Sodexo Q1 Fiscal 2023: strong start to the year

- Revenue growth

+20.2%

- Organic revenue growth

+12.3%

Issy-les-Moulineaux, January 6, 2023

Sodexo (NYSE Euronext Paris FR 0000121220-OTC:

SDXAY).

Q1 Fiscal 2023 revenues

|

REVENUES(in millions of euros) |

Q1 FY23 |

Q1 FY22 |

ORGANIC GROWTH |

EXTERNAL GROWTH |

CURRENCY EFFECT |

TOTAL GROWTH |

|

North America |

2,992 |

2,205 |

+15.7% |

+1.1% |

+18.8% |

+35.7% |

| Europe |

2,047 |

2,023 |

+5.9% |

-3.6% |

-1.1% |

+1.2% |

| Rest of

the World |

1,057 |

854 |

+15.3% |

-1.9% |

+10.4% |

+23.9% |

|

On-Site Services |

6,097 |

5,082 |

+11.9% |

-1.2% |

+9.3% |

+20.0% |

| Benefits & Rewards

Services |

234 |

183 |

+23.4% |

-1.6% |

+6.4% |

+28.2% |

|

Elimination |

(1) |

(1) |

|

|

|

|

|

TOTAL GROUP |

6,330 |

5,264 |

+12.3% |

-1.2% |

+9.2% |

+20.2% |

Commenting the First quarter 2023 performance, Sophie

Bellon, Chairwoman and CEO said:

“As expected, we have had a strong start to the year.

On-Site Services continued to benefit from the post-Covid

ramp-up, with a higher level of attendance, in all geographies, in

the workplace, in stadiums, in convention centers and in

Universities. Price increases also boosted revenue growth. As a

result, On-site Services activity is back up over First quarter

Fiscal 2019 levels.

Benefits & Rewards Services organic growth continued to

accelerate, reflecting in particular this quarter, higher interest

rates in the euro zone and a large one-off Klimabonus contract in

Austria.

During the quarter, we also delivered positive net development

and strong cross-selling.

We are on track.”

Highlights of the period

- First quarter Fiscal

2023 consolidated revenues reached 6.3 billion euros, up

+20.2% year-on-year including a net effect from acquisitions and

disposals of -1.2%, and a strong positive currency impact of +9.2%,

reflecting the strength of the US dollar and the Brazilian real.

Organic growth remained strong at +12.3%.

- On-site Services

revenues reached 6.1 billion euros, up +11.9% organically. This

growth reflected the recovery in Food services, up +19.2%.

Facilities Management Services organic growth impacted by the end

of the Testing Centers contract in the UK stalled at +0.5%.

Excluding this, Facilities Management Services was up by nearly

+6%. Higher prices contributed about 5-6% to growth. By zone, the

key elements were:

- North

America generated organic growth of +15.7% boosted by the

post-Covid return to the workplace, a better-than-expected increase

in the sporting and convention center activity and more retail and

event catering activity on University campuses. Healthcare was also

up in particular due to a strong increase in retail sales.

- In

Europe, organic growth was more contained at +5.9%

due to the end of the Testing Centers. However, there was a strong

return to the workplace across the zone as well as a recovery in

the number of corporate events and tourists, particularly in

Paris.

- The Rest of

the World organic growth was +15.3% with a very solid

performance in Business & Administrations in all regions

despite the impact of the sporadic lockdowns in China and a

particularly strong recovery in Education in India.

- The acceleration of

the organic growth in revenues of Benefits & Rewards Services

continued in the First quarter, at +23.4%. Higher demand, face

values, net new business and interest rates all contributed. In

particular, the quarter benefited from higher interest rates in the

euro zone for the first time and a significant one-off contribution

from the Austrian Klimabonus.

- During this first

quarter, Sodexo continued to reinforce its commitments to reduce

its environmental footprint:

- Sodexo progressed

towards its 2025 CSR objectives:

- By promoting

plant-based meal options: Sodexo just concluded its first global

Sustainable Chef Challenge. This international competition brought

together Sodexo’s talent to showcase innovative dishes.

- By raising awareness

about the importance of reducing Food waste: Sodexo has celebrated

the 10th Anniversary of its WasteLESS Week Campaign.

- Our Corporate

Responsibility achievements have also been recognized externally:

- For the 18th

consecutive year, Sodexo was ranked as one of the top-rated

companies of its sector in the Dow Jones Sustainability Index

(DJSI).

- Sodexo earned top

LGBTIQ+ inclusion achievement from 2022 Workplace Pride Global

Benchmark.

- Sodexo has been

awarded the 2022 GEEIS-SDG trophy for its gender equality

initiative “Fairy Godmother” in Brazil.

- Sodexo received the

2022 AGEFI Sustainable Business Award in the Environment

category.

Outlook

The strong start to Fiscal 2023 in the first quarter was

expected. As we progress during the year, the post-Covid ramp-up

will reduce gradually. From the second quarter, the strong momentum

in Benefits & Rewards Services will continue but against a

stronger comparative base. Growth is expected to be higher in the

first half than in the second half of the year, even if the

progressive increase in the contribution of last year’s net new

development will support the organic growth in the second half.

Group Fiscal 2023 guidance is

maintained:

- Fiscal 2023

organic revenue growth expected to be between +8 and +10%

driven by:

- Further recovery in

Corporate Services and Sports & Leisure;

- Positive net new

business momentum including expected further improvement in

retention;

- Inflationary pricing

at 4-5%;

- Partially offset by

the impact of the end of the Testing Centers contract in the United

Kingdom (-100 bps).

- Fiscal 2023

Underlying operating profit margin close to 5.5%, at constant

rates, supported by:

- Continued price

increases and inflation mitigation action plans;

- Operational

excellence including supply chain efficiencies;

- Further ramp-up in

volume;

- Increased investment

to sustain growth.

Fiscal 2023 guidance for Benefits & Rewards

Services is also maintained:

- Organic

growth of +12 to +15% for Fiscal 2023,

driven by:

- Further progress in

new business, cross-selling and retention;

- Strong demand in all

regions;

- Benefits from

inflation and higher interest rates.

- Underlying

operating profit margin around 30% at constant rates for Fiscal

2023, supported by:

- The benefits of the

topline growth flow-through;

- Increased investment

in technology, digital offers, brand and sales &

marketing.

Conference call

Sodexo will hold a conference call in (English) today at

9:00 a.m. (Paris time), 8:00 a.m. (London time) to comment on its

Q1 Fiscal 2023 revenues. Those who wish to connect may do so on the

following lines:

- From the UK: +44 121

281 8004, or

- From France: +33 1

70 91 87 04, or

- From the US: +1

718-705-8796,

- Using the access

code 07 26 38.

The press release, presentation and webcast will be available on

the Group website www.sodexo.com in both the “Latest News” section

and the « Finance – Financial Results » section.

Fiscal 2023 financial calendar

|

Fiscal 2023 First half Results |

April 5, 2023 |

|

Fiscal 2023 Third quarter Revenues |

June 30, 2023 |

|

Fiscal 2023 Annual Results |

October 26, 2023 |

|

Fiscal 2023 Annual Shareholders Meeting |

December 15, 2023 |

These dates are indicative and may be subject to

change without notice.

Regular updates are available in the calendar on

our website www.sodexo.com

About Sodexo

Founded in Marseille in 1966 by Pierre Bellon, Sodexo is the

global leader in Quality of Life Services, an essential factor in

individual and organizational performance. Operating in 53

countries, our 422,000 employees serve 100 million consumers

each day. Sodexo Group stands out for its independence and its

founding family shareholding, its sustainable business model and

its portfolio of activities including Food Services, Facilities

Management Services and Employee Benefit Solutions. We provide

quality, multichannel and flexible food experiences, but also

design attractive and inclusive workplaces and shared spaces,

manage and maintain winfrastructure in a safe and environmentally

friendly way, offer personalized support for patients or students,

or even create programs fostering employee engagement. From Day 1,

Sodexo has been focusing on tangible everyday gestures and actions

through its services in order to have a positive economic, social

and environmental impact over time. For us, growth and social

commitment go hand in hand. Creating a better everyday for everyone

to build a better life for all is our purpose.

Sodexo is included in the CAC Next 20, CAC 40 ESG, FTSE 4 Good

and DJSI indices.

Key figures

- 21.1 billion euros

in Fiscal 2022 consolidated revenues

- 422,000 employees as

at August 31, 2022

- #2 France-based

private employer worldwide

|

- 53 countries

- 100 million

consumers served daily

- 13.3 billion euros

in market capitalization (as at January 5, 2023)

|

Contacts

|

Analysts and Investors |

Media |

| Virginia Jeanson+33 1 57 75 80

56virginia.jeanson@sodexo.com |

Mathieu Scaravetti+33 6 28 62 21

91mathieu.scaravetti@sodexo.com |

Q1 Fiscal 2023 Activity Report

Q1 revenues: strong start to the year

|

REVENUES BY GEOGRAPHICAL ZONE AND ACTIVITY |

|

REVENUES(in million euros) |

Q1 FY23 |

Q1 FY22 |

|

ORGANIC GROWTH |

EXTERNAL GROWTH |

CURRENCY EFFECT |

TOTAL GROWTH |

|

North America |

2,992 |

2,205 |

|

+15.7% |

+1.1% |

+18.8% |

+35.7% |

|

Europe |

2,047 |

2,023 |

|

+5.9% |

-3.6% |

-1.1% |

+1.2% |

|

Rest of the World |

1,057 |

854 |

|

+15.3% |

-1.9% |

+10.4% |

+23.9% |

|

ON-SITE SERVICES |

6,097 |

5,082 |

|

+11.9% |

-1.2% |

+9.3% |

+20.0% |

|

BENEFITS & REWARDS SERVICES |

234 |

183 |

|

+23.4% |

-1.6% |

+6.4% |

+28.2% |

|

Elimination |

(1) |

(1) |

|

|

|

|

|

|

TOTAL GROUP |

6,330 |

5,264 |

|

+12.3% |

-1.2% |

+9.2% |

+20.2% |

First quarter Fiscal 2023 consolidated revenues reached

6.3 billion euros, up +20.2% year-on-year including a net

contribution from acquisitions and disposals of -1.2%, and a strong

positive currency impact of +9.2%, reflecting, in particular, the

strength of the US dollar and the Brazilian real. Organic growth

remained strong at +12.3%, with On-site Services at +11.9% and

Benefits & Rewards Services at +23.4%.

On-site Services

On-site Services revenues reached 6.1 billion euros, up +11.9%

organically. This growth reflected the recovery in Food services,

up +19.2%. Facilities Management Services organic growth impacted

by the end of the Testing Centers contract in the UK stalled at

+0.5%. Excluding this, Facilities Management Services was up by

nearly +6%. Higher prices contributed to about 5-6% to same site

sales growth.

Net Development was positive in the quarter.

North America

|

REVENUES BY SEGMENT(in million euros) |

Q1 FY23 |

Q1 FY22 |

ORGANIC GROWTH |

|

Business & Administrations |

1,009 |

643 |

+31.8% |

|

Healthcare & Seniors |

877 |

693 |

+9.0% |

|

Education |

1,106 |

869 |

+9.3% |

|

NORTH AMERICA TOTAL |

2,992 |

2,205 |

+15.7% |

First quarter Fiscal 2023 North America

revenues totaled 3.0 billion euros, up +15.7%

organically.

Organic growth in Business &

Administrations was +31.8%, with all segments strong.

Corporate Services benefited from continued return to the

workplace, Sports & Leisure was up by more than 50% as the

volume and average spend of sporting and convention center events

increased significantly. Entegra was also very strong, boosted by

the improvement in Food services activities generally. Energy &

Resources and Government & Agencies were both up, more

modestly.

In Healthcare & Seniors, organic growth was

+9.0%, continuing to accelerate quarter after quarter with a strong

improvement in retail sales, price increases in hospitals and

senior homes, and at the end of the quarter the start-up of the

Ardent contract.

In Education, organic revenue growth was +9.3%,

boosted in particular by the significant pick-up in retail and

event catering activities in Universities due to fewer staff

shortages. Schools was down slightly against a particularly strong

first quarter in the previous year, linked to very high levels of

Covid-related free meals supplied by local authorities and the last

base effect of the loss of the Chicago Public Schools contract in

2021.

Europe

|

REVENUES BY SEGMENT(in million euros) |

Q1 FY23 |

Q1 FY22 |

ORGANIC GROWTH |

|

Business & Administrations |

1,337 |

1,208 |

+14.8% |

|

Healthcare & Seniors |

504 |

578 |

-12.1% |

|

Education |

206 |

237 |

+4.7% |

|

EUROPE TOTAL |

2,047 |

2,023 |

+5.9% |

Europe revenues amounted to

2.0 billion euros, up +5.9% organically.

In Business & Administrations, organic

growth was +14.8%. All segments were up except Government &

Agencies, impacted by the loss of a large prisons contract in

France, from the beginning of October 2022. Sports & Leisure

was particularly strong, boosted by a large number of tourists in

Paris and strong activity in sporting and corporate events. The

return to the office also continued to progress across the

zone.

In Healthcare & Seniors, revenues were down

-12.1% organically, impacted by the closure of the Testing Centers.

Excluding this, activity would have been up by nearly +7%, as a

result of a combination of pricing and volume growth, particularly

in France.

In Education, organic revenue growth was +4.7%,

with higher pricing and a strong pick up in attendance in France

due to both a calendar effect and an favorable comparative base

impacted by the Delta variant last year.

Rest of the World

|

REVENUES BY SEGMENT(in million euros) |

Q1 FY23 |

Q1 FY22 |

ORGANIC GROWTH |

|

Business & Administrations |

941 |

766 |

+15.1% |

|

Healthcare & Seniors |

87 |

67 |

+11.0% |

|

Education |

29 |

20 |

+36.8% |

|

REST OF THE WORLD TOTAL |

1,057 |

854 |

+15.3% |

First quarter Fiscal 2023 revenues in Rest of the

World were 1.1 billion euros, up

+15.3% organically.

Business & Administrations was up +15.1%.

Corporate Services growth was boosted by net new business and

strong demand in all regions, despite activity being flat in China

due to the sporadic lockdowns. Energy & Resources performed

strongly in the Middle East, Africa and Latin America, while growth

in Australia was impacted by prior year contract losses.

Healthcare & Seniors was up +11.0%, with

solid growth in all regions, boosted by volume growth and net new

business as well as pricing in Brazil.

In Education, organic growth was +36.8%, due to

very strong post-Covid ramp-up in India, and modest growth in

China.

Breakdown by segment

|

ON-SITE SERVICES REVENUES BY SEGMENT |

|

REVENUES BY SEGMENT(in million euros) |

Q1 FY23 |

Q1 FY22 |

ORGANIC GROWTH |

|

Business & Administrations |

3,288 |

2,617 |

+19.2% |

|

Healthcare & Seniors |

1,468 |

1,339 |

+0.3% |

|

Education |

1,341 |

1,126 |

+8.8% |

|

ON-SITE SERVICES TOTAL |

6,097 |

5,082 |

+11.9% |

Business & Administrations was up +19.2%,

resulting in particularly strong recovery in Sports & Leisure

and a solid return to the office in all zones.

Healthcare & Seniors was flat with recovery

in retail sales and new business compensating the closure of the

Testing Centers.

Education was up +8.8% boosted by pricing, much

better retail and event catering sales in Universities in North

America as open positions have now been filled and strong growth in

Schools in Asia.

Benefits & Rewards Services

First quarter Fiscal 2023 Benefits & Rewards

Services revenues amounted to 234 million euros, up

+23.4% organically. Strong demand, face value increases, net new

business and higher interest rates all contributed. In particular,

the quarter benefited from higher eurozone interest rates for the

first time and a significant one-off public sector contract in

Austria.

|

REVENUES BY ACTIVITY(in million euros) |

Q1 FY23 |

Q1 FY22 |

ORGANIC GROWTH |

|

Employee benefits |

191 |

148 |

+22.5% |

|

Services Diversification* |

44 |

35 |

+26.9% |

|

BENEFITS & REWARDS SERVICES |

234 |

183 |

+23.4% |

* Including Incentive & Recognition, Mobility & Expenses

and Public Benefits.

Employee benefits organic growth was +22.5%

compared to an issue volume (4.1 billion euros) up +16.4%.

Services Diversification had a strong quarter up

+26.9% organically, due to very strong public benefits activity

boosted by the one-off Austrian Klimabonus contract and the new

social card in Romania.

|

REVENUES BY REGION(in million euros) |

Q1 FY23 |

Q1 FY22 |

ORGANIC GROWTH |

|

Europe, Asia and USA |

142 |

120 |

+22.7% |

|

Latin America |

92 |

63 |

+24.5% |

|

BENEFITS & REWARDS SERVICES |

234 |

183 |

+23.4% |

In Europe, Asia and USA, organic revenue growth

was +22.7%. This performance is consistently good across the region

due to face value increases and net new business. Romania and

Austria were particularly strong due to new public benefit

contracts with Klimabonus vouchers (one-off) and the Social

card.

In Latin America, organic growth was +24.5%,

boosted by the combination of strong new business, face value

increases, like for like volumes and higher interest rates across

the region.

|

REVENUES BY NATURE(in million euros) |

Q1 FY23 |

Q1 FY22 |

ORGANIC GROWTH |

|

Operating Revenues |

207 |

172 |

+15.8% |

|

Financial Revenues |

27 |

10 |

+153.4% |

|

BENEFITS & REWARDS SERVICES |

234 |

183 |

+23.4% |

Operating revenues increased +15.8% due to

strong growth in all regions and in all activities.

Financial revenues more than doubled as the effect

of higher eurozone rates came on top of the significant increase in

interest rates in Eastern Europe and Brazil, already impacting

previous quarters.

Financial position

There were no material changes in the Group's financial position

as of November 30, 2022, relative to that presented in the Fiscal

2022 Universal Registration Document filed with the AMF on November

9, 2022.

Principal risks and uncertainties

There were no significant changes to the principal risks and

uncertainties identified by the Group in the Risk Factors section

of the Fiscal 2022 Universal Registration Document filed with the

AMF on November 9, 2022.

Currency effects

Exchange rate fluctuations do not generate operational risks,

because each subsidiary bills its revenues and incurs its expenses

in the same currency. However, given the weight of the

Benefit & Rewards activity in Brazil, and the high level

of its margins relative to the Group, when the Brazilian real

declines against the euro, it has a negative effect on the

underlying operating margin due to a change in the mix of margins.

Conversely, when the Brazilian real strengthens Group margins

increase.

|

1€= |

AVERAGE RATEQ1 FY 2023 |

AVERAGE RATEQ1 FY 2022 |

AVERAGE RATEQ1 FY

2023VS. Q1 FY 2022 |

CLOSING RATEFY 2023 AT

11/30/2022 |

CLOSING RATE FY 2022 AT

08/31/22 |

CLOSING

RATE11/30/2022VS.

08/31/2022 |

|

U.S. dollar |

0.996 |

1.161 |

+16.5% |

1.038 |

1.000 |

-3.6% |

|

Pound Sterling |

0.869 |

0.854 |

-1.8% |

0.865 |

0.860 |

-0.5% |

|

Brazilian real |

5.304 |

6.363 |

+20.0% |

5.506 |

5.148 |

-6.5% |

The positive currency impact in First quarter Fiscal 2023 of

+9.2% results from the strong increase in the U.S. dollar, +16.5%,

and the Brazilian real, +20.0%.

The currency effect is determined by applying the previous

year’s average exchange rates to the current year figures except in

hyper-inflationary economies where all figures are converted at the

latest closing rate for both periods when the impact is

significant.

Alternative Performance Measure definitions

Growth excluding currency effect

The currency effect is determined by applying the previous

year’s average exchange rates to the current year figures except in

hyper-inflationary economies where all figures are converted at the

latest closing rate for both periods when the impact is

significant.

Issue volume

Issue volume corresponds to the total face value of service

vouchers, cards and digitally delivered services issued by

Benefits & Rewards Services for beneficiaries on behalf of

clients.

Organic growth

Organic growth corresponds to the increase in revenue for a

given period (the “current period”) compared to the revenue

reported for the same period of the prior fiscal year, calculated

using the exchange rate for the prior fiscal year; and excluding

the impact of business acquisitions (or gain of control) and

divestments, as follows:

- for businesses

acquired (or gain of control) during the current period, revenue

generated since the acquisition date is excluded from the organic

growth calculation;

- for businesses

acquired (or gain of control) during the prior fiscal year, revenue

generated during the current period up until the first anniversary

date of the acquisition is excluded;

- for businesses

divested (or loss of control) during the prior fiscal year, revenue

generated in the comparative period of the prior fiscal year until

the divestment date is excluded;

- for businesses

divested (or loss of control) during the current fiscal year,

revenue generated in the period commencing 12 months before

the divestment date up to the end of the comparative period of the

prior fiscal year is excluded.

Underlying operating profit margin

The Underlying operating profit margin corresponds to Underlying

operating profit divided by revenues.

Underlying operating profit margin at constant

rates

The Underlying operating profit margin at constant rates

corresponds to Underlying operating profit divided by revenues,

calculated by converting Fiscal 2023 figures at Fiscal 2022

rates, except for countries with hyperinflationary economies.

- PR Sodexo Q1 Fiscal 2023 Revenues ENG

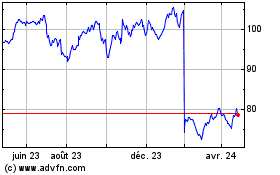

Sodexo (EU:SW)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

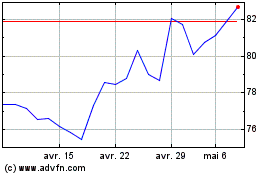

Sodexo (EU:SW)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024