-

-

Inventiva secures €21.4 million leading to completion of the first

tranche of the financing for c. €116 million, part of the

multi-tranche equity financing of up to €348 million announced on

October 14, 2024.

-

Proceeds from the completed first tranche to be primarily used to

advance Inventiva’s Phase III, NATiV3 clinical trial evaluating

lanifibranor in patients with MASH.

-

Appointment of Mark Pruzanski as new Chairman of the Board of

Directors and Srinivas Akkaraju as new member of the Board of

Directors.

Daix (France), New York City (New

York, United States), December 16, 2024 – Inventiva (Euronext

Paris and Nasdaq: IVA) (“Inventiva” or the

“Company”), a clinical-stage biopharmaceutical company

focused on the development of oral small molecule therapies for the

treatment of metabolic dysfunction-associated steatohepatitis

(“MASH”) and other diseases with significant unmet medical

needs, today announced that, following the general meeting of the

shareholders held on December 11, 2024 (the “General

Meeting”), the Board of Directors decided to use the

delegations granted by the General Meeting to issue the second

phase of Tranche 1 (the “T1 bis Transaction”) for a

gross amount of €21.4 million (net amount of €20.1 million) of the

multi-tranche equity financing of up to €348 million announced on

October 14, 2024 (the “Multi-Tranche Financing”).

Frédéric Cren, Chief Executive Officer of

Inventiva, stated: "We are pleased to announce that we

secured €21.4 million successfully completing the first tranche of

the financing announced in October. The multi-tranche equity raise

of up to €348 million has been instrumental to keep Inventiva on

track with recruitment for our pivotal Phase III clinical trial of

our asset lanifibranor. We believe that lanifibranor holds

significant potential to address unmet medical needs, and we are

encouraged by the intensification of trial activities, with a

completion of our recruitment expected in the first half of 2025. I

am also delighted to welcome Mark and Srinivas to our Board of

Directors. Their expertise and strategic insights will be

invaluable as we advance our clinical program and prepare for a

potential NDA filing for lanifibranor."

On October 14, 20241 the Company announced the

Multi-Tranche Financing and the completion of a capital increase of

an aggregate of €94.1 million through the issuance of 34,600,507

new ordinary shares of the Company, par value €0.01 per share (the

“T1 New Shares”) at a price of €1.35 per T1 New Share, and

the issuance of 35,399,481 prefunded warrants to purchase up to

35,399,481 ordinary shares at an exercise price of €0.01 per new

ordinary share (the “T1 BSAs”) at a subscription price of

€1.34 per T1 BSA, subject to the satisfaction of customary closing

conditions. Settlement and delivery of the T1 New Shares and the T1

BSAs, took place on October 17, 2024.

Following issuance of the T1 New Shares and T1

BSAs, and the subsequent adoption by shareholders of the

appropriate resolutions by the General Meeting, the Board of

Directors decided on December 13, 2024 to use the delegations

granted by the General Meeting to proceed with the T1 bis

Transaction, consisting of 7,872,064 new ordinary shares (the

“T1 bis Shares”) at a subscription price of €1.35 per T1 bis

Share and 8,053,847 pre-funded warrants to purchase up to 8,053,847

ordinary shares at an exercise price of €0.01 per new ordinary

share (the “T1 bis BSAs”) at a subscription price of €1.34

per T1 bis BSA, for aggregate gross proceeds of €21,419,441.38.

Reasons for the issuance and use of the

proceeds of the T1 bis Transaction

The Company intends to use the net proceeds of

€20.1 million from the T1 bis Transaction, together with available

cash, as follows: approximately 85% for the clinical program

evaluating lanifibranor for the treatment of MASH (“NATiV3”)

and, in the event of positive NATiV3 results, for the submission of

a new drug application, and the remainder, approximately 15%, for

general corporate purposes. The Company has undertaken not to use

these proceeds for the early redemption of its financial debt prior

to its scheduled maturity or for the repurchase of securities

issued as part of the T1 bis Transaction, subject to the

implementation of its liquidity contract with Kepler Cheuvreux.

Working capital statement

As of the date of this press release, the

Company believes that its net working capital would not be

sufficient to meet its obligations over the next 12 months. As of

September 30, 2024, 2024, the Company had cash and cash equivalents

of €13.9 million, compared with cash and cash equivalents of €26.9

million and €9.0 million of long-term deposit2 at December 31,

2023.

Taking into account its current cost structure

and expected expenses and taking into account the (i) the receipt

of €94.1 million in gross proceeds from the issuance of the T1 New

Shares and the T1 BSAs, (ii) the anticipated receipt of €21.4

million in gross proceeds from the T1 bis Transaction, and (iii)

the first milestone of $10 million (gross proceeds) received under

the amendment to the licensing agreement with Chia Tai Tianqing

Pharmaceutical (Guangzhou) CO., LTD. (“CTTQ”), the Company

estimates that its cash, cash equivalents and deposits would enable

it to finance its operations until the middle of the third quarter

of 20253. Accordingly, the Company will not have sufficient net

working capital to meet its current obligations over the next 12

months from the date of this press release.

Based on its current business plan, the Company

estimates that to cover its obligations until mid-December 2025 its

additional cash requirements amount to between €120 million and

€130 million.

Subject to satisfaction of the applicable

conditions precedent, if the second tranche of the Multi-Tranche

Financing is completed for anticipated gross proceeds of €116

million, the Company could extend its financial visibility beyond

12 months.

To the extent the applicable conditions

precedent for the issuance of the second tranche of the

Multi-Tranche Financing are not satisfied and/or the T3 Triggering

Event (as defined in the press release published on October 14,

2024) does not occur and, therefore, the Company does not receive

any of the contemplated gross proceeds from the issuance of the

ABSAs or exercise of the T3 BSAs (each as defined in the press

release published on October 14, 2024), the Company will need to

raise additional funds to support its business and its research and

development programs as currently contemplated through:

-

other potential public offerings or private placements of equity or

debt instruments; or

-

potential strategic options such as business development

partnerships and/or licensing agreements.

Main characteristics of the T1 bis

Transaction

Pursuant to the 5th to 32nd resolutions of the

General Meeting and in accordance with Articles L. 225-138 and

seq. of the French Commercial Code (Code de commerce), the Board of

Directors held on December 13, 2024 has decided to issue, without

shareholders’ preferential subscription rights, the T1 bis Shares

to the investors named in resolutions 6 to 22 of the General

Meeting and the T1 bis BSAs to the investors named in resolutions

24 to 32 of the General Meeting.

Conditions precedent to the issuance and

subscription of the T1 bis Shares and T1 bis BSAs

The issuance by the Company of the T1 bis Shares

and T1 bis BSAs was subject to the approval of the General Meeting

no later than December 16, 2024 and the absence of a “material

adverse change” (defined as any event, breach or circumstance,

individually or in the aggregate, that has had or could reasonably

be expected to have a material adverse effect on the clinical

development stages of lanifibranor, or on the manufacture of the

new drug in preparation for commercial launch, or with respect to

the company's ability to successfully complete the NATiV3 trial and

obtain the necessary Food and Drug Administration approvals)

between October 17, 2024 and the settlement and delivery of the T1

bis Shares and T1 bis BSAs.

Subscription price of the T1 bis Shares and the

T1 bis BSAs

On December 11, 2024, the General Meeting set

the subscription price (i) of each T1 bis Share to €1.35 (i.e.,

€0.01 nominal value and €1.34 premium) (the “T1 bis Subscription

Price”) and (ii) of each T1 bis BSAs to €1.34, which

corresponds to the T1 bis Subscription Price (i.e., €1.35) reduced

by the nominal value of an ordinary share (€0.01).

Allocation of the T1 bis Transaction

The number of T1 bis Shares and T1 bis BSAs were

subscribed by each investor pro rata to the number of T1 New Shares

and T1 BSAs subscribed for by such investor.

Form of the T1 bis Shares and the T1 bis

BSAs

The T1 bis Shares shall be registered in pure

registered form (au nominatif pur) under French law until the

earlier of (x) the date of settlement-delivery of T2 New Shares (as

defined in the press release published on October 14, 2024) or (y)

May 20, 2025. Thereafter, the T1 bis Shares will be held at the

option of the holder either in registered form (au nominatif) or in

bearer form (au porteur).

The T1 bis BSAs will be securities giving access

to the capital within the meaning of Article L. 228-91 of the

French Commercial Code. They will be issued in dematerialized form

and held in pure registered form (au nominatif pur) until the

expiration of the lock-up (described below) in the securities

account opened in the name of the investor in the books of the

Company's account keeper. No physical document evidencing ownership

of the T1 bis BSAs will be issued. The T1 bis BSAs will not be

listed but will be admitted to Euroclear.

The shares issued upon the exercise of T1 bis

BSAs (the “T1 bis Warrant Shares”) will be held in pure

registered form (au nominatif pur) until expiration of the lock-up

and thereafter at the option of the holder, in registered form (au

nominatif) or in bearer form (au porteur).

As soon as they are issued, the T1 bis Shares

and T1 bis Warrant Shares will be automatically assimilated to the

Company's ordinary shares and will be admitted to trading on the

regulated market of Euronext Paris under ISIN number

FR0013233012.

Lock-up on T1 bis Shares, T1 bis BSAs and T1 bis

Warrant Shares

Investors participating in the T1 bis

Transaction have agreed to a lock-up on the T1 bis Shares, the T1

bis BSAs and the T1 bis Warrant Shares until the earlier of (x) the

issuance date of the ABSAs or (y) May 20, 2025, subject to certain

exceptions (including transfers to an affiliate to the investor, to

another investor, or, subject to the agreement of the Company in

its sole discretion, to any third party who makes the same lock-up

commitment on the T1 bis Shares and on the T1 bis BSAs and T1 bis

Warrant Shares).

Representation of T1 bis BSAs

The T1 bis BSAs holders will each be grouped

automatically for the defense of their common interests in a masse.

The masses will act, in part, through a representative and, in

part, through collective decisions of the relevant holders.

T1 bis Transaction participants

BVF Partners LP (“BVF”), which holds

approximately 9.8% of the share capital and approximately 8.6% of

the voting rights of the Company as of the date hereof and not

taking into account the T1 bis Transaction, subscribed to 1,872,668

T1 bis BSAs for an amount of approximately €2.5 million. Assuming

the issuance of the T1 bis Shares and the T1 bis BSAs, BVF will

hold approximately 9.0% of the share capital of the Company, on a

non-diluted basis immediately following the settlement and delivery

of the T1 bis Shares and the T1 bis BSAs.

New Enterprise Associates (“NEA”), which

holds approximately 9% of the share capital and approximately 7.8%

of the voting rights of the Company as of the date hereof and not

taking into account the T1 bis Transaction, subscribed to 514,846

T1 bis Shares for an amount of approximately €700,000 and to

2,917,464 T1 bis BSAs for an amount of approximately €3.9 million.

Assuming the issuance of the T1 bis Shares and the T1 bis BSAs, NEA

will hold approximately 8.8% of the share capital of the Company,

on a non-diluted basis immediately following the settlement and

delivery of the T1 bis Shares and the T1 bis BSAs.

Sofinnova Crossover I SLP (“Sofinnova”),

which holds approximately 7.4% of the share capital and

approximately 7.5% of the voting rights of the Company as of the

date hereof and not taking into account the T1 bis Transaction,

subscribed to 311,654 T1 bis Shares for an amount of approximately

€420,000. Assuming the issuance of the T1 bis Shares and the T1 bis

BSAs, Sofinnova will hold approximately 7.1% of the share capital

of the Company, on a non-diluted basis immediately following the

settlement and delivery of the T1 bis Shares and the T1 bis

BSAs.

Yiheng Capital Management, L.P.,

(“Yiheng”), which holds approximately 6.3% of the share

capital and approximately 5.5% of the voting rights of the Company

as of the date hereof and not taking into account the T1 bis

Transaction, subscribed to 370,689 T1 bis Shares for an amount of

approximately €500,000. Assuming the issuance of the T1 bis Shares

and the T1 bis BSAs, Yiheng will hold approximately 6.2% of the

share capital of the Company, on a non-diluted basis immediately

following the settlement and delivery of the T1 bis Shares and the

T1 bis BSAs.

Invus Public Equities, (“Invus”), which

holds approximately 8.7% of the share capital and approximately

7.6% of the voting rights of the Company as of the date hereof and

not taking into account the T1 bis Transaction, subscribed to

1,372,924 T1 bis Shares for an amount of approximately €1.8

million. Assuming the issuance of the T1 bis Shares and the T1 bis

BSAs, Yiheng will hold approximately 9.5% of the share capital of

the Company, on a non-diluted basis immediately following the

settlement and delivery of the T1 bis Shares and the T1 bis

BSAs.

Andera Partners, (“Andera”), which holds

approximately 5.8% of the share capital and approximately 5.0% of

the voting rights of the Company as of the date hereof and not

taking into account the T1 bis Transaction, subscribed to 1,139,527

T1 bis Shares for an amount of approximately €1.5 million. Assuming

the issuance of the T1 bis Shares and the T1 BSAs, Andera will hold

approximately 6.5% of the share capital of the Company, on a

non-diluted basis immediately following the settlement and delivery

of the T1 bis Shares and the T1 bis BSAs.

Perceptive Advisors, (“Perceptive”),

which holds approximately 5.2% of the share capital and

approximately 4.5% of the voting rights of the Company as of the

date hereof and not taking into account the T1 bis Transaction,

subscribed to 1,029,693 T1 bis Shares for an amount of

approximately €1.3 million and to 343,321 T1 bis BSAs for an amount

of approximately €460,000. Assuming the issuance of the T1 bis

Shares and the T1 bis BSAs, Perceptive will hold approximately 5.8%

of the share capital of the Company, on a non-diluted basis

immediately following the settlement and delivery of the T1 bis

Shares and the T1 bis BSAs.

Governance

As previously announced, Mark Pruzanski and

Srinivas Akkaraju have been appointed as directors by the

shareholders, replacing Pierre Broqua and Sofia BVBA, represented

by Chris Buyse, during the General Meeting for a term expiring at

the end of the annual general meeting to be held in 2027 to approve

the financial statements for the year ending December 31, 2026.

The General Meeting also approved (i) a

remuneration policy for the Chairperson of the Board of Directors

and for the Chief Executive Officer applicable in respect of the

current year from the date of separation of the functions of the

Chairperson of the Board of Directors and the Chief Executive

Officer, (ii) an amendment to the remuneration policy of the Deputy

Chief Executive Officer and (ii) an amendment to the remuneration

policy of the directors.

On December 13, 2024, the Board of Directors

acknowledged the separation of the roles of the Chairperson of the

Board of Directors and the Chief Executive Officer as well as the

appointment of Mark Pruzanski as Chairperson of the Board of

Directors and Frédéric Cren as Chief Executive Officer.

Up to four new members of the Board of Directors

may be appointed or co-opted, during the next general meeting and

at the latest, during the general meeting of shareholders convened

to approve the financial statements for the year ending December

31, 2025, (other than Frédéric Cren, Mark Pruzanski and Srinivas

Akkaraju), one of which upon the proposal of BVF, and three of

which upon the proposal of each of the three largest

subscribers.

Exemption of a French Listing Prospectus

The Company, for the purpose of listing the T1

bis Shares and the T1 bis Warrant Shares issuable upon exercise of

the T1 bis BSAs on the regulated market of Euronext Paris, is

exempt from the requirement to file with the Autorité des marchés

financiers a French-language listing prospectus, as these

securities are fungible with securities already admitted to trading

on the same regulated market, and represent, over a twelve-month

period, less than 30% of the number of securities already admitted

to trading on the same regulated market in accordance with Article

1(5)(a) of Regulation (EU) 2017/1129 of the European Parliament and

of the Council of 14 June 2017, as amended by Regulation (EU)

2024/2809 of 23 October 2024.

Impact of the T1 bis Transaction on the share

capital

Following the settlement and delivery of the T1

bis Shares and the T1 bis BSAs, the Company’s share capital will be

€949,497.59, divided into 94,949,759 shares.

For illustration purposes, the impact of the

issuance of the T1 bis Shares and the T1 bis Warrant Shares

(assuming full exercise) on the ownership of a shareholder holding

1% of the Company’s share capital prior to the T1 bis Transaction

and not subscribing to it, is as follows (calculation made on the

basis of the Company's share capital as of October 30, 2024):

|

|

Percentage of capital |

|

Non-diluted basis |

Diluted basis(1) |

|

Before issuance of the T1 bis Shares and T1 bis BSAs |

1% |

0.65% |

|

After issuance of the T1 bis Shares and the T1 bis BSAs |

0.92 % |

0.62 % |

|

After issuance of the T1 bis Shares and Warrant Shares upon

exercise of the T1 bis BSAs |

0.85 % |

0.58 % |

(1) Calculations are based on the assumption

that all share subscription warrants (BSA) and warrants for the

subscription of business creators’ shares (BSPCE) will be exercised

and that all allocated free shares (actions gratuites) will

vest.

Impact of the T1 bis Transaction on

shareholders' equity

For illustration purposes, the impact of the

issuance of the T1 bis Shares and the T1 bis Warrant Shares

(assuming full exercise) on the Company's equity per share

(calculation made on the basis of the Company's equity at October

30, 2024) is as follows:

|

|

Equity per share in euros |

|

Non-diluted basis |

Diluted basis(1) |

|

Before issuance of the T1 bis Shares and T1 bis BSAs |

€ - 0.21 |

€ -0.14 |

|

After issuance of the T1 bis Shares and the T1 bis BSAs |

€ - 0.08 |

€ - 0.06 |

|

After issuance of the T1 bis Shares and Warrant Shares upon

exercise of the T1 bis BSAs |

€ 0.03 |

€ 0.02 |

(1) Calculations are based on the assumption that all

share subscription warrants (BSA) and warrants for the subscription

of business creators' shares (BSPCE) will be exercised and that all

allocated free shares (actions gratuites) will vest.

Evolution of the shareholding structure in

connection with the T1 bis Transaction

The shareholding structure of the Company prior

to the T1 bis Transaction is set forth below:

|

|

Shareholding prior to the T1 bis Transaction |

|

|

On a non-diluted basis |

|

Shareholders |

Number of Shares |

% of share capital |

Number of voting rights |

% of voting rights |

|

Frédéric Cren |

5,612,224 |

6.45% |

11,224,448 |

11.23% |

|

Pierre Broqua |

3,882,500 |

4.56% |

7,765,000 |

7.77% |

|

Sub-total – Concert |

9,494,724 |

10.91% |

18,989,448 |

19.0% |

|

BVF Partners L.P. |

8,545,499 |

9.81% |

8,545,499 |

8.55% |

|

New Enterprise Associates (NEA) |

7,835,884 |

9.00% |

7,835,884 |

7.84% |

|

Invus |

7,606,810 |

8.74% |

7,606,810 |

7.61% |

|

Sofinnova |

6,440,093 |

7.40% |

7,480,654 |

7.49% |

|

Yiheng |

5,474,986 |

6.29% |

5,474,986 |

5.48% |

|

Qatar Holding LLC |

5,157,233 |

5.92% |

5,157,233 |

5.16% |

|

Andera Partners |

5,008,620 |

5.75% |

5,008,620 |

5.01% |

|

Perceptive |

4,525,862 |

5.20% |

4,525,862 |

4.53% |

|

Employees |

1,338,127 |

1.54% |

2,282,563 |

2.28% |

|

ISLS Consulting |

111,000 |

0.13% |

222,000 |

0.22% |

|

Treasury shares |

106,115 |

0.12% |

- |

0.00% |

|

Directors (non-executive) |

10,000 |

0.01% |

10,000 |

0.01% |

|

Free floats |

25,422,742 |

29.20% |

26,799,821 |

26.81% |

|

Total |

87,077,695 |

100.00% |

99,939,380 |

100.00% |

The issuance of T1 bis Shares and the T1 bis

BSAs will have the following impact on the allocation of the share

capital and the voting rights of the Company:

|

|

Shareholding following the issuance of the T1 bis Shares

and the T1 bis BSAs |

|

|

On a non-diluted basis |

|

Shareholders |

Number of Shares |

% of share capital |

Number of voting rights |

% of voting rights |

|

Frédéric Cren (Family) |

5,612,224 |

5.91% |

11,224,448 |

10.41% |

|

Pierre Broqua |

3,882,500 |

4.09% |

7,765,000 |

7.20% |

|

Sub-total – Concert |

9,494,724 |

10.00% |

18,989,448 |

17.61% |

|

Invus |

8,979,734 |

9.46% |

8,979,734 |

8.33% |

|

BVF Partners L.P. |

8,545,499 |

9.00% |

8,545,499 |

7.93% |

|

New Enterprise Associates (NEA) |

8,350,730 |

8.79% |

8,350,730 |

7.75% |

|

Sofinnova |

6,751,746 |

7.11% |

7,792,307 |

7.23% |

|

Andera Partners |

6,148,147 |

6.48% |

6,148,147 |

5.70% |

|

Yiheng |

5,845,675 |

6.16% |

5,848,675 |

5.42% |

|

Perceptive |

5,555,555 |

5.85% |

5,555,555 |

5.15% |

|

Qatar Holding LLC |

5,157,233 |

5.43% |

5,157,233 |

4.78% |

|

Eventide |

5,059,258 |

5.33% |

5,059,258 |

4.69% |

|

Employees |

1,338,127 |

1.41% |

2,282,563 |

2.12% |

|

ISLS Consulting |

111,000 |

0.12% |

222,000 |

0.21% |

|

Treasury shares |

106,115 |

0.11% |

0 |

0.00% |

|

Directors (non-executive) |

10,000 |

0.01% |

10,000 |

0.01% |

|

Free float |

23,496,216 |

24.75% |

24,873,295 |

23.07% |

|

Total |

94,949,759 |

100.00% |

107,811,444 |

100.00% |

About Inventiva

Inventiva is a clinical-stage biopharmaceutical

company focused on the research and development of oral small

molecule therapies for the treatment of patients with MASH and

other diseases with significant unmet medical need. The Company

benefits from a strong expertise and experience in the field of

compounds targeting nuclear receptors, transcription factors and

epigenetic modulation. Inventiva is currently advancing one

clinical candidate, has a pipeline of two preclinical programs and

continues to explore other development opportunities to add to its

pipeline.

Inventiva’s lead product candidate,

lanifibranor, is currently in a pivotal Phase III clinical trial,

NATiV3, for the treatment of adult patients with MASH, a common and

progressive chronic liver disease.

Inventiva’s pipeline also includes odiparcil, a

drug candidate for the treatment of adult MPS VI patients. As part

of Inventiva’s decision to focus clinical efforts on the

development of lanifibranor, it suspended its clinical efforts

relating to odiparcil and is reviewing available options with

respect to its potential further development. Inventiva is also in

the process of selecting a candidate for its Hippo signaling

pathway program.

The Company has a scientific team of

approximately 90 people with deep expertise in the fields of

biology, medicinal and computational chemistry, pharmacokinetics

and pharmacology, and clinical development. It owns an extensive

library of approximately 240,000 pharmacologically relevant

molecules, approximately 60% of which are proprietary, as well as a

wholly owned research and development facility.

Inventiva is a public company listed on compartment B of the

regulated market of Euronext Paris (ticker: IVA, ISIN:

FR0013233012) and on the Nasdaq Global Market in the United States

(ticker: IVA).

www.inventivapharma.com

Contacts

|

Inventiva Pascaline ClercEVP of Global External

Affairsmedia@inventivapharma.com +1 202 499

8937 |

Brunswick GroupTristan Roquet Montegon /Aude

Lepreux /Julia CailleteauMedia

relationsinventiva@brunswickgroup.com +33 1 53 96 83

83 |

Westwicke, an ICR CompanyPatricia L. BankInvestor

relationspatti.bank@westwicke.com

+1 415 513-1284 |

|

|

|

|

|

|

Important NoticeThis press release

contains certain “forward-looking statements” within the meaning of

the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. All statements, other than statements of

historical facts, included in this press release are

forward-looking statements. These statements include, but are not

limited to, forecasts and estimates with respect to Inventiva’s

cash resources, the anticipated proceeds from the T1 bis

Transaction and Inventiva’s expected use of such proceeds,

satisfaction of the closing conditions and timing of closing,

settlement and delivery of the T1 bis Transaction, Inventiva’s cash

position following the closing of the T1 bis Transaction, the

satisfaction in part or full of the T2 Conditions Precedent, the

occurrence of the T3 Triggering Event, the anticipated proceeds

from Tranche 2 of the Multi-Tranche Financing and the exercise by

the investors of the warrants and pre-funded warrants issued or to

be issued in connection with the Multi-Tranche Financing,

Inventiva’s expectations with respect to ownership in its share

capital by certain investors, forecasts and estimates with respect

to Inventiva’s pre-clinical programs and clinical trials, including

design, protocol, duration, timing, recruitment, costs, screening

and enrollment for those trials, including the ongoing NATiV3 Phase

III clinical trial of lanifibranor in MASH, and the results and

timing thereof and regulatory matters with respect thereto,

clinical trial data releases and publications, the information,

insights and impacts that may be gathered from clinical trials,

potential regulatory submissions, approvals and commercialization,

Inventiva’s pipeline and preclinical and clinical development

plans, the clinical development of and regulatory plans and pathway

for lanifibranor, and future activities, expectations, plans,

growth and prospects of Inventiva. Certain of these statements,

forecasts and estimates can be recognized by the use of words such

as, without limitation, “believes”, “anticipates”, “expects”,

“intends”, “plans”, “seeks”, “estimates”, “may”, “will”, “would”,

“could”, “might”, “should”, “designed”, “hopefully”, “target”,

“potential”, “opportunity”, “possible”, “aim”, and “continue” and

similar expressions. Such statements are not historical facts but

rather are statements of future expectations and other

forward-looking statements that are based on management's beliefs.

These statements reflect such views and assumptions prevailing as

of the date of the statements and involve known and unknown risks

and uncertainties that could cause future results, performance, or

future events to differ materially from those expressed or implied

in such statements. Actual events are difficult to predict and may

depend upon factors that are beyond Inventiva's control. There can

be no guarantees with respect to pipeline product candidates that

the clinical trial results will be available on their anticipated

timeline, that future clinical trials will be initiated as

anticipated, that product candidates will receive the necessary

regulatory approvals, or that any of the anticipated milestones by

Inventiva or its partners will be reached on their expected

timeline, or at all. Future results may turn out to be materially

different from the anticipated future results, performance or

achievements expressed or implied by such statements, forecasts and

estimates due to a number of factors, including that interim data

or data from any interim analysis of ongoing clinical trials may

not be predictive of future trial results, the recommendation of

the DMC may not be indicative of a potential marketing approval,

Inventiva cannot provide assurance on the impacts of the Suspected

Unexpected Serious Adverse Reaction on enrollment or the ultimate

impact on the results or timing of the NATiV3 trial or regulatory

matters with respect thereto, that Inventiva is a clinical-stage

company with no approved products and no historical product

revenues, Inventiva has incurred significant losses since

inception, Inventiva has a limited operating history and has never

generated any revenue from product sales, Inventiva will require

additional capital to finance its operations, in the absence of

which, Inventiva may be required to significantly curtail, delay or

discontinue one or more of its research or development programs or

be unable to expand its operations or otherwise capitalize on its

business opportunities and may be unable to continue as a going

concern, Inventiva’s ability to obtain financing, to enter into

potential transactions and Inventiva’s ability to satisfy in part

or full the closing conditions for the T1 bis Transaction and T2

Conditions Precedent, and whether and to what extent the prefunded

warrants issued in connection with the Multi-Tranche Financing may

be exercised and by which holders, Inventiva's future success is

dependent on the successful clinical development, regulatory

approval and subsequent commercialization of current and any future

product candidates, preclinical studies or earlier clinical trials

are not necessarily predictive of future results and the results of

Inventiva's and its partners’ clinical trials may not support

Inventiva's and its partners’ product candidate claims, Inventiva's

expectations with respect to its clinical trials may prove to be

wrong and regulatory authorities may require holds and/or

amendments to Inventiva’s clinical trials, Inventiva’s expectations

with respect to the clinical development plan for lanifibranor for

the treatment of MASH may not be realized and may not support the

approval of a New Drug Application, Inventiva and its partners may

encounter substantial delays beyond expectations in their clinical

trials or fail to demonstrate safety and efficacy to the

satisfaction of applicable regulatory authorities, the ability of

Inventiva and its partners to recruit and retain patients in

clinical studies, enrollment and retention of patients in clinical

trials is an expensive and time-consuming process and could be made

more difficult or rendered impossible by multiple factors outside

Inventiva's and its partners’ control, Inventiva's product

candidates may cause adverse drug reactions or have other

properties that could delay or prevent their regulatory approval,

or limit their commercial potential, Inventiva faces substantial

competition and Inventiva’s and its partners' business, and

preclinical studies and clinical development programs and

timelines, its financial condition and results of operations could

be materially and adversely affected by geopolitical events, such

as the conflict between Russia and Ukraine and related sanctions,

impacts and potential impacts on the initiation, enrollment and

completion of Inventiva’s and its partners’ clinical trials on

anticipated timelines and the conflict in the Middle East and the

related risk of a larger conflict, health epidemics, and

macroeconomic conditions, including global inflation, fluctuations

in interest rates, uncertain financial markets and disruptions in

banking systems. Given these risks and uncertainties, no

representations are made as to the accuracy or fairness of such

forward-looking statements, forecasts, and estimates. Furthermore,

forward-looking statements, forecasts and estimates only speak as

of the date of this press release. Readers are cautioned not to

place undue reliance on any of these forward-looking

statements.

Please refer to the Universal Registration

Document for the year ended December 31, 2023 filed with the

Autorité des Marchés Financiers on April 3, 2024 as amended on

October 14, 2024 and the Annual Report on Form 20-F for the year

ended December 31, 2023 filed with the Securities and Exchange

Commission (the “SEC”) on April 3, 2024 and the Half-Year Report

for the six months ended June 30, 2024 on Form 6-K filed with the

SEC on October 15, 2024 for other risks and uncertainties affecting

Inventiva, including those described under the caption “Risk

Factors”, and in future filings with the SEC. Other risks and

uncertainties of which Inventiva is not currently aware may also

affect its forward-looking statements and may cause actual results

and the timing of events to differ materially from those

anticipated. All information in this press release is as of the

date of the release. Except as required by law, Inventiva has no

intention and is under no obligation to update or review the

forward-looking statements referred to above. Consequently,

Inventiva accepts no liability for any consequences arising from

the use of any of the above statements.

DisclaimersThis press release does not

constitute an offer to sell or the solicitation of an offer to buy

securities in any jurisdiction, and shall not constitute an offer,

solicitation or sale in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of that jurisdiction.The

distribution of this document may, in certain jurisdictions, be

restricted by local legislations. Persons into whose possession

this document comes are required to inform themselves about and to

observe any such potential local restrictions.

France

The T1 bis Shares and the T1 bis BSAs (the

“Securities”) have not been and will not be

offered or sold to the public in France (except for public

offerings defined in Article L.411-2 1° of the French Monetary and

Financial Code).The Securities may only be offered or sold in

France pursuant to Article L. 411-1 of the French Monetary and

Financial Code to “qualified investors” (as such term is defined in

Article 2(e) of Prospectus Regulation) acting for their own

account, and in accordance with Articles L. 411-1, L. 411-2 and D.

411-2 to D.411-4 of the French Monetary and Financial Code.This

announcement is not an advertisement and not a prospectus within

the meaning of the Prospectus Regulation.

European Economic AreaIn

relation to each Member State of the European Economic Area (each,

a ‘‘Member State’’) no offer to the public of

Securities may be made in that Member State other than:

-

to any legal entity which is a ‘‘qualified investor’’ as defined in

the Prospectus Regulation;

-

to fewer than 150 natural or legal persons (other than a qualified

investor as defined in the Prospectus Regulation), subject to

obtaining the prior consent of the representatives of the Placement

Agents for any such offer; or

-

in any other circumstances falling within Article 1(4) of the

Prospectus Regulation, provided that no such offer of Securities

shall require us or any Placement Agent to publish a prospectus

pursuant to Article 3 of the Prospectus Regulation or supplement a

prospectus pursuant to Article 23 of the Prospectus Regulation and

each person who initially acquires any shares or to whom any offer

is made will be deemed to have represented, acknowledged and agreed

to and with each of the Placement Agents and the Company that it is

a ‘‘qualified investor’’ as defined in the Prospectus

Regulation.

For the purposes of this provision, the

expression an ‘‘offer to the public’’ in relation to any Securities

in any Member State means the communication in any form and by any

means of sufficient information on the terms of the offer and any

Securities to be offered so as to enable an investor to decide to

purchase any ordinary shares.

United Kingdom

This document is only being distributed to, and

is only directed at, persons in the United Kingdom that (i) are

“investment professionals” falling within Article 19(5) of the

Financial Services and Markets Act 2000 (Financial Promotion) Order

2005 (as amended, the “Order”), (ii) are persons

falling within Article 49(2)(a) to (d) (“high net worth companies,

unincorporated associations, etc.”) of the Order, or (iii) are

persons to whom an invitation or inducement to engage in investment

activity (within the meaning of Article 21 of the Financial

Services and Markets Act 2000) in connection with the issuance or

sale of any securities may otherwise lawfully be communicated or

caused to be communicated (all such persons together being referred

to as “Relevant Persons”). This document is

directed only at Relevant Persons and must not be acted on or

relied on by persons who are not Relevant Persons. Any investment

or investment activity to which this document relates is available

only to Relevant Persons and will be engaged in only with Relevant

Persons.

United States of America

This press release shall not constitute an offer

to sell or a solicitation of an offer to buy these securities in

the United States of America, nor shall there be any sale of these

securities in any state or other jurisdiction in which such offer,

solicitation or sale would be unlawful prior to the registration or

qualification under the securities laws of any such state or other

jurisdiction.None of the securities issued or to be issued in

connection with the Multi-Tranche Financing have been registered

under the Securities Act of 1933, as amended, and such securities

may not be offered or sold in the United States except pursuant to

an effective registration statement or an applicable exemption from

the registration requirements.

1 Press release of October 14, 20242 The long-term

deposit had a two year-term, were accessible prior to the

expiration of the term with a notice period of 31 days and were

considered as liquid by the Company3 This estimate is based on the

Company’s current business plan and excludes any proceeds from

subsequent tranches of the Multi-Tranche Financing, potential

milestones payable to or by the Company and any additional

expenditures related to the potential continued development of the

odiparcil program or resulting from the potential in licensing or

acquisition of additional product candidates or technologies, or

any associated development the Company may pursue. The Company may

have based this estimate on assumptions that are incorrect, and the

Company may end up using its resources sooner than anticipated.

- Inventiva - PR - Financing T1bis - EN - 12 16 2024

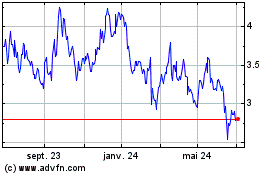

Inventiva (EU:IVA)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Inventiva (EU:IVA)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024