ALSTOM SA: Alstom’s third quarter 2023/24: good commercial momentum

and Free Cash Flow guidance reaffirmed for FY 2023/24

Alstom’s third quarter 2023/24: good commercial momentum

and Free Cash Flow guidance reaffirmed for FY 2023/24

- Q3: strong orders of €5.5

billion, sales at €4.3 billion, book-to-bill at 1.3

- 9-months: orders at €13.9

billion, sales at €12.8 billion, book-to-bill at 1.1

- Full year 2023/24 outlook

and mid-term objectives confirmed

- Executing on the

deleveraging plan

24 January 2024 – Over the

third quarter of 2023/24 (from 1 October to 31 December 2023),

Alstom booked €5.5 billion of orders. The Group’s sales reached

€4.3 billion in the quarter.

For the first nine months of 2023/24 (from 1

April to 31 December 2023), Alstom’s order intake reached €13.9

billion, compared to €15.2 billion for the same period last fiscal

year. The Group sales increased by 4.1% over 9 months, of which

7.3% organic growth, reaching €12.8 billion, in line with the

targeted trajectory.

The backlog, as of 31 December 2023, settled at

€90.3 billion, providing strong visibility on future sales.

Key figures

|

Reported figures(in € million) |

2022/23Q3 |

2023/24Q3 |

% ChangeReported |

% ChangeOrganic |

|

Orders received |

5,152 |

5,451 |

+5.8% |

+6.4% |

|

Sales |

4,223 |

4,332 |

+2.6% |

+4.6% |

|

Reported figures(in € million) |

2022/239 months |

2023/249 months |

% ChangeReported |

% ChangeOrganic |

|

Orders received |

15,224 |

13,898 |

(8.7)% |

(7.0)% |

|

Sales |

12,271 |

12,775 |

+4.1% |

+7.3% |

Geographic and product breakdowns of reported orders and sales

are provided in Appendix 1. All figures mentioned in this release

are unaudited.

“Alstom delivered strong levels of order intake

during the third quarter, on the back of positive market momentum

in Services and Systems. We are relentlessly focused on the

operational action plan to generate cash in the second half of the

year, notably through improved production and working capital

efficiency. Considering the progress made since November, we will

provide the breakdown of each measure of the €2 billion inorganic

plan in May 2024. Confident in the resilience of our business

model, we confirm our short and mid-term targets,” said

Henri POUPART-LAFARGE, Alstom Chairman and Chief

Executive Officer.

***

Detailed review

During the third quarter of 2023/24

(from 1 October to 31 December 2023), Alstom recorded

€5,451 million in orders, compared to €5,152 million over

the same period last fiscal year. Over three months,

orders for Services, Signalling and Systems reached 84% of the

total order intake and 66% over the 9 months. On a regional level,

Europe accounts for 34% of the Group total order intake. In the

United Kingdom, Alstom has signed an eight-year extension to its

Train Services Agreement (TSA) with CrossCountry. With this

contract extension, valued at around €950 million, Alstom will

continue to maintain, overhaul, service and clean CrossCountry’s

Voyager and Super Voyager fleet until 2031.

In France, Alstom has won a twelve-year

framework contract worth almost €300 million to develop and deploy

the NExTEO signalling system on the RER B and RER D lines in the

Île-de-France region. Alstom’s Urbalis signalling technology will

help infrastructure managers and transport operators to improve the

performance and punctuality.

In the Asia-Pacific region, Alstom has been

announced as the successful bidder for a contract worth around €900

million to maintain the regional rolling stock VLocity and Classic

fleets in Victoria, Australia for the next decade.

In Africa-Middle East-Central Asia, the Group

reached financial closure for Israel’s NTA contract of Tel Aviv’s

Green Line light rail systems. With around €900 million share in

the contract, Alstom is set to design, build and maintain the Tel

Aviv Metropolitan LRT Green Line by Metropolitan Mass Transit

System Ltd (NTA).

The level of base orders (less than €200 million

of contract value) has exceeded €2 billion during this third

quarter.

Sales were €4,332 million in Q3 2023/24

compared to €4,223 million in Q3 2022/23.

Over 9 months, sales amounted to €12,775

million, representing a growth of 4.1% on a reported basis and a

strong 7.3% on an organic basis compared with Alstom sales in the

same period last fiscal year.

For the same period, Rolling Stock sales reached

€6,765 million, representing an increase of 1% on a reported basis

and 5% on an organic basis, driven by a ramp-up of projects in

Brazil and in India as well as a solid level of execution in the US

and in France.

Signalling sales stood at €1,911 million for the

9 months, up 8% on a reported basis and 12% on an organic basis,

led by a consistent execution across all regions, mainly in the US,

the UK and Australia.

In Systems, Alstom reported €1,118 million sales

for the 9 months, up 5% on a reported basis and 8% on an organic

basis, on the back of a good performance of Turnkey Systems

projects in Egypt, Canada and France and a ramp-up of projects in

Mexico.

Services delivered a sustained performance and

reported €2,981 million of sales over 9 months, up 7% on a reported

basis and 10% on an organic basis, benefiting from a strong ramp-up

in the UK, in Italy and in the US.

The book-to-bill ratio is 1.3 over the quarter

and 1.1 over 9 months.

***

Main highlights of the third quarter of

2023/24

During the quarter, Alstom reached important

delivery milestones, and launched a range of initiatives to

accelerate its transformation into a more competitive and agile

group.

In October 2023, Alstom reached a milestone for

India’s rail revolution with the inauguration of NaMo Bharat,

India's first semi-high-speed regional rail service, with both

rolling stock and signalling solutions provided by Alstom India.

The first phase, the seventeen-kilometre Duhai-Sahibabad section of

the Delhi-Meerut corridor which is now operational for general

public, also marks the world debut of Level 3 ETCS (European Train

Control System).

In November 2023 in Paris, Ile-de-France

Mobilités, SNCF Voyageurs and Alstom together inaugurated the RER

NG, the “New Generation RER” in the presence of elected

representatives and passengers. The RER NG commuter train, designed

and manufactured with the contribution of 9 Alstom sites in France,

will bring lasting improvements to travel conditions for the

hundreds of thousands of people who use the RER D and RER E lines

every day.

In December 2023, for the first time in France,

a battery-powered train carried passengers on a non-electrified

track in Toulouse, in the Occitanie region. This innovative

tri-mode electric-combustion-battery train was presented at

Toulouse-Matabiau station before departing for Mazamet. The hybrid

train will be tested for a year in commercial service on several

lines in the four partner regions.

Also in December 2023, Tren Maya, a brand-new

rail service for Mexico’s Yucatán Peninsula entered commercial

service. The trains were built by Alstom, at its plant in Ciudad

Sahagún, in Mexico. Alstom is providing the X’trapolis trains for

this project. Alstom is responsible for the maintenance of the

trains for the next five years and continues the work to provide

signalling as well.

-

One Alstom team Agile, Inclusive and

Responsible

For the thirteenth consecutive year, Alstom has

been included in the Dow Jones Sustainability Indices (DJSI), World

and Europe, attesting to its leadership position in sustainable

business practices.

The Company reached an overall score of 70 out

of 100 in the Corporate Sustainability Assessment and remained in

the top of the best scored companies of the industry. Significant

improvement has been recorded this year in areas such as Resource

Efficiency and Circularity, Customer relationship, Environmental

Emissions and Human rights.

Alstom has also ranked among Corporate Knights’

2024 100 Most Sustainable Corporations in the World.

In December 2023, Alstom and Fundación ONCE

renewed their collaboration to continue building accessible and

inclusive mobility by bolstering their commitments for the social

inclusion of people with disabilities. Fundación ONCE has become a

worldwide strategic advisor in terms of inclusiveness and a

strategic partner in research, development and innovation.

***

Progress on Alstom’s action plan to

secure financial targets

During this third quarter, the company has been

mobilizing around the operational, commercial, and cost efficiency

plan:

- Quality of order intake during Q3

2023/24 provides comfort to continue growing the margin in backlog

(+0.5% per year in coming three years)

- After 9 months, Alstom has produced

3,415 cars (compared to 2,998 in 2022/23), continuing to deliver

the production ramp-up

- Strong actions have been launched

to revert the negative trend on inventory days of sales

- Plan to reduce overhead costs has

been announced to employees representatives and is expected to be

finalized (sizing, cost, modalities and timeline) and launched by

the year-end, with the objective to decrease SG&A costs by ca.

1 percentage point of sales by March 2026.

Reinforce Balance sheet to maintain

Investment Grade Rating

Alstom’s Board of Directors is committed to

maintaining a solid and sustainable Investment Grade rating. It has

decided to reinforce the Group’s balance-sheet and is targeting a

reduction in its net debt position by €2 billion by March 2025.

Existing reference shareholders are supportive

of this plan and are working closely with the management to execute

it swiftly.

- Assets disposal processes are

progressing, which allows confirmation of the announced range of

expected proceeds between €0.5 billion and €1.0 billion.

- Equity-like instruments preparation

is also in progress, with advisors mandated and underlying business

selection and structuration well advanced.

- Feasibility and sizing of a

potential capital increase (with pre-emptive rights for

shareholders) is being studied in parallel.

Not taken into account in the €2 billion

deleveraging plan is the exit of TMH Limited, which was closed

early January 2024 for an amount of €75 million, contributing to

the de-risking of the company’s portfolio, and which was accounted

for as asset held for sale as of 30 September 2023. The sale of TMH

Limited will result in a non-cash loss of around €(127) million due

to the recognition of the €(202) million Currency Translation

Adjustment accounted for directly in equity since the

acquisition.

Alstom will precise the breakdown of the €2

billion deleveraging plan latest by full-year results release in

May 2024.

***

Financial trajectory for FY

2023/24

The Group has based its 2023/24 outlook on a

central inflation scenario reflecting a consensus of public

institutions. The Group also assumes its continuous ability to

navigate supply chain disruptions and macroeconomic and

geopolitical challenges as it has done during these first nine

months of fiscal year 2023/24.

- Book to bill ratio above 1

- Sales organic growth above 5%

- Adjusted EBIT Margin around 6%

- Free Cash Flow within the range

€(500)m - €(750)m

As already announced, the Board will propose to

the Shareholders’ General Assembly that no dividend will be paid

with regards to the fiscal year 2023/24.

***

Mid-term financial trajectory and

objectives to be reached in FY 2025/26

- Sales: Between 2020/21 (proforma

sales of €14 billion) – and 2025/26, Alstom is aiming at sales

Compound Annual Growth Rate over 5% supported by strong market

momentum and unparalleled €90.3 billion backlog as of 31 December

2023, securing sales of ca. €38 to €40 billion over the next three

years. Rolling Stock should grow above market rate, Services and

Signalling at high-single digit path.

- Profitability: the adjusted EBIT

margin should reach between 8% and 10% from 2025/26 onwards,

benefiting from operational excellence initiatives, strong margins

on new orders including improved indexation, the completion of the

challenging projects in backlog while synergies are expected to

deliver €400 million run rate in 2024/25 and €475 - €500 million

annually from 2025/26 onwards.

- Free Cash Flow: from 2025/26

onwards, the conversion from adjusted net profit to Free Cash Flow

should be over 80%1 driven by mid-term stability of trade working

capital, stabilisation of CAPEX to around 2% of sales and cash

focus initiatives while benefiting from volume and synergies take

up.

***

Conference Call

Alstom is pleased to invite you to a conference

call presenting its third quarter orders and sales of the fiscal

year 2023/24 on Wednesday 24 January 2024 at 08:30 am (Paris time),

hosted by Bernard Delpit, Alstom CFO. A live audiocast will also be

available on Alstom’s website: Alstom’s orders and sales for the

third quarter of fiscal year 2023/24.

To participate in the Q&A session (audio only), please use

the dial-in numbers below:

-

UK +44 (0) 33 0551 0200

-

USA +1 786 697 3501

- France +33 (0) 1

7037 7166

Quote ALSTOM to the operator to be transferred to the

appropriate conference.

***

Alstom™, VLocity™, Urbalis™ and X’trapolis™ are protected

trademarks of the Alstom Group.NExTEO™ is a protected trademark of

the SNCF Group

1 Subject to short term volatility

|

|

About Alstom |

|

|

|

Alstom commits to contribute to a low carbon future by developing

and promoting innovative and sustainable transportation solutions

that people enjoy riding. From high-speed trains, metros,

monorails, trams, to turnkey systems, services, infrastructure,

signalling and digital mobility, Alstom offers its diverse

customers the broadest portfolio in the industry. With its presence

in 63 countries and a talent base of over 80,000 people from 175

nationalities, the company focusses its design, innovation, and

project management skills to where mobility solutions are needed

most. Listed in France, Alstom generated revenues of €16.5 billion

for the fiscal year ending on 31 March 2023. For more information,

please visit www.alstom.com |

|

|

|

| |

Contacts |

Press:Coralie COLLET - Tel. : +33 (0) 7 63 63 09

62 coralie.collet@alstomgroup.com Samuel MILLER –

Tel. : +33 (0) 6 65 47 40 14 samuel.miller@alstomgroup.com

Thomas ANTOINE - Tel. : +33 (0) 6 11 47 28

60thomas.antoine@alstomgroup.com Investor relations

:Martin VAUJOUR – Tel. : +33 (0) 6 88 40 17

57martin.vaujour@alstomgroup.com Estelle MATURELL ANDINO –

Tel.: +33 (0)6 71 37 47 56 estelle.maturell@alstomgroup.com

|

|

This press release contains forward-looking

statements which are based on current plans and forecasts of

Alstom’s management. Such forward-looking statements are relevant

to the current scope of activity and are by their nature subject to

a number of important risks and uncertainty factors (such as those

described in the documents filed by Alstom with the French AMF)

that could cause actual results to differ from the plans,

objectives and expectations expressed in such forward-looking

statements. These such forward-looking statements speak only as of

the date on which they are made, and Alstom undertakes no

obligation to update or revise any of them, whether as a result of

new information, future events or otherwise.

This press release does not constitute or form

part of a prospectus or any offer or invitation for the sale or

issue of, or any offer or inducement to purchase or subscribe for,

or any solicitation of any offer to purchase or subscribe for any

shares or other securities in the Company in France, the United

Kingdom, the United States or any other jurisdiction. Any offer of

the Company’s securities may only be made in France pursuant to a

prospectus having received the visa from the AMF or, outside

France, pursuant to an offering document prepared for such purpose.

The information does not constitute any form of commitment on the

part of the Company or any other person. Neither the information

nor any other written or oral information made available to any

recipient, or its advisers will form the basis of any contract or

commitment whatsoever. In particular, in furnishing the

information, the Company, the Banks, their affiliates,

shareholders, and their respective directors, officers, advisers,

employees or representatives undertake no obligation to provide the

recipient with access to any additional information.

APPENDIX 1A – GEOGRAPHIC

BREAKDOWN

|

Reported figures |

2022/23 |

% |

2023/24 |

% |

|

(in € million) |

9 months |

Contrib. |

9 months |

Contrib. |

|

Europe |

9,395 |

62% |

8,224 |

59% |

|

Americas |

1,510 |

10% |

1,767 |

13% |

|

Asia / Pacific |

2,104 |

14% |

2,977 |

21% |

|

Middle East / Africa |

2,215 |

14% |

929 |

7% |

|

Orders by destination |

15,224 |

100% |

13,898 |

100% |

|

Reported figures |

2022/23 |

% |

2023/24 |

% |

|

(in € million) |

9 months |

Contrib. |

9 months |

Contrib. |

|

Europe |

7,343 |

60% |

7,391 |

58% |

|

Americas |

2,074 |

17% |

2,516 |

20% |

|

Asia / Pacific |

1,797 |

15% |

1,782 |

14% |

|

Middle East / Africa |

1,057 |

8% |

1,086 |

8% |

|

Sales by destination |

12,271 |

100% |

12,775 |

100% |

APPENDIX 1B – PRODUCT BREAKDOWN

|

Reported figures |

2022/23 |

% |

2023/24 |

% |

|

(in € million) |

9 months |

Contrib. |

9 months |

Contrib. |

|

Rolling stock |

7,648 |

50% |

4,666 |

34% |

|

Services |

5,047 |

33% |

4,943 |

36% |

|

Systems |

852 |

6% |

2,419 |

17% |

|

Signalling |

1,677 |

11% |

1,870 |

13% |

|

Orders by product line |

15,224 |

100% |

13,898 |

100% |

|

Reported figures |

2022/23 |

% |

2023/24 |

% |

|

(in € million) |

9 months |

Contrib. |

9 months |

Contrib. |

|

Rolling stock |

6,667 |

54% |

6,765 |

53% |

|

Services |

2,775 |

23% |

2,981 |

23% |

|

Systems |

1,062 |

9% |

1,118 |

9% |

|

Signalling |

1,767 |

14% |

1,911 |

15% |

|

Sales by product line |

12,271 |

100% |

12,775 |

100% |

APPENDIX 2 - NON-GAAP FINANCIAL

INDICATORS DEFINITIONS

This section presents financial indicators used

by the Group that are not defined by accounting standard

setters.

Orders receivedA new order is

recognised as an order received only when the contract creates

enforceable obligations between the Group and its

customer. When this condition is met, the order is recognised

at the contract value. If the contract is denominated in a currency

other than the functional currency of the reporting unit, the Group

requires the immediate elimination of currency exposure using

forward currency sales. Orders are then measured using the spot

rate at inception of hedging instruments.

Book-to-Bill The book-to-bill

ratio is the ratio of orders received to the amount of sales traded

for a specific period.

Gross margin % on backlogGross

Margin % on backlog is a Key Performance Indicator to present the

expected performance level of firmed contracts in backlog. It

represents the difference between the sales not yet recognized and

the cost of sales not yet incurred from the contracts in backlog.

This % is an average of the portfolio of contracts in backlog and

is meaningful to project mid- and long-term

profitability.

Adjusted Gross Margin before

PPAAdjusted Gross Margin before PPA is a Key Performance

Indicator to present the level of recurring operational

performance. It represents the sales minus the cost of sales,

adjusted to exclude the impact of amortisation of assets

exclusively valued when determining the purchase price allocations

(“PPA”) in the context of business combination as well as

non-recurring “one off” items that are not supposed to occur again

in following years and are significant.

EBIT before PPAFollowing the

Bombardier Transportation acquisition and with effect from the

fiscal year 2021/22 condensed consolidated financial statements,

Alstom decided to introduce the “EBIT before PPA” indicator aimed

at restating its Earnings Before Interest and Taxes (“EBIT”) to

exclude the impact of amortisation of assets exclusively valued

when determining the purchase price allocations (“PPA”) in the

context of business combination. This indicator is also aligned

with market practice.

Adjusted EBITAdjusted EBIT

(“aEBIT”) is the Key Performance Indicator to present the level of

recurring operational performance. This indicator is also aligned

with market practice and comparable to direct competitors. Starting

September 2019, Alstom has opted for the inclusion of the share in

net income of the equity-accounted investments into the aEBIT when

these are considered to be part of the operating activities of the

Group (because there are significant operational flows and/or

common project execution with these entities). This mainly includes

Chinese joint-ventures, namely CASCO joint-venture for Alstom as

well as, following the integration of Bombardier Transportation,

Alstom Sifang (Qingdao) Transportation Ltd. (formerly Bombardier

Sifang), Bombardier NUG Propulsion System Co. Ltd and Changchun

Changke Alstom Railway Vehicles Company Ltd (formerly Changchun

Bombardier).aEBIT corresponds to Earning Before Interests and Tax

adjusted for the following elements:

- net

restructuring expenses (including rationalization costs)

- tangibles and

intangibles impairment

- capital gains or

loss/revaluation on investments disposals or controls changes of an

entity

- any other

non-recurring items, such as some costs incurred to realize

business combinations and amortization of an asset exclusively

valued in the context of business combination, as well as

litigation costs that have arisen outside the ordinary course of

business

- and including

the share in net income of the operational equity-accounted

investments

A non-recurring item is a “one-off” exceptional

item that is not supposed to occur again in following years and

that is significant.Adjusted EBIT margin corresponds to Adjusted

EBIT expressed as a percentage of sales.

EBITDA + JV dividendsEBITDA +

JV dividends is the EBIT before PPA, before the depreciation and

amortisation, with the addition of the dividends received from the

JVs.

Adjusted net profitFollowing

the Bombardier Transportation, Alstom decided to introduce the

“adjusted net profit” indicator aimed at restating its net profit

from continued operations (Group share) to exclude the impact of

amortisation of assets exclusively valued when determining the

purchase price allocations (“PPA”) in the context of business

combination, net of the corresponding tax effect. This indicator is

also aligned with market practice.

Free cash flow Free Cash Flow

is defined as net cash provided by operating activities minus

capital expenditures including capitalised development costs, net

of proceeds from disposals of tangible and intangible assets. Free

Cash Flow does not include any proceeds from disposals of activity.

The most directly comparable financial measure to Free Cash Flow

calculated and presented in accordance with IFRS is net cash

provided by operating activities.

Funds from OperationsFunds from

Operations “FFO” in the EBIT to FCF statement refers to the Free

Cash Flow generated by Operations, less Working Capital

variations.

Trade Working Capital and Contract

Working CapitalTrade Working Capital is the Working

Capital that is not strictly contractual, hence not included in

Project Working Capital. It includes:

- Inventories

- Trade

Receivables

- Trade

Payables

- Other elements

of Working Capital, defined as the sum of Other Current

Assets/Liabilities and Non-Current provisions

Contract Working Capital is the sum of:

- Contract Assets

& Liabilities, which includes the Customer Down-Payments

- Current

provisions, which includes Risks on contracts and Warranties

Net cash/(debt)The net

cash/(debt) is defined as cash and cash equivalents, marketable

securities and other current financial asset, less borrowings.

Pay-out ratio The pay-out ratio

is calculated by dividing the amount of the overall dividend with

the “Adjusted Net profit from continuing operations attributable to

equity holders of the parent, Group share” as presented in the

management report in the consolidated financial statements.

Organic basis This press

release includes performance indicators presented on an actual

basis and on an organic basis. Figures given on an organic basis

eliminate the impact of changes in scope of consolidation and

changes resulting from the translation of the accounts into Euro

following the variation of foreign currencies against the Euro. The

Group uses figures prepared on an organic basis both for internal

analysis and for external communication, as it believes they

provide means to analyse and explain variations from one period to

another. However, these figures are not measurements of performance

under IFRS.

| |

Q3 2022/23 |

|

Q3 2023/24 |

|

|

|

|

|

(in € million) |

Reported figures |

Exchange rate and scope

impact |

Organic Figures |

|

Reported figures |

|

|

% Var Act. |

% Var Org. |

|

Orders |

5,152 |

(28) |

5,124 |

|

5,451 |

|

|

+5.8% |

+6.4% |

|

Sales |

4,223 |

(83) |

4,140 |

|

4,332 |

|

|

+2.6% |

+4.6% |

| |

9 months2022/23 |

|

9 months2023/24 |

|

|

|

|

|

(in € million) |

Reportedfigures |

Exchange rate and scope

impact |

Organic Figures |

|

Reported figures |

|

|

% Var Act. |

% Var Org. |

|

Orders |

15,224 |

(275) |

14,949 |

|

13,898 |

|

|

(8.7)% |

(7.0)% |

|

Sales |

12,271 |

(370) |

11,901 |

|

12,775 |

|

|

+4.1% |

+7.3% |

- Alstom - PR Q3 2023-24 ENG - Final

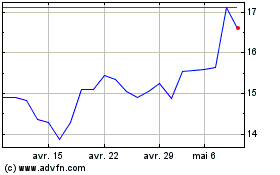

Alstom (EU:ALO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Alstom (EU:ALO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024