Regulatory News:

Sopra Steria (Paris:SOP), a leading European tech company in

consulting, digital services and software publishing, is

strengthening its commitment to the fight against climate change by

including a non-financial indicator structured by Crédit Agricole

CIB and LCL in the refinancing terms and conditions of its €1.1bn

syndicated credit facility.

As provided for by the transaction,

which was oversubscribed and supported by all of Sopra Steria’s

main long-standing banking partners, the cost of financing will be

annually indexed to a non-financial performance indicator (KPI)

central to Sopra Steria’s strategy for corporate responsibility,

namely the reduction of greenhouse gas emissions.

With the sustainability-linked loan facility, Sopra Steria will

be able to strengthen its climate and environmental initiatives. In

line with the objective of limiting global warming to 1.5°C, the

Group’s commitment to reducing greenhouse gas emissions by 85% per

employee by 2040 for Scopes 1, 2 and 3 (partial)(1) has been

approved by the Science Based Target Initiative and is part of

Sopra Steria’s low-carbon strategy launched nearly ten years ago.

As a member of the European Climate Pact and the European Green

Digital Coalition, Sopra Steria is committed to the ecological

transition of the digital sector, with a view to helping its

clients and the Company in the fight against climate change and

contributing to the transformation of the economy. For the fifth

year in a row in 2021, Sopra Steria was recognized as a world

leader in corporate climate action by being included on the A list

of the CDP Climate Change ranking.

With input from Crédit Agricole CIB and LCL, Sopra Steria has

drafted a framework document specifying the allocation of the

contribution related to an environmental criterion in accordance

with the four pillars of the Green Bond Principles(2). The lenders

and Sopra Steria have committed to financing high-impact digital

projects contributing to the first two objectives of the European

Taxonomy, on mitigating and adapting to climate change. The

projects will be chosen based on a number of eligibility criteria

by a selection committee of experts. Allocation and impact reports

will be communicated to lenders on an annual basis.

“This innovative transaction

strengthens our sustainable development strategy consistent with

our vision and our values. It demonstrates the Sopra Steria Group’s

ability to prepare for and integrate our major collective

environmental and societal challenges,” said Cyril Malargé,

Chief Executive Officer of Sopra Steria.

“Crédit Agricole CIB is proud to

have helped Sopra Steria with LCL to structure this transaction,

which reflects the Group's commitment to decarbonising its entire

value chain. In addition to this ambitious objective, Sopra Steria

has paved the way for a new market standard through a framework

document setting out the terms for transferring the contribution

linked to an environmental criterion to innovative impact-based

digital projects, in line with the recommendations of the Green

Bond Principles,” said Nathalie Sarel, Head of Sustainable

Banking, SMEs/mid-cap companies, at Crédit Agricole CIB.

“We would like to thank Sopra Steria

for placing its trust in us as the ESG coordinator of this major

refinancing transaction, in terms of the amount and ambition of the

transaction as well as the high standards it embodies relative to

the reduction of the Group’s carbon footprint. This ambition needs

to be promoted and disseminated as widely as possible to meet the

huge challenge of the climate emergency. This indexed loan

contributes to this necessity,” said Bj�rn de Fos, Head of

Sustainable Financing at LCL.

(1) Sopra Steria’s Scope 3 (partial) greenhouse gas emissions

include emissions related to business travel and off-site data

centres, as provided for in categories 3.6 and 3.8 of the GHG

Protocol.

(2) The Green Bond Principles are recommendations and guidelines

for green-bond issuers published by the International Capital

Market Association. The principles concern four main areas: the use

of funds, the process for evaluating and selecting funded projects,

the management of funds, and reporting.

About Sopra Steria

Sopra Steria, a European leader in consulting, digital services

and software development, helps its clients drive their digital

transformation and obtain tangible and sustainable benefits. It

provides end-to-end solutions to make large companies and

organisations more competitive by combining in-depth knowledge of a

wide range of business sectors and innovative technologies with a

fully collaborative approach. Sopra Steria places people at the

heart of everything it does and is committed to putting digital to

work for its clients in order to build a positive future for all.

With 47,000 employees in nearly 30 countries, the Group generated

revenue of €4.7 billion in 2021. The world is how we shape

it. Sopra Steria (SOP) is listed on Euronext Paris (Compartment

A) – ISIN: FR0000050809 For more information, visit us at

www.soprasteria.com

About Crédit Agricole Corporate and Investment Bank (Crédit

Agricole CIB)

Crédit Agricole CIB is the corporate and investment banking arm

of Credit Agricole Group, the 12th largest banking group worldwide

in terms of tier 1 capital (The Banker, July 2021). Nearly 8,600

employees across Europe, the Americas, Asia-Pacific, the Middle

East and Africa support the Bank's clients, meeting their financial

needs throughout the world. Crédit Agricole CIB offers its large

corporate and institutional clients a range of products and

services in capital markets activities, investment banking,

structured finance, commercial banking and international trade. The

Bank is a pioneer in the area of climate finance, and is currently

a market leader in this segment with a complete offer for all its

clients.

For many years Crédit Agricole CIB has been committed to

sustainable development. The Bank was the first French bank to sign

the Equator Principles in 2003. It has also been a pioneer in Green

Bond markets with the arrangement of public transactions from 2012

for a wide array of issuers (supranational banks, corporates, local

authorities, banks) and was one of the co-drafter of Green Bond

Principles and of the Social Bond Guidance. Relying on the

expertise of a dedicated sustainable banking team and on the strong

support of all bankers, Crédit Agricole CIB is one of the most

active banks in the Green bonds market. For more information,

please visit www.ca-cib.com LinkedIn Twitter

About LCL

LCL, an urban bank, is a subsidiary of Crédit Agricole S.A. and

one of the largest retail banks in France. LCL has made an absolute

priority of its clients’ satisfaction, and its ambition is to be

the leading bank in terms of client satisfaction by the end of

2022. Combining human and digital resources, LCL provides its 6

million individual clients - among which 216 000 Private Banking

clients, 380 000 professionals and 29 900 corporates and

institutions – with an all-channel relationship through its 1,500

city-centre branches, its "LCL Mon Contact" remote client relations

centres with 400 advisers available by telephone, and its websites

and apps, including "LCL Mes Comptes", which is very popular with

its clients. With a full range of banking/insurance and non-banking

solutions, LCL advises its clients in their daily lives and with

all their life projects. In line with its strategy as an urban

bank, LCL is also committed to supporting its clients who want to

take practical initiatives to help tackle climate change.

LCL elected Client Service of the Year 2022 in the Banking

category – BVA Survey - Viséo CI – More information:

www.escda.fr.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220406005652/en/

Sopra Steria

Investor Relations Olivier Psaume

olivier.psaume@soprasteria.com +33 (0)1 40 67 68 16

Press Caroline Simon (Image 7) caroline.simon@image7.fr

+33 (0)1 53 70 74 65

Press contacts - Crédit Agricole CIB Maryse Dournes - +

33 1 41 89 89 38 - maryse.dournes@ca-cib.com Sandra Claeys - + 33 6

11 91 11 67 - sandra.claeys@ca-cib.com

Press contacts - LCL Julie TERZULLI - 01 42 95 10 61 -

julie.terzulli@lcl.fr Brigitte NEIGE - 01 42 95 39 97 -

brigitte.neige@lcl.fr

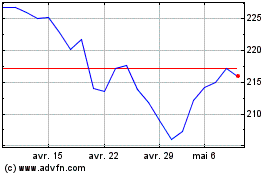

Sopra Steria (EU:SOP)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

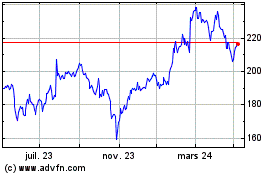

Sopra Steria (EU:SOP)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024