Casino completes reverse share split Adjustments to the warrants

exercise parity and allocation rights under free share allocation

plans

Casino completes reverse share

split

Adjustments to the warrants exercise

parity and allocation rights under free share allocation

plans

Paris, 14 June 2024

Casino, Guichard-Perrachon

(“Casino”) today announces (i) the completion of

the reverse share split of its share capital through the exchange

of one hundred (100) existing shares for one (1) new share and (ii)

the effectiveness of the share capital reduction through a decrease

in the par value of the shares decided by Casino’s Board of

Directors meeting on 24 April 2024, in accordance with the twelfth

and thirteenth resolutions approved by Casino's shareholders in a

meeting of the parties affected by Casino's safeguard plan approved

by the Paris Commercial Court on 26 February 2024, dated 11 January

2024 (the “Shareholders' Meeting”).

These technical adjustments are purely

arithmetical and have no impact on the value of Casino shares held

by each shareholder.

Terms and conditions of the reverse

share split

The main features of this reverse share split,

as detailed in the notice of reverse share split published in the

Bulletin des Annonces Légales Obligatoires (BALO) on 29 April 2024

and in the press release published by Casino on 24 April 2024, are

as follows:

- Basis for

consolidation: exchange of one hundred (100) existing

shares with a nominal value of one euro cent (€0.01) for one (1)

new share with a nominal value of one euro (€1) and current

dividend rights.

- Number of

existing shares subject to the reverse share split:

thirty-nine billion five hundred and seventy-four million

forty-four thousand four hundred and twenty-nine (39,574,044,429)

shares, each with a par value of one euro cent (€0.01).

- Number of

new shares to be issued on consolidation: three hundred

and ninety-five million seven hundred and forty thousand four

hundred and forty-four (395,740,444) shares with a par value of one

euro (€1.00) each.

-

Centralization: new shares resulting from the

reverse split were admitted to trading on the Euronext regulated

market in Paris from 14 June 2024, the first day of trading, and

were assigned the following ISIN code: FR001400OKR3.

New shares resulting from the reverse split will

be eligible for the SRD (Service de Règlement Différé) from 14 June

2024.

Shareholders who are unable to obtain a number

of old shares that is a multiple of one hundred (100) will be

compensated for their fractional rights within a maximum period of

30 days from the date of delivery (Payment Date) by their financial

intermediary, i.e. up to and including 18 July 20241. Shareholders

are invited to contact their financial intermediary if they have

any questions on this subject.

Terms and conditions of the share

capital reduction motivated by losses through a reduction in the

par value of Casino shares

During its meeting held on 24 April 2024,

Casino's Board of Directors decided to implement the share capital

reduction in accordance with the terms of the authorization granted

to it by the Shareholders’ Meeting, subject to the completion of

the Casino reverse share split transactions.

As a result, the par value of each Casino share

has been reduced from one euro (€1.00) to one euro cent (€0.01),

representing a reduction of ninety-nine euro cents per share. The

amount of this share capital reduction has been allocated to a

special reserve account entitled “Special reserve arising from

Share Capital Reduction no. 2 decided on 11 January 2024”, and may

only be used to offset losses incurred by Casino.

It is reminded that the reduction in par value

is a purely technical operation, with no impact on the market value

of Casino shares or on the number of shares outstanding.

Consequently, Casino's share capital is now set

at three million nine hundred and fifty-seven thousand four hundred

and four euros and forty-four cents (€3,957,404.44), divided into

three hundred and ninety-five million seven hundred and forty

thousand four hundred and forty-four (395,740,444) fully paid-up

shares with a par value of one euro cent (€0.01) each.

Technical adjustments to the exercise

parity and exercise price, if any, of warrants issued by

Casino

As a result of the reverse share split, and by

decision of the CEO dated 14 June 2024, the exercise parity and

exercise price, if any, of the warrants issued by Casino on 27

March 2024 are adjusted in accordance with the following terms, set

out in the notice of reverse share split published in the Bulletin

des Annonces Légales Obligatoires on 29 April 2024:

- one hundred (100)

Warrants #1 will entitle their holders, as from the end of the

period of suspension of the right to exercise the Warrants #1, i.e.

18 June 2024, to subscribe to one (1) new ordinary share at a price

per new ordinary share of 4.61 euros (i.e. 0.0461 euro per Warrant

#1), the Warrants #1 in circulation on the date hereof thus giving

entitlement, in the event of exercise, to a maximum total number of

21,116,885 new ordinary shares of Casino with a par value of 0.01

euro each;

- one hundred (100)

Warrants #2 will entitle the holder, as from the end of the period

of suspension of the right to exercise the Warrants #2, i.e. 18

June 2024, to subscribe to one (1) new ordinary share at a price

per new ordinary share of 0.0092 euros (i.e. 0.000092 euro per

Warrant #2), the Warrants #2 outstanding on the date hereof thus

entitling the holder, in the event of exercise, to a maximum total

number of 396,436 new ordinary shares of Casino with a par value of

0.01 euro each;

- one (1) Warrant #3

will entitle the holder, as from the end of the period of

suspension of the right to exercise the Warrants #3, i.e. 18 June

2024, to subscribe for approximately 0.015 new ordinary shares at a

price per new ordinary share of 16.88 euros (corresponding to an

exercise parity of two hundred (200) Warrants #3 for three (3) new

ordinary shares), the Warrants #3 outstanding on the date hereof

thus entitling the holder, in the event of exercise, to a maximum

total number of 10,604,835 new ordinary shares of Casino with a par

value of one euro cent (€0.01) each; and

- one hundred (100)

Warrants Additional Shares will entitle their holders, as from the

end of the period of suspension of the right to exercise the

Warrants Additional Shares, i.e. 18 June 2024, to subscribe for one

(1) new ordinary share at a price per new ordinary share equal to

the par value of the ordinary share, the Warrants Additional Shares

outstanding on the date hereof thus entitling their holders to a

maximum total number of 5,083,947 new ordinary shares of Casino

with a par value of one euro cent (€0.01) each.

Technical adjustments to allocation

rights under Casino free share allocation plans

Pursuant to a CEO decision dated 14 June 2024,

the free shares allocation rights under existing Casino free shares

allocation plans (the “Plans”) have been adjusted

to take account of this reverse share split transaction.

Consequently, the number of shares to be

allocated to each beneficiary of the Plans has been adjusted to

correspond to the product of (i) the number of free shares to be

allocated to each beneficiary of the Plans prior to the start of

the reverse share split and (ii) the ratio between the number of

new shares comprising the Company's share capital after the reverse

share split and the number of existing shares comprising the

Company's share capital prior to the reverse share split, i.e.

1/100, it being specified that where the number of free shares

calculated in this way is not a whole number, the number of free

shares to be allocated to the beneficiary of the said free shares

will, for each holder, be rounded down to the nearest whole number

of shares (in accordance with the doctrine of the French tax

authorities).

***

This press release has been prepared for

information purposes only and should not be construed as a

solicitation or offer to buy or sell any securities or related

financial instruments. Similarly, it does not constitute, and

should not be treated as, investment advice. It has no regard to

the investment objectives, financial situation or particular needs

of any Receiver. No representation or warranty, express or implied,

is made as to the accuracy, completeness or reliability of the

information contained herein. It should not be considered by

recipients as a substitute for the exercise of their own judgment.

All opinions expressed in this document are subject to change

without notice.

***

ANALYSTS AND INVESTORS

CONTACTS

Christopher WELTON -

cwelton.exterieur@groupe-casino.fr - Tel: +33 (0)1 53 65 64

17orIR_Casino@groupe-casino.fr - Tel: +33 (0)1 53 65 24 17

PRESS CONTACTS

Groupe Casino Communications

Stéphanie ABADIE -

sabadie@groupe-casino.fr – Tel: +33 (0)6 26 27 37

05ordirectiondelacommunication@groupe-casino.fr - Tel: + 33(0)1 53

65 24 78

Agence IMAGE 7

Karine Allouis - kallouis@image7.fr - Tel: +33

(0)6 11 59 23 26

Laurent Poinsot - lpoinsot@image7.fr - Tel: +

33(0)6 80 11 73 52

1 With the exception of beneficiaries of free

shares granted under a free share allocation plan, who are

currently in a holding period (période de conservation), in

accordance with tax doctrine.

- 2024 06 14 - PR - Reverse Split

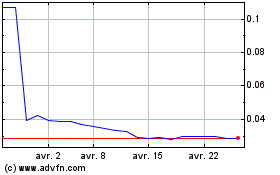

Casino Guichard Perrachon (EU:CO)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Casino Guichard Perrachon (EU:CO)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024