- Total growth of 0.9% relative to Q3 2023

- Revenue remained stable at constant scope and exchange

rates

- Full-year targets confirmed for organic growth, operating

margin and free cash flow

Regulatory News:

Sopra Steria Group (Paris:SOP) generated consolidated revenue

of €1,356.9 million in the third quarter of 2024, representing

total growth of 0.9%.

Sopra Steria: Consolidated revenue – Q3 2024

Q3 2024

Q3 2023 restated*

Q3 2023 reported

Organic growth

Total growth

Sopra Steria Group

1,356.9

1,357.5

1,345.4

0.0%

+0.9%

* Revenue at 2024 scope, exchange rates and accounting policies

(IFRS 5 & 15)

Cyril Malargé, Chief Executive Officer of Sopra Steria Group,

commented:

“The European market overall was held back by a wait-and-see

attitude and weak momentum, with the exception of certain countries

including Spain, Italy and Norway.

In this unfavourable context, we renewed several of our very

substantial positions in transport, aeronautics, the public sector

and defence.

The past three months’ performance confirms our outlook of a

relatively stable level of full-year revenue, as indicated in

July.

During the quarter, we finalised the sale of Sopra Banking

Software activities. This major decision clarifies Sopra Steria’s

positioning as a European consulting and digital services firm. It

also reinforces our balance sheet and financial flexibility.

In addition, I am pleased to share that Sopra Steria has been

recognised as a leader in cloud infrastructure services by

NelsonHall and received a ’Best in Class’ rating among AI and

generative AI service providers ranked by PAC.

Lastly, on 16 October 2024 the Group’s employees were especially

proud to have received the AGEFI award for the year’s most

sustainable business in the ‘Environment’ category.”

Presentation of quarterly revenue

The sale of Sopra Banking Software, announced on 21 February

2024 as part of Sopra Steria’s process of refocusing its activities

on digital services and solutions, was finalised on 2 September

2024. Revenue for Q3 2024 was consolidated excluding the activities

sold. As a reminder, these accounted for €336.3 million in revenue

in 2023. They were already recognised as discontinued operations

(under IFRS 5) in the H1 2024 accounts released on 24 July

2024.

In addition, as announced upon the release of the H1 results,

since 1 January 2024 revenue generated by Ordina through the sale

of external expertise has been standardised. It is now recognised

as net earnings in the Netherlands and Belgium, under the agent

principle.1

Comments on Q3 2024 business activity

Sopra Steria posted revenue of €1,356.9 million, up 0.9%

compared with Q3 2023. Changes in scope had a €10.9 million

positive impact. This comprised the positive €86.9 million impact

of the consolidation of Ordina (after the negative €20.0 million

impact of restating “agent” revenue) and the negative €76.0 million

impact of the disposal of Sopra Banking Software activities.

Currency fluctuations had a positive impact of €1.1 million. At

constant exchange rates, scope and accounting standards, revenue

remained stable.

In France (42% of the Group total), revenue fell by 1.2%

on an organic basis to €571.2 million. In a more uncertain

environment, the French market was held back by a prevailing

wait-and-see attitude. The Hybrid Cloud & Technology Services

business was highly resilient, achieving 3.3% growth. Consulting

& Systems Integration contracted by 0.3%. The Product Lifecycle

Management business was down 12.8%. In terms of vertical markets,

growth was positive in the public sector and defence, while it was

negative in aeronautics, financial services, energy and

telecommunications.

Revenue for the United Kingdom (18% of the Group total)

was €240.2 million, representing organic growth of 2.3%. The

best-performing vertical markets were financial services,

government & transport and the NHS SBS platform. The SSCL

platform’s business continued to be affected by the snap election

context and the arrival of a new government.

The Europe reporting unit (34% of the Group total)

generated revenue of €467.7 million. At constant scope, exchange

rates and accounting standards, revenue contracted very slightly

(0.5%). The most buoyant growth was in Spain, Italy and

Scandinavia. Revenue contracted slightly in Benelux and decreased

in Germany.

The Solutions reporting unit (6% of the Group total)

posted revenue of €77.8 million, representing organic growth of

3.9%. The Human Resources Solutions business grew by 7.5%. The

Property Management Solutions business was down 2.7%.

Workforce

The Group’s net headcount stood at 51,866 employees at 30

September 2024 (compared with 49,190 employees at 30 September

2023, restated for the Sopra Banking Software scope sold). The

consolidation of Ordina added 2,676 people. A total of 7,901 staff

were employed at international service centres (India, Poland,

Spain, etc.).

The workforce attrition rate was 13.2% (vs 15.1% at 30

September 2023).

Change in scope

Since the end of H1 2024, Sopra Steria has received a total of

€410.5 million arising from the finalised refocusing of the Group’s

activities on digital services and solutions. Following these

transactions, Sopra Steria has retained an 11.1% stake in Axway’s

share capital.

Share buyback programme

Confident in its outlook and its ability to create value over

the long term, on 2 October 2024 Sopra Steria announced the launch

of a €150 million share buyback programme, with the shares bought

back under this programme to be retired. An investment services

provider has been entrusted with carrying out the buyback during

the period from 2 October 2024 to 20 May 2025.

Recap of targets for 2024

- Revenue relatively stable on an organic basis

- Operating margin on business activity of at least 9.7%

- Free cash flow of around €350 million

Presentation meeting

Revenue for the third quarter of 2024 will be presented to

financial analysts and investors via a bilingual (French and

English) conference call to be held on Thursday, 31 October 2024 at

8:30 a.m. CET (Paris time).

- French-language phone number: +33 (0)1 70 37 71 66

- English-language phone number: +44 (0)33 0551 0200

Practical information about this presentation can be found in

the ‘Investors’ section of the Group’s website:

https://www.soprasteria.com/investors

Upcoming financial releases

Thursday, 12 December 2024 (9:00 a.m.): Capital Market Day

Thursday, 27 February 2025 (8:30 a.m.): Meeting to report 2024

annual results

Wednesday, 30 April 2025 (8:30 a.m.): Meeting to report Q1 2025

revenue

Wednesday, 21 May 2025 (2:30 p.m.): General Meeting of

Shareholders

Friday, 25 July 2025 (8:30 a.m.): Meeting to report 2025

half-year results

Wednesday, 29 October 2025 (8:30 a.m.): Meeting to report Q3

2025 revenue

Glossary

- Restated revenue: Revenue

for the prior year, expressed on the basis of the scope and

exchange rates for the current year.

- Organic revenue growth:

Increase in revenue between the period under review and restated

revenue for the same period in the prior financial year.

- EBITDA: This measure, as

defined in the Universal Registration Document, is equal to

consolidated operating profit on business activity after adding

back depreciation, amortisation and provisions included in

operating profit on business activity.

- Operating profit on business

activity: This measure, as defined in the Universal

Registration Document, is equal to profit from recurring operations

adjusted to exclude the share-based payment expense for stock

options and free shares and charges to amortisation of allocated

intangible assets.

- Profit from recurring

operations: This measure is equal to operating profit

before other operating income and expenses, which includes any

particularly significant items of operating income and expense that

are unusual, abnormal, infrequent or not foreseeable, presented

separately in order to give a clearer picture of performance based

on ordinary activities.

- Basic recurring earnings per

share: This measure is equal to basic earnings per share

before other operating income and expenses net of tax.

- Free cash flow: Free cash

flow is defined as the net cash from operations; less investments

(net of disposals) in property, plant and equipment, and intangible

assets; less lease payments; less net interest paid; and less

additional contributions to address any deficits in defined-benefit

pension plans.

- Downtime: Number of days

between two contracts (excluding training, sick leave, other leave

and pre-sales) divided by the total number of business days.

Disclaimer

This document contains forward-looking information subject to

certain risks and uncertainties that may affect the Group’s future

growth and financial results. Readers are reminded that licence

agreements, which often represent investments for clients, are

signed in greater numbers in the second half of the year, with

varying impacts on end-of-year performance. Actual outcomes and

results may differ from those described in this document due to

operational risks and uncertainties. More detailed information on

the potential risks that may affect the Group’s financial results

can be found in the 2023 Universal Registration Document filed with

the Autorité des Marchés Financiers (AMF) on 15 March 2024 (see

pages 40 to 46 in particular). Sopra Steria does not undertake any

obligation to update the forward-looking information contained in

this document beyond what is required by current laws and

regulations. The distribution of this document in certain countries

may be subject to the laws and regulations in force. Persons

physically present in countries where this document is released,

published or distributed should enquire as to any applicable

restrictions and should comply with those restrictions.

About Sopra Steria

Sopra Steria, a major tech player in Europe with 52,000*

employees in nearly 30 countries, is recognised for its consulting,

digital services and solutions. It helps its clients drive their

digital transformation and obtain tangible and sustainable

benefits. The Group provides end-to-end solutions to make large

companies and organisations more competitive by combining in-depth

knowledge of a wide range of business sectors and technologies with

a collaborative approach. Sopra Steria places people at the heart

of everything it does and is committed to putting digital to work

for its clients in order to build a positive future for all. In

2023, the Group generated revenue of €5.8 billion.

* Headcount reassessed following the sale of Sopra Banking

Software activities in September 2024.

The world is how we shape it. Sopra Steria (SOP) is

listed on Euronext Paris (Compartment A) – ISIN: FR0000050809 For

more information, visit us at www.soprasteria.com

Annexes

Sopra Steria: Impact on revenue of changes in scope and exchange

rates – 9M 2024 €m

9M 2024

9M 2023

Growth

Revenue

4,306.3

4,185.5

+2.9% Changes in exchange rates

9.3

Revenue at constant exchange rates

4,306.3

4,194.9

+2.7% Changes in scope

102.3

Revenue at constant exchange rates, scope and accounting

standards

4,306.3

4,297.2

+0.2% Sopra Steria: Changes in exchange rates – 9M

2024 For €1 / % Average rate9M 2024 Average

rate9M 2023 Change Pound sterling

0.8514

0.8707

+ 2.3% Norwegian krone

11.5854

11.3483

- 2.0%

Swedish krona

11.4120

11.4789

+ 0.6% Danish krone

7.4589

7.4486

- 0.1%

Swiss franc

0.9581

0.9774

+ 2.0%

Sopra Steria: Revenue by reporting unit – 9M 2024

9M 2024

9M 2023restated* 9M 2023reported Organic

growth Totalgrowth France

1,822.5

1,849.9

1,766.8

-1.5%

+3.2% United Kingdom

727.5

707.4

691.8

+2.8% +5.2% Europe

1,518.2

1,504.7

1,198.0

+0.9% +26.7% Solutions

238.1

235.2

208.6

+1.2% +14.2% Sopra Banking Software

-

-

320.3

-

-

Sopra Steria Group

4,306.3

4,297.2

4,185.5

+0.2% +2.9% * Revenue at 2024 scope, exchange rates

and accounting policies (IFRS 5 & 15)

Sopra Steria: Revenue

by reporting unit – Q3 2024 Q3 2024 Q3

2023restated* Q3 2023reported Organic growth

Totalgrowth France

571.2

577.8

567.9

-1.2%

+0.6% United Kingdom

240.2

234.9

230.8

+2.3% +4.1% Europe

467.7

469.9

378.2

-0.5%

+23.7% Solutions

77.8

74.9

66.2

+3.9% +17.5% Sopra Banking Software

-

-

102.3

-

-

Sopra Steria Group

1,356.9

1,357.5

1,345.4

0.0%

+0.9% * Revenue at 2024 scope, exchange rates and accounting

policies (IFRS 5 & 15)

Sopra Steria: Workforce breakdown –

30/09/2024 9/30/2024 9/30/2023 France

20,282

21,681

United Kingdom

7,199

7,767

Europe

16,244

14,102

Rest of the World

240

552

X-Shore

7,901

9,328

Total (continuing operations)

51,866

53,430

Activities classified as assets held for sale

∼ 4,000

1 For a negative €82.1 million impact on full-year revenue

(baseline: 2023)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030571573/en/

Investor Relations Olivier Psaume

olivier.psaume@soprasteria.com +33 (0)1 40 67 68 16

Press Relations Caroline Simon (Image 7)

caroline.simon@image7.fr +33 (0)1 53 70 74 65

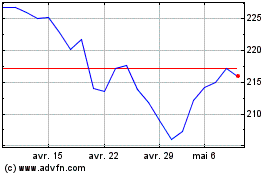

Sopra Steria (EU:SOP)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

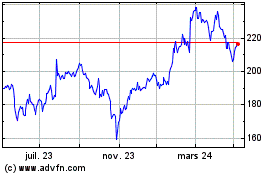

Sopra Steria (EU:SOP)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025