all material respects the financial condition and

results of Agfa-Gevaert NV, including its consolidated

subsidiaries. Based on our knowledge, the report includes all

information that is required to be included in such document and

does not omit to state all necessary material

facts.”Statement of riskThis statement is made in

order to comply with new European transparency regulation enforced

by the Belgian Royal Decree of November 14, 2007 and in effect as

of 2008."As with any company, Agfa is continually confronted with –

but not exclusively – a number of market and competition risks or

more specific risks related to the cost of raw materials, product

liability, environmental matters, proprietary technology or

litigation." Key risk management data is provided in the annual

report available on www.agfa.com.

Contact:Viviane DictusDirector

Corporate CommunicationSeptestraat 272640 Mortsel - BelgiumT +32

(0) 3 444 71 24E viviane.dictus@agfa.com

The full press release and financial information is also

available on the company's website:

www.agfa.com.Consolidated

Statement of Profit or Loss

(in million Euro)

Unaudited, consolidated figures following IFRS

accounting policies.

|

Continued operations |

Q2 2023 |

Q2 2022re-presented |

H1 2023 |

H1 2022re-presented |

|

Revenue |

287 |

287 |

557 |

539 |

|

Cost of sales |

(200) |

(198) |

(384) |

(372) |

|

Gross profit |

87 |

90 |

173 |

167 |

|

Selling expenses |

(42) |

(45) |

(86) |

(88) |

|

Administrative expenses |

(35) |

(39) |

(71) |

(77) |

|

R&D expenses |

(19) |

(20) |

(39) |

(39) |

|

Net impairment loss on trade and other receivables, including

contract assets |

- |

- |

1 |

- |

|

Other & sundry operating income |

13 |

15 |

26 |

33 |

|

Other & sundry operating expenses |

(11) |

(8) |

(20) |

(16) |

|

Results from operating activities |

(8) |

(7) |

(16) |

(20) |

|

Interest income (expense) - net |

- |

- |

1 |

(1) |

|

Interest income |

3 |

- |

6 |

1 |

|

Interest expense |

(3) |

(1) |

(5) |

(1) |

|

Other finance income (expense) - net |

(6) |

(10) |

(13) |

(8) |

|

Other finance income |

- |

(2) |

2 |

5 |

|

Other finance expense |

(7) |

(8) |

(15) |

(13) |

|

Net finance costs |

(6) |

(11) |

(12) |

(9) |

|

Share of profit of associates, net of tax |

- |

- |

- |

- |

|

Profit (loss) before income taxes |

(14) |

(18) |

(28) |

(28) |

|

Income tax expenses |

(4) |

(2) |

(9) |

(4) |

|

Profit (loss) from continued operations |

(17) |

(20) |

(37) |

(32) |

|

Profit (loss) from discontinued operations, net of

tax |

3 |

7 |

(43) |

12 |

|

Profit (loss) for the period |

(14) |

(13) |

(81) |

(20) |

|

Profit (loss) attributable to: |

|

|

|

|

|

Owners of the Company |

(14) |

(17) |

(82) |

(21) |

|

Non-controlling interests |

- |

4 |

1 |

1 |

|

|

|

|

|

|

|

Results from operating activities |

(8) |

(7) |

(16) |

(20) |

|

Restructuring and non-recurring items |

(10) |

(12) |

(20) |

(20) |

|

Adjusted EBIT |

2 |

5 |

4 |

- |

|

|

|

|

|

|

|

Earnings per Share Group – continued operations (Euro) |

(0.11) |

(0.13) |

(0.24) |

(0.21) |

|

Earnings per Share Group – discontinued operations (Euro) |

0.02 |

0.02 |

(0.29) |

0.08 |

|

Earnings per Share Group – total (Euro) |

(0.09) |

(0.11) |

(0.53) |

(0.13) |

(1) Compliant with IFRS 5.33, the Company has presented in its

Consolidated Statement of Profit or Loss and Comprehensive Income,

a single amount comprising the total of the post-tax profit of

discontinued operations and the post-tax gain on the disposal of

net assets constituting the discontinued operations. The Group has

sold its Offset Solutions business in April, 2023. Comparative

information has been re-presented.

Consolidated Statement of Comprehensive Income for

the quarter ending

June

2022

/ June

2023 (in million

Euro) Unaudited, consolidated figures

following IFRS accounting policies.

|

|

Q2

2023 |

Q2

2022

re-presented |

|

Profit / (loss) for the period |

(14) |

(13) |

|

Profit / (loss) for the period from continuing

operations |

(17) |

(20) |

|

Profit / (loss) for the period from discontinuing

operations |

3 |

7 |

|

Other Comprehensive Income, net of tax |

|

|

|

Items that are or may be reclassified subsequently to

profit or loss: |

|

|

|

Exchange differences: |

1 |

24 |

|

Exchange differences on translation of foreign operations |

3 |

24 |

|

Release of exchange differences of discontinued operations to

profit or loss |

(2) |

- |

|

Cash flow hedges: |

- |

(2) |

|

Effective portion of changes in fair value of cash flow hedges |

- |

(3) |

|

Changes in the fair value of cash flow hedges reclassified to

profit or loss |

- |

1 |

|

Adjustments for amounts transferred to initial carrying amount of

hedged items |

- |

- |

|

Income taxes |

- |

- |

|

Items that will not be reclassified subsequently to profit

or loss: |

- |

117 |

|

Equity investments at fair value through OCI – change in fair

value |

- |

(2) |

|

Remeasurements of the net defined benefit liability |

- |

130 |

|

Income tax on remeasurements of the net defined benefit

liability |

- |

(11) |

|

Total Other Comprehensive

Income for the period, net of tax |

1 |

138 |

|

Total other comprehensive income for the period from

continuing operations |

2 |

118 |

|

Total other comprehensive income for the period from

discontinuing operations |

(1) |

20 |

|

|

|

|

|

Total Comprehensive

Income for the period,

net of tax attributable to |

(13) |

125 |

|

Owners of the Company |

(14) |

120 |

|

Non-controlling interests |

2 |

5 |

|

Total comprehensive income for the period from continuing

operations attributable to: |

(15) |

98 |

|

Owners of the Company (continuing operations) |

(15) |

98 |

|

Non-controlling interests (continuing operations) |

- |

- |

|

Total comprehensive income for the period from

discontinuing operations attributable to: |

2 |

27 |

|

Owners of the Company (discontinuing operations) |

- |

22 |

|

Non-controlling interests (discontinuing operations) |

2 |

5 |

(1) Compliant with IFRS 5.33, the Company has presented in its

Consolidated Statement of Profit or Loss and Comprehensive Income,

a single amount comprising the total of the post-tax profit of

discontinued operations and the post-tax gain on the disposal of

net assets constituting the discontinued operations. The Group has

sold its Offset Solutions business in April, 2023. Comparative

information has been re-presented.Consolidated Statement of

Comprehensive Income for the period

ending June

2022 /

June 2023

(in million Euro) Unaudited,

consolidated figures following IFRS accounting policies.

|

|

H1 2023 |

H1 2022

re-presented |

|

Profit / (loss) for the period |

(81) |

(20) |

|

Profit / (loss) for the period from continuing

operations |

(37) |

(32) |

|

Profit / (loss) for the period from discontinuing

operations |

(43) |

12 |

|

Other Comprehensive Income, net of tax |

|

|

|

Items that are or may be reclassified subsequently to

profit or loss: |

|

|

|

Exchange differences: |

(6) |

32 |

|

Exchange differences on translation of foreign operations |

(4) |

32 |

|

Release of exchange differences of discontinued operations to

profit or loss |

(2) |

- |

|

Cash flow hedges: |

2 |

(2) |

|

Effective portion of changes in fair value of cash flow hedges |

1 |

(4) |

|

Changes in the fair value of cash flow hedges reclassified to

profit or loss |

2 |

2 |

|

Adjustments for amounts transferred to initial carrying amount of

hedged items |

- |

- |

|

Income taxes |

- |

- |

|

Items that will not be reclassified subsequently to profit

or loss: |

- |

117 |

|

Equity investments at fair value through OCI – change in fair

value |

- |

(2) |

|

Remeasurements of the net defined benefit liability |

- |

130 |

|

Income tax on remeasurements of the net defined benefit

liability |

- |

(11) |

|

Total Other Comprehensive

Income for the period, net of tax |

(4) |

147 |

|

Total other comprehensive income for the period from

continuing operations |

(3) |

122 |

|

Total other comprehensive income for the period from

discontinuing operations |

(1) |

26 |

|

|

|

|

|

Total Comprehensive

Income for the period,

net of tax attributable to |

(86) |

127 |

|

Owners of the Company |

(87) |

125 |

|

Non-controlling interests |

2 |

2 |

|

Total comprehensive income for the period from continuing

operations attributable to: |

(40) |

90 |

|

Owners of the Company (continuing operations) |

(40) |

90 |

|

Non-controlling interests (continuing operations) |

- |

- |

|

Total comprehensive income for the period from

discontinuing operations attributable to: |

(44) |

38 |

|

Owners of the Company (discontinuing operations) |

(46) |

35 |

|

Non-controlling interests (discontinuing operations) |

2 |

2 |

(1) Compliant with IFRS 5.33, the Company has

presented in its Consolidated Statement of Profit or Loss and

Comprehensive Income, a single amount comprising the total of the

post-tax profit of discontinued operations and the post-tax gain on

the disposal of net assets constituting the discontinued

operations. The Group has sold its Offset Solutions business in

April, 2023. Comparative information has been

re-presented.(2)

Consolidated Statement of Financial

Position (in million Euro)

Unaudited, Consolidated figures following IFRS

accounting policies.

| |

30/06/2023 |

31/12/2022re-presented |

|

Non-current assets |

575 |

602 |

| Goodwill |

218 |

218 |

| Intangible

assets |

25 |

29 |

| Property, plant

and equipment |

111 |

107 |

| Right-of-use

assets |

41 |

45 |

| Investments in

associates |

1 |

1 |

| Other financial

assets |

4 |

5 |

| Assets related to

post-employment benefits |

19 |

18 |

| Trade

receivables |

3 |

9 |

| Receivables under

finance leases |

73 |

72 |

| Other assets |

5 |

8 |

| Deferred tax

assets |

74 |

91 |

| Current

assets |

809 |

1,153 |

| Inventories |

353 |

487 |

| Trade

receivables |

158 |

291 |

| Contract

assets |

98 |

94 |

| Current income

tax assets |

47 |

56 |

| Other tax

receivables |

25 |

28 |

| Other financial

assets |

- |

1 |

| Receivables under

finance lease |

20 |

31 |

| Other

receivables |

43 |

6 |

| Other current

assets |

16 |

17 |

| Derivative

financial instruments |

2 |

3 |

| Cash and cash

equivalents |

44 |

138 |

| Non-current

assets held for sale |

2 |

2 |

|

TOTAL ASSETS |

1,383 |

1,756 |

|

|

30/06/2023 |

31/12/2022re-presented |

| Total

equity |

434 |

561 |

| Equity

attributable to owners of the company |

433 |

520 |

| Share

capital |

187 |

187 |

| Share

premium |

210 |

210 |

| Retained

earnings |

971 |

1,042 |

| Other

reserves |

(1) |

(3) |

| Translation

reserve |

(16) |

(9) |

| Post-employment

benefits: remeasurements of the net defined benefit liability |

(919) |

(908) |

|

Non-controlling interests |

2 |

41 |

|

Non-current liabilities |

534 |

610 |

| Liabilities for

post-employment and long-term termination benefit plans |

476 |

536 |

| Other employee

benefits |

6 |

9 |

| Loans and

borrowings |

29 |

41 |

| Provisions |

11 |

14 |

| Deferred tax

liabilities |

8 |

9 |

| Trade

payables |

3 |

- |

| Other non-current

liabilities |

1 |

- |

| Current

liabilities |

415 |

585 |

| Loans and

borrowings |

49 |

25 |

| Provisions |

20 |

36 |

| Trade

payables |

124 |

249 |

| Contract

liabilities |

104 |

109 |

| Current income

tax liabilities |

19 |

29 |

| Other tax

liabilities |

20 |

32 |

| Other

payables |

6 |

6 |

| Employee

benefits |

69 |

95 |

| Other current

liabilities |

3 |

- |

| Derivative

financial instruments |

1 |

2 |

| TOTAL

EQUITY AND LIABILITIES |

1,383 |

1,756 |

Consolidated Statement of Cash Flows (in million

Euro) Unaudited, consolidated figures following IFRS

accounting policies.

|

|

Q2 2023 |

Q2 2022 |

H1 2023 |

H1 2022 |

|

Profit (loss) for the period |

(14) |

(13) |

(81) |

(20) |

|

Income taxes |

4 |

4 |

12 |

7 |

|

Share of (profit)/loss of associates, net of tax |

- |

- |

- |

- |

|

Net finance costs |

6 |

11 |

13 |

9 |

|

Operating result |

(4) |

2 |

(56) |

(3) |

|

|

|

|

|

|

|

Depreciation & amortization (excluding D&A on right-of-use

assets) |

7 |

8 |

13 |

17 |

|

Depreciation & amortization on right-of-use assets |

5 |

7 |

10 |

14 |

|

Impairment losses on goodwill, intangibles and PP&E |

- |

- |

- |

- |

|

Impairment losses on right-of-use assets |

4 |

- |

7 |

- |

|

|

|

|

|

|

|

Exchange results and changes in fair value of derivates |

- |

4 |

- |

8 |

|

Recycling of hedge reserve |

- |

1 |

2 |

2 |

|

Government grants and subsidies |

(1) |

(1) |

(2) |

(2) |

|

Result on the disposal of discontinued operations |

(3) |

- |

44 |

- |

|

Expenses for defined benefit plans & long-term termination

benefits |

11 |

15 |

16 |

22 |

|

Accrued expenses for personnel commitments |

10 |

9 |

30 |

30 |

|

Write-downs/reversal of write-downs on inventories |

3 |

2 |

8 |

7 |

|

Impairments/reversal of impairments on receivables |

- |

- |

(1) |

- |

|

Additions/reversals of provisions |

(1) |

4 |

1 |

4 |

|

|

|

|

|

|

|

Operating cash flow before changes in working

capital |

29 |

53 |

70 |

97 |

|

|

|

|

|

|

|

Change in inventories |

(2) |

(43) |

(34) |

(102) |

|

Change in trade receivables |

(3) |

22 |

(4) |

14 |

|

Change in contract assets |

(5) |

(10) |

(5) |

(13) |

|

Change in trade working capital assets |

(10) |

(30) |

(42) |

(101) |

|

Change in trade payables |

2 |

(7) |

(26) |

(5) |

|

Change in contract liabilities |

(3) |

3 |

11 |

14 |

|

Changes in trade working capital liabilities |

(1) |

(4) |

(15) |

9 |

|

Changes in trade working capital |

(11) |

(34) |

(57) |

(92) |

|

|

Q2 2023 |

Q2 2022 |

H1 2023 |

H1 2022 |

|

Cash out for employee benefits |

(43) |

(63) |

(73) |

(87) |

|

Cash out for provisions |

(7) |

(8) |

(12) |

(11) |

|

Changes in lease portfolio |

- |

4 |

10 |

9 |

|

Changes in other working capital |

(8) |

1 |

(21) |

(7) |

|

Cash settled operating derivatives |

- |

(3) |

- |

(3) |

|

|

|

|

|

|

|

Cash used in operating activities |

(39) |

(49) |

(83) |

(95) |

|

|

|

|

|

|

|

Income taxes paid |

1 |

(4) |

- |

(6) |

|

Net cash from / (used in) operating

activities |

(37) |

(53) |

(83) |

(101) |

|

of which related to discontinued operations |

- |

(16) |

(13) |

(19) |

|

|

|

|

|

|

|

Capital expenditure |

(8) |

(6) |

(14) |

(13) |

|

Proceeds from sale of intangible assets & PP&E |

1 |

- |

1 |

1 |

|

Acquisition of subsidiaries, net of cash acquired |

- |

(48) |

3 |

(48) |

|

Disposal of discontinued operations, net of cash disposed of |

(5) |

(2) |

(5) |

(2) |

|

Acquisition of associates |

(1) |

- |

(1) |

- |

|

Interests received |

3 |

1 |

6 |

2 |

|

Dividends received |

- |

- |

- |

- |

|

|

|

|

|

|

|

Net cash from / (used in) investing

activities |

(9) |

(54) |

(9) |

(59) |

|

of which related to discontinued operations |

(4) |

(1) |

(5) |

(2) |

|

|

|

|

|

|

|

Interests paid |

(3) |

(1) |

(5) |

(2) |

|

Dividends paid to non-controlling interests |

- |

(5) |

(9) |

(5) |

|

Purchase of treasury shares |

- |

(13) |

- |

(21) |

|

Proceeds from borrowings |

(10) |

- |

31 |

- |

|

Repayment of borrowings |

- |

- |

(1) |

(1) |

|

Payment of finance leases |

(5) |

(8) |

(12) |

(15) |

|

Proceeds / (payment) of derivatives |

(1) |

(4) |

(4) |

(6) |

|

Other financing income / (costs) received/paid |

- |

(2) |

- |

4 |

|

|

|

|

|

|

|

Net cash from / (used in) financing

activities |

(19) |

(33) |

- |

(46) |

|

of which related to discontinued operations |

- |

(2) |

(2) |

(4) |

|

|

|

|

|

|

|

Net increase / (decrease) in cash & cash

equivalents |

(65) |

(140) |

(92) |

(206) |

|

|

|

|

|

|

|

Cash & cash equivalents at the start of the

period |

108 |

330 |

138 |

398 |

|

Net increase / (decrease) in cash & cash equivalents |

(65) |

(140) |

(92) |

(206) |

|

Effect of exchange rate fluctuations on cash held |

1 |

1 |

(2) |

(1) |

|

Cash & cash equivalents at the end of the

period |

44 |

191 |

44 |

191 |

(1) The Group has elected to present a

statement of cash flows that includes all cash flows, including

both continuing and discontinuing operations.Consolidated

Statement of changes in Equity (in million Euro)

Unaudited, consolidated figures following IFRS accounting

policies.

|

in million Euro |

Share capital |

Share premium |

Retained earnings |

Reserve for own shares |

Revaluation reserve |

Hedging reserve |

Remeasurement of the net defined benefit

liability |

Translation reserve |

Total |

NON-CONTROLLING INTERESTS |

TOTAL EQUITY |

|

Balance at January 1, 2022 |

187 |

210 |

1,284 |

- |

2 |

(2) |

(1,033) |

(15) |

632 |

54 |

685 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income for the period |

|

|

|

|

|

|

|

|

|

|

|

|

Profit (loss) for the period |

- |

- |

(21) |

- |

- |

- |

- |

- |

(21) |

1 |

(20) |

|

Other comprehensive income, net of tax |

- |

- |

- |

- |

(2) |

(2) |

119 |

31 |

146 |

2 |

147 |

|

Total comprehensive income for the period |

- |

- |

(21) |

- |

(2) |

(2) |

119 |

31 |

125 |

2 |

127 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transactions with owners, recorded directly in

equity |

|

|

|

|

|

|

|

|

|

|

|

|

Dividends |

- |

- |

- |

- |

- |

- |

- |

- |

- |

(5) |

(5) |

|

Purchase of own shares |

- |

- |

- |

(21) |

- |

- |

- |

- |

(21) |

- |

(21) |

|

Cancellation of own shares |

- |

- |

(21) |

21 |

- |

- |

- |

- |

- |

- |

- |

|

Total transactions with owners, recorded directly in

equity |

- |

- |

(21) |

- |

- |

- |

- |

- |

(21) |

(5) |

(26) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at June

30,

2022 |

187 |

210 |

1,242 |

- |

- |

(4) |

(914) |

15 |

736 |

51 |

787 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at January 1, 2023 |

187 |

210 |

1,042 |

- |

(1) |

(2) |

(908) |

(9) |

520 |

41 |

561 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income for the period |

|

|

|

|

|

|

|

|

|

|

|

|

Profit (loss) for the period |

- |

- |

(82) |

- |

- |

- |

- |

- |

(82) |

1 |

(81) |

|

Other comprehensive income, net of tax |

- |

- |

- |

- |

- |

2 |

- |

(7) |

(5) |

1 |

(4) |

|

Total comprehensive income for the period |

- |

- |

(82) |

- |

- |

2 |

- |

(7) |

(87) |

2 |

(85) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transactions with owners, recorded directly in

equity |

|

|

|

|

|

|

|

|

|

|

|

|

Dividends |

- |

- |

- |

- |

- |

- |

- |

- |

- |

(9) |

(9) |

|

Transfer of amounts recognized in OCI to retained earnings

following loss of control |

- |

- |

11 |

- |

- |

- |

(11) |

- |

- |

- |

- |

|

Derecognition of NCI following loss of control |

- |

- |

- |

- |

- |

- |

- |

- |

- |

(32) |

(32) |

|

Total transactions with owners, recorded directly in

equity |

- |

- |

11 |

- |

- |

- |

(11) |

- |

- |

(41) |

(41) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at June

30, 2023 |

187 |

210 |

971 |

- |

(1) |

- |

(919) |

(16) |

433 |

2 |

434 |

- HY report 2023 in pdf

- Press release in pdf

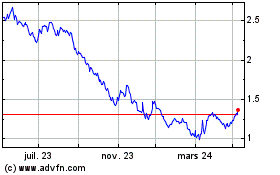

AGFA Gevaert NV (EU:AGFB)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

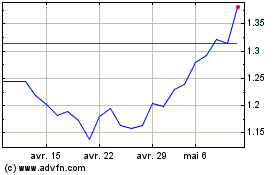

AGFA Gevaert NV (EU:AGFB)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024