Ubisoft Shares Tumble After Bond Placement -- Update

28 Novembre 2023 - 12:10PM

Dow Jones News

By Helena Smolak and Mauro Orru

Shares of Ubisoft Entertainment slumped after the maker of the

Assassin's Creed videogame franchise placed bonds convertible or

exchangeable into shares to bolster its financial flexibility,

refinance existing debt, and to fund repurchase of shares.

At 1025GMT, Ubisoft shares traded 9% lower at EUR26.75. Shares

opened at EUR27.35.

Ubisoft said Tuesday that it had raised 494.5 million euros

($541.7 million) from the placement. The bonds have a Dec. 5, 2031

maturity date, a 2.875% coupon and a 47.5% conversion premium.

"While the new bond comes with a higher coupon and entails up to

9.6% dilution assuming full conversion, it extends the weighted

average maturity of Ubisoft's balance sheet at a reasonable cost,"

Citi analysts wrote in a research note.

Shares were expected to open roughly 7% down at €27.35 after the

placement, the analysts said, "but the incremental comfort it gives

on the risk profile, over time, we think will be well

received."

Ubisoft plans to use about half of the funds it raised to

repurchase up to EUR250 million in shares.

Write to Helena Smolak at helena.smolak@wsj.com and Mauro Orru

at mauro.orru@wsj.com

(END) Dow Jones Newswires

November 28, 2023 05:55 ET (10:55 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

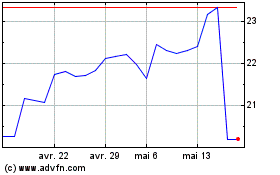

UBISoft Entertainment (EU:UBI)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

UBISoft Entertainment (EU:UBI)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024