→ First-half revenue of €148.7m, up 1.9% organically and 2.2%

in total → Annual Recurring Revenue (ARR) at €229.9m, up

7.2% compared with end-June 2023 → Profit on operating

activities consistent with expectations at 11.5%, in line with

first-half 2023 → Sopra Banking Software acquisition project

well on track to complete fully in Q3 2024

Regulatory News:

Axway Software (Paris:AXW):

Axway Software's Board of Directors, chaired by Pierre Pasquier,

approved on July 18, the financial statements for the first half of

2024, which were subject to a limited review by the statutory

auditors1. As a consequence, Axway’s management announces:

Axway Software: 2024 Half-year results

Key income statement items*

Half-year 2024 Half-year 2023

(€m) (% Rev) (€m) (% Rev)

Revenue

148.7

145.5

Organic growth + 1.9%

Growth at constant exchange rates + 2.2%

Total growth + 2.2%

Profit on Operating Activities

17.1

11.5%

17.8

12.2%

Profit from Recurring Operations

12.5

8.4%

14.7

10.1%

Operating Profit

8.3

5.6%

11.2

7.7%

Net Profit attributable to the Group

2.8

1.9%

3.7

2.5%

Basic earnings per

share (in €)

0.13

0.17

* Alternative performance measures are defined in the

glossary at the end of this document

Patrick Donovan, Chief Executive Officer, declared:

"In the first half of 2024, we maintained a measured pace,

achieving 1.9% organic growth, aligned with our guidance range,

while diligently managing expenses to maintain a healthy 11.5%

margin on operating activities, consistent with our full-year

ambitions. Unlike the exceptional start in 2023, H1 2024 has

reflected a more balanced outlook. Higher-than-expected bookings on

Axway Managed offerings, which will drive future subscription

revenue but had minimal impact in the first half, hindered our

ability to sustain a stronger growth momentum. Axway Managed

offerings represented over 42% of our bookings in the first 6

months of the year, indicating a trend likely to persist. As Axway

advances towards its annual objectives, we are steadfast in our

commitment and eager to complete the acquisition of Sopra Banking

Software during the third quarter."

____________________________________ 1 The interim consolidated

financial statements were subject to limited review procedures.

Comments on business activity in the first half of

2024

In the first half of 2024, Axway's performance aligned with its

annual objectives. After experiencing a robust Q1, the company saw

a deceleration in growth during Q2 due to delays in finalizing some

key contracts. The Americas region maintained steady mid-digit

growth throughout the entire first half, and the Asia-Pacific

region continued to progress. France and Europe, which had shown

significant growth over the past two years, faced a downturn in Q2

due to a high comparison basis. Nevertheless, Axway continued to

successfully attract new customers, which accounted for 25% of

bookings during the period.

Several highlights marked Axway's recent news. In February, the

company announced its project to acquire Sopra Banking Software, an

acquisition that will more than double Axway's revenue and

strengthen the company's position in the financial services and

banking industries, while diversifying its product portfolio,

geographical coverage, and customer base. Simultaneously, the

company continued its efforts to further enhance the relevance of

its offerings and customer satisfaction. To this end, Axway Summits

in North America, Brazil and Europe, held between April and June,

were a great success, attracting several hundred customers, eager

to discover Axway's vision and new capabilities.

On the product side, Axway's Amplify API Management platform's

robustness continued to support customer transaction growth,

leading to strong performance for the product line in H1 2024. This

highlights the platform's crucial role in enhancing customer

success and satisfaction, especially for those with the most

advanced systems. The MFT offering was also in high demand over the

half-year, buoyed by the success of Axway's Managed offerings,

which provide customers with high-end, reliable and secure cloud

services, designed to meet all their expectations and

challenges.

Finally, Axway was positioned as a Leader in The Forrester

Wave™: API Management Software2 by Forrester Research. This new

recognition testifies to the company’s relentless efforts in

delivering innovative solutions that drive digital transformation

and business growth for its customers. The API Management, B2B

Integration and MFT offerings, were also each named leaders in

their respective categories of the Summer 2024 reports of the G23

evaluation platform for enterprise solutions.

Comments on operational performance in the first half of

2024

In H1 2024, Axway's revenue totaled €148.7m, up 1.9% organically

and 2.2% in total. Within the H1 2023 restated figures, currency

fluctuations had non-significant impact, while changes in the

consolidation scope resulting from the 2023 acquisitions, had a

positive impact of €0.4m. Profit on operating activities amounted

to €17.1m for the period, or 11.5% of revenue.

Axway Software: Revenue by business

line

Half-year 2024 (€m)

H1 2024

H1 2023 Restated*

H1 2023 Reported

Total Growth

Organic Growth

Subscription

93.2

79.0

78.7

18.5%

18.0%

of which Axway Managed

25.9

22.6

22.3

16.5%

14.8%

of which Customer Managed

67.3

56.4

56.4

19.3%

19.3%

Maintenance

34.6

44.6

44.6

-22.3%

-22.3%

Subtotal - Renewable Contracts

127.9

123.6

123.3

3.7%

3.4%

License

2.6

3.0

3.0

-12.2%

-12.1%

Services

18.2

19.3

19.2

-5.4%

-5.7%

Axway Software

148.7

145.9

145.5

2.2%

1.9%

* Revenue at 2024 scope and exchange rates

The Subscription activity continued to perform strongly

in H1 2024, achieving organic growth of 18.0% to €93.2m in revenue.

Axway Managed offerings revenue saw organic growth of 14.8%,

supported by the full impact of deals signed in 2023 in addition to

those concluded in H1 2024, while Customer Managed offerings

revenue soared by 19.3%. Upfront revenue from Customer Managed

contracts signed in the first 6 months of the year represented

€39.4m. Axway continued to win new business, as illustrated by the

annual value of new subscription contracts (ACV) signed in H1 2024,

which totaled €15.9m. Axway Managed offerings once again attracted

a growing number of customers, accounting for 42% of total bookings

in H1 2024, which will boost future revenue for the activity. This

trend is expected to continue for the foreseeable future.

In H1 2024, Maintenance generated €34.6m in revenue,

making up 23% of Axway's overall revenue. The activity experienced

an organic decline of 22.3%, due to the continued shift of

customers to subscription models, yet maintained a high renewal

rate of around 91%.

At the end of June 2024, Axway's Annual Recurring Revenue (ARR)

reached €229.9m, up 7.2% on a like-for-like basis, compared to

€214.5m at the end of June 2023. In H1 2024, revenue from renewable

contracts represented 86% of total revenue.

License revenue for the first half amounted to €2.6m,

reflecting a 12.1% organic decline. Q2 revenue showed a strong

recovery with a 44.3% increase compared to the previous year,

partially offsetting Q1's sharp decline. Axway expects the

full-year activity revenue to remain consistent with last year's

figures, contributing 2 to 4% of the company's total revenue.

______________________________________ 2 The Forrester Wave™:

API Management Software, Q3 2024, Forrester Research, Inc., July 1,

2024. To learn more click here. 3 To learn more about Axway’s G2

evaluations click here.

The Services activity, representing approximately 12% of

Axway's total revenue, experienced a slight organic decrease in H1

2024, with revenue of €18.2m, marking a 5.7% drop from the same

period last year. Full-year revenue is expected to be slightly down

on the previous year, due to the higher than expected proportion of

Axway Managed contracts signed in H1.

Axway Software: Revenue by geographic

area

Half-year

2024 (€m)

H1 2024

H1 2023 Restated*

H1 2023 Reported

Total Growth

Organic Growth

France

41.7

45.6

45.5

-8.3%

-8.4%

Rest of Europe

38.6

36.1

35.6

8.4%

7.0%

Americas

60.2

57.2

57.2

5.2%

5.2%

Asia/Pacific

8.1

7.0

7.1

14.4%

16.0%

Axway Software

148.7

145.9

145.5

2.2%

1.9%

* Revenue at 2024 scope and exchange

rates

France posted first-half revenue of €41.7m in H1 2024,

representing an expected organic decline of 8.4%. This contraction

is attributable to the high comparison basis resulting from the

previous year's strong performance, which made growth difficult,

notably due to significant upfront revenues recorded last year when

major subscription migration projects were signed.

Across the Rest of Europe, Axway maintained a robust

growth trajectory, reporting revenue of €38.6m in H1 2024, with an

organic growth rate of 7.0%. This positive trend was driven by good

performances in key markets such as Germany and Southern Europe,

leveraging the Amplify API Management and MTF offerings. Axway's

strategic commitment to enhancing customer value and expanding its

market reach played a pivotal role across the region.

Axway continued its upward trajectory in the Americas

(USA and Latin America), reporting €60.2m in revenue over H1 2024,

reflecting a strong 5.2% organic growth rate. Thanks to a solid

reputation for security, Axway has seen several new customers

choose its MFT and APIM offerings to replace competing solutions.

The region remains a cornerstone of Axway's global strategy,

accounting for 40% of its overall revenue in the first half.

Axway achieved promising results in Asia/Pacific with

revenue totaling €8.1m in H1 2024, reflecting a very solid organic

growth rate of 16.0%, driven by the ramp-up of major deals

contracted in 2023.

Comments on net profit for the first half of 2024

Profit from recurring operations was €12.5m in H1 2024, or 8.4%

of revenue, compared to 10.1% (€14.7m) in H1 2023. It includes

amortization of allocated intangible assets of €1.7m and a

share-based payment expense of €2.9m.

Operating profit for the half-year was €8.3m, or 5.6% of

revenue, compared to €11.2m or 7.7% of revenue in H1 2023.

Net profit for the period was €2.8m, representing 1.9% compared

to 2.5% in H1 2023.

Basic earnings per share were €0.13 for the period, down from

€0.17 in H1 2023.

Financial position at June 30, 2024

At June 30, 2024, Axway's financial position was solid, with

cash of €16.9m and bank debt of €87.7m.

Free cash flow was €6.7m in H1 2024, compared to €16.5m a year

earlier. Due to the timing of some collections and payments that

will recover in H2, Axway expects that 2024 full-year free cash

flows will improve compared to the 2023 level.

Shareholders' equity stood at €355.9m at June 30, 2024, compared

to €314.6m at the end of June 2023.

Update on Sopra Banking Software acquisition project

On July 10, 2024, Axway announced that all regulatory conditions

precedent to the completion of the acquisition were satisfied, with

the exception of the AMF's approval of the prospectus to be

submitted by Axway in connection with the contemplated rights issue

to help finance the transaction.

Axway's intention is to launch the rights issue before the end

of July 2024. The indicative timetable for the rights issue will be

set out in the operation prospectus, which is expected to be

approved by the AMF in the next few days. The rights issue

constitutes the final step in the project to acquire Sopra Banking

Software, which is expected to be finalized in Q3 2024.

Change in the workforce

At June 30, 2024, Axway had 1,471 employees compared to 1,465 at

December 31, 2023.

2024 Targets

For 2024, Axway confirms that it expects organic growth of

between 1% and 3% and a profit on operating activity of around 20%

of revenue. These confirmed targets apply to Axway’s current

structure. Guidance including Sopra Banking Software will be

disclosed to the market at the time of the launch of the rights

issue.

Today, Friday, July 19, 2024,

8.30 a.m. (UTC+2):

2024 Half-Year Results Virtual

Analyst Conference

→ Virtual Conference

Registration: Click here - Please note that the meeting will

be held in English.

Financial calendar

Thursday, October 24, 2024, before market opening: Publication

of Q3 2024 Revenue.

Glossary & Alternative performance measures

ACV: Annual Contract Value – Annual

contract value of a subscription agreement.

ARR: Annual Recurring Revenue –

Expected annual billing amounts from all active maintenance and

subscription agreements.

Growth at constant exchange rates:

Growth in revenue between the period under review and the prior

period restated for exchange rate impacts.

Organic growth: Growth in revenue

between the period under review and the prior period, restated for

consolidation scope and exchange rate impacts.

Profit on operating activities:

Profit from recurring operations adjusted for the non-cash

share-based payment expense, as well as the amortization of

allocated intangible assets.

Restated revenue: Revenue for the

prior year, adjusted for the consolidation scope and exchange rates

of the current year.

Disclaimer

This press release contains forward-looking statements that may

be subject to various risks and uncertainties concerning Axway’s

growth and profitability, notably in the event of future

acquisitions. Axway highlights that signature of contracts, which

represent investments for customers, are more significant in the

second half of the year and may therefore have a more or less

favorable impact on full-year performance. In addition, Axway notes

that potential acquisition(s) could also impact this financial

data. Furthermore, activity during the year and/or actual results

may differ from those described in this document as a result of a

number of risks and uncertainties set out in the 2022 Universal

Registration Document filed with the French Financial Markets

Authority (Autorité des Marchés Financiers, AMF) on March 24, 2023.

The distribution of this document in certain countries may be

subject to prevailing laws and regulations. Natural persons present

in these countries and in which this document is disseminated,

published, or distributed, should obtain information about such

restrictions, and comply with them.

About Axway

Axway enables enterprises to securely open everything by

integrating and moving data across a complex world of new and old

technologies. Axway’s API-driven B2B integration and MFT software,

refined over 20 years, complements Axway Amplify, an open API

management platform that makes APIs easier to discover and reuse

across multiple teams, vendors, and cloud environments. Axway has

helped over 11,000 businesses unlock the full value of their

existing digital ecosystems to create brilliant experiences,

innovate new services, and reach new markets. Learn more at

axway.com

Appendices (1/4)

Axway Software: Revenue by business

line

1st Quarter 2024 (€m)

Q1 2024

Q1 2023 Restated*

Q1 2023 Reported

Total Growth

Organic Growth

License

1.4

2.1

2.1

-36.3%

-35.8%

Subscription

49.4

37.9

37.8

30.9%

30.3%

Maintenance

17.1

22.3

22.5

-23.8%

-23.4%

Services

9.0

9.5

9.5

-5.2%

-5.5%

Axway Software

76.9

71.9

71.8

7.1%

6.9%

2nd Quarter 2024

(€m)

Q2 2024

Q2 2023 Restated*

Q2 2023 Reported

Total Growth

Organic Growth

License

1.3

0.9

0.9

47.0%

44.3%

Subscription

43.8

41.1

40.9

7.1%

6.6%

Maintenance

17.5

22.3

22.1

-20.9%

-21.3%

Services

9.1

9.7

9.7

-5.6%

-5.9%

Axway Software

71.7

73.9

73.6

-2.5%

-3.0%

* Revenue at 2024 scope and exchange

rates

Axway Software: Revenue by

geographic area

1st

Quarter 2024 (€m)

Q1 2024

Q1 2023 Restated*

Q1 2023 Reported

Total Growth

Organic Growth

France

23.9

24.8

24.7

-3.2%

-3.5%

Rest of Europe

17.4

13.8

13.5

29.5%

25.9%

Americas

32.1

30.6

30.9

4.2%

5.2%

Asia/Pacific

3.4

2.7

2.8

21.5%

25.1%

Axway Software

76.9

71.9

71.8

7.1%

6.9%

2nd

Quarter 2024 (€m)

Q2 2024

Q2 2023 Restated*

Q2 2023 Reported

Total Growth

Organic Growth

France

17.8

20.8

20.8

-14.4%

-14.4%

Rest of Europe

21.2

22.2

22.2

-4.4%

-4.7%

Americas

28.1

26.7

26.4

6.3%

5.3%

Asia/Pacific

4.7

4.3

4.3

9.8%

10.2%

Axway Software

71.7

73.9

73.6

-2.5%

-3.0%

* Revenue at 2024 scope and exchange

rates

Appendices (2/4)

Axway Software : Consolidated Income Statement

Half-year 2024 H1 2024 H1

2023 Full-year 2023 €m % Rev.

€m % Rev. €m % Rev.

Revenue

148.7

145.5

319.0

of which License

2.6

3.0

8.8

of which Subscription

93.2

78.7

186.6

of which Maintenance

34.6

44.6

87.0

Sub-total Products

130.5

126.3

282.4

Services

18.2

19.2

36.5

Cost of sales

43.9

42.9

87.2

of which License and Maintenance

6.3

6.4

24.1

of which Subscription

19.4

18.6

28.2

of which Services

18.1

17.9

34.9

Gross profit

104.7

70.5%

102.6

70.5%

231.7

72.7%

Operating expenses

87.6

84.8

168.9

of which Sales and marketing

41.8

42.1

81.6

of which Research and development

31.2

29.4

60.1

of which General and administrative

14.6

13.3

27.2

Profit on operating activities

17.1

11.5%

17.8

12.2%

62.8

19.7%

Stock option expense

-2.9

-1.4

-4.2

Amortization of intangible assets

-1.7

-1.7

-3.2

Profit from recurring operations

12.5

8.4%

14.7

10.1%

55.4

17.4%

Other income and expenses

-4.1

-3.5

-7.9

Operating profit

8.3

5.6%

11.2

7.7%

47.6

14.9%

Cost of net financial debt

-2.7

-2.1

-4.6

Other financial revenues and expenses

-0.9

0.4

-0.2

Income taxes

-2.0

-5.9

-7.0

Net profit

2.8

1.9%

3.7

2.5%

35.8

11.2%

Basic earnings per share (in €)

0.13

0.17

1.71

Appendices (3/4)

Axway Software: Simplified Balance Sheet

Half-year 2024

6/30/2024 6/30/2023

12/31/2023 (€m) (€m) (€m)

Assets

Goodwill

302.7

299.3

302.1

Intangible assets

9.4

6.9

5.1

Property, plant and equipment

10.2

10.4

9.3

Lease right-of-use assets

15.5

12.9

17.8

Other non-current assets

31.2

32.6

33.2

Non-current assets

369.1

362.1

367.6

Trade

receivables

166.3

135.2

178.0

Other current assets

38.8

34.0

32.3

Cash and cash equivalents

16.9

14.2

16.7

Current assets

222.0

183.4

227.0

Total

Assets

591.1

545.4

594.6

Equity and Liabilities

Share capital

43.3

43.3

43.3

Reserves and net profit

312.6

271.4

303.0

Total Equity

355.9

314.6

346.3

Financial

debt - long-term portion

83.3

83.8

88.0

Lease liabilities - long-term portion

18.9

13.2

19.7

Other non-current liabilities

16.3

14.1

16.5

Non-current liabilities

118.6

111.2

124.2

Financial

debt - short-term portion

4.4

3.7

4.3

Lease liabilities - short-term portion

2.5

6.1

4.0

Deferred Revenues

60.1

66.5

49.1

Other current liabilities

49.7

43.3

66.7

Current liabilities

116.7

119.7

124.1

Total

Liabilities

235.3

230.8

248.3

Total Equity

and Liabilities

591.1

545.4

594.6

Appendices (4/4)

Axway Software: Cash Flow Statement

Half-year 2024

H1 2024 H1 2023

Full-year 2023 (€m)

(€m) (€m) Net profit

for the period

2.8

3.7

35.8

Net charges to amortization, depreciation and provisions

3.3

9.4

19.3

Other income and expense items

4.1

-1.0

1.4

Cash from operations after cost of net debt and tax

10.1

12.2

56.6

Change in

operating working capital requirements (incl. employee benefits

liability)

2.6

4.5

-32.9

Cost of net financial debt

2.7

2.1

4.6

Income tax paid net of accrual

-0.3

4.4

3.9

Net cash from operating activities

15.0

23.1

32.1

Net cash used

in investing activities

-2.7

-8.6

-12.6

Proceeds from the

exercise of stock options

0.0

-

-

Purchases and proceeds from disposal of treasury shares

-2.2

-4.4

-4.8

Dividends paid

0.0

-8.4

-8.4

Change in loans

-5.1

-0.4

3.4

Change in lease liabilities

-3.2

-3.5

-7.2

Net interest paid

-2.2

-1.6

-3.7

Other flows

0.1

-0.3

-0.4

Net cash from (used in) financing activities

-12.6

-18.6

-21.1

Effect of foreign

exchange rate changes

0.1

-0.1

-0.2

Net change in cash and cash equivalents

-0.2

-4.2

-1.8

Opening cash

position

16.5

18.3

18.3

Closing cash position

16.3

14.2

16.5

Axway Software: Impact on revenue of changes in scope and

exchange rates

Half-year 2024 (€m)

H1 2024

H1 2023

Growth

Revenue

148.7

145.5

+ 2.2%

Changes in exchange rates

+0.0

Revenue at constant exchange rates

148.7

145.5

+ 2.2%

Changes in scope

+0.4

Revenue at constant scope and exchange rates

148.7

145.9

+ 1.9%

Axway Software: Changes in exchange rates

Half-year

2024For 1€

Average rate H1 2024

Average rate H1 2023

Change

US Dollar

1.081

1.081

- 0.1%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240718450349/en/

Investor Relations: Arthur Carli – +33 (0)1 47 17 24 65 –

acarli@axway.com

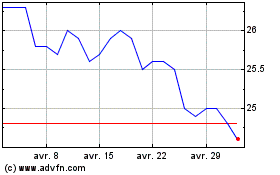

Axway Software (EU:AXW)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Axway Software (EU:AXW)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025