Pound Falls On BoE Rate Cut Hopes

22 Avril 2024 - 1:14PM

RTTF2

The pound dropped against its major counterparts in the European

session on Monday, as investors expect the Bank of England to start

reducing interest rates in August following dovish comments from

Bank of England Deputy Governor Ramsden last week.

UK CPI inflation in March was below US CPI inflation, and the

April data is expected to show the UK converging in line with euro

area inflation, Ramsden said.

Ramsden added that he has now "become more confident in the

evidence that risks to persistence in domestic inflation are

receding, helped by improved dynamics."

Risks to inflation are tilted to the downside and inflation

could stay close to the 2% target over the next three years,

Ramsden suggested.

S&P Global will publish flash PMI data for April on

Tuesday.

The pound fell to more than a 5-month low of 1.2299 against the

greenback. If the currency drops further, it may find support

around the 1.21 level.

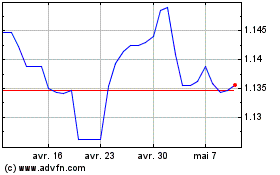

The pound weakened to 190.32 against the yen and 1.1213 against

the franc, off its early highs of 191.70 and 1.1295, respectively.

The pound is seen finding support around 188.00 against the yen and

1.10 against the franc.

The pound touched 0.8644 against the euro, setting a 3-1/2-month

low. The pound may face support around the 0.88 level.

Sterling vs CHF (FX:GBPCHF)

Graphique Historique de la Devise

De Avr 2024 à Mai 2024

Sterling vs CHF (FX:GBPCHF)

Graphique Historique de la Devise

De Mai 2023 à Mai 2024