- Revenue of 2,621 million euros, up 6.5% and 2.8% on a

like-for-like basis1

- Strong lottery fundamentals, 4.9% excluding Euromillions and

Amigo

- Good momentum in sports betting and online gaming open to

competition, up +10.9%, supported by a presence in all gaming

segments

- Strong growth in all online games with an 18.8% increase in net

gaming revenue (NGR)2, to nearly 13% of the Group’s NGR

- Integration of Premier Lotteries Ireland and ZEturf in line

with expectations

- Recurring EBITDA of €657m, up 11.3%, i.e. a margin of

25.1%

- Excluding non-replicable year-end items, the margin would be

24.3%

- Net profit of €425m, which benefited from the high level

of recurring EBITDA and the very sharp change in financial

profit

- Responsible growth with recognised societal commitments

- Expanded and recreational gaming model and continued

commitments to reduce the share of gross gaming revenue generated

by high-risk players

- Implementation of the partnership with the non-profit sector to

support the prevention of underage gambling: €10m over the period

2023-2027

- Extra-financial ratings maintained at the highest level

- Performance benefiting of all stakeholders

- 4.3 billion euros contribution to public finances

- 56,000 jobs maintained or created in France

- 983 million euros paid to retailers

- Strong dividend3 growth at 1.78 euro per share, i.e. a

payout ratio of 80%

- 2024 targets: revenue growth in lottery and sports betting

and online gaming open to competition activities in France of

around 5%. With the contribution from other activities

(International, Payment & Services), the Group’s revenue growth

should be around 8%. Recurring EBITDA margin of around

24.5%

- On 22 January 2024, FDJ announced a tender offer for Kindred

to create a European gaming champion

- The tender offer will open on 20 February 2024 for a period of

nine months. In particular, its completion will remain subject to

obtaining regulatory authorisations.

Regulatory News:

La Française des Jeux (FDJ) (Paris:FDJ), the leading betting and

gambling operator in France, announces its 2023 results and 2024

outlook.

Stéphane Pallez, Chairwoman and CEO of the FDJ Group,

said: “FDJ delivered solid growth and results this year. The Group

reached in 2023 a major milestone in the implementation of its

strategy with the completion of the acquisition of Premier

Lotteries Ireland and ZEturf. The proposed acquisition of Kindred,

announced at the end of January, will enable the creation of a

European champion and significant value creation for the benefit of

all stakeholders, in line with our model combining performance and

responsibility.”

Key figures (in millions of euros)

2023

2022

Change in

Revenue*

2,621

2,461

+6.5%

Recurring operating

income

532

459

+15.8%

Net income

425

308

+38.1%

Dividend per share (€)

1.78

1.37

+29.9%

Recurring EBITDA**

657

590

+11.3%

Recurring EBITDA/revenue

margin

25.1%

24.0%

* Revenue: net gaming revenue and revenue

from other activities

** Recurring EBITDA: recurring operating

income adjusted for depreciation and amortisation expense

2023 highlights

Lottery, sports betting and online gaming open to

competition

- Strong lottery fundamentals: revenue of €1.938m, up 1.1% and

up 4.9% excluding Euromillions and Amigo

- Successful animation of the instant games

portfolio, such as the launches and relaunches of Carré Or

in January, Club Color in March, As de Cœur in October and Mission

Nature in November.

- Successful launch of EuroDreams, in

partnership with eight European lotteries This game, whose

first draw took place on 6 November, gives players the chance to

win up to €20,000 a month for 30 years at tier 1 and €2,000 a month

for five years at tier 2. EuroDreams is a success, especially

online, as this game has the highest digitisation rate of draw

games.

- Low number of high jackpot Euromillions

draws (> 75 million euros) After a 2022 financial year

that had registred a record number of high jackpot Euromillions

draws (43), 2023 was marked by the low number of these draws (23),

particularly in the 2nd semester (8 vs. 27 in 2022), which affected

overall stakes given the strong attraction of such jackpots.

Nevertheless, stakes on high jackpots offered in 2023 have reached

historically very high levels. As Euromillions is a game with a

high stakes-into-revenue conversion rate, the later was therefore

particularly affected by the low number of high jackpot draws. The

same applies to the performance of the online lottery, as this game

has a significant digitisation rate. Net gaming revenue from online

lottery games increased by more than 10%, and by more than 17%

excluding Euromillions. This performance was mainly due to a

further increase in the number of players. More than 5 million

players played at least once a year in an FDJ online lottery game.

In terms of responsible gaming, the target of generating less than

2% of the gross gaming revenue of online lottery games with

high-risk players was achieved in 2023.

- New Amigo formula Amigo, a

point-of-sale game with a draw every 5 minutes, was relaunched in

early June 2023 with a revised formula in accordance with the

decision of the French regulator (Autorité nationale des jeux).

This revision notably concerns the reduction in the number of draws

(with a suspension of 15 minutes per hour between 6:00 and 14:00)

and the maximum amount per bet (8 euros vs. 20 euros). Since its

relaunch, Amigo’s business has stabilised at a level down by around

25% compared to the same period in 2022.

- Good momentum in sports betting and online gaming open to

competition, bolstered by a presence in all gaming segments FDJ

has historically been present in point-of-sale and online sports

betting, online poker since the end of 2022 and online horse-race

betting since the acquisition of ZEturf at the end of 2023. Sports

betting and online gaming open to competition continued to show

good momentum, with a revenue up 10.9% to 518 million euros and up

8.4% excluding ZEturf. This performance is based on a still buoyant

sports betting market, which benefited in particular from the

momentum generated by the FIFA World Cup at the end of 2022. For

the 3rd consecutive year, ParionsSport En Ligne has gained market

shares. Revenue growth is also explained by the first consolidation

of ZEturf in the 4th quarter and sporting results favourable to the

operator, in particular during the Champions League and Ligue 1. In

addition, the poker offer works very well, with nearly 20% of

online sports betting players also playing it.

- Strong growth in online games: net gaming revenue (NGR) up

18.8% to nearly 13% of the total, compared to more than 11% in

2022 The strong momentum of the Group’s online activities,

lottery on the one hand and sports betting and online gaming open

to competition on the other, enabled FDJ to record an increase of

18.8% in its net gaming revenue from online games, which represents

nearly 13% of total NGR compared to more than 11% in 2022.

Excluding the integration of PLI and ZEturf in the 4th quarter, the

annual increase in NGR for online gaming activities would have been

13.9%. Confirmation of the exclusive rights of La Française des

Jeux by the Council of State Following a referral in December

2019 by an association and several gambling companies, the French

Council of State ruled, on 14 April 2023, that La Française des

Jeux’s exclusive rights comply with European Union law. It also

ruled that the twenty-five-year term of its exclusive rights,

defined in the framework of the Pacte Act, is not excessive.

Concerning the equalisation payment of 380 million euros paid to

the State in respect of its exclusive rights, the Council of State

will decide after the European Commission’s decision on the

appropriateness of this sum, following its State aid investigation

launched in July 2021. External growth transactions

- Premier Lotteries Ireland (PLI) On 3 November 2023, FDJ

finalised the acquisition of 100% of the share capital of Premier

Lotteries Ireland, which holds exclusive rights to operate the

Irish National Lottery until 2034, after the authorisation from the

Irish National Lottery regulator. This transaction is part of FDJ’s

strategic ambition to become an international B2C operator and FDJ

thus operates a foreign lottery for the first time.

PLI’s strategic plan aims to accelerate its growth and increase

its profitability by sharing the best practices of the two

operators so as to capitalise on FDJ’s experience to run PLI’s

instant games portfolio, boost the draw game player base, and

continue to improve the digital experience of Irish players.

- ZEturf The acquisition of the ZEturf group, an online

horse-race betting and online sports betting operator under the

ZEbet brand, was finalised on 29 September 2023 following the

authorisation from the French Competition Authority. ZEturf rounds

out FDJ’s online betting offering, which has become the 4th largest

operator in the French sports betting and online gaming open to

competition market, with a market share of more than 10%.

In order to take full advantage of the merger with ZEturf and

the synergies within its competitive online activity, the FDJ Group

will adopt a new organisation for this activity, in line with the

commitments made to the Competition Authority.

Societal commitments

- Increased support for the prevention of underage

gambling To further strengthen its actions in favour of

responsible gaming, FDJ is providing €10 million over the 2023-2027

period to support the underage gambling prevention programme

targeted at young people and implemented by the ARPEJ

association4.

- Extra-financial ratings maintained at the best levels

- For the fifth consecutive year, Moody’s ESG Solutions awarded

FDJ the highest sustainability rating in the “Hotels, Leisure and

Services” sector with 72/100. The second largest operator in the

sector received a rating of 53/100. The Group is ranked 20th out of

nearly 5,000 global companies monitored by Moody’s ESG

Solutions.

- FDJ remains in the Top 3 in its sector in the S&P Global

ESG Scores rating despite increased requirements.

- MSCI raised FDJ’s sustainability rating from “A” in 2021 and

2022 to “AA” in 2023, with a maximum rating of 10/10 on the

environmental side.

- Performance that benefits all stakeholders For the

eighth consecutive year, the Economic Information and Forecasting

Office (Bureau d’information et de prévision économique or

BDO-Bipe) assessed the FDJ Group’s economic and social contribution

in France.

- In 2023, FDJ’s contribution to national wealth amounted to 6.6

billion euros, i.e. 0.25% of Gross Domestic Product (GDP)

- In terms of employment, the FDJ Group’s activities created or

maintained 56,000 jobs in France, including 21,800 in the network

of bars, tobacconists and newsagents.

- FDJ’s growth is benefiting the national community and in

particular public finances, with a total contribution of

more than 4.3 billion euros, including 4.1 billion euros in public

levies on games, which benefit:

- Endangered French heritage sites. Thanks to

the Mission Patrimoine lottery games, more than 28 million euros

were donated to the French national heritage foundation (Fondation

du Patrimoine) for the 2023 edition;

- And French sport, both professional and

amateur, via the action of the National Sports Agency (ANS).

The company’s economic impact is significant, particularly

on:

- Local retail, with 983 million euros paid to its more

than 29,000 retailers;

- French suppliers, with 648 million euros in purchases,

mainly from SMEs and mid-caps, i.e. more than 85% of the total of

purchases.

FDJ Group’s value creation is shared between employees and

shareholders, with:

- Personnel costs of 369 million euros, including profit-sharing

and incentive bonuses representing 24% of total payroll5;

- 262 million euros in dividends in respect of the 2022 financial

year, which benefit veterans associations, who are founding

shareholders, to finance their social initiatives, and nearly

400,000 individual shareholders.

Post-closing events

On 22 January 2024, FDJ announced that it was launching a tender

offer for Kindred, one of Europe's leading online betting and

gaming companies, to implement its ambition to become an

international gaming operator, and thus create a European

champion.

This offer:

- Is made at a price of SEK 130 per share listed on Nasdaq

Stockholm, and corresponds to an enterprise value of Kindred of 2.6

billion euros;

- and will create value for FDJ’s shareholders. In particular, it

should result in a more than 10% accretion in dividend per share,

as soon as the dividend paid for the 2025 financial year.

- The transaction takes the form of a public tender offer, which

will open on 20 February 2024 for a period of nine months. The

completion of the takeover bid will remain subject in particular to

obtaining regulatory authorisations and the acquisition by FDJ of

at least 90% of Kindred’s share capital.

2024 targets

In line with the Group’s medium-term objectives, in 2024 FDJ

aims:

- Revenue growth from lottery and sports betting and online

gaming open to competition activities in France of around 5%. With

the contribution from other activities (International, Payment

& Services), the Group’s revenue growth should be

around8%;

- and a recurring EBITDA margin of around 24.5%.

To date, these projections do not include any element related to

the tender offer on Kindred.

In 2024, the lottery will benefit from the contribution of

EuroDreams on a full-year basis but will continue to be affected by

Amigo’s new formula in comparison until early June. A normative

level of Loto and Euromillions draws with high jackpots was

retained.

In sports betting and online gaming open to competition, the

2024 financial year will be marked by numerous major sporting

events (Africa Cup of Nations, UEFA EURO 2024, Paris 2024 Olympic

and Paralympic Games) and FDJ will continue to capitalise on its

offering enrichment. The high margin recorded by the operator on

sports betting in 2023 does not seem to be able to be renewed for

the 2024 financial year. Finally, the establishment of a new

organisation in order to fully benefit from the potential of the

merger with ZEturf, in line with the commitments made to the

Competition Authority, is continuing.

At the same time, the Group will continue to develop its

societal commitments, in particular to the fight against underage

gambling and excessive gambling.

2023 activity and

results

- Revenue of 2,621 million euros, up

6.5% and 2.8% on a like-for-like basis Gross gaming

revenue (GGR = stakes – player winnings) came to 6,710.4 million

euros (+2.8%). Net gaming revenue (NGR = GGR – public levies on

games) constitutes the FDJ Group’s remuneration from gaming. After

4,237.1 million euros in public levies (+2.2%), the NGR amounted to

2,481.4 million euros (+3.9%). After taking into account revenue

from other activities for 140.0 million euros, the Group’s revenue

amounted to 2,621.4 million euros, up 6.5% and up 2.8% on a

like-for-like basis.

€m

2023

2022

Change in €m

% change

Scope impact

Organic change

Lottery

1,937.8

1,916.2

+21.5

+1.1%

-

+1.1%

Sports betting and online gaming

open to competition

518.1

467.0

+51.1

+10.9%

+2.5%

+8.4%

Other activities

165.5

77.8

+87.6

+112.6%

+104.7%

+7.9%

Group total

2,621.4

2,461.1

+160.3

+6.5%

+3.7%

+2.8%

- Recurring operating income of 532

million euros and recurring EBITDA of 657 million euros,

representing a recurring EBITDA margin on revenue of 25.1% compared

to 24.0% in 2022 Cost of sales amounted to

1,392.5 million euros (+4.7%). This includes 983 million euros

(+1.9%) in remuneration paid to retailers, which are correlated to

stakes recorded in the network. The increase in other sales costs,

44.6 million euros, is mainly due to acquisitions, particularly

that of Aleda.

Marketing and communication costs include the costs of

advertising and designing offers, as well as the costs of IT

development and operation of games and services. They amounted to

455.6 million euros. The decline of 1.2% was mainly due to

advertising spending, particularly corporate communications, which

came out at 1% of GGR.

Administrative and general costs mainly comprise the

personnel and operating costs of the central functions, as well as

the costs of buildings and IT infrastructure. Their 14.2% increase

to 241.5 million euros was due in particular to a scope effect as

well as the exceptional allocation of 10 million euros to support

actions to prevent underage gambling carried out by the associative

sector over the 2023-2027 period.

The Group’s recurring operating profit was thus 531.8

million euros, up 15.8%.

Net depreciation and amortisation expenses amounted 125.1

million euros compared to 130.9 million euros in 2022.

Recurring EBITDA, recurring operating profit restated for

depreciation and amortisation, was 656.8 million euros, up 11.3%,

i.e. a recurring EBITDA margin of 25.1%, up from 24.0% recorded in

2022.

The recurring EBITDA level notably reflects the strong digital

momentum. It takes into account the exceptional level of sporting

results favourable to the operator at the end of the year and a

reversal of provisions relating to disputes with former

broker-agents. Without these elements, the margin rate would be

24.3%.

- Net income of 425 million euros

compared to 308 million euros in 2022 In 2023,

non-recurring operating revenue and expenses were stable at -10.6

million euros, and included in particular costs related to external

growth transactions.

Operating income amounted to 521.1 million euros in 2023, up

16.1% compared to 2022.

The change in financial profit (+42.7 million euros in 2023

versus -28.7 million euros in 2022) is mainly explained by the high

level of interest rates that remunerate the Group’s cash position,

whereas in 2022, the decline in the markets had affected the

Group’s financial profit. The revision of the Group’s investment

policy at the end of 2022 enabled it to fully benefit from this

rate hike in 2023.

The tax expense amounted to 141.0 million euros, representing an

effective rate of 25.0%.

Consolidated net profit thus amounted to 425.1 million euros

compared to 307.9 million euros in 2022.

By

business

The Group’s organisation is structured around

three operating segments: two Business Units (BUs), the Lottery and

Sports betting and online gaming open to competition, and

diversification activities (International, including PLI, and

Payment & Services) with cross-functional support functions (in

particular customer, distribution and information systems). In

addition, the holding company mainly covers overheads.

The contribution margin is one of the key

performance indicators for these segments. It is calculated as the

difference between segment revenue, sales costs (including retailer

remuneration) and marketing and communication costs (excluding

depreciation) allocated to them.

- Lottery Lottery revenue

totalled 1,937.8 million euros, up 1.1%. Sales costs totalled

1,045.5 million euros (+1.2%) and correspond mainly to the

remuneration of retailers, which are correlated to stakes recorded

in the network.

Marketing and communication costs totalled 169.6 million euros,

down 2.7%, mainly due to the decrease in advertising and

promotional expenses.

The contribution margin of the lottery was 722.6 million euros,

i.e. a contribution margin on revenue of 37.3%, up from 37.0% in

2022.

- Sports betting and online gaming open

to competition Revenue from sports betting and online

gaming open to competition amounted to 518.1 million euros, up

10.9% compared to 2022 and up 8.4% excluding the first

consolidation of ZEturf in the 4th quarter. Stable at the end of

September 2023 compared to 2022, the operator’s margin6 increased

significantly in the 4th quarter compared to the low rate in the

4th quarter of 2022 attributable in large part to the victories of

favourites in World Cup matches. Thus, over the full year, the

operator’s margin stood at more than 11%, up from its 2022 level.

Cost of sales amounted to 238.8 million euros, an increase of 1.6%.

They correspond mainly to the remuneration of retailers, which are

correlated to stakes recorded in the network. Other sales costs are

increasing, in particular due to the integration of ZEturf and the

first year of poker.

Marketing and communication costs amounted to 125.9 million

euros (+9.8%). Excluding ZEturf, they rose by only 3.4%, driven by

the development of the offering, while advertising and promotional

costs decline.

The contribution margin for sports betting was 153.4 million

euros, i.e. a contribution margin on revenue of 29.6%, compared to

25.1% in 2022.

- Other activities Other

activities (International including PLI, Payment & Services)

recorded a revenue of 165.5 million euros. The 87.6 million euros

increase compared to 2022 is mainly attributable to the full-year

effect of the acquisitions of L’Addition (end-July 2022) and Aleda

(end-November 2022) and the contribution of PLI from November 2023.

The contribution margin of 15.3 million euros in 2023 is mainly

attributable to PLI. Furthermore, as announced, measures have been

taken to improve the profitability of the Group's activities in the

United Kingdom, which is at breakeven in terms of contribution

margin.

- Holding company Holding

costs amounted to 234.5 million euros. Their 18.1 million euros

increase compared to 2022 is mainly attributable to the allocation

to actions to prevent underage gambling and perimeter effects.

Solid financial

structure and free cash flow of 855 million euros

The Group’s investments in tangible and

intangible assets amounted to 124.7 million euros, compared to

104.1 million euros in 2022. They mainly relate to the development

of information and back-office systems as well as point-of-sale

gaming terminals.

Acquisitions of ZEturf and PLI represented

483 million euros, taking into account the net debt of the acquired

companies.

The normalised change in working capital

linked to the activity (restated for calendar impacts and unclaimed

winnings) was 54 million euros in excess. Thus, based on recurring

EBITDA of 657 million euros, free cash flow7 amounted to 586

million euros, up from 545 million euros in 2022, with a recurring

EBITDA to cash conversion rate of 89%.

At the end of December 2023:

- The Group’s shareholders’ equity stood at 1,071.1 million euros

out of a balance sheet total of 3,760.8 million euros;

- The net cash surplus8, one of the indicators representative of

the Group’s net cash position, was 671 million euros, down from 900

million euros restated9 at the end of 2022; FDJ has available

cash10 of 855 million euros.

Dividend

FDJ’s Board of Directors, at its meeting of Tuesday 13 February,

approved the Group’s 2023 financial statements. It will propose a

dividend of 1.78 euros per share to the Shareholders’ Meeting of 25

April 2024, an increase of 30%, i.e. a payout ratio of 80% in line

with the Group’s commitments. Payment will be made on 7 May

2024.

The audit procedures on the consolidated financial statements

have been completed. The audit report will be released after the

review of the management report is finalized.

A financial presentation and the 2023 consolidated financial

statements, in French and English, are available on the FDJ Group

website: https://www.groupefdj.com/en/publications-and-results/

Next financial release

The FDJ Group will publish its revenue for the 1st quarter 2024

on Wednesday 17 April after the market close.

The FDJ Group will hold its Shareholders’ Meeting on Thursday 25

April 2024.

Forward-looking statements

This press release contains information on FDJ Group’s

objectives, as well as forward-looking statements. These statements

do not reflect historical data and must not be interpreted as

guarantees that the facts and data mentioned will occur. The

information contained herein is based on what the Group considers

to be reasonable data, assumptions and estimates. FDJ operates in a

competitive and rapidly changing environment. The Group is

therefore not in a position to anticipate all of the risks,

uncertainties or other factors likely to impact its activity, the

potential impact thereof on its activity, or even to what extent

the materialisation of a risk or a combination of risks could

present significantly different results from those mentioned in any

forward-looking statements. The information contained herein is

provided solely as at the date of the present press release. The

Group makes no commitment to update this information or the

assumptions on which it is based, aside from any legal and

regulatory obligations to which it is subject. FDJ will disclose to

the market any update to information provided that is likely to

have a significant impact on its activities, results, financial

position or outlook, in accordance with applicable regulations, and

will comply with the ongoing disclosure obligations applicable to

all companies the shares of which are listed for trading on the

regulated market of Euronext Paris.

About FDJ Group

France's leading gaming operator and one of the industry leaders

worldwide, FDJ offers responsible gaming to the general public in

the form of lottery games (draws and instant games), sports betting

(through its ParionsSport point de vente et ParionsSport en ligne

brands), horse-race betting and poker. FDJ's performance is driven

by a large portfolio of iconic brands, the leading local sales

network in France, a growing market, and recurring investments. The

Group implements an innovative strategy to increase the

attractiveness of its gaming and service offering across all

distribution channels, by offering a responsible customer

experience.

FDJ Group is listed on the regulated market of Euronext Paris

(Compartment A – FDJ.PA) and is part of the SBF 120, Euronext 100,

Euronext Vigeo 20, EN EZ ESG L 80, STOXX Europe 600, MSCI Europe

and FTSE Euro indices.

For more information, visit www.groupefdj.com

X @FDJ Facebook FDJ Instagram @FDJ_official LinkedIn

@FDJ

1Including Aleda and L’Addition on a

full-year basis in 2022 and excluding the 2023 contribution from

PLI and ZEturf

2NGR corresponds to gross gaming revenue

(GGR = stakes – player winnings) net of public levies

3Proposed to the Shareholders’ Meeting of

25 April 2024

4 Support is given to the RPEJ endowment

fund

5 Withheld at the Urssaf gross level

6 NGR rate on stakes

7 Free cash flow = cash flow generated by

operations after investments related to operations.

8 It corresponds to non-current financial

assets, current financial assets and cash and cash equivalents, net

of non-current financial liabilities and current financial

liabilities, less: (i) current and non-current deposits and

guarantees given; (ii) cash subject to restrictions; (iii) sums

allocated exclusively to the winners of the Euromillions game; (iv)

non-consolidated securities, mainly composed of units in venture

capital funds (FDJ Ventures).

9 Non-consolidated shares, presented under

non-current financial assets, are excluded from the definition of

Net Cash Surplus from January 1, 2023 and restated accordingly.

10 Cash available = cash & cash

equivalents net of Euromillions funds, and deposits available

within thirty-two days.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240214200437/en/

Media 01 41 10 33 82 | servicedepresse@lfdj.com

Investor Relations 01 41 04 19 74 | invest@lfdj.com

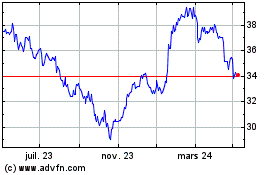

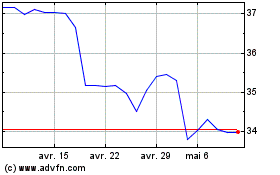

Francaise Des Jeux (EU:FDJ)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Francaise Des Jeux (EU:FDJ)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024