First Half 2024 Results

Further market share

gains

Upgrading guidance

July 18, 2024

-

H1 2024 net revenue organic growth of +5.4%; +7.4% on a

like-for-like revenue basis

-

Stronger than expected Q2 net revenue organic growth at

+5.6%

-

Accelerating versus 4Y Q2 CAGR of 4.7%

-

Gaining market share with c. 400

bps1 outperformance versus peer

average

-

Solid performance across all regions in Q2:

-

Continued momentum in the U.S. at +5.3%

-

Robust Europe at +4.2% on top of a high

comparable

-

Strong APAC at +7.7%, with China accelerating to

+10.5%

-

Operating margin rate at record H1 level of 17.3%,

including AI investment

-

Headline diluted EPS up +5.3% at €3.38, Free cash

flow2 up at €744m

-

Upgrading full year 2024 net revenue organic growth to

+5-6% vs +4-5% previously, despite persistent macro

uncertainties

-

Maintaining industry-high 2024 financial KPIs: Operating

margin at 18.0%, Free cash flow2

between €1.8bn-1.9bn

|

Q2 2024 |

|

|

Net revenue |

€3,458m |

|

Reported growth |

+6.8% |

|

Organic growth |

+5.6% |

|

H1 2024 Results |

|

|

|

(EUR million) |

H1 2024 |

2024 vs 2023 |

|

Revenue |

7,650 |

+7.7% |

|

Net revenue |

6,688 |

+5.9% |

|

Organic growth |

+5.4% |

|

|

Operating margin |

1,160 |

+6.1% |

|

Operating margin rate |

17.3% |

|

|

Headline Groupe net income |

857 |

+5.4% |

|

Headline diluted EPS (euro) |

3.38 |

+5.3% |

|

Free cash flow2 |

744 |

+2.6% |

1 Based on consensus

2 Before change in working capital

requirements

Arthur Sadoun, Chairman and CEO of Publicis

Groupe:

“Publicis achieved a very strong first half of

the year, with net revenue organic growth at +5.4% and +7.4% growth

on a like-for-like revenue basis.

We continued to win market share, with Q2 net

revenue organic growth accelerating to +5.6%, above expectations

and 400bps ahead of our industry.

For the first 6 months of the year, we kept

delivering industry leading financial KPIs.

Despite a backdrop of ongoing macro-economic

pressures, not only did our H1 performance demonstrate that our

model is strong. It also showed that our outperformance versus our

peers is sustainable, with our growth rate close to doubling that

of our competitors since 2019.

As a result, we are confident in our ability to

accelerate further in H2.

We are raising our net revenue organic growth

guidance and now expect to deliver between +5-+6%. We will maintain

our best-in-class financial ratios while continuing to make

material investments in our talent and AI strategy.

As we further extract ourselves from the pack,

we have everything we need to continue to lead and reinvent our

industry thanks to our transformation.

We have a winning go to market, which has put us

at the head of the new business rankings for the past five years.

We have taken the leadership of personalization at scale,

demonstrated by our combined Data and Media offering’s double-digit

growth this quarter, for the third year in a row. And thanks to

Publicis Sapient, we are uniquely positioned to partner with our

clients in their AI-led transformation.

I would like to take this opportunity to thank

all of our clients for their trust. I would also like to thank our

people around the world for their outstanding work. Sustaining

these levels of outperformance in such a difficult environment is

an everyday battle and with the Executive Committee we are truly

grateful for all of their efforts.”

. .

.

The Publicis Board of Directors met on July 17, 2024

under the chairmanship of Arthur Sadoun and approved the financial

statements for the first half of 2024.

KEY FIGURES

|

EUR million, except per-share data and

percentages |

H1 2024 |

H1 2023 |

2024 vs 2023 |

|

Data from the Income statement and Cash flow

statement |

|

|

|

|

Net revenue |

6,688 |

6,318 |

+5.9% |

|

Pass-through revenue |

962 |

787 |

+22.2% |

|

Revenue |

7,650 |

7,105 |

+7.7% |

|

EBITDA |

1,401 |

1,335 |

+4.9% |

|

% of net revenue |

20.9% |

21.1% |

-20bps |

|

Operating margin |

1,160 |

1,093 |

+6.1% |

|

% of net revenue |

17.3% |

17.3% |

0bps |

|

Operating income |

1,008 |

843 |

+19.6% |

|

Net income attributable to the Groupe |

773 |

623 |

+24.1% |

|

Earnings per share (EPS) |

3.08 |

2.48 |

+24.2% |

|

Headline diluted EPS3 |

3.38 |

3.21 |

+5.3% |

|

Free cash flow before change in working capital requirements |

744 |

725 |

+2.6% |

|

Data from the Balance sheet |

June 30, 2024 |

Dec 31, 2023 |

|

|

Total assets |

35,918 |

36,716 |

|

|

Groupe share of Shareholders’ equity |

9,916 |

9,788 |

|

|

Net debt (net cash) |

99 |

(909) |

|

3 Net income attributable to the Groupe, after elimination of

impairment charges, amortization of intangibles arising on

acquisitions, the main capital gains (or losses) on disposals,

change in the fair value of financial assets, the revaluation of

earn-out costs, divided by the average number of shares on a

diluted basis

NET REVENUE IN Q2 2024

Publicis Groupe’s net revenue in Q2 2024 was

3,458 million euros, up +6.8% from 3,239 million euros in 2023.

Exchange rates had a small positive impact of 13 million euros.

Acquisitions, net of disposals, accounted for an increase in net

revenue of 25 million euros. Organic growth reached +5.6%.

Breakdown of Q2 2024 net revenue by

region

|

EUR |

Net revenue |

Reported |

Organic |

|

million |

Q2 2024 |

Q2 2023 |

growth |

growth |

| North

America |

2,104 |

1,955 |

+7.6% |

+5.2% |

| Europe |

856 |

809 |

+5.8% |

+4.2% |

| Asia

Pacific |

306 |

300 |

+2.0% |

+7.7% |

| Middle East

& Africa |

100 |

91 |

+9.9% |

+9.1% |

|

Latin America |

92 |

84 |

+9.5% |

+18.9% |

|

Total |

3,458 |

3,239 |

+6.8% |

+5.6% |

North America net revenue was

up +7.6% on a reported basis, including a positive impact of the

U.S. dollar to euro exchange rate. Organic growth in the region was

+5.2%. In the U.S., organic growth came at +5.3%,

with Media and Epsilon continuing to be accretive this quarter,

confirming the strength of our integrated offer in this geography

where our model is the most advanced. Media grew double-digits, on

top of double-digit growth over the last two years, while Epsilon

posted mid-single digit growth mainly led by Digital Media and Data

activities. Publicis Sapient posted a slight decline on top of a

solid +5% in Q2 2023, in a context of continued “wait and see”

attitude from clients. Creative activities were broadly stable.

Net revenue in Europe was up by

+5.8% on a reported basis and +4.2% organically. Organic growth in

the U.K. was broadly stable, with double-digit

growth in Media and Creative. Organic growth in

France was +4.2% led by mid-single-digit growth in

Media while Publicis Sapient faced a challenging comparable base.

Germany posted +3.4% organic growth driven by

Media and Publicis Sapient. Central & Eastern

Europe was very strong at +17.4% organically, with

double-digit growth in most countries, led by both Media and

Creative.

Net revenue in Asia Pacific

recorded +2.0% growth on a reported basis and +7.7% on an organic

basis. China accelerated to +10.5% organic growth

after +6.7% in Q1 2024, benefitting from new business wins in

Media. South-East Asia posted high-single-digit

growth, fueled by Thailand, India and Malaysia.

Australia was up by a low-single-digit, improving

sequentially from Q1 2024.

In Middle East & Africa,

net revenue was up +9.9% on a reported basis, and +9.1%

organically, largely driven by double-digit-growth in Media and

Publicis Sapient.

Net revenue in Latin America

was up +9.5% on a reported basis, and +18.9% organically, led by

both Media and Creative, notably in Brazil, Mexico and

Colombia.

NET REVENUE IN H1 2024

Publicis Groupe’s net revenue for the first half

of 2024 was 6,688 million euros, up by 5.9% compared to 6,318

million euros in the first half of 2023. Exchange rate variations

over the period had a small negative impact of 16 million euros.

Acquisitions (net of disposals) had a positive impact of 43 million

euros on net revenue. Organic growth was +5.4% in the first half of

2024.

Breakdown of H1 2024 net revenue by

sector

On the basis of 3,266 main clients representing

92% of Groupe net revenue

Breakdown of H1 2024 net revenue by

region

|

EUR |

Net revenue |

Reported |

Organic |

|

million |

H1 2024 |

H1 2023 |

growth |

growth |

|

North America |

4,112 |

3,893 |

+5.6% |

+5.0% |

| Europe |

1,649 |

1,552 |

+6.3% |

+5.1% |

| Asia

Pacific |

572 |

550 |

+4.0% |

+7.0% |

| Middle East

& Africa |

190 |

179 |

+6.1% |

+6.6% |

|

Latin America |

165 |

144 |

+14.6% |

+14.0% |

|

Total |

6,688 |

6,318 |

+5.9% |

+5.4% |

Net revenue in North America

was up by +5.0% on an organic basis in the first half of 2024

(+5.6% on a reported basis). The U.S. performed

strongly with +5.2% organic growth.

Europe posted +5.1% organic

growth in the first half (+6.3% on a reported basis). The

U.K. was broadly stable, France at +6.6%,

Germany at +4.1% and Central & Eastern

Europe at +19.2% on an organic basis.

Asia Pacific net revenue was up

by +7.0% on an organic basis (+4.0% on a reported basis).

China reported an organic growth of +8.9%, and

Australia was up by +1.3% on an organic basis.

Net revenue in the Middle East &

Africa region was up by +6.6% on an organic basis (+6.1%

on a reported basis) and up by +14.0% in Latin

America (+14.6% on a reported basis).

ANALYSIS OF H1 2024 KEY FIGURES

Income statement

EBITDA amounted to 1,401

million euros in H1 2024, compared to 1,335 million euros in H1

2023, up by +4.9%. This represents 20.9% of net revenue.

Personnel costs totaled 4,498

million euros in H1 2024 from 4,200 million euros in H1 2023, an

increase of +7.1%. As a percentage of net revenue, personnel

expenses were 67.3% in H1 2024, versus 66.5% in H1 2023. Fixed

personnel costs were 4,006 million euros and represented 59.9% of

net revenue versus 59.0% in H1 2023, the increase being largely

attributable to the AI investment. The cost of freelancers remained

stable compared to H1 2023 in percentage of net revenue,

representing 174 million euros in H1 2024. Restructuring costs were

41 million euros, slightly down versus 45 million euros in H1

2023.

Non personel costs amounted to

1,030 million euros in H1 2024, compared to 1,025 million euros in

H1 2023. This represented 15.4% of net revenue in H1 2024 versus

16.2% of net revenue in H1 2023, improving by 80 basis points. They

comprised:

- Other operating

expenses (excluding pass-through costs, depreciation &

amortization) amounted to 789 million euros, compared to 783

million euros in H1 2023. They represent 11.8% of net revenue,

compared to 12.4% in H1 2023, reflecting solid cost control.

- Depreciation and

amortization charge was 241 million euros in H1 2024,

stable compared to 242 million euros in H1 2023.

As a result, the operating

margin amounted to 1,160 million euros, up by +6.1%

compared to H1 2023. This represents an operating margin rate of

17.3% in H1 2024, in line with H1 2023, while including circa 45

million euros relating to the Groupe’s AI investment.

Operating margin rates by

geographies were 18.7% in North America, 16.1% in Europe,

19.6% in Asia-Pacific, 3.7% in Middle East & Africa and 3.6% in

Latin America.

Amortization of intangibles arising from

acquisitions totaled 123 million euros in H1 2024, down 19

million euros versus H1 2023, related to the end of the

amortization associated with technologies.

Impairment losses amounted to

45 million euros, down from 112 millions euros in H1 2023, as 2023

included the impact of our real estate footprint optimization.

In addition, non-current

expense was an income of 16 million euros, mainly

corresponding to the contribution of the CitrusAd and Epsilon

technologies to the Group's 49%-owned associate Unlimitail. In H1

2023, non-current income amounted to 4 million euros.

Operating income totaled 1,008

million euros in H1 2024, versus 843 million euros in H1 2023.

The financial result,

comprising the cost of net financial debt and other financial

charges and income, was at 0 million euro in H1 2024, compared to a

charge of 14 million euros in H1 2023.

- The cost of net financial

debt was an income of 39 million euros in H1 2024,

compared to an income of 42 million euros in H1 2023. In H1 2024,

it included 61 million euros of financial expenses (59 million

euros in H1 2023) and financial income of 100 million euros,

broadly stable versus last year.

- Other financial income and

expenses were a charge of 39 million euros in H1 2024,

notably composed by 42 million euros interest on lease liabilities

and 7 million euros income from the fair value remeasurement of

mutual funds. In H1 2023, other financial income and expenses were

a charge of 56 million euros, notably composed by 39 million euros

interest on lease liabilities and 8 million euros cost from the

fair value remeasurement of Mutual Funds.

The revaluation for earn-outs

payments was an income of 28 million euros in H1 2024,

compared to 1 million euros income in H1 2023.

The income tax

charge was 256 million euros in H1 2024, corresponding to

a forecasted effective tax rate of 24.9% for 2024, compared to 205

million euros in H1 2023 corresponding to a forecasted effective

tax rate of 24.8% for 2023.

The share of profit of

associates is a 3 million euros loss in H1 2024, compared

to a 3 million euros profit in H1 2023.

Minority interests were a gain

of 4 million euros in H1 2024 compared to a gain of 5 million euros

in Groupe results in H1 2023.

Overall, net income attributable to the

Groupe was 773 million euros in H1 2024, compared to 623

million euros in H1 2023.

Finally the earning per share

was 3.08 euros in H1 2024, compared to 2.48 euros in H1 2023, up by

+24.2%.

Free cash flow

|

EUR million |

H1 2024 |

H1 2023 |

|

EBITDA |

1,401 |

1,335 |

|

Repayment of lease liabilities and related interests |

(224) |

(207) |

|

Investments in fixed assets (net) |

(118) |

(75) |

|

Financial interest paid (net) |

13 |

17 |

|

Tax paid |

(376) |

(386) |

|

Other |

48 |

41 |

|

Free cash flow before changes in WCR |

744 |

725 |

The Groupe’s free cash flow,

before change in working capital requirements, is up by 19 million

euros compared to H1 2023, to 744 million euros.

Repayment of lease liabilities and

related interests amounted to 224 million euros in H1

2024, compared to 207 million euros in H1 2023.

Net investments in fixed assets

were 118 million euros in H1 2024, up 43 million compared to 75

million euros in H1 2023, reflecting higher investment in platforms

and cloud infrastructure, the cost related to ERP deployment across

the entire organization, as well as costs associated with new

leases.

Financial interest were an

income of 13 million euros in H1 2024, compared to an income of 17

million euros in H1 2023.

Tax paid amounted to 376

million euros, down 10 million euros compared to H1 2023. In

January 2023, the Group made an additional payment of 110 million

euros related to fiscal year 2022, reflecting the implementation of

the Tax Cuts and Jobs Act (TCJA) in the United States. However,

this impact was largely offset by an increase in taxes paid in H1

2024, due to various items including true-ups on 2023 tax and

withholding tax.

Net debt

Net financial debt amounted to 99 million euros

as of June 30, 2024 compared to a net cash position of 909 million

euros of December 31, 2023 reflecting the seasonality of the

activity. The Groupe's last twelve months average net debt as of

June 30, 2024 amounted to 375 million euros compared to 498 million

euros as of June 30, 2023.

ACQUISITIONS

On January 18, 2024, Publicis

Groupe Singapore announced the acquisition of AKA

Asia, one of Singapore's leading integrated communications

agencies. Founded in 2009, AKA is a highly respected player in the

South-East Asian market, known for delivering award-winning and

innovative communication campaigns. The acquisition will expand and

diversify Publicis Groupe's capabilities in the region, while

bolstering the Groupe's strategic communications, PR and influence

offering. AKA will join the Groupe's regional Influence

practice.

On March 12, 2024, Publicis

Sapient announced the acquisition of Spinnaker

SCA, a leading supply chain services firm that provides

end-to-end supply chain strategy, planning and execution consulting

services. Founded in 2002 and based in Boulder in the U.S.,

Spinnaker SCA will become part of Publicis Sapient and bring core

capabilities and skill sets including advanced AI and ML analytics,

supply chain digital twins, warehouse and transportation management

and expanded digital services. Spinnaker SCA will further enable

Publicis Sapient to offer solutions for clients to optimize their

agile supply chains as part of their digital business

transformation.

On June 5, 2024, Publicis

Groupe in France announced the acquisition of Downtown

Paris, a creation and production house specialized in

leading brands in the beauty and luxury business. Founded in 2016,

the agency will strengthen the production vertical of Publicis

France and will work with the Groupe's various luxury entities.

CSR

In May 2024, the Groupe announced the arrival of

Nannette LaFond-Dufour as Chief Impact Officer. In this newly

created global role, Nannette will be responsible for driving

immediate impact across the Groupe’s long-term ESG commitments.

These include Publicis’ ambitious SBTI-approved climate goals, its

concrete diversity, equity and inclusion action plans, as well as

its flagship initiatives like the Working with Cancer pledge and

the Women’s Forum for the Economy & Society.

GOVERNANCE

The Combined General Shareholder’s meeting of Publicis Groupe

SA, held on May 29, 2024, approved the change in the Company's

governance structure to adopt a Board of Directors, replacing the

previous Management Board and Supervisory Board.

The Board of Directors, which met following the General Meeting,

agreed to combine the roles of Chairman and Chief Executive

Officer, appointing Mr. Arthur Sadoun as Chairman and CEO.

Mrs. Élisabeth Badinter was appointed Vice-Chair of the Board of

Directors.

Mr. Maurice Lévy has taken on the role of Chairman Emeritus of

Publicis Groupe and is invited to attend Board meetings.

Mr. André Kudelski was appointed to the position of Lead

Director (Administrateur Référent). In this role, his primary

missions are to facilitate the smooth operation of the Company’s

governing bodies alongside the Chairman of the Board; preside over

executive sessions; guard against potential conflicts of interest;

and supervise the evaluation process of the Board of Directors.

All the proposed amendments to the Articles of Incorporation

were approved, as was the extension of the Company’s term.

POST-REPORTING PERIOD

EVENTS

On July 12, 2024, the Groupe put a new Revolving Credit Facility

in place for an amount of 2,000 million euros with a maturity of

July 2029 (and a two-year extension option). This facility cancels

and replaces the confirmed credit facility of 1,579 million euros,

maturing in 2026.

OUTLOOK

After a better than expected first half of 2024,

which demonstrated the strength of the Groupe’s model and the

sustainability of its industry outperformance, the Groupe is

confident in its potential to accelerate further on organic growth

in the second half of the year, and upgrades its organic growth

guidance for the full year 2024 despite ongoing macroeconomic

uncertainties.

The Groupe now aims for +5% to +6%

organic growth for the full year, compared to +4% to +5%

previously.

The bottom-end of the guidance at +5% is

the new floor in the current macroeconomic environment,

factoring in continued delays in clients’ digital business

transformation projects and reduced spend in classic

advertising.

The top-end of the guidance at +6% is

the new stretch, assuming an improved macroeconomic

context, which would lead to resumed spend on digital business

transformation projects, fewer reductions in classic advertising

and some positive impact from increased client budgets in the

fourth quarter.

The Groupe also confirms its 2024

guidance on financial ratios, which will be maintained at

the industry-leading levels of 18% operating margin rate and

between 1.8 and 1.9 billion euros free cash flow before change in

working capital, including the Groupe’s opex investment of 100

million euros for its AI plan.

Disclaimer

Certain information contained in this document,

other than historical information, may constitute forward-looking

statements or unaudited financial forecasts. These

forward-looking statements and forecasts are subject to risks and

uncertainties that could cause actual results to differ materially

from those projected. These forward-looking statements and

forecasts are presented at the date of this document and, other

than as required by applicable law, Publicis Groupe does not assume

any obligation to update them to reflect new information or events

or for any other reason. Publicis Groupe urges you to carefully

consider the risk factors that may affect its business, as set out

in the Universal Registration Document filed with the French

Autorité des Marchés Financiers (AMF) and which is available on the

website of Publicis Groupe (www.publicisgroupe.com), including an

unfavorable economic climate, a highly competitive industry,

risks associated with the confidentiality of personal data, the

Groupe’s business dependence on its management and employees, risks

associated with mergers and acquisitions, risks of IT system

failures and cybercrime, the possibility that our clients could

seek to terminate their contracts with us on short notice, risks

associated with the reorganization of the Groupe, risks of

litigation, governmental, legal and arbitration proceedings, risks

associated with the Groupe’s financial rating and exposure to

liquidity risks.

About Publicis Groupe - The Power of One

Publicis Groupe [Euronext Paris FR0000130577,

CAC 40] is a global leader in communication. The Groupe is

positioned at every step of the value chain, from consulting to

execution, combining marketing transformation and digital business

transformation. Publicis Groupe is a privileged partner in its

clients’ transformation to enhance personalization at scale. The

Groupe relies on ten expertise concentrated within four main

activities: Communication, Media, Data and Technology. Through a

unified and fluid organization, its clients have a facilitated

access to all its expertise in every market. Present in over 100

countries, Publicis Groupe employs around 103,000 professionals.

www.publicisgroupe.com | Twitter: @PublicisGroupe | Facebook |

LinkedIn | YouTube | Viva la Difference!

|

ContactsPublicis

Groupe |

|

Amy Hadfield |

Corporate Communications |

+ 33 1 44 43 70 75 |

amy.hadfield@publicisgroupe.com |

|

Jean-Michel Bonamy |

Investor Relations |

+ 33 1 44 43 74 88 |

jean-michel.bonamy@publicisgroupe.com |

|

Lorène Fleury |

Investor Relations |

+ 33 1 44 43 57 24 |

lorene.fleury@publicisgroupe.com |

|

Maxine Miller |

Investor Relations |

+ 33 1 44 43 74 21 |

maxine.miller@publicisgroupe.com |

Please find the press release here

Appendices

Net revenue: organic growth

calculation

|

(million euro) |

Q1 |

Q2 |

H1 |

|

Impact of currencyat end June

2024(million euro) |

|

2023 net revenue |

3,079 |

3,239 |

6,318 |

|

GBP (2) |

15 |

|

Currency impact (2) |

(29) |

13 |

(16) |

|

USD (2) |

(1) |

|

2023 net revenue at 2024 exchange rates (a) |

3,050 |

3,252 |

6,302 |

|

Others |

(30) |

|

2024 net revenue before acquisition impact (b) |

3,212 |

3,433 |

6,645 |

|

Total |

(16) |

|

Net revenue from acquisitions (1) |

18 |

25 |

43 |

|

|

|

|

2024 net revenue |

3,230 |

3,458 |

6,688 |

|

|

|

|

Organic growth (b/a) |

+5.3% |

+5.6% |

+5.4% |

|

|

|

(1) Acquisitions (Spinnaker SCA, Practia,

Corra, AKA Asia, ARBH, Downtown Paris), net of disposals.

(2) EUR = USD 1.081 on average in H1 2024 vs.

USD 1.081 on average in H1 2023 EUR = GBP 0.855

on average in H1 2024 vs. GBP 0.877 on average in H1 2023

Definitions

Net revenue or Revenue less pass-through

costs: Pass-through costs mainly concern production and

media activities, as well as various expenses incumbent on clients.

These items that can be re-billed to clients do not come within the

scope of assessment of operations, net revenue is a more relevant

indicator to measure the operational performance of the Groupe’s

activities.

Organic growth: Change in net

revenue excluding the impact of acquisitions, disposals and

currencies.

Like-for-like growth: Growth at

current year exchange rates and current perimeter, including

organic growth coming from acquisitions since the acquisition

date.

4Y CAGR organic growth:

Calculated as: ( [1 + organic growth (n-4)]*[1 + organic growth

(n-3)]*[1 + organic growth (n-2)]*[1 + organic growth (n-1)]

)^(1/4) - 1.

EBITDA (Earnings Before Interest, Taxes,

Depreciation and Amortization): Operating margin before

depreciation & amortization.

Operating margin: Revenue after

personnel costs, other operating expenses (excl. non-current income

and expense) and depreciation (excl. amortization of intangibles

arising on acquisitions).

Operating margin rate:

Operating margin as a percentage of net revenue.

Headline Group Net Income: Net

income attributable to the Groupe, after elimination of impairment

charges / real estate transformation expenses, amortization of

intangibles arising on acquisitions, the main capital gains (or

losses) on disposals, change in the fair value of financial assets

and the revaluation of earn-out costs.

EPS (Earnings per share): Group

net income divided by average number of shares, not diluted.

EPS, diluted (Earnings per share,

diluted): Group net income divided by average number of

shares, diluted.

Headline EPS, diluted (Headline Earnings

per share, diluted): Headline group net income, divided by

average number of shares, diluted.

Capex: Net acquisitions of

tangible and intangible assets, excluding financial investments and

other financial assets.

Free cash flow before changes in working

capital requirements: Net cash flow from operating

activities less interests paid & received, repayment of lease

liabilities & related interests and before changes in WCR

linked to operating activities.

Free cash flow: Net cash flow

from operating activities less interests paid & received,

repayment of lease liabilities & related interests.

Net debt (or financial net

debt): Sum of long and short financial debt and associated

derivatives, net of treasury and cash equivalents, excluding lease

liability since 1st January 2018.

Average net debt: Last twelve

month average of monthly net debt at end of month.

Dividend pay-out: Dividend per

share / Headline diluted EPS.

Consolidated income statement

|

(in millions of euros) |

|

30 June 30, 2024 (6

months) (6 months) |

30 June 30, 2023 (6

months) (6 months) |

December 31, 2023 (12

months) |

| Net

revenue (*) |

|

6,688 |

6,318 |

13,099 |

| Pass-through

revenue |

|

962 |

787 |

1,703 |

|

Revenue |

|

7,650 |

7,105 |

14,802 |

| Personnel

costs Other operating costs |

|

(4,498) (1,751) |

(4,200) (1,570) |

(8,514) (3,443) |

| Operating

margin before depreciation & amortization |

|

1,401 |

1,335 |

2,845 |

| Depreciation and

amortization (excluding intangibles from acquisitions) |

|

(241) |

(242) |

(482) |

| Operating

margin |

|

1,160 |

1,093 |

2,363 |

|

Amortization of intangibles from acquisitions |

|

(123) |

(142) |

(268) |

|

|

| Impairment

loss |

|

(45) |

(112) |

(153) |

| Other non-current

income and expenses |

|

16 |

4 |

(202) |

| |

|

|

|

1 434 |

| Operating

income |

|

1,008 |

843 |

1,740 |

| Financial expense

Financial income Cost of net financial debt Other

financial income and expenses Revaluation of earn-out payments |

|

(61) 100 39 (39) 28 |

(59) 101 42 (56) 1 |

(120) 198 78 (99) 12 |

| Pre-tax

income of consolidated companies |

|

1,036 |

830 |

1,731 |

| Income

taxes |

|

(256) |

(205) |

(415) |

| Net income

of consolidated companies |

|

780 |

625 |

1,316 |

| Share of

profit of associates |

|

(3) |

3 |

6 |

| Net

income |

|

777 |

628 |

1,322 |

| Of which: - Net

income attributable to non-controlling interests |

|

4 |

5 |

10 |

|

Net income attributable to equity holders of the parent

company |

|

773 |

623 |

1,312 |

|

Per share data (in euros) - Net income

attributable to equity holders of the parent

company |

|

|

|

|

| Number of shares |

|

250,711,640 |

250,829,338 |

250,706,485 |

| Earnings per share |

|

3.08 |

2.48 |

5.23 |

| |

|

|

|

|

| Number of diluted shares |

|

253,302,880 |

253,618,058 |

253,999,363 |

| Diluted earnings per

share |

|

3.05 |

2.46 |

5.17 |

(*) Net revenue: Revenue less pass-through

costs. Those costs are mainly production & media costs and

out-of-pocket expenses. As these items that can be passed on to

clients are not included in the scope of analysis of transactions,

the net revenue indicator is the most appropriate for measuring the

Groupe’s operational performance.

Consolidated statement of comprehensive

income

|

(in millions of euros) |

|

June 30, 2024 (6 months) |

June 30, 2023 (6 months) |

December 31, 2023 (12

months) |

|

Net income for the period (a) |

|

777 |

628 |

1,322 |

|

|

|

|

|

|

|

Comprehensive income that will not be reclassified

to income statement |

|

|

|

|

|

- Actuarial gains (and losses) on defined benefit plans |

|

18 |

(6) |

12 |

|

- Deferred taxes on comprehensive income that will not be

reclassified to income statement |

|

(4) |

2 |

(3) |

|

Comprehensive income that may be reclassified to

income statement |

|

|

|

|

|

- Remeasurement of hedging instruments |

|

19 |

13 |

34 |

|

- Consolidation translation adjustments |

|

239 |

(217) |

(390) |

|

Total other comprehensive income (b) |

|

272 |

(208) |

(347) |

|

|

|

|

|

|

|

Total comprehensive income for the period (a) +

(b) |

|

1,049 |

420 |

975 |

|

Of which: |

|

|

|

|

|

- Comprehensive income for the period attributable to

non-controlling interests |

|

4 |

(2) |

4 |

|

- Comprehensive income for the period attributable to equity

holders of the parent company |

|

1,045 |

422 |

971 |

Consolidated balance sheet

|

(in millions of euros) |

|

June 30, 2024 |

December 31, 2023 |

|

Assets |

|

|

|

|

Goodwill, net |

|

12,812 |

12,422 |

|

Intangible assets, net |

|

901 |

958 |

|

Right-of-use assets related to leases |

|

1,640 |

1,614 |

|

Property, plant and equipment, net |

|

591 |

596 |

|

Deferred tax assets |

|

173 |

212 |

|

Investments in associates |

|

80 |

46 |

|

Other financial assets |

|

316 |

316 |

|

Non-current assets |

|

16,513 |

16,164 |

|

Inventories and work-in-progress |

|

482 |

341 |

|

Trade receivables |

|

12,883 |

13,400 |

|

Contract assets |

|

1,860 |

1,297 |

|

Other receivables and current assets |

|

1,098 |

1,264 |

|

Cash and cash equivalents |

|

3,082 |

4,250 |

|

Current assets |

|

19,405 |

20,552 |

| |

|

|

|

|

Total assets |

|

35,918 |

36,716 |

|

Equity and liabilities |

|

|

|

|

Share capital |

|

102 |

102 |

|

Additional paid-in capital and retained earnings, Groupe share |

|

9,814 |

9,686 |

|

Equity attributable to holders of the parent company –

Groupe share |

|

9,916 |

9,788 |

| Non-controlling interests

(minority interests) |

|

(41) |

(40) |

|

Total equity |

|

9,875 |

9,748 |

|

Long-term borrowings |

|

1,650 |

2,462 |

|

Long-term lease liabilities |

|

1,990 |

1,992 |

|

Deferred tax liabilities |

|

63 |

98 |

|

Pension commitments and other short-term benefits |

|

260 |

265 |

|

Long-term provisions |

|

365 |

319 |

| Non-current

liabilities |

|

4,328 |

5,136 |

|

Trade payables |

|

15,953 |

17,077 |

|

Contract liabilities |

|

481 |

513 |

|

Short-term borrowings |

|

1,382 |

726 |

|

Short-term lease liabilities |

|

372 |

360 |

|

Income taxes payable |

|

302 |

378 |

|

Pension commitments and other short-term benefits |

|

24 |

21 |

|

Short-term provisions |

|

207 |

255 |

|

Other creditors and current liabilities |

|

2,994 |

2,502 |

|

Current liabilities |

|

21,715 |

21,832 |

| |

|

|

|

|

Total equity and liabilities |

|

35,918 |

36,716 |

Consolidated statement of cash flows

|

(in millions of euros) |

|

June 30, 2024 (6 months) |

June 30, 2023 (6 months) |

December 31, 2023 (12

months) |

| Cash flow from

operating activities |

|

|

|

|

|

Net income |

|

777 |

628 |

1,322 |

|

Neutralization of non-cash income and expenses: |

|

|

|

|

|

Income taxes |

|

256 |

205 |

415 |

|

Cost of net financial debt |

|

(39) |

(42) |

(78) |

|

Capital losses (gains) on disposal of assets (before tax) |

|

(16) |

(2) |

(1) |

|

Depreciation, amortization and impairment losses |

|

409 |

496 |

903 |

|

Share-based compensation |

|

46 |

41 |

85 |

|

Other non-cash income and expenses |

|

12 |

51 |

79 |

|

Share of profit of associates |

|

3 |

(3) |

(6) |

|

Dividends received from associates |

|

1 |

2 |

7 |

|

Taxes paid |

|

(376) |

(386) |

(669) |

|

Change in working capital requirements |

|

(1,629) |

(1,053) |

(9) |

| Net cash flows

generated by (used in) operating activities (I) |

|

(556) |

(63) |

2,048 |

| Cash flow from

investing activities |

|

|

|

|

|

Purchases of property, plant and equipment and intangible

assets |

|

(120) |

(75) |

(180) |

|

Disposals of property, plant and equipment and intangible

assets |

|

2 |

- |

2 |

|

Purchases of investments and other financial assets, net |

|

12 |

(10) |

13 |

|

Acquisitions of subsidiaries |

|

(229) |

(158) |

(194) |

|

Disposals of subsidiaries |

|

- |

- |

11 |

|

|

|

|

|

|

| Net cash flows

generated by (used in) investing activities (II) |

|

(335) |

(243) |

(348) |

| Cash flow from

financing activities |

|

|

|

|

|

Dividends paid to holders of the parent company |

|

- |

- |

(726) |

|

Dividends paid to non-controlling interests |

|

(9) |

(7) |

(9) |

|

Proceeds from new borrowings |

|

- |

4 |

5 |

|

Repayment of borrowings |

|

(5) |

- |

(502) |

|

Repayment of lease liabilities |

|

(182) |

(168) |

(344) |

|

Interest paid on lease liabilities |

|

(42) |

(39) |

(79) |

|

Interest paid |

|

(85) |

(86) |

(99) |

|

Interest received |

|

98 |

103 |

192 |

|

Buy-outs of non-controlling interests |

|

(7) |

(2) |

(4) |

|

Net (buybacks)/sales of treasury shares and warrants |

|

(119) |

(193) |

(189) |

| Net cash flows

generated by (used in) financing activities (III) |

|

(351) |

(388) |

(1,755) |

| Impact of

exchange rate fluctuations (IV) |

|

74 |

(239) |

(311) |

| Change in consolidated

cash and cash equivalents (I + II + III + IV) |

|

(1,168) |

(933) |

(366) |

|

Cash and cash equivalents on January 1 |

|

4,250 |

4,616 |

4,616 |

|

Bank overdrafts on January 1 |

|

(1) |

(1) |

(1) |

|

Net cash and cash equivalents at beginning of year

(V) |

|

4,249 |

4,615 |

4,615 |

|

Cash and cash equivalents at closing date |

|

3,082 |

3,682 |

4,250 |

|

Bank overdrafts at closing date |

|

(1) |

- |

(1) |

|

Net cash and cash equivalents at closing date

(VI) |

|

3,081 |

3,682 |

4,249 |

| Change in consolidated

cash and cash equivalents (VI - V) |

|

(1,168) |

(933) |

(366) |

| |

|

|

|

|

Consolidated statement of changes in

equity

|

Number of outstanding shares |

(in millions of euros) |

Share capital |

Additional paid-in capital |

Reserves and earnings brought forward |

Translationreserve

|

Fair value reserve |

Equity attributable to equity holders of the parent

company |

Non-controlling interests |

Total equity |

|

| |

| |

|

250,574,493 |

January 1, 2024 |

102 |

3,336 |

6,633 |

(299) |

16 |

9,788 |

(40) |

9,748 |

|

| |

Net

income |

|

|

773 |

|

|

773 |

4 |

777 |

|

| |

Other

comprehensive income, net of tax |

|

|

14 |

239 |

19 |

272 |

- |

272 |

|

| |

Total income and expenses for the period |

|

|

787 |

239 |

19 |

1,045 |

4 |

1,049 |

|

| - |

Dividends |

|

(53) |

(800) |

|

|

(853) |

(9) |

(862) |

|

| - |

Share-based

compensation, net of tax |

|

|

60 |

|

|

60 |

|

60 |

|

| |

Effect of

acquisitions and commitments to buy-out non-controlling

interests |

|

|

(5) |

|

|

(5) |

4 |

(1) |

|

| - |

Equity

warrant exercise |

|

|

- |

|

|

- |

|

- |

|

|

416,958 |

(Buybacks)/Sales of treasury shares |

|

|

(119) |

|

|

(119) |

|

(119) |

|

|

250,991,451 |

June

30, 2024 |

102 |

3,283 |

6,556 |

(60) |

35 |

9,916 |

(41) |

9,875 |

|

|

Number of outstanding shares |

(in millions of euros) |

Share capital |

Additional paid-in capital |

Reserves and earnings brought forward |

Translationreserve

|

Fair value reserve |

Equity attributable to equity holders of the parent

company |

Non-controlling interests |

Total equity |

|

| |

| |

|

251,992,065 |

January 1, 2023 |

102 |

4,037 |

5,324 |

85 |

87 |

9,635 |

(35) |

9,600 |

|

| |

Net

income |

|

|

623 |

|

|

623 |

5 |

628 |

|

| |

Other

comprehensive income, net of tax |

|

|

|

(210) |

9 |

(201) |

(7) |

(208) |

|

| |

Total income and expenses for the period |

0 |

0 |

623 |

(210) |

9 |

422 |

(2) |

420 |

|

| - |

Dividends |

|

(701) |

(25) |

|

|

(726) |

(7) |

(733) |

|

| - |

Share-based

compensation, net of tax |

|

|

50 |

|

|

50 |

|

50 |

|

| |

Effect of

acquisitions and commitments to buy-out non-controlling

interests |

|

|

1 |

|

|

1 |

0 |

1 |

|

| - |

Equity

warrant exercise |

|

|

0 |

|

|

0 |

|

0 |

|

|

(1,490,149) |

(Buybacks)/Sales of treasury shares |

|

|

(194) |

|

|

(194) |

|

(194) |

|

|

250,501,916 |

June

30, 2023 |

102 |

3,336 |

5,779 |

(125) |

96 |

9,188 |

(44) |

9,144 |

|

Earnings per share (basic and

diluted)

|

(in millions of euros, except for share data) |

|

June 30, 2024 |

June 30, 2023 |

|

Net income used for the calculation of earnings per

share |

|

|

|

| Net income share attributable

to equity holders of the parent company |

A |

773 |

623 |

| Impact of dilutive

instruments: |

|

|

|

|

- Savings in financial expenses related to the conversion of debt

instruments, net of tax |

|

- |

- |

| Net income – Groupe share –

diluted |

B |

773 |

623 |

| Number of shares used

to calculate earnings per share |

|

|

|

| Number of shares at January

1 |

|

254,311,860 |

254,311,860 |

| Shares created over the

period |

|

- |

- |

| Treasury shares to be deducted

(average for the period) |

|

(3,600,220) |

(3,482,522) |

| Average number of shares used

for the calculation |

C |

250,711,640 |

250,829,338 |

| Impact of dilutive

instruments: |

|

|

|

| - Free shares and dilutive

stock options |

|

2,591,240 |

2,788,720 |

| - Equity warrants (BSA) |

|

- |

- |

| Number of diluted shares |

D |

253,302,880 |

253,618,058 |

| (in euros) |

|

|

|

| Earnings per

share |

A/C |

3.08 |

2.48 |

| |

|

|

|

| Diluted earnings per

share |

B/D |

3.05 |

2.46 |

Headline earnings per share (basic and

diluted)

|

(in millions of euros, except for share data) |

|

June 30, 2024 |

June 30, 2023 |

|

Net income used to calculate headline earnings per

share(1) |

|

|

|

| Net income – Groupe share |

|

773 |

623 |

| Items excluded: |

|

|

|

- Amortization of intangibles from acquisitions, net of tax

|

|

92 |

105 |

- Impairment loss, net of tax

|

|

34 |

83 |

- Revaluation of earn-out payments

|

|

(28) |

(1) |

- Main capital gains and losses on disposal of assets and fair

value adjustment of financial assets, net of tax(2)

|

|

(14) |

3 |

| Headline Groupe net

income |

E |

857 |

813 |

| Impact of dilutive

instruments: |

|

|

|

| - Savings in financial

expenses related to the conversion of debt instruments, net of

tax |

|

- |

- |

| Headline Groupe net income,

diluted |

F |

857 |

813 |

| |

|

|

|

| Number of shares used

to calculate earnings per share |

|

|

|

| Number of shares at January

1 |

|

254,311,860 |

254,311,860 |

| Shares created over the

period |

|

- |

- |

| Treasury shares to be deducted

(average for the period) |

|

(3,600,220) |

(3,482,522) |

| Average number of shares used

for the calculation |

C |

250,711,640 |

250,829,338 |

| Impact of dilutive

instruments: |

|

|

|

| - Free shares and dilutive

stock options |

|

2,591,240 |

2,788,720 |

| - Equity warrants (BSA) |

|

- |

- |

| Number of diluted shares |

D |

253,302,880 |

253,618,058 |

| (in euros) |

|

|

|

| Headline earnings per

share(1) |

E/C |

3.42 |

3.24 |

| |

|

|

|

| Headline earnings per

share – diluted(1) |

F/D |

3.38 |

3.21 |

(1) EPS after elimination of

impairment losses, amortization of intangibles from acquisitions,

the main capital gains and losses on disposal and fair value

adjustment of financial assets and revaluation of earn-out

payments.(2) As of June 30, 2024, the main capital gains

and losses on disposal amount to euro 8 million and the fair value

adjustment of financial assets amounts to euro 6 million. At June

30, 2023, the main capital gains and losses on disposal amount to

euro 4 million and the fair value adjustment of financial assets

amounts to euro (7) million.

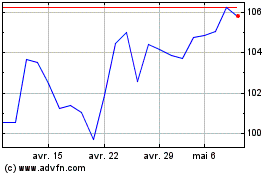

Publicis Groupe (EU:PUB)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Publicis Groupe (EU:PUB)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024