First half 2023-2024

First half 2023-2024

Satisfactory results amid a challenging

market environment, more favorable outlook for the second

half

On May 29, 2024, the Board of Directors chaired

by Mr. Daniel Derichebourg approved the financial statements for

the six months ended March 31, 2024.

Satisfactory results, a relative improvement

compared to other market players, and a positive outlook:

- An improved

performance by Derichebourg Group compared to its competitors amid

a challenging market environment during this first half.

- A robust

development model underpinned by a solid asset base, the relevance

of which has been highlighted by the results.

- A group that is

developing its service activities: with a remarkable performance

from Elior Group, in which Derichebourg Group holds a 48.3% stake,

with a return to profitability and growth less than a year after

the Multiservices division was transferred to Elior Group.

Derichebourg’s stake in Elior Group is valued at €435 million as of

May 28, 2024.

Daniel Derichebourg, Chairman of the

Derichebourg Board of Directors, said:

“Amid an unfavorable economic environment for

the sector as a whole, our results are more than satisfactory. We

have improved our relative performance compared to the main market

players. The decline in recurring EBITDA over the first half is

less severe in percentage terms than that observed among the

Group’s main listed competitors. This clearly demonstrates the

robustness and relevance of our business model. I am confident

about our outlook, marked in particular by a buoyant recycling

market as part of the ecological transition and the development of

the circular economy, experienced, responsive and committed teams

and, above all, our model.”

Abderrahmane El Aoufir, Chief Executive

Officer of Derichebourg Group, said:

“The Group faced a challenging economic

environment in the first half along with an exceptional event that

has now been overcome. The momentum is nonetheless positive, with

the second quarter up on the previous one, and results that we

intend to improve over the long term. Consequently, we can look to

the future boasting an exceptionally high-quality fully-owned

industrial asset base, including a significant proportion of land

assets, a solid financial structure with no significant short-term

repayments due, and the ability to generate free cash flow. We are

confident in our strengths and our long-term strategy.”

Economic environment

All sector players faced a deterioration in

economic conditions in their markets during the first half. Against

the backdrop of sluggish growth in Europe, a sharp rise in energy

costs and high interest rates, the entire sector was impacted. In

particular, the Recycling business saw a continuation of the

economic climate of the previous half year (second half of the

2022/2023 fiscal year). As a result, demand from steelmaker

customers was limited, which in turn was impacted by the economic

environment. Across Europe, the construction sector is faring less

well than in previous years. European steelmakers and metallurgists

are also suffering from higher energy prices than their competitors

in other regions, which is impacting their competitiveness,

limiting their sales volumes and hence their supply requirements.

In the automotive sector, production has not returned pre-Covid-19

levels in terms of quantity, which is limiting supplies of

end-of-life vehicles and customer demand for aluminum ingots.

Cyberattack

On November 10, 2023, Derichebourg Group

suffered a cyberattack that did not interrupt operations but

disrupted progress (until January 2024). The teams’ admirable

responsiveness allowed us to restore the systems, improving them at

the same time, and limit the consequences of this episode, which is

luckily now behind the Group.

It became apparent, on the one hand, that

purchasing volumes had been lost, and that there had been a delay

in the computer entry of flows. Furthermore, once the

administrative delay was caught up, the margins generated in

November and December 2023 were lower than usual. The financial

impact is between €15 million and €20 million.

Satisfactory results and improved

performance

Derichebourg Group has improved its performance relative to the

market.

Consolidated revenue

First half consolidated revenue was €1.733

billion, down 4.9% year on year, mainly due to the revenue decline

in the Recycling division (down 5.5%), partly offset by a 7.8%

increase in Public Sector Services revenue.

|

(in thousands of metric tons) |

H1 2023/2024 |

H1 2022/2023 |

Change |

|

Ferrous metals |

2,204.4 |

2,307.4 |

(4.5%) |

|

Non-ferrous metals |

352.9 |

359.2 (1) |

(1.8%) |

|

Total volumes |

2,557.3 |

2,666.6 |

(4.1%) |

(1): after deduction of 22.6 kt of low-quality products leaving

post-shredding sorting facilities at zero price

|

(in millions of euros) |

H1 2023/2024 |

H1 2022/2023 (2) |

Change |

|

Ferrous metals |

774.0 |

829.2 |

(6.7%) |

|

Non-ferrous metals |

775.9 |

803.7 |

(3.5%) |

|

Services |

84.9 |

97.2 |

(12.6%) |

|

Recycling revenue |

1,634.9 |

1,730.1 |

(5.5%) |

|

Public Sector Services revenue |

97.2 |

90.1 |

7.8% |

|

Holding company revenue |

0.6 |

0.9 |

(29.4%) |

|

Total Group |

1,732.7 |

1,821.1 |

(4.9%) |

(2): Reclassification of Derichebourg Environnement from the

Holding segment to the Recycling segment

Recycling

Volumes of ferrous scrap metal sold in the first

half were down 4.5%. 46% of this drop was due to the sale of eight

recycling centers, as required by the European Commission. Demand

for ferrous scrap metal was mixed over the half year. Steel

production in the European Union, the Group’s main market, was down

1.6% over the half year, while it rose sharply in Turkey (up

approximately 21%), with a particularly low comparison base with

the previous year. This high level of demand in Turkey prevented

ferrous scrap metal prices from falling too much, even on the

domestic market. The average price of ferrous scrap metal sold by

the Group was €351/t, down 2.3% on the previous year. Overall,

revenue from the Ferrous Metals business amounted to €774 million,

down 6.7%.

Volumes of non-ferrous metals sold by the Group

were down 1.8% on the previous year. Trends varied from one metal

to another (higher sales of copper and aluminum excluding ingots,

lower sales of aluminum ingots and stainless steel scrap). Overall,

the average price of NFM sold was 1.7% lower than last year,

resulting in a 3.5% drop in revenue for the NFM business, to €776

million.

Public Sector Services

Revenue rose 7.8% over the first half, driven by

the start of new contracts and the full-year impact of contracts

commenced last year:

- Start of Civis

contract on Réunion Island;

- Start of

contract in Montreal Ahuntsic (Canada);

- Full-year impact

of waste collection contracts started last year in Guérande, and

the management contract for the Biopôle sorting center in

Angers.

Recurring

EBITDA1

First half recurring EBITDA stood at €142.0

million, down 20.8% year on year. A slight drop in volumes, and a

decline in unit margins partly attributable to the cyberattack,

account for most of this trend in the Recycling business, while

recurring EBITDA in the Collection business was up.

Derichebourg Group recurring EBITDA amounted to

€297.6 million on a rolling 12-month basis. Adjusted for the

exceptional impact of the disruption to its activities on the

first-half financial statements, recurring EBITDA would amount to

between €313 million and €318 million.

Recurring operating profit

(loss)2

After allowing for €77 million in depreciation

over the half year, recurring operating profit came to €65 million,

down 38.8% year on year.

Operating profit (loss)

Only one non-recurring item (excluding the

impact of the exceptional event) is to be noted for the first half:

a €3.8 million gain following a ruling in the Group’s favor by the

Paris Court of Appeal in a dispute between a Veolia subsidiary and

Collection business subsidiaries over the past ten years, in which

Veolia contested the terms and conditions for transferring

employees following a change of public contract holder. After March

31, 2024, Veolia appealed to the Court of Cassation.

After taking this item into account, operating

profit amounted to €68.7 million, down 39.0% year on year.

Profit (loss) before tax

After €18.8 million in financial expenses (up

€5.4 million due to the increase in interest rates and the

comparison base) and other financial expenses of €1.9 million,

Group profit before tax came to €48.1 million, down 51% year on

year.

Income from associates

Income from associates totaled €0.8 million,

including a €0.5 million first-half gain generated by Elior Group.

As of March 31, 2024, Derichebourg SA holds a 48.31% stake in Elior

Group.

Net profit (loss) from continuing

operations

After taking into account a corporate income tax

expense of €16.5 million, entailing an effective tax rate of 34.4%,

and income from associates, net profit from continuing operations

totaled €32.3 million, down 51.4% year on year.

Consolidated net profit

(loss)

Consolidated net profit for the first half of

2023/2024 totaled €32.3 million, down 55.2% year on year. The

portion attributable to Derichebourg shareholders was €31.4

million.

Outlook

In view of the aforementioned business

environment, it is currently unlikely that the Group will be able

to make up the first half EBITDA shortfall by the end of the fiscal

year and achieve the minimum €350 million EBITDA target for 2024

announced upon publication of 2023 earnings. A full-year recurring

EBITDA target of €300 million to €310 million appears more

realistic under the present circumstances. Restated for the

negative effects of the first half, it would amount to between €315

million and €330 million.

The decline in recurring EBITDA over the first

half is less severe in percentage terms than that observed among

our main listed competitors. The Group is therefore demonstrating

the relevance of its business model and maintaining its performance

trajectory amid a challenging economic environment. It expects to

reap the benefits in the years ahead of the investments made in new

sorting lines over the past 24 months.

Annex 1: INCOME STATEMENT

|

(in millions of euros) |

H1 2023/2024 |

H1 2022/2023 |

Change |

|

Revenue |

1,732.7 |

1,821.1 |

(4.9%) |

|

Recurring EBITDA |

142.0 |

179.2 |

(20.8%) |

|

|

122.0 |

166.5 |

(26.7%) |

|

|

20.1 |

14.8 |

35.8% |

|

Recurring operating profit (loss) |

65.0 |

106.1 |

(38.8%) |

|

|

52.5 |

102.2 |

(48.6%) |

|

|

13.1 |

6.5 |

102.3% |

|

Net non-recurring items |

3.8 |

6.6 |

|

|

Operating profit (loss) |

68.7 |

112.7 |

(39.0%) |

|

Net financial expenses |

(18.8) |

(13.4) |

|

|

Other financial items |

(1.9) |

(1.3) |

|

|

Profit (loss) before tax |

48.1 |

98.0 |

(51.0%) |

|

Income tax |

(16.5) |

(26.3) |

|

|

Income from associates |

0.8 |

(5.2) |

|

|

Income from discontinued or held-for-sale activities |

- |

5.6 |

|

|

Net profit (loss) attributable to non-controlling interests |

(0.8) |

(0.5) |

|

|

Net profit attributable to shareholders |

31.4 |

71.5 |

(56.1%) |

Annex 2: BALANCE SHEET

|

Assets |

|

|

|

|

(in millions of euros) |

3/31/2024 |

9/30/2023 |

Change |

|

Goodwill |

276.1 |

276.1 |

|

|

Intangible assets |

2.1 |

2.0 |

|

|

Property, plant and equipment |

870.1 |

838.5 |

|

|

Right-of-use assets |

280.6 |

274.5 |

|

|

Financial assets |

5.0 |

5.0 |

|

|

Interests in associates and joint ventures |

408.5 |

414.8 |

|

|

Deferred taxes |

19.6 |

23.2 |

|

|

Other assets |

0.0 |

0.0 |

|

|

Total non-current assets |

1,861.9 |

1,834.2 |

1.5% |

|

Inventories |

191.7 |

158.3 |

|

|

Trade receivables |

267.8 |

305.8 |

|

|

Tax receivables |

8.6 |

7.4 |

|

|

Other assets |

103.0 |

105.7 |

|

|

Financial assets |

16.3 |

11.4 |

|

|

Cash and cash equivalents |

140.3 |

161.1 |

|

|

Financial instruments |

0 |

1.5 |

|

|

Total current assets |

727.7 |

751.1 |

(3.2%) |

| Total

non-current assets and asset groups held for sale |

- |

- |

|

|

Total assets |

2,589.6 |

2,585.3 |

0.2% |

|

Liabilities |

|

|

|

|

(in millions of euros) |

3/31/2024 |

9/30/2023 |

Change |

|

Group shareholders’ equity |

994.1 |

990.4 |

|

|

Non-controlling interests |

2.4 |

2.4 |

|

|

Total shareholders’ equity |

996.5 |

992.8 |

0.4% |

|

Loans and financial debts |

742.1 |

773.6 |

|

|

Provision for pensions and similar benefits |

29.0 |

28.2 |

|

|

Other provisions |

33.7 |

31.8 |

|

|

Deferred taxes |

35.4 |

33.4 |

|

|

Other liabilities |

3.9 |

4.2 |

|

|

Total non-current liabilities |

844.1 |

871.2 |

(3.1%) |

|

Loans and financial debts |

167.4 |

160.2 |

|

|

Provisions |

3.9 |

14.3 |

|

|

Trade payables |

437.7 |

390.0 |

|

|

Tax payables |

11.8 |

9.7 |

|

|

Other liabilities |

127.5 |

144.9 |

|

|

Financial instruments |

0.7 |

2.2 |

|

|

Total current liabilities |

749.0 |

721.3 |

3.8% |

| Total

liabilities related to a group of assets held for sale |

|

|

|

|

Total equity & liabilities |

2,589.6 |

2,585.3 |

0.2% |

| Net

financial debt at September 30, 2023 |

772.7 |

| Recurring

EBITDA |

(142.0) |

| Change in

working capital requirements |

(42.8) |

| Net financial

expenses |

18.8 |

| Corporate

income taxes |

12.2 |

| Capital

expenditure |

116.9 |

| New rights of

use from operating leases |

5.9 |

| Dividends |

25.5 |

| Other |

2.0 |

|

Net financial debt at March 31, 2024 |

769.2 |

1 Recurring EBITDA = Recurring operating profit + net

depreciation and amortization on tangible and intangible assets and

right-of-use assets2 Recurring operating profit (loss): operating

profit (loss) +/- non-recurring items

- First Half 2023-2024 results

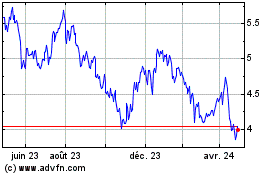

Derichebourg (EU:DBG)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

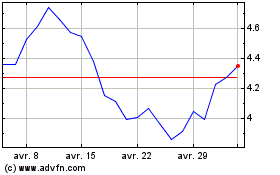

Derichebourg (EU:DBG)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025