- Very strong growth in international sales driven by the $3

million (approx. €2.8 million) milestone payment from

NuVasive

- Solid cash position of €7.3 million at June 30, 2023,

excluding €1.5 million in non-dilutive financing obtained from

SMAIO’s longstanding banking partners

Regulatory News:

SMAIO (Software, Machines and

Adaptative Implants in Orthopaedics – Euronext

Growth Paris ISIN: FR0014005I80 / Ticker: ALSMA, eligible for

PEA-PME equity savings plans), a French player specialized in

complex spine surgery with a comprehensive offer including

software, adaptative implants and related services, today published

its sales for the first half of 2023 and issued an update on its

development.

Philippe ROUSSOULY, Chairman and CEO of SMAIO, said: “The

first half of 2023 was firstly marked by the achievement of a major

milestone for SMAIO with the granting of FDA 510(k) clearance for a

customized version of the KEOPS Balance Analyzer 3D surgery

planning software co-developed with NuVasive. In accordance with

the plan, this clearance triggered a $3 million payment from our

American partner. This partnership is the cornerstone of our US

market access strategy. Firstly, it demonstrates the capabilities

of the technological collaboration between the two companies, and,

secondly, it provides NuVasive clients, primarily in the United

States, with the possibility of using our high-performance

customized surgery planning services in the near future. These

activities should thus create additional recurring revenue flows

from the end of 2023 or early 2024, depending on registration

timeframes in selected North American centers. These flows should

help improve the Company’s profitability indicators and reduce its

cash requirements. Furthermore, during the semester, SMAIO has

focused its commercial efforts on training ambassador surgeons on

the American market for the dissemination of its comprehensive

i-kontrol offer. Following registration procedures in targeted

American hospitals, several complex surgeries could be performed

during the second half of the year. At the same time, the confirmed

participation of more than 30 surgeons specialized in complex

surgery in the “Sagittal Alignment Think Tank” organized by SMAIO

in November 2023 in San Diego is an extremely positive sign of the

rapid ramping up of the Company’s reputation in the United States.

Consequently, this targeted and controlled strategic investment

policy, combined with the use of non-dilutive financing levers

carried out in advantageous conditions with Bpifrance and the

Company’s longstanding banking partners (BNP Paribas, Société

Générale), enabled SMAIO to have a comfortable cash position at

June 30, 2023. Within this context, the Company will continue its

efforts to achieve the $2 million second milestone payment with

NuVasive, further strengthening its partnership while significantly

developing its sales and profitability”.

First-half 2023 sales

In € thousands

June 30, 2023

June 30, 2022

Change

Sales*

3,997

1,318

+203.3%

France

612

605

+1.2%

International

3,385

713

+374.8%

* Unaudited data

Sales totaled €4.0 million in the first half of 2023, up +203%

compared with the first half of 2022 (€1.3m).

International activity saw very strong growth compared with the

same period of 2022 (+375%). This substantial increase was

primarily due to the $3 million (approx. €2.8 million) milestone

payment received from NuVasive, a leading player in technological

innovations for spine surgery, following the granting of FDA 510(k)

clearance for a customized version of the surgery planning software

co-developed with this partner, in line with the roadmap published

at the time of the Company’s IPO. Moreover, sales of implants and

instruments have recorded good growth via distributors in Spain and

in Sweden, as well as a new distributor in Australia.

Excluding the NuVasive milestone payment, first-half 2023

revenue primarily consisted of sales of the Kheiron system

comprising customized implants and rods (€1.2 million). Kheiron

sales should be driven by the opening up of the US market in the

second half of 2023, with a number of American centers currently in

the final stages of the registration process for SMAIO’s

implantable devices.

Regarding the software segment, the latter should increase over

coming semesters thanks to the partnership and licensing agreement

signed with NuVasive. Within this framework, SMAIO could provide

its planning services to NuVasive’s clients and generate additional

recurring revenue by the end of 2023 or early 2024, depending on

the required registration timeframes in the targeted American

hospitals.

Solid financial structure

The Company had a cash position of €7.3 million at June 30, 2023

compared with €5.7 million at December 31, 2022. This increase was

due to good control over cash burn levels, the payment relating to

the milestone achieved with NuVasive and the receipt of the €1

million Bpifrance Innovation R&D loan that includes a 3-year

grace period.

Moreover, the Company’s cash position will benefit from the

drawdown, in September, of €1.5 million in the form of loans from

BNP Paribas and Société Générale. These loans have a maturity of 4

years.

This level of cash will allow SMAIO to finance its development

in accordance with the strategy presented at the time of the

Company’s IPO, in April 2022.

Upcoming financial publication

- H1 2023 results: Wednesday, October 18, 2023, after

market

About SMAIO

A precursor in the use of clinical data and imaging of the

spine, SMAIO designs global solutions for spine surgery

specialists. The Company has recognized expertise thanks to KEOPS,

its Big Data management software that has become a global reference

with more than 100,000 patient cases documented.

SMAIO offers spine surgeons a comprehensive platform, I-Kontrol,

incorporating planning, implants and related services, enabling

them to treat spinal pathologies in a safe, effective and lasting

way.

SMAIO is positioned at the forefront of innovation with the

ambition of providing surgeons with the first active robotic

solution enabling a high level of performance and repeatability to

be achieved.

Based in Lyon, France, SMAIO benefits from the skill and

expertise of more than 30 highly specialized staff.

For further information, please visit our website:

www.smaio.com

Listing market: Euronext Growth Paris ISIN:

FR0014005I80 Mnemonic: ALSMA

Disclaimer

This press release contains non-factual elements, including, but

not limited to, certain statements regarding future results and

other future events. These statements are based on the current

vision and assumptions of the management of the Company. They

incorporate known and unknown risks and uncertainties that could

result in significant differences in results, profitability and

expected events. In addition, SMAIO, its shareholders and its

affiliates, directors, officers, counsels and employees have not

verified the accuracy of, and make no representations or warranties

about, statistical information or forecast information contained

within this news release and that originates or is derived from

third party sources or industry publications; these statistical

data and forecast information are only used in this press release

for information purposes. Finally, this press release may be

drafted in French and in English. In the event of differences

between the two texts, the French version will prevail.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230718157070/en/

SMAIO Philippe Roussouly Chief Executive Officer Renaut

Fritsch Chief Financial Officer investors@smaio.com

NewCap Dusan Oresansky/Quentin Massé Investor Relations

smaio@newcap.eu Tel.: +33 (0)1 44 71 94 92

NewCap Arthur Rouillé Media Relations smaio@newcap.eu

Tel.: +33 (0)1 44 71 00 15

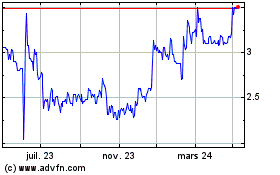

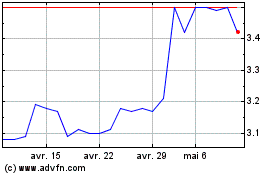

SMAIO (EU:ALSMA)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

SMAIO (EU:ALSMA)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024