Yen Rises Amid BoJ Rate Hike Bets, Trump's Tariff Threats

20 Février 2025 - 3:32AM

RTTF2

The Japanese yen strengthened against other major currencies in

the Asian session on Thursday, amid rising bets that the Bank of

Japan (BoJ) would hike interest rates further. The safe-haven JPY

also firmed on geopolitical worries.

Asian stock markets traded lower, as the U.S. Fed's minutes

showed policymakers are more inclined to keep interest rates steady

amid stubborn inflation. The continued concerns about the potential

impact of higher tariffs to be imposed by the U.S. on partner

nations also hurt market sentiment.

The minutes of the latest U.S. Fed policy meeting on January

28-29 revealed that officials want to see further progress on

inflation before they consider resuming lowering interest rates. It

also reiterated officials believe a "careful approach" in

considering additional adjustments to the stance of monetary policy

is appropriate given the high degree of uncertainty.

The meeting participants said the upside risks to the inflation

outlook partly reflected the possible effects of potential changes

in trade and immigration policy.

In the Asian trading today, the yen rose to more than a 2-month

high of 150.05 against the U.S. dollar, from yesterday's closing

value of 151.22. The next possible upside target for the yen is

seen around the 148.00 region.

Against the euro and the pound, the yen advanced to 9-day highs

of 156.51 and 188.99 from Wednesday's closing quotes of 157.60 and

190.29, respectively. If the yen extends its uptrend, it is likely

to find resistance around 154.00 against the euro and 186.00

against the pound.

Against the Swiss franc and the Canadian dollar, the yen climbed

to 10-day highs of 166.26 and 105.51 from yesterday's closing

quotes of 167.19 and 106.21, respectively. The yen is likely to

find resistance around 165.00 against the franc and 104.00 against

the loonie.

Against the Australia and the New Zealand dollars, the yen

jumped to 9-day highs of 95.33 and 85.73 from Wednesday's closing

quotes of 95.89 and 86.21, respectively. On the upside, 93.00

against the aussie and 83.00 against the kiwi are seen as the next

resistance levels for the yen.

Looking ahead, Eurostat releases euro area construction output

data for December at 5:00 am ET in the European session.

At 6.00 am ET, the Confederation of British Industry publishes

Industrial Trends survey results for February. The order book

balance is forecast to rise to -30 in February from -34 in

January.

In the New York session, Canada new housing price index, PPI

data and raw material price index, all for January, U.S. weekly

jobless claims data, U.S. Philly Fed business conditions for

February, U.S. Consumer Board's leading index for January and U.S.

EIA crude oil data are slated for release.

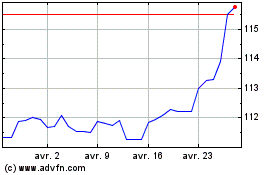

CAD vs Yen (FX:CADJPY)

Graphique Historique de la Devise

De Jan 2025 à Fév 2025

CAD vs Yen (FX:CADJPY)

Graphique Historique de la Devise

De Fév 2024 à Fév 2025