Pound Rebounds After U.K. CPI Data

15 Janvier 2025 - 6:55AM

RTTF2

The British pound rebounded from recent weakness against other

major currencies in the European session on Wednesday, after

reacting wildly to data showing that U.K. consumer price inflation

moderated unexpectedly in December.

Data from the Office for National Statistics showed that the

U.K. consumer price index registered an annual increase of 2.5

percent in December, weaker than the 2.6 percent rise in November,

prompting traders to price in a higher number of BoE interest rate

cuts for the year. The rate was seen unchanged at 2.6 percent.

Month-on-month, the CPI climbed 0.3 percent, following a 0.1

percent rise in November. Prices were expected to gain 0.4

percent.

Another data from ONS showed that input prices fell for the

fifth straight month in December. Input prices dropped 1.5 percent

annually after a 2.1 percent drop.

Meanwhile, factory gate prices rose 0.1 percent after falling

for three consecutive months. Prices were down 0.5 percent in

November.

On a monthly basis, input prices edged up 0.1 percent compared

to flat growth in November. Likewise, output prices gained 0.1

percent after November's 0.4 percent gain.

Meanwhile, U.K. retailers plan to increase prices this year in

response to increased National Insurance costs, according to a

survey of Chief Financial Officers, conducted by the British Retail

Consortium.

Two-thirds of respondents said they will lift prices and around

half said they would be reducing number of hours/overtime work.

Investors await the U.S. consumer price index (CPI) report for

December 2024 later in the day for clues on the path of Federal

Reserve policy.

Economists expect U.S. consumer prices to rise by 0.3 percent in

December, matching the increase seen in November. The annual rate

of growth is expected to accelerate to 2.9 percent from 2.7

percent.

Reports emerged that Donald Trump's incoming economic team is

considering a plan to gradually raise tariffs month by month.

In the European trading today, the pound rose to 0.8420 against

the euro, from an early more than a 4-1/2-month low of 0.8465. The

pound may test resistance near the 0.82 region.

Against the U.S. dollar, the pound edged up to 1.2241 from an

early low of 1.2161. On the upside, 1.25 is seen as the next

resistance level for the pound.

Against the Swiss franc and the yen, the pound advanced to

1.1158 and 192.08 from an early 2-day lows of 1.1095 and 191.29,

respectively. If the pound extends its downtrend, it is likely to

find support around 1.09 against the franc and 200.00 against the

yen.

Looking ahead, U.S. MBA mortgage approvals data, U.S. CPI data

for December, U.S. NY Empire State manufacturing index for January,

Canada manufacturing and wholesale sales reports for November, U.S.

EIA crude oil data and U.S. Fed Beige Book report are slated for

release in the New York session.

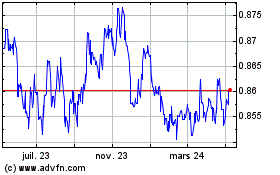

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Déc 2024 à Jan 2025

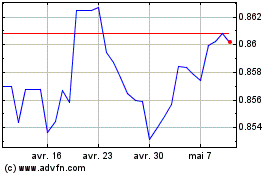

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Jan 2024 à Jan 2025