Gecina - Residential Portfolio: Signature by Nuveen Real Estate and Global Student Accommodation (GSA) of a Firm Acquisition Commitment on Student Housing Assets

18 Décembre 2024 - 8:21AM

Business Wire

Regulatory News:

Gecina (Paris:GFC):

Potential transaction with Nuveen Real Estate and GSA

expected to close in the first half of 2025 (subject to usual

conditions precedent)

- The firm acquisition commitment was

signed at an implied valuation of c. €567m including duties

(€539m excluding duties) for a portfolio of 18 assets in

operation (approximately 3,300 beds) and 4 development projects

(approximately 400 beds) to be transferred upon completion in

2025 (with €30m still to invest as of the end of 2023)

- The joint-venture between Nuveen Real

Estate, on behalf of its parent company TIAA, and GSA was selected

following the completion of a competitive sales process launched in

2024, after reviewing several robust offers from various

institutional investors and student housing operators demonstrating

strong interest from the market in this portfolio

- Nuveen Real Estate is a long-term US

investor, who has formed a strategic partnership with GSA, a global

pure-player student housing asset manager, not yet present in

the French market

- The potential transaction is expected to

close during the first half of 2025, subject to the usual

conditions precedent, the consultation of Gecina's employee

representative bodies and the information of the employees

concerned according to applicable regulations

- Gecina, leveraging its expertise and

platform, will assist the buyer and their operating partner Yugo

in operating the portfolio through the transition period until

the end of 2025

A long-term value-creation story reflecting Gecina's know-how

in development, investment, asset-management, and operational

performance

- Gecina operates a residential portfolio

of €3.5bn with strong focus in Paris, with an efficient platform

integrating the full range of real estate expertise (asset

management, leasing, property management, maintenance and

engineering), featuring fully digitalized B2C business processes

securing high occupancy and high-end market rents

- This prime student housing portfolio

represents c. 2.5% of Gecina's global portfolio and c. 11.9% of its

residential portfolio, always located in central areas or near

major university campuses in France

- The company has focused on delivering

products that meet market demands for centrality and

connectivity to transportation hubs, amenities and services,

streamlined and digitalized procedures for clients, bringing

gross rents from €16.8m in 2018 (pre-pandemic) to €25.6m expected

in 2024 excluding assets under development (i.e. a net rent

after operating platform costs expected at €20.8m in 2024)

- Gecina now leverages insights from

student housing performance drivers, by applying them to its

broader residential portfolio (with a multi-offerings approach

including furnished and serviced turnkey apartments) to

strategically drive growth in the coming years

An opportunity to crystallize value and redeploy capital in

our value accretive pipeline

Beñat Ortega, Chief Executive Officer: “This remarkable

transaction project illustrates Gecina's expertise in creating

value through an active development, asset management and portfolio

rotation strategy. The value crystallized will allow us to further

consolidate our balance sheet, finance our value-creating office

and residential pipeline, and provide additional leeway to finance

opportunistic acquisitions while respecting our investment

discipline”.

Financial agenda

2024 Earnings press release: February 13, 2025, after market

close

About Gecina

As a specialist for centrality and uses, Gecina operates

innovative and sustainable living spaces. A real estate investment

company, Gecina owns, manages and develops a unique portfolio at

the heart of the Paris Region’s central areas, with more than 1.2

million sq.m of offices and more than 9,000 housing units, almost

three-quarters of which are located in Paris City or

Neuilly-sur-Seine. These portfolios are valued at 17.1 billion

euros at end-June 2024.

Gecina has firmly established its focus on innovation and its

human approach at the heart of its strategy to create value and

deliver on its purpose: “Empowering shared human experiences at the

heart of our sustainable spaces”. For our 100,000 clients, this

ambition is supported by our client-centric brand YouFirst. It is

also positioned at the heart of UtilesEnsemble, our program setting

out our solidarity-based commitments to the environment, to people

and to the quality of life in cities.

Gecina is a French real estate investment trust (SIIC) listed on

Euronext Paris, and is part of the SBF 120, CAC Next 20, CAC Large

60 and CAC 40 ESG indices. Gecina is also recognized as one of the

top-performing companies in its industry by leading sustainability

benchmarks and rankings (GRESB, Sustainalytics, MSCI, ISS-ESG and

CDP).

www.gecina.fr

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241217603454/en/

Gecina Contacts

Financial communications

Nicolas BROBAND Tel.: +33 (0)1 40 40 18 46

nicolasbroband@gecina.fr

Attalia NZOUZI Tel.: + 33 (0)1 40 40 18 44

attalianzouzi@gecina.fr

Press relations

Glenn DOMINGUES Tel.: + 33 (0)1 40 40 63 86

glenndomingues@gecina.fr

Armelle MICLO Tel.: + 33 (0)1 40 40 51 98

armellemiclo@gecina.fr

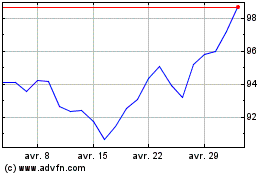

Gecina Nom (EU:GFC)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

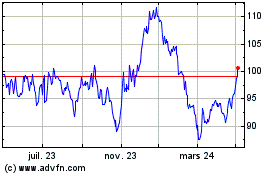

Gecina Nom (EU:GFC)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025