AKWEL: 2021 TURNOVER TOTALS €922.4 MILLION

10 Février 2022 - 5:45PM

AKWEL: 2021 TURNOVER TOTALS €922.4 MILLION

Thursday 10

February 2022

2021 TURNOVER

TOTALS €922.4 MILLION

-

Turnover up when comparing like-for-like

figures

-

Record net cash position at €108.3 million

-

Confirmation of a marked decrease in the 2021 current

operating income

AKWEL (FR0000053027, AKW, PEA-eligible), the

automotive and HGV equipment and systems manufacturer specialising

in fluid management and mechanisms, posted consolidated turnover of

€922.4m in 2021, down by -1.6%, but up +2.8% comparing

like-for-like figures.

Consolidated turnover

(1 January to 31 December)

|

In € millions - unaudited |

2021 |

2020 |

Variation |

Like-for-like variation (1) |

|

1st half-year |

487.5 |

387.1 |

+25.9% |

+33.7% |

|

3rd quarter |

211.4 |

262.0 |

-19.3% |

-17.3% |

|

4th quarter |

223.5 |

288.1 |

-22.4% |

-20.6% |

|

Total for 12 months |

922.4 |

937.2 |

-1.6% |

+2.8% |

(1) Comparing like-for-like

figures.

ACTIVITY CONTINUING TO FALL IN Q4

2021

Compared to the second half of 2020, which saw a

clear upturn in activity following the near-stoppage of global

automobile production in Q2 2020, Q4 2021 was part of a downward

trend that is comparable to the previous year. Production levels in

the global automotive industry remained low in a context that

continues to pose difficulties in terms of raw materials and

electronic components. Over the course of the 2021 financial year

as a whole, which was characterised both by an upturn in activity

following the 2020 crisis and by a major lack of visibility

regarding supply, which disrupted its manufacturer clients’

production, AKWEL recorded growth of 2.8% when comparing

like-for-like figures. Currency fluctuations resulted in a

significant annual impact of -€40.3m, with the Turkish lira

accounting for -€30.8m and the US dollar accounting for -€9.8m.

Products & Functions turnover reached

€882.0m in 2021, with slight growth experienced in Cooling

activities (+2.5%), which now represents 24.9% of the total

turnover, and Mechanisms (+1.9%). The Depollution product line

limited its contraction to -2.9% with aftermarket sales. Tooling

turnover stood at €30.7m, down by -27.3% after two atypical

financial years in 2019 and 2020.

ANALYSIS OF THE BREAKDOWN OF

REVENUE

The annual growth trends are relatively similar

across geographical zones, aside from Asia and the Middle East

where the drop is more pronounced as a result of the more

significant reductions in production volumes among supplied

manufacturers, particularly in Turkey. The geographical breakdown

by production zone was as follows in 2021:

-

France: €264.8 million (-3.9%)

-

Europe (excluding France) and Africa: €278.1 million (+1.8%)

-

North America: €234.8 million (+0.7%)

-

Asia and the Middle East (including Turkey): €137.7 million

(-8.3%)

-

South America: €7.0 million (+37.3%)

A STRONG IMPROVEMENT IN NET CASH

POSITION

Net cash excluding lease obligations increased

by €10.0m in Q4 to reach €108.3m by financial year end, an increase

of €47.7m over the year, confirming that the group is continuing to

generate strong free cash flow.

OUTLOOK

In a context of low visibility and high

volatility in terms of manufacturers’ production levels, AKWEL has

succeeded in keeping up with its clients’ demand, thanks in

particular to an intentionally cautious stock management approach.

Disruption to production and cost increases resulting from supply

limitations will, as predicted, weigh heavily on the group’s

current operating income for 2021. This is expected to have fallen

by around 35%, including an additional provision for warranty

returns of around €7m, for a similar level of current operating

margin to the 2018 and 2019 financial years.

Visibility regarding the global vehicle market

over 2022 remains poor at this time, making all forecasting

exercises difficult. In this context, AKWEL nonetheless anticipates

an increase in its turnover and will focus its efforts on its

industrial model to ensure it efficiently adapts to these market

conditions and to better serve its manufacturer clients. Bolstered

by a solid financial position, the group will also continue to

invest in its long-term development by focusing on product

developments in its sector, particularly new mobility

solutions.

|

Next press release: 2021 annual results, 07 April 2022, after the

markets close. |

|

An independent, family-owned group listed on the Euronext

Paris Stock Exchange, AKWEL is an automotive and HGV equipment and

systems manufacturer specialising in fluid management and

mechanisms, offering first-rate industrial and technological

expertise in applying and processing materials (plastics, rubber,

metal) and mechatronic integration.Operating in

20 countries across every continent, AKWEL employs more than

10,000 people worldwide.Euronext Paris – Compartment

B – ISIN: FR0000053027 – Reuters: AKW.PA – Bloomberg: AKW:FP |

- 2022-02-10_AKWEL_TO-2021_EN

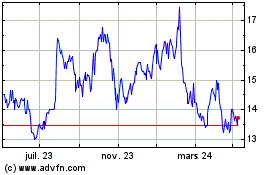

Mgi Coutier (EU:AKW)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

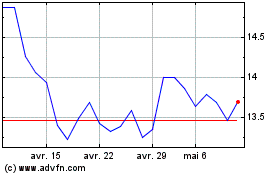

Mgi Coutier (EU:AKW)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024