Biosynex SA (“Biosynex”) (EPA: ALBIO), a French market leader

specializing in the design and distribution of rapid tests, and

Chembio Diagnostics, Inc. (“Chembio”) (Nasdaq: CEMI), a

leading point-of-care diagnostics company focused on infectious

diseases, today announced that the companies have entered into a

definitive merger agreement under which Biosynex, through a

subsidiary, will acquire Chembio for $0.45 per share, representing

a premium of 27% compared to the closing price of Chembio stock on

January 30, 2023, in an all-cash transaction valued at $17.2

million.

The acquisition combines two leading rapid

diagnostic test companies. Each company specializes in the

development, manufacturing and marketing of point-of-care

diagnostic tests for the professional and at home markets. Chembio,

based in the United States, focuses on infectious disease assays

covering sexually transmitted infections, respiratory viruses and

fever and tropical disease, built on the DPP, SURE CHECK and

STAT-PAK proprietary, accurate and easy-to-use technology

platforms. Biosynex, based in France, provides pharmacies and

professional healthcare settings with a diversified portfolio of

rapid tests covering different market segments including infectious

disease and women’s health tests, Point of Care devices and

molecular diagnostics systems. Biosynex will operate Chembio and

its 100% owned German, Brazil and Malaysia subsidiaries as a wholly

owned group.

“The acquisition of Chembio significantly advances

our mission to develop, manufacture and market rapid diagnostics

for screening, diagnosis and prevention to facilitate patient care

and monitor health,” said Larry Abensur, Chief Executive Officer of

Biosynex. “Chembio’s portfolio of diagnostic solutions and

technology platforms complement our current test portfolio. DPP,

SURE CHECK and STAT-PAK are clinically validated with accurate

results, ease-of-use, and U.S. FDA and global regulatory approvals

including CE marked and WHO prequalified products to provide

transformative commercial opportunities that can represent

meaningful growth drivers over the near and long-term.

Additionally, there are numerous strong synergies across our

businesses that can be leveraged to create significant cost savings

as a scaled organization. We are excited to enhance our position as

key European player for professional point-of-care and self-test

diagnostics.”

“Chembio is pleased about the opportunity to become

part of Biosynex, uniting two companies that provide healthcare

professionals and individuals with innovative diagnostic solutions

intended to accelerate care,” said Richard L. Eberly, President and

Chief Executive Officer of Chembio. “The backing of BIOSYNEX will

enable Chembio to secure its financial needs and the synergies

expected from this combination are aiming at returning the business

to profitability. I believe this transaction can benefit customers,

employees and patients, while creating value as the combined

company can offer the expertise, scale and resources to expand the

impact of Chembio’s technology.”

Strategic Benefits of the

Merger

- Chembio’s differentiated tests enhance the Biosynex

rapid diagnostic portfolio. Chembio’s sexually transmitted

infection, tropical and fever and respiratory assays complement

Biosynex’s current virology portfolio to create a more

comprehensive offering.

- The Chembio commercial infrastructure broadens the

Biosynex footprint globally. The combined commercial team

and distribution partners expand Biosynex’s presence in the United

States, Brazil, Africa and Asia as well as bolster Biosynex’s

European network.

- Accelerating and enhancing product

development. Combining the expertise of two industry

leaders to drive product innovation and development along with

global regulatory expertise will help to continue expansion of the

product portfolio.

- Consolidation of operations offers potential cost

savings, synergies and value creation. The combined

organization can leverage increased manufacturing scale,

consolidated operating overhead, reduced public company and

administrative costs to potentially improve product gross margins

and operating margins.

Transaction DetailsUnder the

terms of the merger agreement, Biosynex, through a subsidiary, will

initiate a tender offer to acquire all outstanding shares of

Chembio. The closing of the tender offer will be subject to certain

conditions, including the tender of shares representing at least a

majority of the total number of Chembio’s outstanding shares and

other customary conditions. Upon the successful completion of the

tender offer, Biosynex’s acquisition subsidiary will be merged into

Chembio, and any remaining shares of common stock of Chembio will

be canceled and converted into the right to receive the same $0.45

per share price payable in the tender offer. The transaction is

expected to close in the first quarter of 2023. The terms of the

merger agreement were unanimously approved by the Boards of

Directors of both companies, and the Board of Directors of Chembio

intends to recommend the transaction to Chembio’s stockholders.

AdvisorsErnst & Young (EY)

is acting as financial advisor and White & Case is serving as

legal counsel to Biosynex. Craig-Hallum Capital Group LLC is acting

as financial advisor and K&L Gates LLP is serving as legal

counsel to Chembio.

About BiosynexFounded in 2005 and

based in Illkirch-Graffenstaden in Alsace, France, Biosynex is a

major player in public health with 329 employees. Biosynex designs,

manufactures and distributes Rapid Diagnostic Tests (RDTs) as well

as diagnostic equipment for healthcare professionals and the

general public, aiming to improve patient care through rapid

results and ease of use. As the leader in the RDT market in France,

Biosynex has complete control over its value chain thanks to its

technological platform, which can be adapted to numerous

applications and is suitable for different types of users such as

laboratories, hospitals, doctors and consumers. Driven by strong

values of innovation, Biosynex has a proactive vision of tomorrow's

medicine focused on prevention, screening, emergency diagnosis and

rapid treatment. Learn more at www.biosynex.com.

About Chembio

DiagnosticsChembio is a leading diagnostics company

focused on developing and commercializing point-of-care tests used

to detect and diagnose infectious diseases, including sexually

transmitted disease, insect vector and tropical disease, COVID-19

and other viral and bacterial infections, enabling expedited

treatment. Coupled with Chembio’s extensive scientific expertise,

its novel DPP technology offers broad market applications beyond

infectious disease. Chembio’s products are sold globally, directly

and through distributors, to hospitals and clinics, physician

offices, clinical laboratories, public health organizations,

government agencies, and consumers. Learn more at

www.chembio.com.

Additional Information and Where to Find It

This press release relates to a pending business combination

between Biosynex and Chembio. The tender offer referenced in this

press release has not yet commenced. This press release is for

informational purposes only and does not constitute an offer to

purchase or a solicitation of an offer to sell shares of Chembio,

nor is it a substitute for any tender offer materials that the

parties will file with the U.S. Securities and Exchange Commission

(the “SEC”) upon commencement of the tender offer. At the time the

tender offer is commenced, Biosynex and its acquisition subsidiary

will file a tender offer statement on Schedule TO, including an

offer to purchase, a letter of transmittal and related documents,

and Chembio will file a Solicitation/Recommendation Statement on

Schedule 14D-9 with the SEC with respect to the tender

offer. Each of Biosynex and Chembio also plan to file other

relevant documents with the SEC regarding the proposed transaction.

CHEMBIO STOCKHOLDERS ARE URGED TO READ THE TENDER OFFER MATERIALS

(INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL

AND CERTAIN OTHER TENDER OFFER DOCUMENTS), THE SOLICITATION /

RECOMMENDATION STATEMENT AND OTHER RELEVANT DOCUMENTS THAT MAY BE

FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO ANY

OF THE FOREGOING DOCUMENTS CAREFULLY WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT HOLDERS OF

CHEMBIO SECURITIES SHOULD CONSIDER BEFORE MAKING ANY DECISION

REGARDING TENDERING THEIR SECURITIES. The

Solicitation/Recommendation Statement, the Offer to Purchase, the

related Letter of Transmittal and certain other tender offer

documents will be sent to all of Chembio’s stockholders at no

expense to them. The tender offer materials and the Solicitation /

Recommendation Statement will also be made available for free on

the SEC’s website at www.sec.gov or from the information agent

named in the tender offer materials. Copies of the documents filed

with the SEC by Biosynex will be available free of charge under the

News heading of Biosynex’s website

at https://www.biosynex.com. Copies of the documents filed

with the SEC by Chembio will be available free of charge under the

SEC filings heading of the Investors section of Chembio’s website

at https://chembio.com/investors.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934.

Forward-looking statements involve inherent risks and uncertainties

and you are cautioned that a number of important factors could

cause actual results to differ materially from those contained in

any such forward-looking statement. These statements can otherwise

be identified by the use of words such as “anticipate,” “believe,”

“could,” “estimate,” “expect,” “feel,” “forecast,” “intend,” “may,”

“plan,” “potential,” “predict,” “project,” “seek,” “should,”

“would,” “will,” and similar expressions intended to identify

forward-looking statements, although not all forward-looking

statements contain these identifying words. The forward-looking

statements contained in this press release include, but are not

limited to, statements related to Biosynex’s and Chembio’s plans,

objectives, expectations and intentions with respect to the

proposed transaction and the combined company, the anticipated

timing of the proposed transaction, the conditions precedent to the

closing of the proposed transaction, and the potential impact the

transaction will have on Chembio or Biosynex and other matters

related to either or both of them. The forward-looking statements

are based on assumptions regarding current plans and estimates of

management of Biosynex and Chembio. Such management believes these

assumptions to be reasonable, but there is no assurance that they

will prove to be accurate.

Factors that could cause actual results to differ materially

from those described in this press release include, among others:

changes in expectations as to the closing of the transaction

including timing and changes in the method of financing the

transaction; the satisfaction of the conditions precedent to the

consummation of the proposed transaction (including a sufficient

number of Chembio shares being validly tendered into the tender

offer to meet the minimum condition); the risk of litigation and

regulatory action related to the proposed transactions; expected

synergies and cost savings are not achieved or achieved at a slower

pace than expected; integration problems, delays or other related

costs; retention of customers and suppliers; and unanticipated

changes in laws, regulations, or other industry standards affecting

the companies; and other risks and important factors contained and

identified in Chembio’s filings with the SEC, including its

Quarterly Reports on Form 10-Q and Annual Reports on

Form 10-K.

The foregoing list of factors is not exhaustive. Readers are

cautioned not to place undue reliance on any forward-looking

statements, which speak only as of the date hereof. Readers are

urged to carefully review and consider the various disclosures,

including but not limited to risk factors contained in Chembio’s

Annual Reports on Form 10-K and its quarterly reports on

Form 10-Q, as well as other filings with the SEC.

Forward-looking statements reflect the analysis of management of

Biosynex and Chembio as of the date of this press release. Neither

Biosynex nor Chembio undertakes to update or revise any of these

statements in light of new information or future events, except as

expressly required by applicable law.

DPP, STAT-PAK and SURE CHECK are Chembio’s

registered trademarks, and the Chembio logo is Chembio’s trademark.

For convenience, these trademarks appear in this release without ®

or ™ symbols, but that practice does not mean that Chembio will not

assert, to the fullest extent under applicable law, its rights to

the trademarks.

Biosynex Contacts:Larry

AbensurPrésident-Directeur Généralinvestisseurs@biosynex.com

Julia BridgerListing Sponsor+33 1 44 70 20

84jbridger@elcorp.com

Gilles BroqueletCommunication financière+ 33 1 80 81 50

00gbroquelet@capvalue.fr

Chembio Contact: Philip Taylor

Gilmartin Group415-937-5406investor@chembio.com

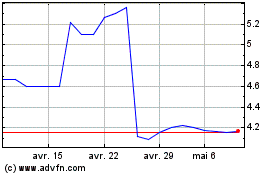

Biosynex (EU:ALBIO)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Biosynex (EU:ALBIO)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024