BONDUELLE

Head office: "La Woestyne" - 59173 Renescure -

FranceBonduelle a French S.C.A (Partnership limited by Shares) with

a capital of 57 102 699,50 eurosRegistered under number: 447 250

044 (Dunkerque Commercial and Companies Register)

Bonduelle is launching its 3 year

transformation program

During a press conference on October 7,

2024, the Bonduelle Group will present its 3 year transformation

program “Transform to win” as well as its FY 2023-2024 financial

and extra-financial performances.

“Transform to win” is based on a solid

strategic review of business activities and aims at restoring the

group’s ability to develop as a successful and attractive B Corp

company.

The Bonduelle Group closed its fiscal

year with higher annual sales and a current operating income above

the guidance(1) and is forcasting

a stable business activity and profitability for FY

2024-2025(1).

Message from Xavier Unkovic - Chief

Executive Officer:

“Transformation is at the heart of our business

model, which has been able to reinvent itself in response to the

challenge it has faced for over 170 years. Driven by powerful

fundamentals - the strong commitment of our teams, healthy and

delicious products carried by iconic brands, and our positive

impact ambition - the Bonduelle metamorphosis takes on a new

dimension.

We operate in a global environment marked by

economic and geopolitical uncertainties, consumer tensions and

erosion of purchasing power. Facing these challenges, we have kept

our commitments and confirmed our ambition to deploy a sustainable

business model. With targeted innovations and relevant activations,

our brands are expanding.

The coming year will be an important period of

transition as we roll out our transformation plan to prepare for a

rebound and then an acceleration in our performance in the years

ahead.”

“Transform to win”, a

transformation supported by 5 pillars:

After a year at the head of the group,

which allowed a strategic review of its business

activities, Xavier Unkovic announces the launch of a vast

transformation program. “Transform to win”, deployed throughout the

Bonduelle Group.

This work has confirmed the relevance of the

group’s mission regarding plant-rich food and that it operates in

attractive market segments in line with strong consumer trends.

The “transform to win” program is built around 5

strategic pillars:

- Performance

- Brands and innovations

- Key geographies

- Operational and organizational efficiency

- Positive impact.

This 3 year plan will create the conditions for

transition, then a rebound, and finally an acceleration of the

company’s performance around an organization aligned with shared

objectives and ambitious strategic planning.

Financial performance

On October 4, 2024, the Supervisory Board, under

the chairmanship of Martin Ducroquet, reviewed the statutory and

consolidated financial statements for FY 2023-2024 as approved by

the General Management and certified by the company's statutory

Auditors.

The Bonduelle Group’s sales for the fiscal year

2023-2024 ended June 30, 2024 amounted to 2,371.8 million euros, an

increase of +2.7% on a like-for-like basis(1). After taking into

account the exchange rate variations, it shows a decline of -1.4%

on reported figures.

Current operating income increased by +30.5% on

a like-for-like basis(1) and +14.3% on a reported figures with the

current operating margin of 3.2% on a reported figures higher than

the communicated guidance.

Key figures

|

(In millions of euros) |

2023-2024 |

2022-2023 |

Variations |

|

Sales |

2,371.8 |

2,406.2 |

-1.4% |

|

Current operating income |

75.3 |

65.9 |

+14.3% |

|

Net result |

-119.8 |

14.5 |

N/A |

Activity by Geographic

Region

|

Total consolidated sales (In millions of

euros) |

2023-2024 |

2022-2023 |

Variation Reported figures |

Variation Like-for-like

basis(1) |

|

Europe Zone |

1,558.2 |

1,508.1 |

3.3% |

2.9% |

|

Non-Europe Zone |

813.6 |

898.1 |

-9.4% |

2.4% |

|

Total |

2,371.8 |

2,406.2 |

-1.4% |

2.7% |

Activity by Operating

Segments

|

Total consolidated sales (In millions of

euros) |

2023-2024 |

2022-2023 |

Variation Reported figures |

Variation Like-for-like

basis(1) |

|

Canned |

1,120.1 |

1,126.3 |

-0.5% |

6.1% |

|

Frozen |

303.0 |

278.8 |

8.7% |

10.3% |

|

Fresh processed |

948.6 |

1,001.1 |

-5.2% |

-3.3% |

|

Total |

2,371.8 |

2,406.2 |

-1.4% |

2.7% |

Europe Zone

The Europe Zone, representing 65.7% of the

business activity over the fiscal year, posted a growth over this

period of +3.3% on reported figures and +2.9% on a like-for-like

basis(1) despite a slowdown in sales reflecting the sluggish

consumer climate in the last quarter.

The canned and frozen private label ranges

enjoyed a strong growth over the year, reflecting the pressure on

purchasing power while the branded Bonduelle and Cassegrain

products showed a significant growth over the period, in both

retail and food service channels.

The fresh processed (bagged salads) and prepared

segment posted stable sales over the period, with salads in Italy

and fresh prepared segments reporting growth, whereas salads in

France and in Germany were down in a declining market.

Non-Europe Zone

The Non-Europe Zone, representing 34.3% of the

business activity over the fiscal year, grew over the 2023-2024

fiscal year by +2.4% on a like-for-like basis(1) (-9.4% on reported

figures).

Over the fiscal year, the Eurasia region and

emerging countries continue to grow both in volumes and in value

thanks to the solid growth of the Bonduelle canned brand and

further sustained acceleration in frozen food in retail.

North American activity remained down over the

period, while the market-leading Ready Pac branded bowls and

salad-kits both grew in volume and value in retail, while the

bagged salad segment declined.

Operating income

|

(In millions of euros) |

2023-2024 |

2022-2023 |

Variation Reported figures |

Variation Like-for-like

basis(1) |

|

Sales |

2,371.8 |

2,406.2 |

-1.4% |

+2.7% |

|

Current operating income |

75.3 |

65.9 |

+14.3% |

+30.5% |

|

Current operating margin rate |

3.2% |

2.7% |

+44 bps |

+74 pbs |

For fiscal year 2023-2024, the Bonduelle Group’s

current operating income stands at 75.3 million euros at constant

exchange rates compared to 65.9 million euros for the previous

fiscal year, i.e., a current operating margin of 3.2% on reported

figures higher than the target announced at the beginning of the

fiscal year enabled by proactive programs to improve industrial

efficiency and tight control of overheads.

The Europe Zone posted an operating margin of

5.1% on a like-for-like basis(1), up 40 bps over the fiscal year,

despite a downturn of the business activity in volumes and an

increase in private labels.

Growth in current operating income for the

Non-Europe Zone and in current operating margin (0.7% on a

like-for-like basis(1) vs. -0.6% the previous year) continued,

driven in particular by the turnaround in the North American

business activities, which benefited from the competitiveness

inititiatives launched in 2022-2023 and pursued throughout the

year.

Non-recurring items amounted to -145 million

euros over FY, mainly comprising the impairment of intangible

assets in the fresh segment in North America on the one hand and

the 100% impairment of assets from the Saint-Mihiel plant in the

Meuse region (France) on the other hand (5 million euros), which

closure was announced in a press release dated August 29, 2024.

Despite a turnaround in the fresh segment in North America expected

to begin in 2023-2024, the anticipated generation of discounted

future cash flow is lower than the value of assets concerned, the

group impaired the goodwill of this business by 131 million

euros.

After taking into account non-recurring items

for the fiscal year, the Bonduelle Group operating income reaches

-69.7 million euros on a reported figures, compared to 54.1 million

euros the previous year.

Net Income

The net financial income came to -35.1 million

euros compared with -31.3 million euros at the end of the previous

year. The increase was due partly to a rise in working capital

requirements, and in particular inventories (volumes effect due to

lower consumption, and value effect due to inflation), and partly

to the continuing rise of interest rates on the main currencies in

which the group operates, partially limited by the hedging

instruments in place. The average financing rate thus rose from

4.01% to 4.39%.

Net income from associates amounted to 3.6

million euros compared with 4.4 million euros the previous year,

mainly corresponding to the group’s share of income from its

minority holding from Nortera Foods.

Income tax expense came to 18.5 million euros,

stable compared with the previous year, as it included the

non-activation losses from the North American fresh activity and

the non-deductibility of the 131 million euros of impairment booked

on the same perimeter as non-recurring items.

After taking into account income from

associates, financial income and tax expense, the Bonduelle Group’s

net income for fiscal year 2023-2024 came to -119.8 million euros

compared with 14.5 million euros for the previous fiscal year.

Financial situation

|

|

June 30, 2022 Reported

figures |

June 30, 2022 Excl. IFRS 16

standards |

June 30, 2023 Reported

figures |

June 30, 2023 Excl. IFRS 16

standards |

June 30, 2024 Reported

figures |

June 30, 2024 Excl. IFRS 16

standards |

|

Net debt (In millions of euros) |

362.9 |

267.9 |

436.1 |

356.7 |

561.9 |

485.6 |

|

Gearing(2) |

0.43 |

0.31 |

0.56 |

0.45 |

0.88 |

0.75 |

|

Leverage ratio(3) |

2.63 |

2.28 |

2.94 |

2.84 |

3.57 |

3.56 |

Net debt (excluding IFRS 16) at June 30, 2024

was 485.6 million euros, compared with 356.7 million euros at June

30 of the previous fiscal year. The ratio of debt to the group’s

shareholders’ equity (gearing(2)) remains limited to 0.75. The

leverage ratio(3) (net debt/REBITDA) amounted to 3.56 compared to

2.84 the previous fiscal year (excluding IFRS 16).

Other significant information and

subsequent events

On August 29, 2024 the Bonduelle Group

announced plans to sell its packaged salad business in France and

Germany.

The Bonduelle Group announced, on August 29,

2024, several projects designed to protect the company’s long-term

future:

- the resizing of Bonduelle Frais France, with a plan to

streamline head office structures and cease operations at the Saint

Mihiel site, with a search for a buyer,

- exclusive negotiations with Les Crudettes, a company of LSDH

Group, for the acquisition of its packaged salad business in

France,

- and exclusive negotiations with Taylor Farms for the

acquisition of its packaged salad business in Germany.

These projects are necessary considering the

ongoing decline in the result of the fresh packaged salad business

in these countries, to preserve jobs within the Bonduelle Group’s

sites in France and Europe. They will shift focus to Bonduelle’s

other business operations to enable the group to continue

accelerating its activities in the fresh prepared, canned and

frozen food markets in these territories.

These transactions are subject to the necessary

approvals.

Annual General Meeting on December 5,

2024 - Dividend

During the Annual General meeting to be held on

December 5, 2024 a dividend of 0.20 euro per share will be

proposed.

Outlook

In a climate of consumption under pressure and

consumer concern about their purchasing power, the Bonduelle Group

intends to accentuate its policy of accessible innovation through

its brand, backed by increased marketing investment, particularly

in the American market.

In the meantime, the group will pursue its

transformation program initiated in 2023-2024, including the plan

to sell its packaged salad business in France and Germany.

In this context, the group’s objective for this

transitional year is to achieve a stability of its activity and its

current operating income, both on a like-for-like basis(1).

(1) at constant currency exchange rate and scope

of consolidation basis. Net sales in foreign currency over the

given period are translated into the rate of exchange for the

comparable period. The impact of business acquisitions (or gain of

control) and divestments is restated as follows

- For businesses acquired (or gain of control) during the current

period, net sales generated since the acquisition date is excluded

from the organic growth calculation;

- For businesses acquired (or gain of control) during the prior

fiscal year, net sales generated during the current period up until

the first anniversary date of the acquisition is excluded;

- For businesses divested (or loss of control) during the prior

fiscal year, net sales generated in the comparative period of the

prior fiscal year until the divestment date is excluded;

- For businesses divested (or loss of control) during the current

fiscal year, net sales generated in the period commencing 12 months

before the divestment date up to the end of the comparative period

of the prior fiscal year is excluded.

(2) net financial debt / equity (3) net

financial debt / recurring EBITDA

Alternative performance indicators: the group

presents in its financial notices performance indicators not

defined by accounting standards. The main performance indicators

are detailed in the financial reports available on

www.bonduelle.com

Next financial events:

- Analysts and investors meeting:

October 7, 2024 -

2024-2025 1st Quarter sales:

November 7, 2024

(after market closing) - Annual Shareholder’s

Meeting: December 5,

2024 - 2024-2025 1st Half Year

sales: February 4,

2025 (after market closing) - 2024-2025 1st Half Year

Results: March 5,

2025 (after market closing) - Analysts and investors meeting:

March 6, 2025

Find all annual results

and the schedule of financial publications on

www.bonduelle.com

About the Bonduelle Group

We want to inspire the transition toward a

plant-rich diet, to contribute to people’s well-being and planet

health. We are a French family business with 10,409 employees and

we have been innovating with our farming partners since 1853. Our

ready-to-use products are cultivated on 69,035 acres and marketed

in 100 countries, with sales of 2,371.8 million euros (data as of

June 30, 2024)

Our 4 brands are: BONDUELLE, READY PAC BISTRO,

CASSEGRAIN, GLOBUS.

Bonduelle is listed on Euronext compartment B

Euronext indices: CAC MID & SMALL – CAC FOOD PRODUCERS – CAC

ALL SHARES Bonduelle is part of the Gaïa non-financial performance

index and employees shareholder index (I.A.S.) Code ISIN:

FR0000063935 - Code Reuters: BOND.PA - Code Bloomberg: BON FP

This document is a free translation into English

and has no other value than an informative one. Should there be any

difference between the French and the English version, only the

French-language version shall be deemed authentic and considered as

expressing the exact information published by Bonduelle.

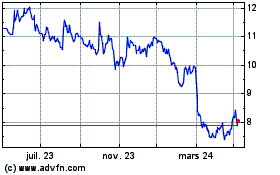

Bonduelle (EU:BON)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

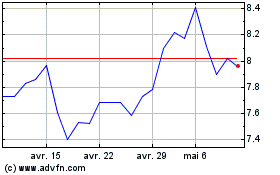

Bonduelle (EU:BON)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025