UPDATE: Enel Pitches Credentials Of Green Unit Ahead Of IPO

18 Octobre 2010 - 4:36PM

Dow Jones News

Enel SpA's (ENEL) chief executive Monday underlined the

credentials of Enel Green Power SpA and said he expects investors

to snap up shares in the multibillion-euro initial public offering

of the renewables unit, despite the sector losing its shine.

Enel is facing the difficult task of convincing investors to buy

at a time when the lure of the sector has diminished as public

money is reined in and returns in the sector's major stocks

continue to disappoint.

However, at a press conference in Milan to kick-start Europe's

biggest IPO in three years, Fulvio Conti said Enel Green Power's

growth "will justify the appetite of investors."

The Rome-based utility is selling a stake of up to 32.5% of Enel

Green Power in a deal worth as much as EUR3.41 billion, as part of

its drive to slash net debt by the end of the year.

Enel Green Power will have a dividend payout ratio of at least

30% of net profit, Conti said. "We offer sure returns," he

said.

Enel's mix of renewables sources outshines that of the company's

competitors, Conti also said.

Based on first-half results, 44% of Enel Green Power's installed

capacity of 5,761 megawatts comes from hydroelectric plants. Wind

makes up 41%, geothermal energy 13%, while the remaining 2% comes

from other technologies, such as solar and biomass.

By contrast, wind power accounts for around 97% and 100% of the

generation capacity of Iberdrola Renovables SA (IBR.MC) and

Portugal's EDP Renovaveis SA (EDPR.LB) respectively, Enel said.

Conti also said that because around 70% of Enel Green Power's

revenue isn't tied to public incentives, the company is

"indifferent" to state schemes.

However, the focus on wind in coming years indicates the

proportion of capacity that will receive state subsidies is set to

rise. In fact, 90% of Enel Green Power's possible future projects

of almost 30,000 MW is tied to wind.

But Conti said the wind investments aren't being made "to chase

incentives."

Conti also underlined Enel Green Power's geographical

diversification, with more than 600 facilities across 16 countries

in Europe and North America, even if about 45% of the company's

installed capacity is located in its home market, Italy.

The IPO of the renewables unit runs until Oct. 29, after which a

final price will be set. Shares are slated to start trading on the

Italian and Spanish stock markets Nov. 4.

Enel has set an IPO price range of between EUR1.80 and EUR2.10 a

share, valuing the unit at a minimum of EUR9 billion and a maximum

of EUR10.5 billion.

A minimum of 15% of the IPO is set aside for retail investors,

with institutional investors getting the rest.

At 1240 GMT, Enel shares were up 1.2% at EUR4, outperforming

Italy's benchmark FTSE Mib Index, which was 0.7% higher.

Company website: http://www.enel.it

-By Liam Moloney, Dow Jones Newswires; +39 06 6976 6924;

liam.moloney@dowjones.com

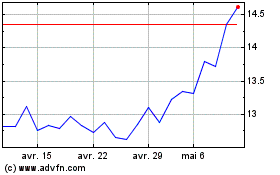

Edp Renovaveis (EU:EDPR)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Edp Renovaveis (EU:EDPR)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024