Getlink: Q1 2022: Revenue up 46%

21 Avril 2022 - 7:30AM

Business Wire

Regulatory News:

Getlink (Paris:GET):

► Group

- Q1 revenue was €227.8m, up 46% on the same period in

20211

- Eurotunnel

- Eurotunnel Shuttle revenue was €137.6m, up 55% reflecting

the lifting of travel restrictions for passenger traffic and the

normalisation of truck traffic.

- Railway Network revenue was up 57% to €52m thanks to the

strong upturn in the number of Eurostar travellers since the

lifting of testing requirements in February.

Yann Leriche, Group Chief Executive Officer said:

"The good momentum seen in the first quarter confirms the relevance

of our offers and our new services across all Group activities. The

strong rebound in passenger traffic and the levels reached over the

Easter holidays show that our customers are keen to resume their

travels.”

► First quarter 2022: key

events

- Eurotunnel

- Le Shuttle Freight

- Strong growth of 23% in truck traffic in the first quarter,

with 374,868 vehicles transported.

- Le Shuttle

- Upturn in passenger traffic linked to the progressive lifting

of travel restrictions.

- Rail freight

- The launch, with the CAT group, of a cross-Channel rail freight

service for Toyota.

- Approval by the European Commission of the Eurostar-Thalys

merger, a positive signal towards developing new cross-Channel

passenger traffic.

- Signing of agreements with Eurostar, DB Cargo and GBRf

promoting their cross-Channel traffic by allowing the

non-duplication of their safety certificates.

- Europorte

- Increase in revenue, up 3% to €33 million.

- Carrying out tests on the French national rail network of

Alstom’s TER Régiolis hybrid train, on behalf of DB

Systemtechnik.

- Launch of its first rail motorway service between Sète (France)

and Cologne (Germany), on behalf of Cargo Beamer.

- ElecLink

- Validation by the Intergovernmental Commission of the safety

dossier.

► REVENUES: FIRST

QUARTER

(€ million)

Q1 2022

Q1 2021

Q1 2021

unaudited

recalculated*

Change

published**

Exchange rate €/£

1.193

1.193

1.152

Shuttle Services

137.6

88.9

55%

87.8

Railway Network

52.0

33.1

57%

32.6

Other revenues

5.2

2.1

150%

2.1

Sub-total Eurotunnel

194.8

124.1

57%

122.5

Europorte

33.0

31.9

3%

31.9

Revenue

227.8

156.0

46%

154.4

* Recalculated using the average exchange rate for the first

three months of 2022: £1 = €1.193. ** Exchange rate for the first

three months of 2021: £1 = €1.152.

A. Group

Consolidated Group revenue is up 46% at a constant exchange

rate, to €227.8 million, driven by the return of Le Shuttle and

Eurostar passenger traffic following the gradual lifting of travel

restrictions linked to the health crisis during the quarter, and

the normalisation of truck traffic.

B. Eurotunnel

At €194.8 million, Eurotunnel’s revenue was up 57% in the first

quarter of 2022 compared to the same period in 2021.

Revenue for the Shuttle activity was €137.6 million, up 55% in

comparison to the same period last year, driven by growth in both

passenger and truck traffic.

Railway Network revenue grew strongly, up 57% to €52 million,

driven by the gradual upturn in passenger numbers travelling

between the different countries served by Eurostar.

C. Rail freight operators: Europorte and its

subsidiaries

Europorte’s revenue increased by 3% to €33 million, driven

notably by the launch of new services including the first

intermodal service between Sète and Cologne.

► EUROTUNNEL TRAFFIC: FIRST

QUARTER

Q1 2022

Q1 2021

Change

Truck Shuttles

Trucks

374,868

305,103

23%

Passenger Shuttles

Passenger vehicles¹

294,762

116,057

154%

High-speed passenger trains²

(Eurostar)

Passengers

996,702

88,051

1,032%

Rail freight trains 3

Trains

377

442

-15%

1Including cars, motorcycles, vehicles with trailers, caravans,

motor homes and coaches. 2Only Eurostar passengers travelling

through the Channel Tunnel are included in this table, excluding

those who travel between continental stations (such as

Brussels-Calais, Brussels-Lille, Brussels-Amsterdam, etc.). 3Rail

freight services by train operators (DB Cargo for BRB, SNCF and its

subsidiaries, GB Railfreight, Rail Operations Group, RailAdventure

and Europorte) using the Tunnel.

A. Eurotunnel Shuttles

- Le Shuttle: Car traffic increased by 156% in the

first three months of the year. Eurotunnel’s market share for cars

in Q1 2022 reached 75%.

- Le Shuttle Freight: Eurotunnel truck traffic saw

a 23% increase over the first three months of 2022 compared to the

same period of 2021, in a market up 15.5% benefitting from a

favourable base effect. Eurotunnel confirms its position as the

leading player in the market, with a 41% share in Q1 2022, up 2.5

points compared to Q1 2021.

B. Railway Network

- High-speed trains: Eurostar saw a strong increase in

cross-Channel traffic in Q1 2022, with nearly 1 million passengers

thanks to the gradual lifting of travel restrictions.

- Cross-Channel rail freight: In the first three months of

the year, the number of rail freight trains passing through the

Tunnel decreased by 15% to 377. Despite the launch of a significant

new service for Toyota, this decrease reflects the disruption of

international supply chains, notably those linked to

semi-conductors.

This positive quarter, marked by organic strong growth, the

reinforcement of yield, high booking levels observed for the summer

period as well as the forthcoming ElecLink commercial

commissioning, confirms the Group’s leadership.

_______________________________

1 All comparisons with Q1 2021

revenue are made at the average exchange rate of the first three

months in 2022 of £1 = €1.193.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220420006172/en/

For UK media enquiries contact: John Keefe on + 44

(0) 1303 284491 Email: press@getlinkgroup.com

For other media enquiries contact: Romain Dufour on

+33(0)1 4098 0464

For investor enquiries contact: Jean-Baptiste Roussille

on +33 (0)1 40 98 04 81 Email :

jean-baptiste.roussille@getlinkgroup.com

Michael Schuller on +44 (0) 1303 288749 Email:

Michael.schuller@getlinkgroup.com

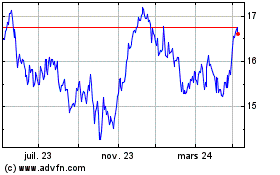

Getlink (EU:GET)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

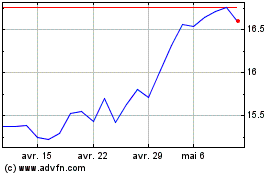

Getlink (EU:GET)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024