Azerion initiates a Written Procedure and launches a Subsequent Bond Issue

14 Juin 2024 - 7:30AM

Azerion initiates a Written Procedure and launches a Subsequent

Bond Issue

Azerion initiates a Written Procedure and

launches a Subsequent Bond Issue

Amsterdam, 14 June 2024 -

Azerion Group N.V. (the "Company" or

"Azerion") announces today that it has:

- Instructed the agent for the

Company's senior secured bonds with ISIN NO0013017657 held within a

EUR 300 million framework, (the "Existing Bonds")

to initiate a written procedure to request the bondholders to vote

in favour of amending the terms and conditions of the Bonds (the

"Terms and Conditions") (the "Written

Procedure"), and

- Instructed Pareto Securities to

conduct a series of fixed income investor meetings. Subject to

market conditions a subsequent bond issue of up to EUR 50 million

(the "Subsequent Bond Issue" and the

"Subsequent Bonds") under the framework detailed

above may follow.

For the Subsequent Bond Issue to be allowed

under the Terms and Conditions, the Company is proposing the

following adjustments to the Terms and Conditions:

- An increase of

the Leverage Ratio for the purpose of the Incurrence Test from

2.50:1 to 3.00:1

- A decrease of

the ratio of Net Interest Bearing Debt to EBITDA for the purpose of

the Distribution Test from 2.25:1 to 2.00:1

- Certain changes

to the calculation adjustments of the Leverage Ratio with respect

to the French subsidiary Hawk SAS, registration number 795 236 868

(“Hawk”)

(together, the “Proposal”).

The full details of the Proposal are set out in

the notice of Written Procedure. Furthermore, the Company has had

discussions with a number of its largest bondholders and obtained

signed voting undertakings from bondholders representing over 40%

of the total bond volume. In addition, certain other investors have

communicated that they will vote in favour of the proposal, which

combined with the voting undertakings, brings the support obtained

from bondholders to over 60% of the total bond volume.

The agent will deliver the notice of the Written

Procedure to all bondholders on 14 June 2024. The written procedure

will end on 2 July 2024. To be eligible to participate in the

Written Procedure a person must fulfil the formal criteria for

being a bondholder on 25 June 2024.

Pareto Securities AB has been retained as

financial advisor in connection with the Written Procedure and the

Subsequent Bond Issue.

The notice to the Written Procedure is available

on the Company's website (www.azerion.com/reports/) and on Stamdata

(www.stamdata.com).

About AzerionFounded in 2014,

Azerion (EURONEXT: AZRN) is one of Europe’s largest digital

advertising and entertainment media platforms. Azerion brings

global scaled audiences to advertisers in an easy and

cost-effective way, delivered through our proprietary technology,

in a safe, engaging, and high quality environment, utilizing our

strategic portfolio of owned and operated content with

entertainment and other digital publishing partners.

Having its roots in Europe and with its

headquarters in Amsterdam, Azerion has commercial teams based in

over 23 offices around the world to closely support our clients and

partners to find and execute creative ways to make a real impact

through advertising.

For more information visit: www.azerion.com

For further information, please

contact:Andrew BuckmanVP Investor

Relationsir@azerion.comInformation:This

information is information that Azerion Group N.V. is obliged to

make public pursuant to the EU Market Abuse Regulation. The

information was submitted for publication, through the agency of

the contact person set out above, at 07:30 CET on 14 June 2024.

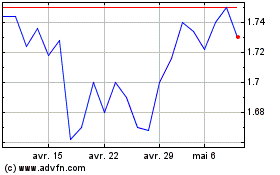

Azerion Group NV (EU:AZRN)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Azerion Group NV (EU:AZRN)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024