- Innovation and US investment in 2023

- 1Q24 sales back to growth +6% globally, +23%

in the US

Regulatory News:

SpineGuard (FR0011464452 – ALSGD), an innovative company

that deploys its DSG (Dynamic Surgical Guidance) sensing technology

to secure and streamline the placement of bone implants, announced

today its full-year 2023 financial results, for the financial year

ending December 31, 2023, as approved by the Board of Directors on

April 17, 2024, and its first quarter 2024 sales.

Q1 2024 revenue

€ thousands – IFRS (unaudited)

2024

2023

Variance

First Quarter

1,351

1,271

+6.3%

2023 Financial Results

€ thousands – IFRS audited

2023

2022

Revenue

4,313

5,600

Gross Margin

3,379

4,715

Gross margin (% of revenue)

78.3 %

84.2 %

Sales, distribution & marketing

4,065

3,700

Administrative costs

1,800

1,640

Research & Development

1,434

901

Operating profit / (loss)

-3,919

-1,526

Non-recurring operating costs

-57

-135

Financial Result

-225

-427

Income Tax

18

-305

Net profit / (loss)

-4,183

-2,393

EBITDA

-3,544

-888

Pierre Jérôme, co-founder, Chairman and CEO of SpineGuard,

said: “Our return to global sales growth in the first quarter

of 2024 validates the choice we made to strengthen our US

commercial infrastructure and invest in R&D to develop three

new products embedding our DSG sensor: the Threaded PediGuard

adapted to the correction of scoliosis via anterior approach, the

Cannulated PediGuard designed for sacroiliac fusion and the DSG

Drill Bit compatible with power drills and surgical navigation in

the spine. This significant financial effort to address clearly

identified and quickly actionable opportunities, explains the

decrease of our net result in 2023. We are building our financial

strategy around our unique real time surgical guidance technology,

its broad spectrum of applications and its clinical relevance now

backed by more than 100,000 surgeries secured and 34 articles

published in peer-reviewed scientific journals. Our growth will

most likely accelerate in the coming quarters driven by the gradual

introduction of these three new products, the impact of our new

sales organization as well as our fruitful collaboration with Omnia

Medical in the United States and XinRong in China. In parallel, we

are in discussions with other potential strategic partners in

particular to deploy DSG in dental implantology and surgical

robotics.”

2023 EBITDA impacted by the strengthening of US investment

and innovation

As announced in January 2024, 2023 sales amounted to €4,313 K,

down -23% at actual exchange rate and -21% cc compared with

2022.

6,138 DSG units were sold in 2023 vs. 5,934 in 2022,

representing overall growth of +3%, which confirms the global

momentum for DSG technology despite the one-off drop in sales in

the United States, with 2,120 units sold in 2023, representing 35%

of all units sold.

In the United States, full-year 2023 sales fell by -29% to

€2,678 K from €3,785 K in 2022, due to the discontinuation of

WishBone Medical's business, related to financial difficulties of

its own, which had exclusive distribution of SpineGuard products in

US pediatric orthopedic hospitals. Nevertheless, the new US team

put in place by SpineGuard in fiscal 2023 has gradually taken over

direct distribution since November. This is reflected in sales,

which have grown sequentially over the last three quarters (on the

date of publication of this press release).

In the rest of the world, sales rose by +22% for products over

the full year, thanks to strong growth in Europe and Latin America,

and a major order in China from XinRong Medical Group, SpineGuard's

local partner.

Besides, overall sales were negatively impacted by the

discontinuation of royalty income relating to the dental project,

following the decision by the Adin Dental Implant Systems Group to

halt developments, for its own financial reasons, at the end of the

first quarter of 2023.

The gross margin rate for 2023 sets at 78.3%, compared with

84.2% in 2022. This decline is mainly due to the discontinuation of

royalty income from the dental project and the decline in US sales,

where gross margins are higher than in the rest of the world.

Current operating expenses rose by 16.9%, i.e. €1,058 K,

reflecting the financial impact of sales and marketing investments,

particularly in the United States, and ongoing R&D

innovation.

Non-current expenses amounted to €57 K at December 31, 2023,

compared with €135 K at December 31, 2022, and correspond mainly to

restructuring costs in the United States.

Operating profit before non-recurring items therefore came to

-€3,919 K, at December 31, 2023, compared with -€1,526 K at

December 31, 2022.

Net financial expense, at -€225 K, mainly reflects interest

payments on debts contracted with Norgine Venture, Harbert European

Growth and Bpifrance, and net foreign exchange losses of -€70 K,

offsetting income from investments (term accounts) of €45 K, as

well as changes in the derivative liability, with no impact on

cash, of €213 K.

After taking these items into account, net income would be

-€4,183 K in 2023, compared with -€2,393 K in 2022.

Operating working capital stood at €540 K at December 31, 2023,

compared with €452 K at December 31, 2022.

Cash and cash equivalents (shown under current financial assets)

at December 31, 2023 came to €3,893 K, compared with €4,115 K at

December 31, 2022. This change in cash and cash equivalents is

mainly due to:

- Cash flow from operations deteriorated to -€3,545 K in 2023

from -€889 K in 2022, and cash used to finance operations increased

by €2,247 K to -€3,649 K in 2023, versus -€1,402 K in 2022;

- The change in working capital requirements, which deteriorated

by €104 K in 2023, compared with a deterioration of €513 K in 2022,

mainly due to the increase in inventories linked to the reduction

in US sales, and the increase in prices linked to the unfavorable

USD/EURO exchange rate and the impact of the increase in the price

of electronic components;

- Partial repayment of principal on bonds taken out with Norgine

Venture and Harbert European Growth for €761 K;

- Repayment of principal on the Bpifrance loan in the amount of

€49 K;

- Payment of interest on bonds subscribed with Norgine Venture

and Harbert European Growth in the amount of €226 K; and

- Equity contributions following drawdowns on the equity

financing line (redeemable equity warrants – “BSAR”) for a total

gross amount of €3 M and the capital increases carried out in July

and December 2023 for a total gross amount of €2 M.

The Company benefits from a repayable advance under COFACE

contracts (prospecting insurance) for China. No repayments have

been made in respect of the fifth year of amortization of this

advance.

Cash position

On March 31, 2024, cash and cash equivalents were €2.5 M.

The Horizon equity line put in place on May 31, 2023 with Nice

& Green's for an amount of €7.5 M, remains undrawn and

suspended per the information given at the launch of the capital

increase with shareholders' preferential subscription rights of

€1.5 M in December 2023.

Considering these elements as well as its commercial and

financial projections, SpineGuard now has cash-flow horizon until

2026.

Significant progress with technology and regulatory

PediGuard Threaded for anterior surgery

The products specifically modified for a precise reading of the

drilling depth, and for compatibility with the main

instrumentations in the market, are available in the United States

and in the process of approval under the new MDR (Medical Device

Regulation) Directive in Europe.

Modified Cannulated PediGuard for the sacroiliac joint

fusion

Fruit of the collaboration with the US based company Omnia

Medical, the design is now completed and the regulatory phase has

started in order to obtain the clearance by the FDA (Food and Drug

Administration) in the United States.

DSG Universal Drill Bit

The design progressed significantly and SpineGuard is now

actively preparing the regulatory phase in the USA. The new range

of drill bits embedded with the DSG sensor is intended to be

compatible with the main power drills in the orthopedic market,

with the dominant surgical navigation system in the US market and

with the DSG Connect interface. It is the first step of a plan to

rollout commercial “smart” products directly derived from the

research programs for robotic application of DSG.

Clearance of the complete range of PediGuard models in

China

SpineGuard progresses well with the execution of its plan

established in collaboration with its partner XinRong Medical Group

and the Franco-Chinese regulatory consultant VVR. It consists in

the staged clearance of the PediGuard products that have not yet

been approved: Curved PediGuard, “XS” (miniaturized) PediGuard, as

well as the Cannulated and Threaded versions.

Smart DSG Pedicle Screw

The collaborative design with Omnia Medical is ongoing.

SpineGuard will provide the DSG components that will equip the

Screw system of Omnia Medical including the bone breach detector

for securing the implantation. This product will target the

American market.

MDR Migration towards the new MDR regulation

SpineGuard continues the work with the TÜV SÜD European notified

body to obtain its updated certificates in the course of 2024.

Strategic and Technology Development Projects

The SpineGuard R&D team is progressing innovative work. As

part of it, the DSG Robotic application advances the bone resection

topic, and the use of ultrasound to determine the pedicle drilling

entry point. The data collection for Bone Quality Measurement

continues, as well as the exploration of the dental application.

Along these progresses, SpineGuard systematically protects the new

concepts, and as a result the patent portfolio accounts as of today

for 14 families and a total of 75 patents and patent applications

in numerous countries.

Q1 2024 revenue

SpineGuard's consolidated sales were up 6% at actual exchange

rate (7% cc) in Q1 2024 compared with Q1 2023.

In the United States, first quarter 2024 sales rose by 23% in

dollar terms to $1,014 K, vs. $822 K in Q1 2023. This sharp

increase is due to the takeover of Wishbone accounts, a significant

order from Omnia Medical, and the fruits of the labor of the new

U.S. team put in place by SpineGuard last spring.

In the rest of the world, sales rose by +1% for products in the

first quarter of 2024. It should be noted that overall growth in Q1

2024 was affected by the absence of royalties (vs. €92 K in Q1

2023) relating to the dental project in collaboration with the Adin

company, which was discontinued in Q1 2023. This will be the last

quarter to suffer this negative comparative impact.

1,780 DSG units were sold in Q1 2024 vs. 1,621 units in Q1 2023,

representing overall growth of +10%.

706 units were sold in the United States, representing 40% of

all units sold.

SpineGuard Priorities

SpineGuard continues its sales drive, particularly in the United

States, and market rollout of three new products based on DSG

technology (the PediGuard Threaded adapted to scoliosis correction

via anterior approach, the PediGuard Canulated designed for

sacroiliac fusion, and the DSG Universal Drill Bit compatible with

power drills and surgical navigation in the spine) in order to

return to double-digit growth in 2024.

The Company is also working on clearing the entire PediGuard

range in China, as well as establishing strategic partnerships in

the dental implantology and surgical robotic fields.

Next events

General Shareholders Meeting on June 5, 2024 (and June 26, 2024,

if second summoning)

2024 half-year revenue on July 10, 2024

About SpineGuard®

Founded in 2009 in France and the USA by Pierre Jérôme and

Stéphane Bette, SpineGuard is an innovative company deploying its

proprietary radiation-free real time sensing technology DSG®

(Dynamic Surgical Guidance) to secure and streamline the placement

of implants in the skeleton. SpineGuard designs, develops and

markets medical devices embedding its technology. Over 100,000

surgical procedures have been secured worldwide thanks to DSG® and

34 studies published in peer-reviewed scientific journals have

demonstrated the multiple benefits DSG® offers to patients,

surgeons, surgical staff and hospitals. Building on these strong

fundamentals and several strategic partnerships, SpineGuard is

expanding the scope of its DSG® technology to the treatment of

scoliosis via anterior approach, sacroiliac joint fusion, dental

implantology and innovations such as the « smart » pedicle screw

and power drill or surgical robotics. DSG® was co-invented by

Maurice Bourlion, Ph.D., Ciaran Bolger, M.D., Ph.D., and Alain

Vanquaethem, Biomedical Engineer. SpineGuard has engaged in

multiple ESG initiatives.

For further information, visit www.spineguard.com

Disclaimer

The SpineGuard securities may not be offered or sold in the

United States as they have not been and will not be registered

under the Securities Act or any United States state securities

laws, and SpineGuard does not intend to make a public offer of its

securities in the United States. This is an announcement and not a

prospectus, and the information contained herein does and shall not

constitute an offer to sell or the solicitation of an offer to buy,

nor shall there be any sale of the securities referred to herein in

the United States in which such offer, solicitation or sale would

be unlawful prior to registration or exemption from

registration.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240417020893/en/

SpineGuard Pierre Jérôme CEO & Chairman Tel: +33 1 45

18 45 19 p.jerome@spineguard.com SpineGuard Anne-Charlotte

Millard CFO Tel.: +33 1 45 18 45 19 ac.millard@spineguard.com

NewCap Investor Relations & Financial Communication

Mathilde Bohin / Aurélie Manavarere Tel.: +33 1 44 71 94 94

spineguard@newcap.eu

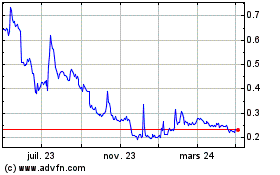

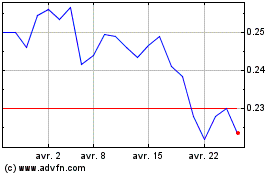

Spineguard (EU:ALSGD)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Spineguard (EU:ALSGD)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024