NZ Dollar Rises Amid RBNZ Rate Hike Speculation

09 Février 2024 - 2:48AM

RTTF2

The New Zealand dollar strengthened against other major

currencies in the Asian session on Friday, as traders expect the

Reserve Bank of New Zealand (RBNZ) to increase its cash rate in the

coming policy meetings.

Analysts at ANZ anticipates the Reserve Bank to increase its

Official Cash Rate (OCR) by 25 basis points at each of the coming

monetary policy meetings in February and April.

The recent jobs data of New Zealand also fueled bets for an

interest rate hike among the traders.

Meanwhile, most markets in the Asian region are fully or

partially closed for Lunar New Year holidays.

In the Asian trading today, the NZ dollar rose to more than a

2-month high of 91.57 against the yen and nearly a 4-week high of

1.7576 against the euro, from yesterday's closing quotes of 91.00

and 1.7668, respectively. If the kiwi extends its uptrend, it is

likely to find resistance around 92.00 against the yen and 1.73

against the euro.

Against the U.S. and the Australian dollars, the kiwi advanced

to a 1-week high of 0.6130 and nearly a 9-month high of 1.0595 from

Thursday's closing quotes of 0.6095 and 1.0643, respectively. The

kiwi may test resistance around 0.62 against the greenback and 1.04

against the aussie.

Looking ahead, Germany's final consumer price data for January

is due to be released in the pre-European session at 2:00 am

ET.

In the New York session, Canada jobs data for January and U.S.

Baker Hughes oil rig count data are slated for release.

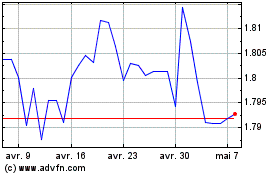

Euro vs NZD (FX:EURNZD)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Euro vs NZD (FX:EURNZD)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024