Euronext publishes Q2 2024 results

|

Contacts Media |

Contact Investor Relations |

| Amsterdam |

+31 20 721

4133 |

Brussels |

+32 2 620 15

50 |

+33 1 70 48 24

27 |

| Dublin |

+39 02 72 42 62

13 |

Lisbon |

+351 210 600

614 |

|

| Milan |

+39 02 72 42 62

12 |

Oslo |

+47 41 69 59

10 |

|

| Paris |

+33 1 70 48 24

45 |

|

|

|

Euronext publishes Q2 2024 results

Euronext’s diversified business model

continues to drive strong topline growth.

Amsterdam, Brussels, Dublin, Lisbon,

Milan, Oslo and Paris – 25 July 2024 – Euronext,

the leading pan-European market infrastructure, today

publishes its results for the second quarter 2024.

- Q2 2024 revenue and income

was up +12.2% at €412.9 million:

- Strong performance of non-volume

related revenue representing 58% of total revenue and income

(compared to 61% in Q2 2023, reflecting the strong dynamic of

trading and clearing in Q2 2024) and covering 153% of underlying

operating expenses, excluding D&A1 (vs. 148% in Q2

2023):

- Custody and Settlement revenue grew

to €69.7 million (+9.4%), driven by growing assets under custody,

dynamic issuance activities and higher settlement activity;

- Advanced Data Services revenue grew

to €60.0 million (+5.4%), driven by continued demand for

fixed-income and power trading data, commercial expansion of the

analytic products offering and dynamic non-professional usage;

- Listing revenue grew to €58.4

million (+5.9%), driven by the strong performance of Euronext

Corporate Services and dynamic debt listing activity. Euronext

sustained its leading position for equity listing in Europe and for

debt listing globally;

- Technology Solutions reported €25.4

million of revenue (-7.0%), primarily reflecting the termination of

double-run connectivity revenues following the migration of Italian

markets to Optiq®, passing on synergies to clients.

- Trading revenue grew to €142.7

million (+20.7%), driven by good trading dynamics in fixed income

and across most asset classes (equity, power, commodity

derivatives, and FX). Fixed income trading revenue reached another

record at €35.6 million (+40.7%), driven by strong volatility.

- Clearing revenue grew to €39.2

million (+33.2%), thanks to the additional business captured by

Euronext Clearing following its expansion for European equities in

Q4 2023. The activity was supported by dynamic fixed income

clearing activity. Net treasury income for Euronext Clearing was

stable at €13.8 million.

- Underlying operating

expenses excluding D&A1

were €156.1 million (+2.7%), in line with the 2024

underlying cost guidance.

- Adjusted

EBITDA1 was €256.8

million (+18.8%) and adjusted EBITDA margin was 62.2%

(+3.5pts).

- Adjusted net

income1 was €165.2

million (+15.6%) and adjusted EPS was €1.59 (+19.0%).

- Reported net income was

€141.7 million (+18.2%).

- Net debt to

EBITDA2 was at 1.8x at

the end of June 2024, impacted by the dividend payment and closing

of the GRSS acquisition.

- Key

figures for the second quarter of 2024:

|

In €m, unless stated otherwise |

Q2 2024 |

Q2 2023 |

% var |

% var l-f-l3 |

|

Revenue and income |

412.9 |

368.1 |

+12.2% |

+11.9% |

|

Underlying operational expenses excluding D&A2 |

(156.1) |

(152.0) |

+2.7% |

+2.4% |

|

Adjusted EBITDA |

256.8 |

216.1 |

+18.8% |

+18.5% |

|

Adjusted EBITDA margin |

62.2% |

58.7% |

+3.5pts |

+3.5pts |

|

Net income, share of the parent company shareholders |

141.7 |

120.0 |

+18.2% |

|

|

Adjusted net income, share of the parent company

shareholders |

165.2 |

142.9 |

+15.6% |

|

|

Adjusted EPS (basic, in€) (share count differs

between the two periods) |

1.59 |

1.34 |

+19.0% |

|

|

Reported EPS (basic, in€) (share count differs between the two

periods) |

1.37 |

1.12 |

+21.7% |

|

|

Adjusted EPS (diluted, in€) (share count differs between the

two periods) |

1.59 |

1.34 |

+19.0% |

|

|

Reported EPS (diluted, in€) (share count differs between the

two periods) |

1.36 |

1.12 |

+21.6% |

|

The figures in this document have not been

audited or reviewed by our external auditor

Entering the last phase of the Borsa Italiana Group

integration:

- €84.2

million of cumulated run-rate annual EBITDA synergies were

achieved at end of June 2024.

€5.2 million run-rate annual EBITDA synergies were delivered in Q2

2024.

- €109.1 million

cumulated implementation costs have been incurred since the

acquisition of the Borsa Italiana Group, of which €3.2 million were

incurred during Q2 2024. Euronext now expects the

total cumulated implementation costs until the end of 2024 to

reduce to €130 million. This is €20 million lower than the €150

million guided in May 2022, and €30 million lower than the €160

million announced in November 2021.

- Euronext has

successfully concluded the migration of the MTS Production Data

Centre to Bergamo. This strategic move enables customers to access

MTS Markets’ Trading and Data services through the same facilities

as all Euronext trading venues, thereby enhancing efficiencies in

European capital markets. Members furthermore benefit from reduced

latency, maximum safety and a reduction of their carbon footprint

thanks to the facility’s 100% use of renewable energy.

-

Euronext successfully migrated the clearing of its commodity

derivatives to Euronext Clearing in July 2024, completing the first

phase of its derivatives clearing migration. The second and final

phase, the migration of financial derivatives, will take place in

September 2024.

- Continued bolt-on

acquisitions to diversify Euronext’s business model

On 3 June 2024, Euronext completed the

acquisition of the leading provider of services to benchmark

administrators, Global Rate Set Systems (GRSS), positioning the

Group as a leading player in the calculation and administration of

Interbank Offered Rate (IBOR) indices.

-

Pioneering with the launch of the Euronext Wireless

Network

In July 2024, Euronext launched its new

microwave service (EWiN), becoming the first exchange in Europe to

offer “Plug & Play” order entry in London via microwave

technology. This service is set to significantly enhance the speed

of order transmission, offering unparalleled latency

improvements.

- Stéphane

Boujnah, Chief Executive Officer and Chairman of the Managing Board

of Euronext, said:

“In the second quarter of 2024, Euronext

reached record revenue and income of €412.9 million. Strong organic

growth in our non-volume related businesses, combined with dynamic

trading activities across asset classes drove the Group’s revenue

growth to +12.2%. Combined with continued cost control, this record

performance led to a +18.8% increase in adjusted EBITDA, to €256.8

million, and to a 62.2% adjusted EBITDA margin. As a result of this

strong performance, our reported net profit grew +18.2% to €141.7

million and adjusted net profit grew +15.6% to €165.2 million. This

represents an adjusted EPS of €1.59, increasing +19.0% compared to

last year.

Over the past few months, we pursued the

diversification of our business model with the closing of the

acquisition of GRSS, a leading benchmark administrator, in June

2024. This bolt-on acquisition will further strengthen Euronext’s

non-volume related revenue growth. We also continued to innovate

with the launch of the Euronext Wireless Network, our new microwave

service. With this new offering, we became the first exchange in

Europe to offer “Plug & Play” order entry in London via

microwave technology, which will significantly enhance the speed of

order transmission and offer unparalleled improvements in

latency.

We are now delivering on the final milestone

of the Borsa Italiana Group integration. On 15 July 2024, we

successfully completed the first phase of the derivatives clearing

migration with the migration of our commodity derivatives clearing

activities to Euronext Clearing. Financial derivatives will follow

in September 2024. With this strategic expansion of our clearing

house, Euronext is creating an integrated market infrastructure

that further contributes to the defragmentation of the European

post-trade landscape, and serves as a catalyst for innovation for

its clients. This milestone will also be the final step in reaching

the targeted €115 million of run-rate EBITDA synergies by the end

of 2024.”

Q2 2024 financial performance

In €m, unless stated otherwise

The figures in this document have not been audited or reviewed

by our external auditor. |

Q2 2024 |

Q2 2023 |

% var |

% var

(like-for-like, constant currencies) |

|

Revenue and income |

412.9 |

368.1 |

+12.2% |

+11.9% |

|

Listing |

58.4 |

55.1 |

+5.9% |

+5.8% |

|

Trading revenue, of which |

142.7 |

118.2 |

+20.7% |

+20.6% |

|

Cash trading |

74.2 |

65.2 |

+13.8% |

+13.8% |

|

Derivatives trading |

13.9 |

13.0 |

+6.6% |

+6.6% |

|

Fixed income trading |

35.6 |

25.3 |

+40.7% |

+40.7% |

|

FX trading |

7.9 |

6.1 |

+28.7% |

+27.3% |

|

Power trading |

11.1 |

8.6 |

+30.1% |

+29.2% |

|

Investor Services |

3.3 |

2.8 |

+17.7% |

+15.6% |

|

Advanced Data Services |

60.0 |

56.9 |

+5.4% |

+4.1% |

|

Post-Trade, of which |

108.9 |

93.1 |

+16.9% |

+16.8% |

|

Clearing |

39.2 |

29.4 |

+33.2% |

+33.2% |

|

Custody and Settlement |

69.7 |

63.7 |

+9.4% |

+9.3% |

|

Euronext Technology Solutions & Other |

25.4 |

27.3 |

-7.0% |

-7.0% |

|

NTI through CCP business |

13.8 |

13.8 |

-0.4% |

-0.4% |

|

Other income |

0.4 |

0.7 |

-39.7% |

-39.8% |

|

Transitional revenues |

- |

0.0 |

-100.0% |

-100.0% |

|

Underlying operational expenses exc. D&A |

(156.1) |

(152.0) |

+2.7% |

+2.4% |

|

Adjusted EBITDA |

256.8 |

216.1 |

+18.8% |

+18.5% |

|

Adjusted EBITDA margin |

62.2% |

58.7% |

+3.5pts |

+3.5pts |

|

Operating expenses exc. D&A |

(162.9) |

(160.9) |

+1.3% |

+1.0% |

|

EBITDA |

249.9 |

207.2 |

+20.6% |

+20.3% |

|

Depreciation & Amortisation |

(47.9) |

(42.2) |

+13.7% |

+13.5% |

|

Total Expenses (inc. D&A) |

(210.9) |

(203.0) |

+3.9% |

+3.6% |

|

Adjusted operating profit |

234.8 |

197.8 |

+18.7% |

+18.4% |

|

Operating Profit |

202.0 |

165.0 |

+22.4% |

|

|

Net financing income / (expense) |

3.5 |

(1.9) |

n/a |

|

|

Results from equity investments |

1.2 |

3.2 |

-61.3% |

|

|

Profit before income tax |

206.7 |

166.4 |

+24.2% |

|

|

Income tax expense |

(55.7) |

(41.2) |

+35.3% |

|

|

Share of non-controlling interests |

(9.2) |

(5.2) |

+76.5% |

|

|

Net income, share of the parent company

shareholders |

141.7 |

120.0 |

+18.2% |

|

|

Adjusted Net income, share of the parent company

shareholders4 |

165.2 |

142.9 |

+15.6% |

|

|

Adjusted EPS (basic, in€) |

1.59 |

1.34 |

+19.0% |

|

|

Reported EPS (basic, in€) |

1.37 |

1.12 |

+21.7% |

|

|

Adjusted EPS (diluted, in€) |

1.59 |

1.34 |

+19.0% |

|

| Reported EPS

(diluted, in€) |

1.36 |

1.12 |

+21.6% |

|

Share count differs between the two periods

-

Q2 2024 revenue and income

In Q2 2024, Euronext’s revenue and income

amounted to €412.9 million, up +12.2% compared to Q2 2023, driven

by the strong performance of trading and post-trade activities,

resulting from dynamic trading environments and the positive

contribution of the Euronext Clearing European expansion at the end

of November 2023, as well as solid organic growth in non-volume

related businesses.

On a like-for-like basis and at constant

currencies, Euronext revenue and income was up +11.9% in Q2 2024

compared to Q2 2023.

Non-volume related revenue accounted for 58% of

Group revenue in Q2 2024, slightly down compared to Q2 2023,

reflecting record performance in fixed-income trading and strong

trading performance across most of the other asset classes and

dynamic clearing activity. The underlying operating expenses

excluding D&A coverage by non-volume related revenue ratio was

at 153% in Q2 2024, compared to 148% in Q2 2023.

Underlying operational expenses excluding

depreciation and amortisation increased by +2.7% to

€156.1 million, reflecting continued cost control in an

inflationary environment. On a like-for-like basis, underlying

operational expenses excluding depreciation and amortisation

increased by +2.4% compared to Q2 2023.

Consequently, adjusted EBITDA for the quarter

totalled €256.8 million, up +18.8% compared to Q2 2023. This

represents an adjusted EBITDA margin of 62.2%, up +3.5 points

compared to Q2 2023. On a like-for-like basis, adjusted EBITDA for

Q2 2024 was up +18.5%, and adjusted EBITDA margin was up +3.5

points compared to the same perimeter in Q2 2023.

-

Q2 2024 net income, share of the parent company

shareholders

Depreciation and amortisation accounted for

€47.9 million in Q2 2024, +13.7% more than in Q2 2023 due to

ongoing migration projects. PPA related to acquired businesses

accounted for €20.1 million and is included in depreciation and

amortisation.

Adjusted operating profit was €234.8 million, up

+18.7% compared to Q2 2023. On a like-for-like basis, adjusted

operating profit was up +18.4% compared to Q2 2023.

€32.8 million of non-underlying expenses,

including depreciation and amortisation, were reported in Q2 2024,

related to the implementation of the ‘Growth for Impact 2024’

strategic plan and the PPA of acquired businesses.

Net financing income for Q2 2024 was €3.5

million, compared to a net financing expense of €1.9 million in Q2

2023. This results from higher interest income due to higher

interest rates, offsetting the cost of debt.

Results from equity investments accounted for

€1.2 million in Q2 2024, reflecting the gain from the disposal of a

non-strategic associate. As a reminder, in Q2 2023, Euronext

reported €3.2 million in results from equity investments, solely

reflecting the contribution from LCH SA.

Income tax for Q2 2024 was €55.7 million. This

translated into an effective tax rate of 27.0% for the quarter,

compared to 24.8% in Q2 2023, which was positively impacted by

non-taxable income.

Share of non-controlling interests mainly

relating to the Borsa Italiana Group and Nord Pool amounted to

€9.2 million in Q2 2024.

As a result, the reported net income, share of

the parent company shareholders, increased by +18.2% for Q2 2024

compared to Q2 2023, to €141.7 million. This represents a reported

EPS of €1.37 basic and €1.36 diluted in Q2 2024, compared to €1.12

basic and €1.12 diluted in Q2 2023. Adjusted net income, share of

the parent company shareholders was up +15.6% to €165.2 million.

Adjusted EPS (basic) was up +19.0% in Q2 2024, at €1.59 per share,

compared to an adjusted EPS (basic) of €1.34 per share in Q2 2023.

This increase reflects higher profit and a lower number of

outstanding shares over the first half of 2024 compared to the

first half of 2023.

The weighted number of shares used over the

first half of 2024 was 103,653,544 for the basic calculation and

103,986,292 for the diluted calculation, compared to 106,741,621

and 106,989,806 respectively over the first half of 2023. The

difference reflects the share repurchase programme carried out in

H2 2023.

In Q2 2024, Euronext reported a net cash flow

from operating activities of €111.5 million, compared to €139.0

million in Q2 2023, reflecting significantly higher negative

changes in working capital from CCP activities at Euronext Clearing

and higher income tax. Excluding the impact on working capital from

Euronext Clearing and Nord Pool CCP activities, net cash flow from

operating activities accounted for 61.0% of EBITDA in Q2 2024.

Q2 2024 business highlights

|

in €m, unless stated otherwise |

Q2 2024 |

Q2 2023 |

% change |

|

Revenue |

58.4 |

55.1 |

+5.9% |

|

Equity |

26.6 |

25.3 |

+5.1% |

|

o/w Annual fees |

18.3 |

17.4 |

+5.3% |

|

o/w Follow-ons |

4.4 |

4.0 |

+8.8% |

|

o/w IPOs |

4.0 |

3.9 |

+0.4% |

|

Debts |

10.8 |

9.2 |

+16.8% |

|

ETFs, Funds & Warrants |

6.0 |

5.7 |

+5.3% |

|

Corporate Services |

12.8 |

11.8 |

+8.8% |

|

ELITE and Other |

2.2 |

3.1 |

-28.2% |

Listing revenue was €58.4 million in Q2 2024, an

increase of +5.9% compared to Q2 2023, driven by the strong

performance of debt listing, continued strong growth of the

Corporate Services SaaS offering and solid equity listing

activity.

|

Money raised (€m) |

Q2 2024 |

Q2 2023 |

% change |

|

| Equity

listings |

3,403 |

1,119 |

+204.2% |

|

| Follow-ons |

2,140 |

4,068 |

-47.4% |

|

| Bonds |

304,686 |

332,705 |

-8.4% |

|

|

|

|

|

|

|

Listed securities |

Q2 2024 |

Q2 2023 |

% change |

|

| New equity

listings over the period |

14 |

16 |

-12.5% |

|

| # ETFs listed,

end of period |

3,885 |

3,755 |

+3.5% |

|

| # Bonds listed,

end of period |

56,672 |

54,061 |

+4.8% |

|

Money raised from follow-ons has been

restated for previous periods.

Euronext sustained its position as the leading

equity listing venue in Europe, recording 14 new equity listings in

Q2 2024. This represented 40% of European listing activity. Several

international large caps listed on Euronext this quarter. A third

of the listings in Q2 2024 were from international companies,

demonstrating the market’s appeal on an international scale.

Euronext Corporate Services revenue grew +8.8%

compared to Q2 2023 to €12.8 million, resulting from the strong

performance of its SaaS products.

Debt listing revenue grew +16.8% from Q2 2023 to

€10.8 million, resulting from dynamic debt issuance activity.

Euronext also sustained its world leading position in debt listing,

including for ESG bonds.

On a like-for-like basis at constant currencies,

listing revenue increased by +5.8% compared to Q2 2023.

|

|

Q2 2024 |

Q2 2023 |

% change |

|

Cash trading revenue (€m) |

74.2 |

65.2 |

+13.8% |

| ADV Cash market

(€m) |

11,062 |

9,994 |

+10.7% |

Cash trading revenue increased by +13.8% to

€74.2 million in Q2 2024, supported by increased volatility.

Over the second quarter of 2024, Euronext cash

trading yield was 0.53 bps, reflecting efficient yield management.

Euronext market share on cash trading averaged 66.0% in Q2

2024.

On a like-for-like basis at constant currencies,

cash trading revenue was up +13.8%.

|

|

Q2 2024 |

Q2 2023 |

% change |

|

Derivatives trading revenue (€m) |

13.9 |

13.0 |

+6.6% |

| ADV Derivatives

market (in lots) |

685,967 |

595,206 |

+15.2% |

| ADV Equity &

Index derivatives (in lots) |

560,600 |

505,806 |

+10.8% |

| ADV Commodity

derivatives (in lots) |

125,367 |

89,400 |

+40.2% |

Derivatives trading revenue increased by +6.6%

to €13.9 million in Q2 2024, reflecting higher trading volumes for

equity, index and commodity derivatives.

Euronext revenue capture on derivatives trading

was €0.32 per lot for the second quarter of 2024.

On a like-for-like basis at constant currencies,

derivatives trading revenue was up +6.6% in Q2 2024 compared to Q2

2023.

|

|

Q2 2024 |

Q2 2023 |

% change |

| Fixed income

trading revenue (€m) |

35.6 |

25.3 |

+40.7% |

|

o/w MTS Cash |

24.9 |

15.5 |

+60.1% |

|

o/w MTS Repo |

6.6 |

6.3 |

+4.8% |

|

ADV MTS Cash (€m) |

36,287 |

21,632 |

+67.7% |

| TAADV MTS Repo

(€m) |

448,618 |

443,680 |

+1.1% |

| ADV other fixed

income (€m) |

1,689 |

1,293 |

+30.6% |

Fixed income revenue reached another record at

€35.6 million in Q2 2024, up +40.7% compared to Q2 2023, reflecting

record quarterly volumes at MTS driven by an economic environment

favouring money markets, sustained sovereign issuance activities

and supportive volatility.

On a like-for-like basis at constant currencies,

fixed income trading revenue was up +40.7% compared to Q2 2023.

|

|

Q2 2024 |

Q2 2023 |

% change |

| Spot FX trading

revenue (€m) |

7.9 |

6.1 |

+28.7% |

| ADV spot FX

Market (in $m) |

27,443 |

21,596 |

+27.1% |

FX trading revenue was up +28.7% to €7.9 million

in Q2 2024, reflecting growing volumes supported by a favourable

volatility environment.

On a like-for-like basis at constant currencies,

FX trading revenue was up +27.3% compared to Q2 2023.

|

|

Q2 2024 |

Q2 2023 |

% change |

Power trading revenue (€m) |

11.1 |

8.6 |

+30.1% |

| ADV Day-ahead

power market (in TWH) |

2.46 |

2.36 |

+4.5% |

| ADV Intraday

power market (in TWH) |

0.34 |

0.18 |

+91.3% |

Power trading revenue reported a strong quarter

with revenue reaching €11.1 million in Q2 2024, up +30.1% compared

to Q2 2023, reflecting the continued strong momentum in the

intraday power market and solid day-ahead volumes.

On a like-for-like basis at constant currencies,

power trading revenue was up +29.2% compared to Q2 2023.

Investor Services reported €3.3 million revenue

in Q2 2024, representing a +17.7% increase compared to Q2 2023,

resulting from continued commercial expansion of the franchise.

On a like-for-like basis at constant currencies,

Investor Services revenue was up +15.6% compared to Q2 2023.

Advanced Data Services reached €60.0 million in

Q2 2024, up +5.4% from Q2 2023, driven by dynamic non-professional

usage, solid demand for fixed-income and power trading data

services, continued commercial expansion of the quant products

offering, as well as the first contribution of GRSS for one month

of consolidation.

On a like-for-like basis at constant currencies,

Advanced Data Services revenue was up +4.1% compared to

Q2 2023.

|

in €m, unless stated otherwise |

Q2 2024 |

Q2 2023 |

% change |

|

Post-trade revenue (exc. NTI) |

108.9 |

93.1 |

+16.9% |

|

Clearing |

39.2 |

29.4 |

+33.2% |

|

o/w Revenue from LCH SA |

23.1 |

17.9 |

+28.7% |

|

o/w Revenue from Euronext Clearing |

16.1 |

11.5 |

+40.2% |

|

o/w Derivatives |

1.3 |

1.3 |

-7.0% |

|

o/w Equities |

6.2 |

3.6 |

+69.8% |

|

o/w Bonds |

3.5 |

3.1 |

+12.2% |

|

o/w Other |

5.1 |

3.3 |

+53.3% |

| Custody,

Settlement and other Post-Trade activities |

69.7 |

63.7 |

+9.4% |

|

Number of transactions and lots cleared |

Q2 2024 |

Q2 2023 |

% change |

| Shares

(number of contracts – single counted) |

58,879,480 |

16,582,689 |

+255.1% |

| Bonds –

Wholesale (nominal value in €bln – double counted) |

6,918 |

6,511 |

+6.2% |

| Bonds – Retail

(number of contracts – double counted) |

3,658,240 |

2,899,622 |

+26.2% |

| Derivatives

(number of contracts – single counted, Euronext Clearing

only) |

4,935,926 |

6,552,284 |

-24.7% |

Clearing revenue was up +33.2% to €39.2 million

in Q2 2024, reflecting the increase in equity clearing volumes

following the expansion of Euronext Clearing and higher clearing

revenues from the dynamic fixed income and commodities activities.

Non-volume related clearing revenue (including membership fees,

treasury income received from LCH SA) accounted for €11.9 million

of the total clearing revenue in Q2 2024.

On a like-for-like basis at constant currencies,

clearing revenue was up +33.2% compared to Q2 2023.

Net treasury income (NTI) amounted to €13.8

million in Q2 2024, stable compared to Q2 2023 and reflecting

higher return on cash held at Euronext Clearing.

- Custody,

Settlement and other Post-Trade activities

|

Euronext Securities activity |

Q2 2024 |

Q2 2023 |

% change |

| Number of

settlement instructions over the period |

32,114,794 |

28,787,026 |

+11.6% |

|

Assets under Custody (in €bn), end of period |

7,049 |

6,424 |

+9.7% |

Revenue from Custody, Settlement and other

Post-Trade activities was €69.7 million in Q2 2024, posting a

strong organic growth of +9.4% compared to Q2 2023. This reflects

growing assets under custody, dynamic issuance activities and

higher settlement activity.

On a like-for-like basis at constant currencies,

Custody, Settlement and other Post-Trade revenue was up +9.3%

compared to Q2 2023.

-

Technology Solutions and Other revenue

Euronext Technologies and Other revenue

decreased to €25.4 million in Q2 2024, down -7.0% from Q2 2023,

mainly driven by the termination of double-run connectivity

revenues following the completion of the migration of Borsa

Italiana cash and derivatives trading markets to Optiq®, passing on

synergies to clients. On a like-for-like basis at constant

currencies, Euronext Technologies and Other revenue was down –7.0%

compared to Q2 2023.

Q2 2024 corporate highlights since publication of the

first quarter 2024 results on 14 May 2024

-

Closing of the acquisition of Global Rate Set

Systems

On 3 June 2024, Euronext announced the closing

of the acquisition of Global Rate Set Systems (GRSS), a leading

provider of services to benchmark administrators. Euronext’s

acquisition of GRSS expands and enhances its index franchise,

positioning the Group as a leading player in the calculation and

administration of Interbank Offered Rate (IBOR) indices. By

partnering with GRSS and its founder, Euronext intends to

strengthen GRSS’s position as the preferred provider in the

contributed data and indices sector, leveraging on Euronext’s

global leadership and reputation. This acquisition contributes to

the growth of Euronext’s fixed and subscription-based revenue.

-

Migration of MTS Data Centre

MTS successfully concluded the migration of its

Production Data Centre from Milan to the Aruba Global Cloud Data

Centre IT3 in Bergamo on 13 May 2024. This strategic move enables

customers to access MTS Markets’ Trading and Data services through

the same facilities as all Euronext trading venues, thereby

enhancing efficiencies in European capital markets.

Key highlights of the migration include:

- Greater efficiency: Customers can

now access MTS Markets’ Trading and Data services via the same

facilities as all Euronext trading venues.

- Reduced latency: There has been a

~30% reduction in gateway-to-gateway latency on all MTS Cash Market

orderbooks since the migration.

- State-of-the-Art Facilities: The

new data centre meets the highest quality standards (rating 4

certification), ensuring maximum safety and resilience.

- Sustainability commitment: The

facility is 100% powered by renewable energy, reflecting our

commitment to minimising environmental impact.

Corporate highlights since 30 June 2024

-

Successful migration of commodity derivatives to Euronext

Clearing

Euronext successfully migrated the clearing of

its commodity derivatives to Euronext Clearing on 15 July 2024,

completing the first phase of its derivatives clearing migration.

Euronext confirmed that the second and final phase, the migration

of financial derivatives, will take place in September 2024.

-

Continued innovation with the launch of microwave

technology

On 11 July 2024, Euronext announced the

successful launch of its new London-based microwave service, the

Euronext Wireless Network (EWiN). Euronext is the first exchange in

Europe to offer “Plug & Play” order entry in London via

microwave technology. This service is set to significantly enhance

the speed of order transmission between London, UK, and Bergamo,

Italy, where Euronext’s core data centre is located, offering

unparallelled improvements in latency for Euronext’s many

London-based members.

The Euronext Wireless Network (EWiN) is a fully

resilient service with 100% fibre back-up, providing order

submission via microwaves from London Equinix LD4 to Bergamo Aruba

IT3 in less than 4 milliseconds. This new service is provided in

collaboration with McKay Brothers, the largest independent

microwave network provider in Europe.

The EWiN microwave network represents a major

technological advancement in the financial services sector. By

leveraging the faster transmission speeds of microwave technology,

EWiN provides a direct and highly efficient communication pathway

that significantly reduces the time it takes to send orders to

Euronext’s single liquidity pool, powered by the single technology

platform Optiq®.

EWiN combines several key benefits, providing

Euronext members with a technological edge in the fast-paced world

of financial trading. The service has been designed with full

straight-through processing (STP). EWiN also has full fibre

back-up, making it 100% resilient. EWiN significantly reduces

latency, ensuring faster and more reliable order execution. Lastly,

it creates a direct microwave link between London and Bergamo, two

major financial data hubs in Europe. Goldman Sachs and Morgan

Stanley have confirmed the deployment of the new technology since

its go-live date.

Agenda

A conference call and webcast

will be held on 26 July 2024, at 09:00 CEST (Paris

time) / 08:00 BST (London time):

Conference call:

To connect to the conference call, please

dial:

| UK

Number: |

+44 33 0551

0200 |

NO

Number: |

+47 2 156

3318 |

| FR

Number: |

+33 1 70 37 71

66 |

PT

Number: |

+351 3 0880

2081 |

| NL

Number: |

+31 20 708

5073 |

IR

Number: |

+353 1 436

0959 |

| US

Number: |

+1 786 697

3501 |

IT

Number: |

+39 06 8336

0400 |

| BE

Number: |

+32 2 789

8603 |

DE

Number: |

+49 30 3001

90612 |

Password:

Euronext

Live webcast:

For the live audio webcast go to:

Euronext Results webcast

The webcast will be available for replay after

the call at the webcast link and on the Euronext Investor Relations

webpage.

|

ANALYSTS & INVESTORS –

ir@euronext.com |

| Investor

Relations |

Aurélie

Cohen |

+33 1 70 48 24

27 |

ir@euronext.com |

| |

Clément

Kubiak |

+33 1 70 48 24

27 |

ir@euronext.com |

|

MEDIA –

mediateam@euronext.com |

Europe

|

Aurélie

Cohen |

+33 1 70 48 24

45 |

mediateam@euronext.com

|

| Andrea

Monzani |

+39 02 72 42 62

13 |

|

Amsterdam |

Marianne

Aalders |

+31 20 721 41

33 |

amsterdampressoffice@euronext.com |

|

Brussels |

Marianne

Aalders |

+32 26 20 15

01 |

brusselspressoffice@euronext.com |

| Dublin |

Andrea

Monzani |

+39 02 72 42 62

13 |

dublinpressoffice@euronext.com |

| Lisbon |

Sandra

Machado |

+351 91 777 68

97 |

portugalpressoffice@euronext.com |

| Milan,

Rome |

Ester

Russom |

+39 02 72 42 67

56 |

italypressoffice@euronext.com |

| Oslo |

Cathrine Lorvik

Segerlund |

+47 41 69 59

10 |

oslopressoffice@euronext.com |

| Paris,

Corporate |

Flavio

Bornancin-Tomasella |

+33 1 70 48 24

45 |

parispressoffice@euronext.com |

| Corporate

Services |

Coralie

Patri |

+33 7 88 34 27

44 |

parispressoffice@euronext.com |

About Euronext

Euronext is the leading pan-European market

infrastructure, connecting European economies to global capital

markets, to accelerate innovation and sustainable growth. It

operates regulated exchanges in Belgium, France, Ireland, Italy,

the Netherlands, Norway and Portugal. With nearly 1,900 listed

equity issuers and around €6.5 trillion in market capitalisation as

of end of June 2024, it has an unmatched blue chip franchise and a

strong diverse domestic and international client base. Euronext

operates regulated and transparent equity and derivatives markets,

one of Europe’s leading electronic fixed income trading markets and

is the largest centre for debt and funds listings in the world. Its

total product offering includes Equities, FX, Exchange Traded

Funds, Warrants & Certificates, Bonds, Derivatives, Commodities

and Indices. The Group provides a multi-asset clearing house

through Euronext Clearing, and custody and settlement services

through Euronext Securities central securities depositories in

Denmark, Italy, Norway and Portugal. Euronext also leverages its

expertise in running markets by providing technology and managed

services to third parties. In addition to its main regulated

market, it also operates a number of junior markets, simplifying

access to listing for SMEs.

For the latest news, go to euronext.com or

follow us on X (twitter.com/euronext) and LinkedIn

(https://www.linkedin.com/company/euronext).

Disclaimer

This press release is for information purposes

only: it is not a recommendation to engage in investment activities

and is provided “as is”, without representation or warranty of

any kind. While all reasonable care has been taken to ensure the

accuracy of the content, Euronext does not guarantee its accuracy

or completeness. Euronext will not be held liable for any loss or

damages of any nature ensuing from using, trusting or acting on

information provided. No information set out or referred to in this

publication may be regarded as creating any right or obligation.

The creation of rights and obligations in respect of financial

products that are traded on the exchanges operated by Euronext’s

subsidiaries shall depend solely on the applicable rules of the

market operator. All proprietary rights and interest in or

connected with this publication shall vest in Euronext. This press

release speaks only as of this date. Euronext refers to Euronext

N.V. and its affiliates. Information regarding trademarks and

intellectual property rights of Euronext is available at

www.euronext.com/terms-use.

© 2024, Euronext N.V. - All rights

reserved.

The Euronext Group processes your personal data

in order to provide you with information about Euronext (the

"Purpose"). With regard to the processing of this personal data,

Euronext will comply with its obligations under Regulation (EU)

2016/679 of the European Parliament and Council of 27 April 2016

(General Data Protection Regulation, “GDPR”), and any applicable

national laws, rules and regulations implementing the GDPR, as

provided in its privacy statement available at:

www.euronext.com/privacy-policy. In accordance with the applicable

legislation you have rights with regard to the processing of your

personal data: for more information on your rights, please refer

to: www.euronext.com/data_subjects_rights_request_information. To

make a request regarding the processing of your data or to

unsubscribe from this press release service, please use our data

subject request form at

connect2.euronext.com/form/data-subjects-rights-request or email

our Data Protection Officer at dpo@euronext.com.

Appendix

Adjustments in financial

disclosure

To highlight its underlying performance, since

Q1 2023 Euronext has published underlying recurring costs, adjusted

EBITDA and non-recurring costs.

Euronext has removed the exceptional items line

from its financial statements. Consequently, costs previously

reported as exceptional items have from Q1 2023 been included in

their respective lines within Euronext operating expenses as

non-recurring items.

The €150 million of implementation costs to

deliver on the ‘Growth for Impact 2024’ strategic plan targets are

therefore considered as non-recurring items and have been withdrawn

from the underlying recurring costs.

The computation of adjusted net income and

earnings per share has been adjusted accordingly. The computation

of reported net income and earnings per share is not impacted.

2024 strategic plan targets remain unchanged and

are not affected by this change in reporting.

The non-IFRS indicators are defined below.

Non-IFRS financial measures

For comparative purposes, the company provides

unaudited non-IFRS measures including:

-

Operational expenses excluding depreciation and amortisation,

underlying operational expenses excluding depreciation and

amortisation;

-

EBITDA, EBITDA margin, adjusted EBITDA, adjusted EBITDA

margin.

Non-IFRS measures are defined as follows:

-

Operational expenses excluding depreciation and amortisation as the

total of salary and employee benefits, and other operational

expenses;

-

Underlying operational expenses excluding depreciation and

amortisation as the total of salary and employee benefits, and

other operational expenses, excluding non-recurring costs;

-

Underlying revenue and income as the total of revenue and income,

excluding non-recurring revenue and income;

- Non-underlying

items as items of revenue, income and expense that are material by

their size and/or that are infrequent and unusual by their nature

or incidence are not considered to be recurring in the normal

course of business and are classified as non-underlying items on

the face of the income statement within their relevant category in

order to provide further understanding of the ongoing sustainable

performance of the Group. These items can include:

- integration or double run costs of

significant projects, restructuring costs and costs related to

acquisitions that change the perimeter of the Group;

- one-off finance costs, gains or

losses on sale of subsidiaries and impairments of investments:

- amortisation and impairment of

intangible assets which are recognised as a result of acquisitions

and mostly comprising customer relationships, brand names and

software that were identified during purchase price allocation

(PPA);

- tax related to non-underlying

items.

-

Adjusted operating profit as the operating profit adjusted for any

non-underlying revenue and income and non-underlying costs,

including PPA of acquired businesses;

-

EBITDA as the operating profit before depreciation and

amortisation;

-

Adjusted EBITDA as the adjusted operating profit before

depreciation and amortisation adjusted for any non-underlying

operational expenses excluding depreciation and amortisation;

-

EBITDA margin as EBITDA divided by total revenue and income;

-

Adjusted EBITDA margin as adjusted EBITDA, divided by total revenue

and income;

-

Adjusted net income, as the net income, share of the parent company

shareholders, adjusted for any non-underlying items and related tax

impact.

Non-IFRS financial measures are not meant to be

considered in isolation or as a substitute for comparable IFRS

measures and should be read only in conjunction with the

consolidated financial statements.

Non-volume related revenue

definition

Non-volume related revenue includes Listing

excl. IPOs, Advanced Data Services, Custody & Settlement and

other Post-Trade, fixed revenue from the Clearing activities

(including for instance NTI and membership fees), Investor

Services, Technology Solutions, Other Income and Transitional

Revenue.

Adjusted EPS definition

|

|

Q2 2024 |

Q2 2023 |

|

Net income reported |

141.7 |

120.0 |

| EPS

reported |

1.37 |

1.12 |

|

Adjustments |

|

|

|

of which revenues |

- |

- |

|

of which Operating expenses exc. D&A |

(6.8) |

(8.9) |

|

of which Depreciation and amortisation |

(26.0) |

(23.8) |

|

of which Net financing expense |

- |

(0.2) |

|

of which results from equity investments |

1.2 |

- |

|

of which Minority interest |

(0.1) |

1.3 |

|

Tax related to adjustments |

8.3 |

8.7 |

|

Adjusted net income |

165.2 |

142.9 |

|

Adjusted EPS |

1.59 |

1.34 |

The figures in this document have not been

audited or reviewed by our external auditor

Consolidated income

statement

| |

Q2 2024 |

Q2 2023 |

|

in € million, unless stated otherwise |

Underlying |

Non-underlying |

Reported |

Underlying |

Non-underlying |

Reported |

|

Revenue and income |

412.9 |

- |

412.9 |

368.1 |

- |

368.1 |

|

Listing |

58.4 |

- |

58.4 |

55.1 |

- |

55.1 |

|

Trading revenue, of which |

142.7 |

- |

142.7 |

118.2 |

- |

118.2 |

|

Cash trading |

74.2 |

- |

74.2 |

65.2 |

- |

65.2 |

|

Derivatives trading |

13.9 |

- |

13.9 |

13.0 |

- |

13.0 |

|

Fixed income trading |

35.6 |

- |

35.6 |

25.3 |

- |

25.3 |

|

FX trading |

7.9 |

- |

7.9 |

6.1 |

- |

6.1 |

|

Power trading |

11.1 |

- |

11.1 |

8.6 |

- |

8.6 |

|

Investor services |

3.3 |

- |

3.3 |

2.8 |

- |

2.8 |

|

Advanced data services |

60.0 |

- |

60.0 |

56.9 |

- |

56.9 |

|

Post-Trade, of which |

108.9 |

- |

108.9 |

93.1 |

- |

93.1 |

|

Clearing |

39.2 |

- |

39.2 |

29.4 |

- |

29.4 |

|

Custody & Settlement and other |

69.7 |

- |

69.7 |

63.7 |

- |

63.7 |

|

Euronext Technology Solutions & other revenue |

25.4 |

- |

25.4 |

27.3 |

- |

27.3 |

|

Net Financing Income through CCP business |

13.8 |

- |

13.8 |

13.8 |

- |

13.8 |

|

Other income |

0.4 |

- |

0.4 |

0.7 |

- |

0.7 |

|

Transitional revenues |

- |

- |

- |

0.0 |

- |

0.0 |

|

Operating expenses excluding D&A |

(156.1) |

(6.8) |

(162.9) |

(152.0) |

(8.9) |

(160.9) |

|

Salaries and employee benefits |

(79.9) |

(0.4) |

(80.2) |

(78.3) |

(2.1) |

(80.3) |

|

Other operational expenses, of which |

(76.2) |

(6.5) |

(82.7) |

(73.7) |

(6.8) |

(80.5) |

|

System & communication |

(24.7) |

(1.1) |

(25.9) |

(23.3) |

(2.4) |

(25.6) |

|

Professional services |

(13.6) |

(4.4) |

(17.9) |

(15.4) |

(3.3) |

(18.7) |

|

Clearing expense |

(9.9) |

- |

(9.9) |

(8.6) |

- |

(8.6) |

|

Accommodation |

(4.1) |

(0.3) |

(4.4) |

(4.8) |

(0.3) |

(5.0) |

|

Other operational expenses |

(23.9) |

(0.7) |

(24.6) |

(21.7) |

(0.9) |

(22.6) |

|

EBITDA |

256.8 |

(6.8) |

249.9 |

216.1 |

(8.9) |

207.2 |

|

EBITDA margin |

62.2% |

|

60.5% |

58.7% |

|

56.3% |

|

Depreciation & amortisation |

(21.9) |

(26.0) |

(47.9) |

(18.3) |

(23.8) |

(42.2) |

|

Total expenses |

(178.0) |

(32.8) |

(210.9) |

(170.3) |

(32.7) |

(203.0) |

|

Operating profit |

234.8 |

(32.8) |

202.0 |

197.8 |

(32.7) |

165.0 |

|

Net financing income / (expense) |

3.5 |

- |

3.5 |

(1.6) |

(0.2) |

(1.9) |

|

Results from equity investment |

0.1 |

1.2 |

1.2 |

3.2 |

- |

3.2 |

|

Profit before income tax |

238.4 |

(31.7) |

206.7 |

199.3 |

(32.9) |

166.4 |

|

Income tax expense |

(64.0) |

8.3 |

(55.7) |

(49.9) |

8.7 |

(41.2) |

|

Non-controlling interests |

(9.2) |

(0.1) |

(9.2) |

(6.6) |

1.3 |

(5.2) |

|

Net income, share of the parent company

shareholders |

165.2 |

(23.4) |

141.7 |

142.9 |

(22.9) |

120.0 |

|

EPS (basic, in €) |

1.59 |

|

1.37 |

1.34 |

|

1.12 |

|

EPS (diluted, in €) |

1.59 |

|

1.36 |

1.34 |

|

1.12 |

The figures in this document have not been audited or

reviewed by our external auditor

Consolidated comprehensive income statement

| |

Q2 2024 |

Q2 2023 |

|

Profit for the period |

151.0 |

125.2 |

| |

|

|

|

Other comprehensive income |

|

|

|

Items that may be reclassified to profit or loss: |

|

|

|

– Exchange differences on translation of foreign operations |

15.2 |

(24.4) |

|

– Income tax impact on exchange differences on translation of

foreign operations |

(1.9) |

2.5 |

|

– Change in value of debt investments at fair value through other

comprehensive income |

0.3 |

0.7 |

– Income tax impact on change in value of debt investments at fair

value through

other comprehensive income |

(0.1) |

(0.2) |

| |

|

|

|

Items that will not be reclassified to profit or loss: |

|

|

|

– Change in value of equity investments at fair value through other

comprehensive income |

6.5 |

11.7 |

– Income tax impact on change in value of equity investments at

fair value through

other comprehensive income |

(1.0) |

(3.1) |

|

– Remeasurements of post-employment benefit obligations |

1.9 |

0.7 |

|

– Income tax impact on remeasurements of post-employment benefit

obligations |

(0.2) |

(0.1) |

|

Other comprehensive income for the period, net of tax |

20.8 |

(12.1) |

|

Total comprehensive income for the period |

171.8 |

113.1 |

| |

|

|

|

Comprehensive income attributable to: |

|

|

|

– Owners of the parent |

162.5 |

108.4 |

|

– Non-controlling interests |

9.3 |

4.7 |

The figures in this document have not been

audited or reviewed by our external auditor

Consolidated balance sheet

| in €

million |

30 June 2024 |

31 March 2024 |

|

Non-current assets |

|

|

|

Property, plant and equipment |

106.1 |

107.2 |

|

Right-of-use assets |

53.1 |

56.1 |

|

Goodwill and other intangible assets |

6,104.6 |

6,069.8 |

|

Deferred income tax assets |

46.0 |

32.3 |

|

Investments in associates and joint ventures |

0.7 |

1.3 |

|

Financial assets at fair value through OCI |

269.2 |

262.6 |

|

Other non-current assets |

4.1 |

4.4 |

|

Total non-current assets |

6,583.8 |

6,533.8 |

| |

|

|

|

Current assets |

|

|

|

Trade and other receivables |

347.8 |

392.2 |

|

Income tax receivable |

7.2 |

28.3 |

|

CCP clearing business assets |

207,536.8 |

212,122.7 |

|

Other current financial assets |

88.5 |

105.1 |

|

Cash & cash equivalents |

1,376.0 |

1,609.6 |

|

Total current assets |

209,356.4 |

214,257.9 |

|

|

|

|

|

Total assets |

215,940.1 |

220,791.7 |

| |

|

|

|

Equity |

|

|

|

Shareholders' equity |

3,961.2 |

4,064.1 |

|

Non-controlling interests |

134.1 |

147.8 |

|

Total Equity |

4,095.4 |

4,211.9 |

| |

|

|

|

Non-current liabilities |

|

|

|

Borrowings |

2,536.3 |

3,032.8 |

|

Lease liabilities |

38.5 |

37.6 |

|

Deferred income tax liabilities |

505.5 |

523.7 |

|

Post-employment benefits |

20.8 |

22.3 |

|

Contract liabilities |

61.2 |

59.0 |

|

Other provisions |

7.1 |

7.2 |

|

Total Non-current liabilities |

3,169.5 |

3,682.6 |

| |

|

|

|

Current liabilities |

|

|

|

Borrowings |

500.8 |

24.2 |

|

Lease liabilities |

18.2 |

23.2 |

|

CCP clearing business liabilities |

207,646.7 |

212,229.1 |

|

Income tax payable |

80.6 |

87.7 |

|

Trade and other payables |

290.9 |

367.2 |

|

Contract liabilities |

135.1 |

160.4 |

|

Other provisions |

3.6 |

5.4 |

|

Total Current liabilities |

208,675.2 |

212,897.2 |

|

|

|

|

|

Total equity and liabilities |

215,940.1 |

220,791.7 |

The consolidated Balance Sheet includes the

Euronext Clearing (CC&G) business assets and liabilities. The

figures in this document have not been audited or reviewed by our

external auditor.

Consolidated statement of cash

flows

| in €

million |

Q2 2024 |

Q2 2023 |

|

Profit before tax |

206.7 |

166.4 |

|

Adjustments for: |

|

|

|

- Depreciation and amortisation |

47.9 |

42.2 |

|

- Share based payments |

2.9 |

3.4 |

|

- Share of profit from associates and joint ventures |

(0.1) |

(3.2) |

|

- Changes in working capital |

(67.9) |

(54.0) |

|

- Gain on sale of associate |

(1.2) |

- |

| |

|

|

|

Cash flow from operating activities |

188.4 |

154.8 |

|

Income tax paid |

(76.9) |

(15.8) |

|

Net cash flows from operating activities |

111.5 |

139.0 |

| |

|

|

|

Cash flow from investing activities |

|

|

|

Business combinations, net of cash acquired |

(38.5) |

- |

|

Proceeds from sale of subsidiary |

- |

(0.2) |

|

Proceeds from sale of associate |

0.9 |

- |

|

Purchase of current financial assets |

(0.6) |

3.3 |

|

Redemption of current financial assets |

17.7 |

26.0 |

|

Purchase of property, plant and equipment |

(5.0) |

(4.8) |

|

Purchase of intangible assets |

(15.8) |

(18.4) |

|

Interest received |

11.3 |

4.9 |

|

Proceeds from sale of Property, plant, equipment and intangible

assets |

(0.1) |

- |

|

Dividends received from associates and joint ventures |

0.1 |

7.8 |

|

Net cash flow from investing activities |

(30.0) |

18.6 |

| |

|

|

|

Cash flow from financing activities |

|

|

|

Interest paid |

(28.2) |

(27.9) |

|

Payment of lease liabilities |

(4.2) |

(6.3) |

|

Acquisitions of own shares |

(10.0) |

(15.0) |

|

Employee Share transactions |

(1.2) |

(1.0) |

|

Dividends paid to the company's shareholders |

(257.3) |

(237.2) |

|

Dividends paid to non-controlling interests |

(18.9) |

(3.1) |

|

Net cash flow from financing activities |

(319.6) |

(290.5) |

| |

|

|

|

Total cash flow over the period |

(238.1) |

(132.9) |

|

Cash and cash equivalents - Beginning of period |

1,609.6 |

1,335.7 |

|

Non cash exchange gains/(losses) on cash and cash equivalents |

4.6 |

(7.1) |

|

Cash and cash equivalents - End of period |

1,376.0 |

1,195.8 |

The figures in this document have not been

audited or reviewed by our external auditor.

Volumes for the first quarter of

2024

| |

Q2 2024 |

Q2 2023 |

%var |

| Number of

trading days |

63 |

62 |

|

|

Number of transactions (buy and sells, inc. reported

trades) |

|

Total Cash Market |

153,354,172 |

145,707,128 |

+5.2% |

| ADV Cash

Market |

2,434,193 |

2,350,115 |

+3.6% |

|

Transaction value ( € million, single

counted) |

|

|

|

|

Total Cash Market |

696,882 |

619,652 |

+12.5% |

| ADV

Cash Market |

11,062 |

9,994 |

+10.7% |

| |

|

|

|

|

Listings |

|

|

|

|

Number of Issuers on Equities |

|

|

|

| Euronext |

1,862 |

1,909 |

-2.5% |

| SMEs |

1,469 |

1,513 |

-2.9% |

| Number

of Listed Securities |

|

|

|

| Funds |

2,347 |

2,783 |

-15.7% |

| ETFs |

3,885 |

3,755 |

+3.5% |

| Bonds |

56,672 |

54,061 |

+4.8% |

| |

|

|

|

|

Capital raised on primary and secondary

market |

|

|

|

|

Total Euronext, in €m |

|

|

|

| Number of new

equity listings |

14 |

16 |

|

| Money Raised -

New equity listings (incl over allotment) |

3,403.3 |

1,119 |

+204.2% |

| Money Raised -

Follow-ons on equities |

2,140 |

4,068 |

-47.4% |

| Money Raised -

Bonds |

304,686 |

332,705 |

-8.4% |

| Total Money

Raised |

310,230 |

337,892 |

-8.2% |

| |

|

|

|

| of

which SMEs |

|

|

|

| Number of new

equity listings |

11 |

13 |

|

| Money Raised -

New equity listings (incl over allotment) |

435 |

253 |

+72.4% |

| Money Raised -

Follow-ons on equities |

786 |

2,052 |

-61.7% |

| Money Raised -

Bonds |

435 |

892 |

-51.2% |

| Total Money

Raised |

1,657 |

3,197 |

-48.2% |

Money raised from follow-ons has been restated for previous

periods.

|

|

|

|

| |

Q2 2024 |

Q2 2023 |

%var |

|

Transaction value (€ million, single counted) |

|

|

|

|

MTS |

|

|

|

| ADV MTS

Cash |

36,287 |

21,632 |

+67.7% |

| TAADV MTS

Repo |

448,618 |

443,680 |

+1.1% |

| Other

fixed income |

|

|

|

| ADV Fixed

income |

1,689 |

1,293 |

+30.6% |

| |

Q2 2024 |

Q2 2023 |

%var |

| Number of trading

days |

65 |

65 |

|

|

FX volume ($m, single counted) |

|

|

|

| Total Euronext

FX |

1,783,772 |

1,403,731 |

+27.1% |

| ADV Euronext

FX |

27,443 |

21,596 |

+27.1% |

| |

|

|

|

| |

Q2 2024 |

Q2 2023 |

% var |

| Number of

trading days |

91 |

91 |

|

|

Power volume (in TWh) |

|

|

|

| ADV Day-ahead

Power Market |

2.46 |

2.36 |

+4.5% |

| ADV Intraday

Power Market |

0.34 |

0.18 |

+91.3% |

|

|

|

|

The figures in this document have not been

audited or reviewed by our external auditor

| |

Q2 2024 |

Q2 2023 |

% var |

| Number of

trading days |

63 |

62 |

|

|

Derivatives Volume (in lots) |

|

|

|

|

Equity |

35,317,815 |

31,359,961 |

+12.6% |

|

Index |

13,753,365 |

12,164,085 |

+13.1% |

|

Futures |

7,760,863 |

8,274,465 |

-6.2% |

|

Options |

5,992,502 |

3,889,620 |

+54.1% |

|

Individual Equity |

21,564,450 |

19,195,876 |

+12.3% |

|

Futures |

2,782,606 |

601,529 |

+362.6% |

|

Options |

18,781,844 |

18,594,347 |

+1.0% |

|

|

|

|

|

|

Commodity |

7,898,126 |

5,542,821 |

+42.5% |

|

Futures |

7,197,681 |

4,977,372 |

+44.6% |

|

Options |

700,445 |

565,449 |

+23.9% |

| |

|

|

|

|

Total Euronext |

43,215,941 |

36,902,782 |

+17.1% |

|

Total Futures |

17,741,150 |

13,853,366 |

+28.1% |

|

Total Options |

25,474,791 |

23,049,416 |

+10.5% |

|

|

|

|

|

|

Derivatives ADV (in lots) |

|

|

|

|

Equity |

560,600 |

505,806 |

+10.8% |

|

Index |

218,307 |

196,195 |

+11.3% |

|

Futures |

123,188 |

133,459 |

-7.7% |

|

Options |

95,119 |

62,736 |

+51.6% |

|

Individual Equity |

342,293 |

309,611 |

+10.6% |

|

Futures |

44,168 |

9,702 |

+355.2% |

|

Options |

298,125 |

299,909 |

-0.6% |

|

|

|

|

|

|

Commodity |

125,367 |

89,400 |

+40.2% |

|

Futures |

114,249 |

80,280 |

+42.3% |

|

Options |

11,118 |

9,120 |

+21.9% |

|

|

|

|

|

|

Total Euronext |

685,967 |

595,206 |

+15.2% |

|

Total Futures |

281,606 |

223,441 |

+10.9% |

|

Total Options |

404,362 |

371,765 |

-0.9% |

The figures in this document have not been

audited or reviewed by our external auditor

- Derivatives open

interest

| |

30 June 2024 |

30 June 2023 |

% var |

| Open

interest (in lots) |

|

|

|

| |

|

|

|

|

Equity |

21,383,008 |

21,544,679 |

-0.8% |

|

Index |

1,165,074 |

1,138,481 |

+2.3% |

|

Futures |

517,596 |

574,205 |

-9.9% |

|

Options |

647,478 |

564,276 |

+14.7% |

|

Individual Equity |

20,217,934 |

20,406,198 |

-0.9% |

|

Futures |

562,620 |

254,427 |

+121.1% |

|

Options |

19,655,314 |

20,151,771 |

-2.5% |

|

|

|

|

|

|

Commodity |

982,939 |

951,527 |

+3.3% |

|

Futures |

645,633 |

560,929 |

+15.1% |

|

Options |

337,306 |

390,598 |

-13.6% |

| |

|

|

|

|

Total Euronext |

22,365,947 |

22,496,206 |

-0.6% |

|

Total Futures |

1,725,849 |

1,389,561 |

24.2% |

|

Total Options |

20,640,098 |

21,106,645 |

-2.2% |

The figures in this document have not been

audited or reviewed by our external auditor

1 Definition in Appendix – adjusted for

non-underlying operating expenses excluding D&A and

non-underlying revenue and income.

2 Last twelve months reported and adjusted EBITDA

3 Like-for-like basis at constant currency

4 For the total adjustments performed please refer to

the Appendix of this press release.

- 2024_Euronext_PR_Q22024_vF

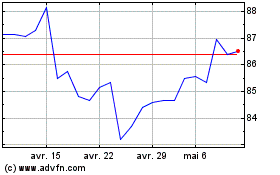

Euronext NV (EU:ENX)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Euronext NV (EU:ENX)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024