- Revenue of €1,289m, up 6% compared to H1 2022 and 4% on a

like-for-like basis1

- 10% increase in sports betting and online gaming open to

competition to €257m

- Lottery growth of 1% to €958m, limited by the low number of

Loto and Euromillions high jackpots2 for the entire half-year,

which also undermines the momentum in digital stakes

- Good activity in point-of-sale (stakes up 3%) and online

(stakes up 13%)

- Recurring EBITDA of €300m, a 23.3% margin

- 24.0% margin excluding the €10m exceptional allowance for the

prevention of underage gambling over the next five years

- Net income of €181m, up 13%, driven by the strong

improvement in financial income

- 2023 targets: revenue growth of over 5% and of over 3% on a

like-for-like basis3, and a recurring EBITDA margin maintained at

around 24%

- Agreement to acquire Premier Lotteries Ireland, the Irish

national lottery operator, another major step in the

deployment of the FDJ Group's international strategy

Regulatory News:

La Française des Jeux (FDJ) (Paris:FDJ), France's leading

gambling operator, announces its results for H1 2023.

Stéphane Pallez, Chairwoman and CEO of the FDJ Group,

said: "FDJ recorded solid results in the first half of the year,

driven by a good increase in stakes in our network of 30,000 points

of sale, a sustained dynamic in digital stakes and the integration

of new activities. I am also delighted with the acquisition of

Premier Lotteries Ireland, the operator of the Irish national

lottery and a long-standing partner in the Euromillions community.

Becoming the operator of a foreign lottery marks another major step

in the FDJ Group's international development."

Key figures (in millions of

euros)

H1 2023

H1 2022 reported

Change

Revenue *

1,289

1,212

+6.3%

Recurring operating

profit

240

245

-2.2%

Net profit

181

160

+13.5%

Recurring EBITDA **

300

308

-2.7%

Recurring EBITDA/revenue

margin

23.3%

25.4%

* Revenue: net gaming revenue and revenue from other activities

** Recurring EBITDA: recurring operating profit adjusted for

depreciation and amortisation expense

Highlights

- Agreement to acquire Premier Lotteries Ireland, the Irish

national lottery operator, another major step in the deployment of

the FDJ Group's international strategy

FDJ has signed today an agreement to acquire Premier Lotteries

Ireland, the operator holding the exclusive rights to the Irish

national lottery until 2034. The completion of this transaction

remains subject to customary conditions precedent, including the

Irish national lottery regulator's approval, which is expected to

come in the second half of 2023.

In 2022, Premier Lotteries Ireland recorded gross gaming revenue

(GGR) of €399 million and revenue of €140 million, with an EBITDA

margin comparable to that of the FDJ Group, i.e. an additional

contribution to Group growth of more than 5% over a full year.

Amigo, a point-of-sale game with a draw every five minutes, was

relaunched at the start of June with a new formula, in accordance

with the decision by the French regulator (Autorité nationale des

jeux). Alongside this relaunch is a reduction in the number of

draws (with a suspension for 15 minutes per hour between 6 am and 2

pm) and in the maximum amount per play (€8 versus €20).

- Support for points of sale (PoS) affected by riots

Around 450 FDJ points of sale suffered varying degrees of damage

during the recent riots; two-third of them have already reopened.

The Group is working alongside its retailers, including postponing

direct debits and managing past-due payments, and is supporting

them to facilitate their reopening, for example through the Rebond

fund (personalised support system, launched in 2020, to provide

administrative assistance, legal support, financial support,

etc.).

- Increased support for the prevention of underage

gambling

To further bolster its actions to support responsible gaming,

and in particular to combat underage gambling, FDJ made a €10

million commitment in early 2023 to support initiatives to prevent

underage gambling, led by the associative sector over the next five

years and due to begin by the end of the year.

- The 30th anniversary of the FDJ Foundation to promote equal

opportunities

Since 1993, the FDJ Corporate Foundation has helped over 300,000

beneficiaries throughout France. It supports general-interest

projects aimed at people facing barriers and is committed to

supporting innovative projects that promote equal opportunities

through education and inclusion in society. According to an EY

study, €3.4 of social value is created for every €1 of support for

associations from the FDJ Foundation.

- Another "A" rating for the Axylia carbon score

For the second year running, FDJ obtained an "A" carbon score

for the Vérité40 index established by Axylia, comprised of the 40

best carbon scores of SBF 120 companies.

Activity and results for H1

2023

Gross gaming revenue (GGR) is the benchmark for the level of

business in the gambling sector. To ensure improved comparability,

the presentation of the FDJ Group's income statement is now aligned

with this aggregate, which corresponds to stakes less winnings and

the GGR of other activities.

Unless otherwise stated, the data and analyses below, up to and

including current operating income, are on a restated 2022 basis,

including L'Addition (July 2022) and Aleda (November 2022) over

comparable periods.

- Revenue of €1,289 million, up 6.3% and

3.6% on a like-for-like basis

GGR amounted to €3,295 million, up 2.4%. After €2,082 million in

public levies, up 1.9%, net gaming revenue (NGR)4 totalled €1,218

million, up 3.0% based on a 4.4% increase in stakes.

Including income from other activities of €71 million, the

Group's half-yearly revenue amounted to €1,289 million, up 3.6%.

Compared to reported data for the first half of 2022, revenue

growth was 6.3%.

- By distribution channel and

activity

Stakes in points of sale increased 3.2% to €9,155 million,

supported by sports betting and instant games.

Online stakes continued their momentum, driven by sports betting

and the lottery. They were up 13.3% to €1,332 million, a

performance attributable in large part to the increase in the

number of players. Online stakes account for nearly 13% of total

stakes.

The Group's organisation is based on three operating segments:

two Business Units (BU) – Lottery and Sports betting & Online

gaming open to competition – and diversification activities, which

include three activities under development (International, Payment

& Services, and Entertainment), with cross-functional support

functions (notably customer, distribution and information systems),

and the holding company, which mainly includes overheads.

The contribution margin is one of the key performance indicators

for these segments. It is the difference between segment revenue

and cost of sales (including PoS commissions), and the marketing

and communication expenses (excluding depreciation and

amortisation) allocated to them.

- Sports betting and online gaming open

to competition

Sports betting and online gaming open to competition revenue was

€257 million, up 10.5% from H1 2022, based on a 13.0% increase in

stakes. The player payout ratio, which gradually normalised in Q2

compared to its high Q1 level, was slightly higher than in H1

2022.

Business growth, strong in both distribution channels, benefited

from the momentum of the FIFA World Cup at the end of 2022 and a

more extensive football calendar.

The cost of sales amounted to €123 million, up 12.0% (+€13

million) compared to H1 2022. This mainly corresponds to PoS

commissions, which are in line with network stakes. Marketing and

communication expenses came to €59 million. Their 10.6% increase

(+€6 million) compared to H1 2022 reflects the business

momentum.

The contribution margin of the Sports betting and Online gaming

open to competition BU was €74 million, up €6 million, representing

a contribution margin of 28.9%.

Lottery revenue totalled €958 million, up 1.3% from a 2.3%

increase in stakes.

This performance, despite a high basis of comparison in H1 2022

which reflected the very successful relaunch of Cash in February,

is attributable to instant games (stakes up 4%), with very well

received launches and relaunches such as Carré Or in January, Club

Color in March and Numéro Fétiche in May.

The performance of draw games (stakes down 1%) is due to a low

number of Loto and Euromillions high jackpots in the first half of

the year, games in which the conversion of stakes into revenue is

high and which have a high rate of digitisation. In addition, the

effects of the new Amigo formula introduced at the start of June

undermined the game's performance.

The cost of sales amounted to €527 million, up 2.6% (+€13

million) compared to H1 2022. They mainly correspond to PoS

commissions of €393 million with a 1.5% increase, in line with the

increase in the network's stakes over the period. Marketing and

communication expenses decreased by 4.6% to €82 million.

The Lottery BU's contribution margin was virtually stable at

€349 million, with a contribution margin rate of 36.4%.

Diversification activities (Payment & Services,

International and Entertainment) recorded revenue of €74 million.

Compared to a restated 2022 basis, the €8 million increase was

mainly driven by the International business and the contribution

margin was €3 million, a €7 million improvement.

As announced, the Group has taken steps to improve the

profitability of its UK business. On 5 July, Sporting Group's B2C -

spread betting5 business was the subject of the signature of a

preliminary disposal agreement, which will be effective once the

competent authorities have given their approval.

- Recurring operating profit of €240

million and recurring EBITDA of €300 million, representing a

recurring EBITDA margin of 23.3%

The cost of sales amounted to €701 million: €493 million in PoS

commissions, with an increase (3.1%, or +€15 million) correlated

with that of point-of-sale stakes, and €208 million for other costs

of sales, with a 4.1% increase (+€8 million) reflecting in

particular the impact of inflation on the various expense items,

including gaming materials.

Marketing and communication costs were €223 million, almost

stable compared to last year. They include costs related to the

development of the gaming range and services, particularly digital,

which continue to rise, as well as decreasing advertising and

communication costs.

Administrative and general expenses mainly include personnel and

central function expenses, as well as building and IT

infrastructure costs. They amounted to €118 million, of which €10

million in exceptional allowance to support, over the next five

years, actions to prevent underage gambling carried out by

charities. Their increase compared to the €90 million in H1 2022

reflects in particular the impact of inflation on the main expense

items.

During the first half, the Group continued to implement

operating efficiency measures, in particular to offset the impact

of inflation on its cost base. These measures will be stepped up in

the second half of the year.

Other operating income and expenses were -€7 million and mainly

include the amortisation charge for exclusive gaming operating

rights.

As such, the Group's recurring operating profit (ROP) totalled

€240 million, down 3.5% (-€9 million) compared to H1 2022.

Recurring EBITDA corresponds to recurring operating profit

adjusted for depreciation and amortisation. Based on net

depreciation and amortisation on tangible and intangible assets of

€60 million, compared to €63 million in H1 2022, recurring EBITDA

was €300 million, down 3.8% (-€12 million) compared to H1 2022.

As such, the recurring EBITDA margin was 23.3%. Excluding the

€10 million one-off allowance to support actions to prevent

underage gambling led by the associative sector, the margin rate

for H1 2023 would be 24.0%.

Other non-recurring operating profit and expenses amounted to

-€14 million, compared to -€6 million in H1 2022. They mainly

include the impact of the reassessment of Sporting Group's B2C -

spread betting assets in the process of being sold and costs

related to the external growth strategy.

Operating profit for H1 2023 was €225 million, down 5.7% (-€14

million) compared with H1 2022.

- Net income of €181 million, up 13%

compared to H1 2022 reported

The change in financial income (+€19 million in H1 2023 versus

-€22 million in H1 2022) reflects the rise in interest rates and a

more favourable financial market environment.

The Group's tax expense was €65 million, representing an

effective tax rate of 26.8% over H1 2023.

As such, consolidated net profit for H1 2023 amounted to €181

million, up 13.5% compared to H1 2022 reported.

Net cash surplus of €941 million at

end-June 2023

One indicator of the Group's cash position is the net cash

surplus (NCS)6.

At 30 June 2023, NCS amounted to €941 million. Its change

compared to the €900 million at 31 December 2022 is attributable

chiefly to:

- Free cash flow of €327 million, after taking into account a

working capital surplus of €78 million and investments in tangible

and intangible assets for €64 million;

- Partially offset by €253 million in dividends for 2022 and €38

million in tax.

For information, the net cash surplus at the end of June cannot

be extrapolated to the end of December as there are significant

calendar effects on the settlement of public levies, in particular

an advance payment on public levies in December.

2023 Outlook

Based on the first half of the year and the full impact of the

new Amigo formula expected in the second half, the Group now

expects revenue to grow by more than 5% and by more than 3% on a

like-for-like basis7, with the current EBITDA margin maintained at

around 24% for the full 2023 financial year8.

FDJ's Board of Directors met on 27 July 2023 and examined the

consolidated financial statements for the six months ended 30 June

2023, which were prepared under its responsibility.

The limited review procedures on the half-yearly financial

statements have been performed. The auditors' limited review report

is in the process of being issued.

The condensed half-yearly consolidated financial statements and

a financial presentation are available on the FDJ Group

website:

-

https://www.groupefdj.com/fr/investisseurs/publications-financieres.html

-

https://www.groupefdj.com/fr/actionnaires/presentations-financieres.html

The Group's next financial communication

FDJ will communicate on Thursday 19 October after the markets

close on its activity to the end of September 2023.

About La Française des Jeux (FDJ Group)

France’s leading gaming operator and one of the industry leaders

worldwide, FDJ offers responsible gaming to the general public in

the form of lottery games (draws and instant games), sports betting

(through its ParionsSport point de vente et ParionsSport en ligne

brands) and poker. FDJ’s performance is driven by a large portfolio

of iconic brands, the #1 local sales network in France, a growing

market, and recurring investments. The Group implements a strategy

of innovation to increase the attractiveness of its gaming and

service offering across all distribution channels, with a

responsible gaming experience.

FDJ Group is listed on the regulated market of Euronext Paris

(Compartment A – FDJ.PA) and is part of the SBF 120, Euronext 100,

Euronext Vigeo 20, EN EZ ESG L 80, STOXX Europe 600, MSCI Europe

and FTSE Euro indices.

For further information, www.groupefdj.com

1 On a 2022 basis including L'Addition and Aleda over comparable

periods. 2 Above €75m for Euromillions and €8m for Loto. 3 Versus

an increase initially expected of between +4% and +5% on a

like-for-like basis. Over the whole of the 2022 financial year,

revenue including L'Addition and Aleda for the full year would have

been €2,514m. 4 Net gaming revenue (NGR) corresponds to the GGR net

of public levies on games. It represents FDJ's remuneration for its

gaming activities. 5read betting involves predicting whether a

number of actions (or events) occurring during a match will be

greater or smaller than the range of actions (spread) set by the

trader. 6 This corresponds to non-current financial assets, current

financial assets and cash and cash equivalents, net of non-current

financial liabilities and current financial liabilities, less: (i)

current and non-current deposits and guarantees given; (ii) cash

subject to restrictions; (iii) amounts allocated exclusively to

Euromillions winners. As of 30 June 2023, it is also restated for

non-consolidated securities, mainly comprised of units in venture

capital funds (innovation). 7 Versus an increase initially expected

of between +4% and +5% on a like-for-like basis. 8 For the full

year 2022, revenue including L'Addition and Aleda for the entire

year would have been €2,514m.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230727107637/en/

Media Contact +33 (0)1 41 10 33 82 |

servicedepresse@lfdj.com

FDJ Group | La Française des Jeux 3-7, Quai du Point du Jour -

CS10177 92650 Boulogne-Billancourt Cedex www.groupefdj.com

Investor Relations Contact +33 (0)1 41 04 19 74 |

invest@lfdj.com

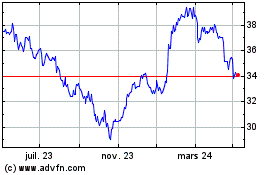

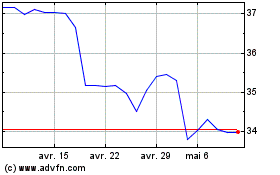

Francaise Des Jeux (EU:FDJ)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Francaise Des Jeux (EU:FDJ)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024