U.S. Dollar Weakens Against Majors

28 Novembre 2023 - 12:45PM

RTTF2

The U.S. dollar fell against its major counterparts in the New

York session on Tuesday on hopes of a dovish pivot by the Federal

Reserve. Recent data has fuelled expectations that the Fed is done

raising rates.

Investors focus on U.S. personal income and spending data due on

Thursday, which includes readings on inflation said to be preferred

by the Federal Reserve.

Reports on weekly jobless claims, pending home sales and

manufacturing activity are due along with the Fed's Beige Book as

well as remarks by Fed Chair Jerome Powell.

The dollar index dropped 0.20 percent to 102.99 from the

previous close of 103.20.

The greenback dropped to near 4-month lows of 0.6119 against the

kiwi and 0.6632 against the aussie, off its early highs of 0.6079

and 0.6596, respectively. The greenback is seen finding support

around 0.63 against the kiwi and 0.69 against the aussie.

The greenback fell to near 3-month lows of 1.2667 against the

pound and 0.8777 against the franc, from its early highs of 1.2606

and 0.8819, respectively. The currency is likely to locate support

around 1.31 against the pound and 0.86 against the franc.

The greenback declined to a 1-week low of 147.70 against the yen

and a 3-1/2-month low of 1.0988 against the euro, reversing from

its previous highs of 148.83 and 1.0934, respectively. The

greenback is poised to challenge support around 144.00 against the

yen and 1.12 against the euro.

Against the loonie, the greenback was down at a 1-1/2-month low

of 1.3573. The greenback may locate support around the 1.33

mark.

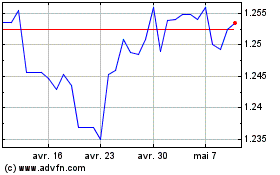

Sterling vs US Dollar (FX:GBPUSD)

Graphique Historique de la Devise

De Juin 2024 à Juil 2024

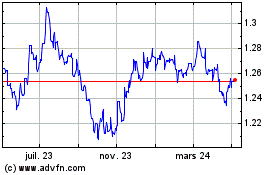

Sterling vs US Dollar (FX:GBPUSD)

Graphique Historique de la Devise

De Juil 2023 à Juil 2024