Pound Weakens On Rate Worries

29 Mai 2024 - 3:06PM

RTTF2

The pound declined against its major counterparts in the New

York session on Wednesday, as a jump in U.S. Treasury yields stoked

concerns that U.S. interest rates will likely stay higher for

longer.

Traders further reduced their rate cut expectations by the U.S.

Federal Reserve after Minneapolis Fed President Neel Kashkari said

he needs to see "many more months of positive inflation data"

before he would consider cutting interest rates.

Markets are pricing in a 25 basis point cut only by November or

December.

U.S. inflation data, due Friday, could have a significant impact

on the outlook for interest rates ahead of the Fed's next monetary

policy meeting on June 11-12.

The U.S. economic calendar remains relatively quiet today,

although the Fed's Beige Book may attract some attention.

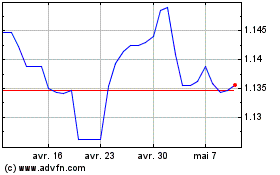

The pound fell to a 1-week low of 1.1597 against the franc and a

5-day low of 1.2704 against the greenback, off its early highs of

1.1655 and 1.2771, respectively. The pound is seen finding support

around 1.11 against the franc and 1.23 against the greenback.

The pound dropped to 0.8516 against the euro, from an early

nearly 2-year high of 0.8484. On the downside, 0.88 is likely seen

as its next support level.

The pound touched a 2-day low of 200.05 against the yen,

reversing from an early nearly 16-year high of 200.74. If the

currency falls further, it is likely to test support around the

189.00 region.

Sterling vs CHF (FX:GBPCHF)

Graphique Historique de la Devise

De Mai 2024 à Juin 2024

Sterling vs CHF (FX:GBPCHF)

Graphique Historique de la Devise

De Juin 2023 à Juin 2024