VGP NV: Financial Result for FY2022

23 Février 2023 - 7:00AM

VGP NV: Financial Result for FY2022

23

February 2023, 7:00am,

Antwerp, Belgium: VGP NV (‘VGP’ or ‘the Group’), today

announces the results for the financial year ended 31 December

2022:

- Solid operating

performance

- Strong rental

activity with € 73.4 million of

signed and renewed leases bringing the annualised committed leases

to € 303.2 million1, a 18.4% YoY increase

- 44 projects

delivered representing a record 1,141,000

m² and € 71.9 million of annualised rental

income.

- 26 projects

under construction at year-end representing 814,000

m² and € 51.3 million of additional annual rent once fully

built and let (>90% pre-let

today2)

- €5.9 million

gross renewable energy income

-

Operating profit of

€ 177.5 million

before unrealized valuation losses of € 293 million3, amongst

others reflecting a like for like negative revaluation change of

7.33% on VGP’s portfolio4 due to further increasing of market

yields

- Cash recycled

for € 347 million through disposals and closings with joint

ventures, which have led to € 87.2 million realized gains on a

record year of transactions with the joint ventures

- Progress on

existing joint ventures:

- successfully

executed the 10th closing as per January 17th with the First Joint

Venture generating € 81 million in cash

- Advanced

discussions on new JVs’ setup and closings in 2023 on various parts

of the portfolio

- Year-end gearing

ratio amounts to 34.4%, supported by € 1.1 billion of available

liquidity

- Intention to

propose to the AGM a distribution of a gross dividend of € 2.75 per

share

Jan Van Geet, CEO of

VGP, said: “I am proud of our performance in 2022, in

terms of leasing activity it is one of our best years ever, and

taking into account the economic and geopolitical challenges it is

perhaps our best year thus far, having signed and renewed leases in

amount of € 73.4 million. Whilst we have booked a devaluation of

our portfolio in response to macroeconomic conditions, VGP realized

€ 87.2 million gains on all disposals to JV’s in ‘22, reflecting

high double digit IRRs, in what was a record year of closings with

our JV partners.”

Jan Van Geet continued: “Over the year we

delivered a record number of >1.1 million square meters of high

quality assets and, as a result, our net rent and renewable energy

income increased with 51% at share to €107 million. With a total of

€ 303 million contracted rental income, our portfolio cash flow

will continue to grow at a similar pace in 2023. Likewise, our

efforts in building a renewable energy platform sees good momentum

with +200 MWp of solar systems either already installed or under

construction.”

Jan Van Geet concluded: “We approach 2023 with

confidence as we see continued healthy occupier demand, start to

see construction costs coming down, and our technical competence

and ESG measures becoming increasingly important factors of

distinction. We benefit from a strong cash position and are on the

look-out for new opportunities which will become available in the

present environment, yet, we remain vigilant due to prevailing

uncertainties and are focused on profitable developments against

attractive conditions. This was showcased during the delivery of

VGP Park München last December, a project fitted to the highest

technical standards and a plurality of sustainability measures,

delivered significantly within budget. We count on the desirability

of our locations and the agility of our teams to further strengthen

our pipeline.”

FINANCIAL AND OPERATING HIGHLIGHTS

Strong new leasing

activity continued

- Signed and

renewed rental income of € 73.4 million driven by 904,812 m² of new

lease agreements signed corresponding to € 53.8 million of new

annualised rental income

- Germany

contributed most new leases (€ 25.4 million; 44%) whilst the

remainder was geographically well spread across the markets VGP

operates in: Romania € 5.2 million (9%), Spain € 4.4 million (8%),

Czech Republic € 4.3 million (8%), Netherlands € 3.9 million (7%),

Serbia € 3.5 million (6%), Hungary € 3.2 million (6%), Slovakia €

3.1 million (5%), Austria € 2.4 million (4%), Latvia € 1.2 million

(2%), Portugal € 0.8 million (3%), and Italy € 0.1 million

(1%).

- Lease

agreements renewed for 308,000 m² (corresponding to € 16.0

million of annualised rental income) and € 3.6 million of

indexation. € 10.3 million rental contracts terminated, replacement

contracts have a 12% average increased pricing.

- The total

signed lease agreements represent € 303.2 million5 annualised

committed rental income (equivalent to 5.2 million m² of lettable

area), a 18.4% increase versus December 2021 reported at € 256.07

million.

- VGP expects a

considerable amount of rental increase in 2023 throughout its

entire portfolio as lease agreements are annually indexed against

inflation.

Record year in project

delivery

- During 2022 we

delivered 44 projects representing a record 1,141,000 m² of

lettable area, which equates to € 71.9 million of annualised rental

income (98.7% let).

- At year-end 26

projects were under construction representing 814,000 m² of future

lettable area, which, once delivered and fully let, will generate €

51.3 million of annualised committed rental income; the portfolio

under construction is currently +90% pre-let6.

Land bank

- Over the last

12 months in total 1,970,000 m2 of land was acquired representing a

development potential of minimum 792,000 m2 and a further 2,405,000

m2 of land plots were committed, pending permits, which have a

development potential of at least 1,076,000 m2 of future lettable

area, bringing the total owned and committed land bank to

10,362,000 m2, supporting a minimum of 4,664,000 m2 of future

lettable area

- In addition to

the owned and committed land bank, VGP has signed non-binding

agreements (“land under option”) and is currently performing due

diligence investigations, on an exclusive basis, on the potential

acquisitions of in total circa 321,000 m² of new land plots

with a development potential of at least 136,000 m2. This

brings the land bank of owned, committed and under option to

10,683,000 m2 supporting circa 5,000,000 m2 of future lettable

area.

- The land bank is

well spread across the countries in which we operate.

- We remain

vigilantly focussed on expanding our landbank, with a priority

focus on Germany and the new countries France and Denmark.

Significant strengthening of the team

- At the end of

2022 the VGP team consisted of 383 FTE equivalent, net +61 FTE

versus 2021 as we have strengthened our teams across the board and

set up a team in France and Denmark. The number of FTE is not

expected to grow further in 2023.

- Start of

operations in Sweden and Greece has been postponed. The Group will

reassess entry into those countries once local logistics markets

have stabilized.

Joint Venture closings

- In March 2022

VGP and Allianz Real Estate announced the successful third closing

in the Second Joint Venture with a total transaction volume of €

364 million. The gross proceeds from this transaction amounted to

circa € 233 million7. The transaction comprised of 13 logistic

buildings, including 9 buildings in 7 new VGP parks and another 4

newly completed logistic buildings which were developed in parks

previously transferred to the Joint Venture.

- Two additional

closings took place on July 1st, one in the First and one in the

Second Joint Venture. The transaction occurred for a total gross

asset value of € 105 million and with gross cash proceeds for VGP

amounting to € 82 million8. The closing in the First Joint Venture,

also called Rheingold, contained 8 logistic buildings of which 3

were located in Germany, 4 in the Czech Republic and one in

Hungary. The closing in the Second Joint Venture, also called

Aurora, consisted of one Portuguese asset.

- In December VGP

and Allianz Real Estate executed the closing of the Third Joint

Venture upon the completion of VGP Park Munich. The transfer

consisted of a total GAV of € 418 million. The remaining payment

received upon the closing amounted to € 70 million cash, a

remaining € 7 million related to the transaction will be received

during H1 ’23.

- An additional

closing was announced in December for the First Joint Venture; the

10th closing comprised of three new logistic buildings located in

Germany (one) and in the Czech Republic (two) representing 113,000

m2. The transaction value exceeded € 110 million and the gross

proceeds amounted to € 81 million. The closing of the transaction

has been effectuated in the course of January. Upon the closing of

this transaction the First Joint Venture has reached completion and

has entered its holding period.

- VGP and Allianz

Real Estate have subsequently agreed to extend the holding term of

the First Joint Venture agreement by 10 years to 2036. When the

First Joint Venture was set up in 2016 it shaped the ambition for a

long term-partnership. The extension announcement has reinforced

the cooperation between the partners.

- In addition VGP

received a total profit distribution of € 60 million9 from the

joint ventures over 2022.

- VGP is currently

in discussions with Allianz Real Estate and various other potential

joint venture partners about the Europa joint venture and other

potential joint ventures. Various alternative structures are being

assessed and the Group expects to be able to update the broader

market once closing term sheets are signed.

- The first upcoming closing will be

the anticipated fourth closing for Aurora, the Second Joint

Venture, which is expected to occur in H1 2023 comprising of 12

assets (260,000 m2) in Austria, Italy, Spain and the

Netherlands.10

Strengthened capital and

financial position

- On the 10th of

January 2022, VGP announced the successful issue of its second

public benchmark green bonds for an aggregate nominal amount of €

1.0 billion, in two tranches, with a € 500 million 5-year bond

paying a coupon of 1.625 per cent p.a. and maturing on 17 January

2027 and a € 500 million 8-year bond paying a coupon of 2.250 per

cent p.a. and maturing on 17 January 2030.

- On 25 November,

VGP successfully completed a € 303 million rights issue by offering

5,458,262 new shares. The transaction had the highest take-up of

issued rights of similar size in Belgium since 2015 and was

completed without a discount.

- The Group

further benefits from its expanded multi-year € 400 million

revolving credit facilities which remain undrawn. The revolving

credit facilities mature as follows: € 100 million matures in July

2027; € 50 million in December 2025; € 200 million matures in

December 2026; and €50 million matures in December 2024.

- Year-end

gearing ratio amounted to 34.4%.

ESG update

- Strong

improvement in ESG ratings: The Sustainalytics score improved by

3.3 points to 12.1 – significant progress was made on the

management score where we moved from Average to Strong. For CDP the

Group achieved a B score (on scale from A to D-, F), part of the

16% highest graded companies globally (48,200 companies

graded).

- CO2 emissions

and 2030 target across Scope 1-3 submitted to Science Based Target

initiative.

- Already over 40%

of portfolio compliant in 2050 on the 1.5°C decarbonization pathway

(CRREM analysis).

- The VGP 2027,

2029 and 2030 bonds have been affirmed as aligned with the Climate

Bonds Taxonomy.

- 131.6MWp in

photovoltaic projects installed or under construction with a

further 75.0MWp in pipeline; once fully built, the PV projects will

generate more renewable energy than all tenants’ energy consumption

combined.

- All VGP offices

switched to renewable energy since 1 January 2022 through a PPA

contract with our own 3.9MWp solar roof at VGP Park Roosendaal

providing the energy.

- We introduced

further steps to reduce embodied emissions within our developments

– first projects completed with wooden load bearing structure and

heat pumps included in the VGP building standard (replacing gas

powered heating), furthermore we have updated our building standard

to implement water saving and retention techniques.

Renewable Energy

- In total, there

are 62 solar panel installations operational across the portfolio.

The total installed renewable energy capacity of the Group’s assets

in 2022 is 56.6 MWp (of which 15.1 MWp is third party operated)

(+66% compared to Dec 2021) with a further 28 projects with a power

of 75.0 MWp under construction, representing an investment of € 78

million once completed. Looking forward, another 60 projects with a

total of 72.7 MWp contracted power are in the pipeline.

- Gross renewable

energy income over 2022 was € 5.9 million (net € 5.6 million);

compared to € 1.3 million in 2021. Gross renewable energy income

over 2022 benefitted from significant increase in production

capacity as well as higher energy prices.

- Operational

solar production capacity should see exponential growth in the

coming year.

- In 2022, new

solar panels were installed across the portfolio. One of largest

multi-site roof-top photovoltaic systems in the Netherlands is

being built in VGP Park Nijmegen (Netherlands): the construction

works started in 2020, with the installation of 4.8 MWp; in 2022 an

additional 3.1 MWp has been installed and the project will be fully

operational in 2023, when the installation will achieve a total

output of around 17.61 MWp. The Group’s largest multi-site in

Germany is at VGP Park München where an 11.55 MWp photovoltaic

plant was installed and finished in December 2022, generating an

estimated saving of energy purchased from the grid of

9,000,000KWh.

- In Germany, VGP

Park München also uses geothermal energy to meet its heating and

cooling needs. A solid pipeline of future projects is maintained

throughout the Group, such as photovoltaic self-consumption plants.

The renewable electricity produced by the Group is either

self-consumed to meet our tenant’s energy needs or sold to the

grid. Once the photovoltaic projects currently under construction

are fully operational the solar power production capacity will

surpass the total energy consumption of all tenants as measured

over FY2021.

Outlook 2023

- Along with our

strong balance sheet, healthy treasury position, well positioned

portfolio and with a primary focus on the development of our

existing and attractive land bank, we remain confident to deliver

solid operational performance and further strengthen our cash

recycling model.

- With the months

of January and February having started well and despite an

uncertain geopolitical and economic environment, VGP pursues

prudently its margin-focused strategy, underpinned by technical

competence and investment as well as a constant quest for high

sustainability and quality in our warehouses and their

locations.

- Given its

annualized contracted rental income of € 303 million and recent

deliveries of 1.1 million square meters to lessees, net rental

income is expected to further record high double digit growth.

Dividend 2022

- The Board of

Directors has decided to propose to the Annual Shareholder’s

Meeting of 12 May 2023 to distribute a gross dividend of € 2.75 per

share, corresponding to a total gross dividend amount of €

75,051,108.

KEY FINANCIAL METRICS

|

Operations and results |

2022 |

2021 |

Change (%) |

|

Committed annualised rental income (€mm) |

303.2 |

256.1 |

18.4% |

|

Gross Renewable Energy income (€mm) |

5.9 |

1.3 |

353.8% |

|

Operating result before unrealized valuation adjustments (€mm) |

177.5 |

45.4 |

291.0% |

|

IFRS net profit (€mm) |

(122.5) |

650.1 |

n/a |

|

IFRS earnings per share (€ per share) |

(5.49) |

31.41 |

n/a |

|

Dividend per share (€ per share) |

2.7511 |

6.85 |

(59.9)% |

|

Portfolio and balance sheet |

2022 |

2021 |

Change (%) |

|

Portfolio value, including Joint Ventures at 100% (€mm) |

6,443 |

5,746 |

12.1% |

|

Portfolio value, including Joint Ventures at share (€mm) |

4,605 |

4,084 |

12.8% |

|

Occupancy ratio of standing portfolio (%) |

98.9 |

99.4 |

- |

|

EPRA NTA12 per share (€ per share) |

103.17 |

106.93 |

(3.52)% |

|

IFRS NAV per share (€ per share) |

98.70 |

99.65 |

(0.95)% |

|

Net financial debt (€mm) |

1,669 |

1,159 |

44.0% |

|

Gearing13 (%) |

34.4 |

29.8 |

- |

AUDIO WEBCAST FOR INVESTORS AND

ANALYSTS

VGP will host an audio webcast at

10:30

(CET) on 23 February 2023The

conference call will be available on:

Webcast link:

-

https://channel.royalcast.com/landingpage/vgp/20230223_1/

- Click on the link above to attend the presentation from your

laptop, tablet or mobile device

- The presentation will stream through your selected device

- Please join the event audio webcast 5-10 minutes prior to the

start time

A presentation will be available on VGP

website:https://www.vgpparks.eu/en/investors/publications/

FINANCIAL CALENDAR

| Publication

Annual Report 2022 |

11 April 2022 |

| First quarter

2023 trading update |

4 May 2022 |

| General meeting

of shareholders |

12 May 2022 |

| Dividend

ex-date |

24 May 2022 |

| Dividend payment

date |

26 May 2022 |

| Half year results

2023 |

24 August 2022 |

| Third quarter

2023 trading update |

3 November 2022 |

CONTACT DETAILS FOR INVESTORS AND MEDIA

ENQUIRIES

|

Investor Relations |

Tel: +32 (0)3 289 1433investor.relations@vgpparks.eu |

|

Karen Huybrechts (Head of Marketing)| |

Tel: +32 (0)3 289 1432 |

ABOUT VGP

VGP is a pan-European owner, manager and

developer of high-quality logistics and semi-industrial real

estate. VGP operates a fully integrated business model with

capabilities and longstanding expertise across the value chain.

Founded in 1998 as a Belgian family-owned real estate developer in

the Czech Republic, VGP with a staff of circa 383 FTE’s today owns

and is active in 17 European countries directly and through several

50:50 joint ventures. the Gross Asset Value of VGP, including the

joint ventures at 100%, amounted to € 6.44 billion and the company

had a Net Asset Value (EPRA NTA) of € 2.30 billion. VGP is listed

on Euronext Brussels (ISIN: BE0003878957). For more

information, please

visit: http://www.vgpparks.eu

Forward-looking statements:

This press release may contain forward-looking statements. Such

statements reflect the current views of management regarding future

events, and involve known and unknown risks, uncertainties and

other factors that may cause actual results to be materially

different from any future results, performance or achievements

expressed or implied by such forward-looking statements. VGP is

providing the information in this press release as of this date and

does not undertake any obligation to update any forward-looking

statements contained in this press release considering new

information, future events or otherwise. The information in this

announcement does not constitute an offer to sell or an invitation

to buy securities in VGP or an invitation or inducement to engage

in any other investment activities. VGP disclaims any liability for

statements made or published by third parties and does not

undertake any obligation to correct inaccurate data, information,

conclusions or opinions published by third parties in relation to

this or any other press release issued by VGP.

1 For Joint Ventures at 100%2 Calculated based on the contracted

rent and estimated market rent for the vacant space3 € 394 million

including JV’s at 100% and excluding realized gains of € 92.3

million4 Including Joint Ventures at 100%5 For Joint Ventures at

100%6 Calculated based on the contracted rent and estimated market

rent for the vacant space7 Including a € 5.5 million equity

distribution8 Including a € 14.75 million equity distribution9

Composed of an equity distribution from the Joint Ventures for an

amount of € 37.4 million and a partial repayment of shareholders’

loan for a total amount of € 22.6 million. Resulting in a total

profit distribution by the Joint Ventures of € 60 million.10

Subject to final agreement between the joint venture partners in

terms of the transferred income generating assets and pricing11

Proposed dividend per share to be approved by the Annual General

Meeting of Shareholders of 12 May 2023.12 EPRA Net Tangible Assets.

Other metrics, EPRA Net Reinstatement Value and Net Disposal Value

can be found in note 12.213 Calculated as Net debt / Total equity

and liabilities

- VGP_Press_Release_FY2022 - EN 23022023

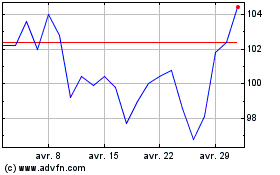

VGP NV (EU:VGP)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

VGP NV (EU:VGP)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025